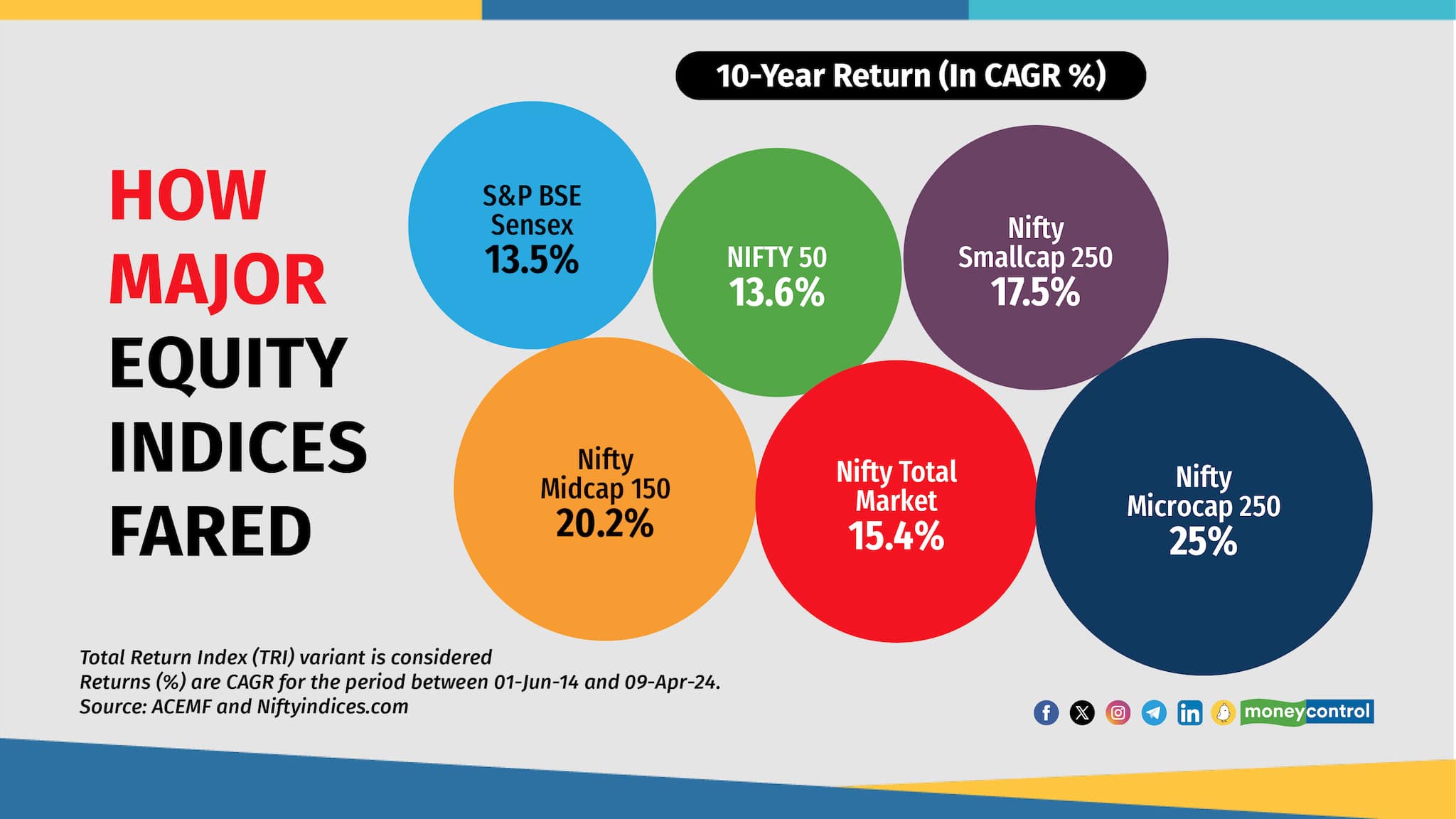

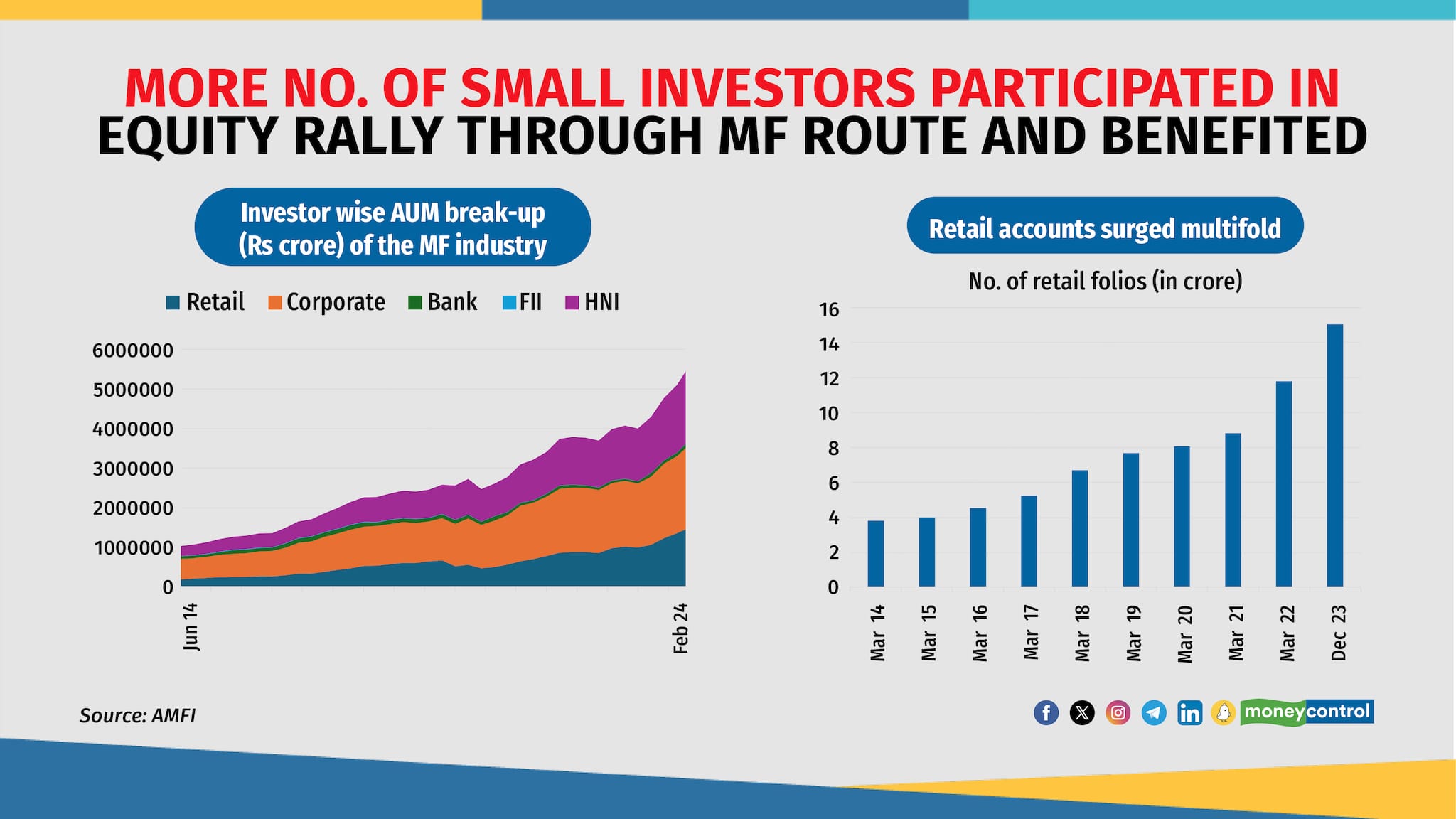

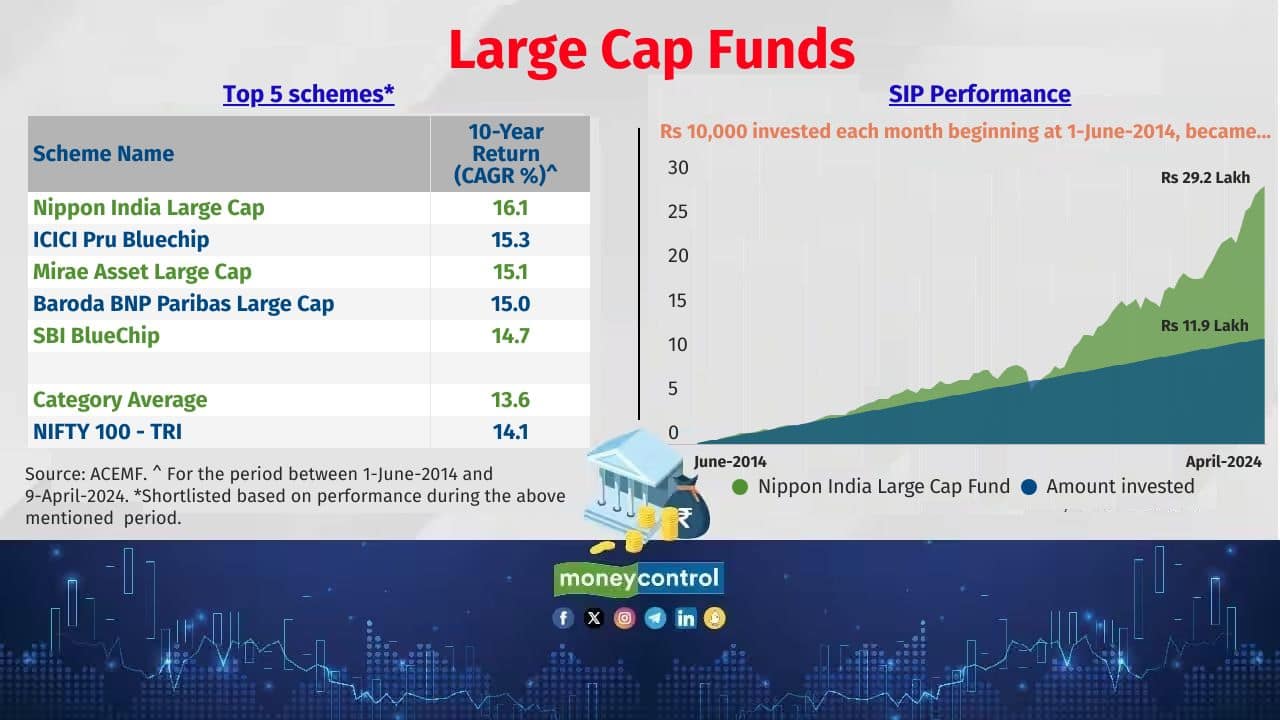

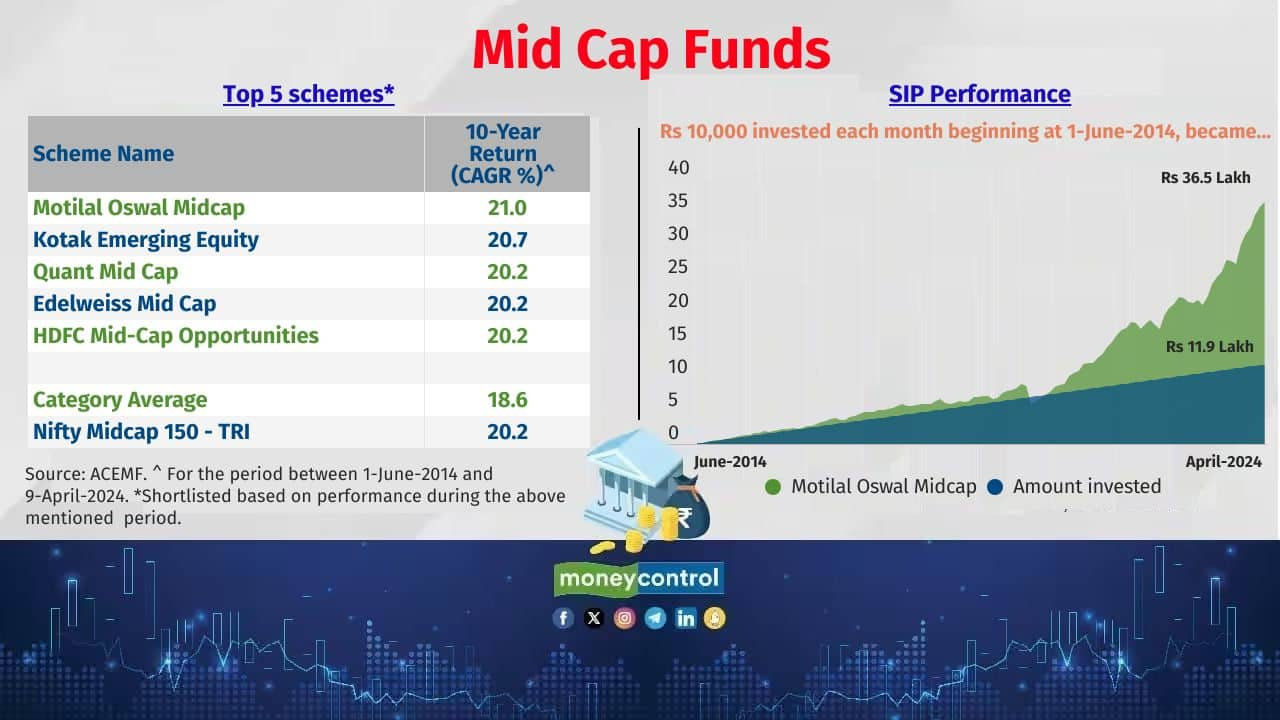

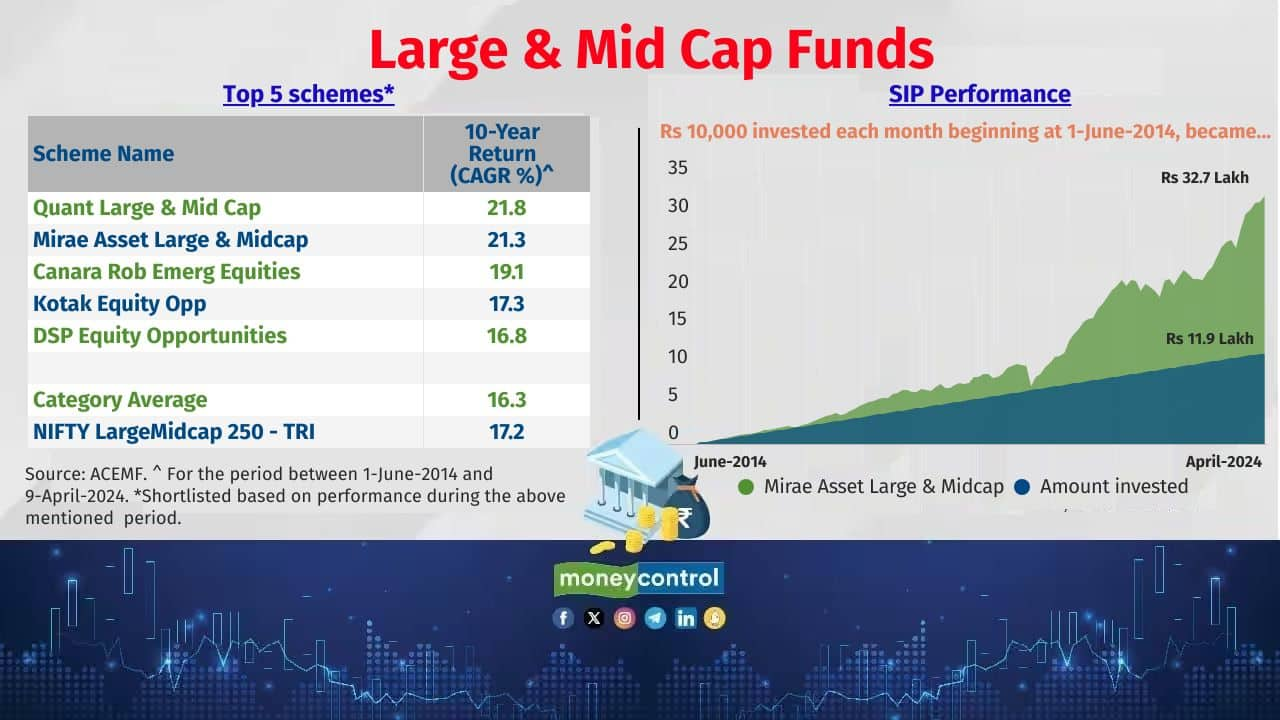

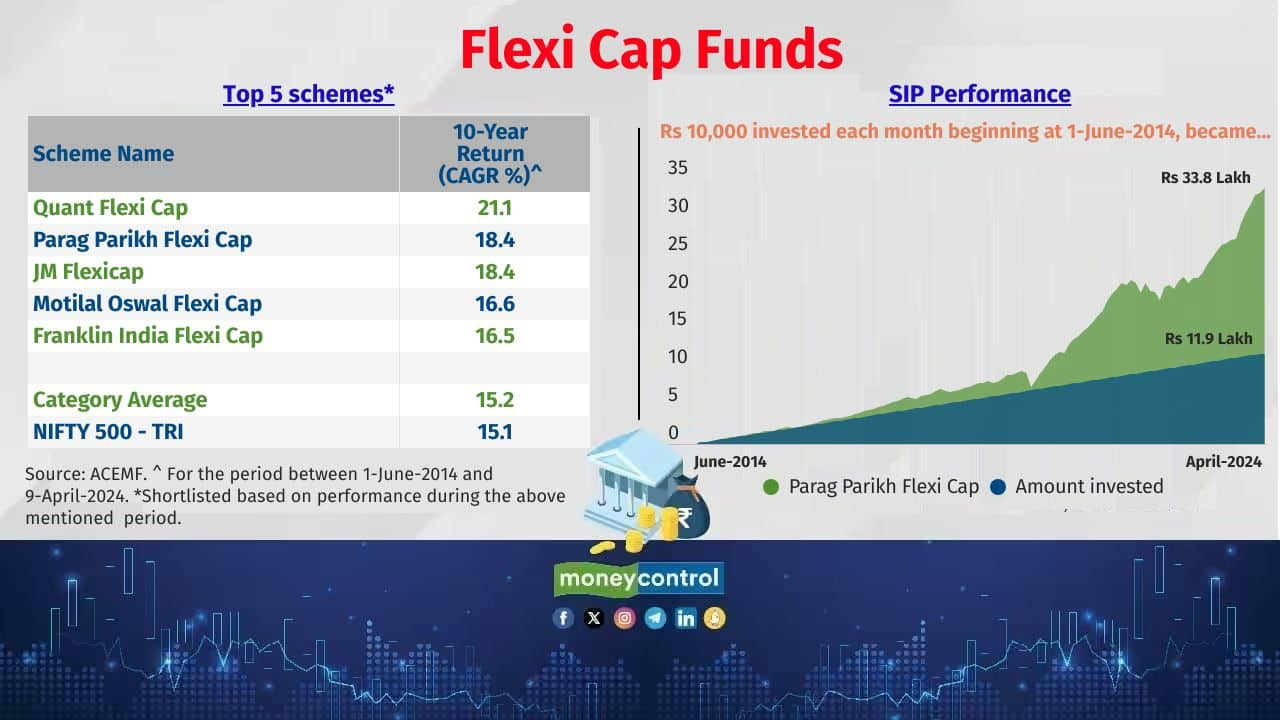

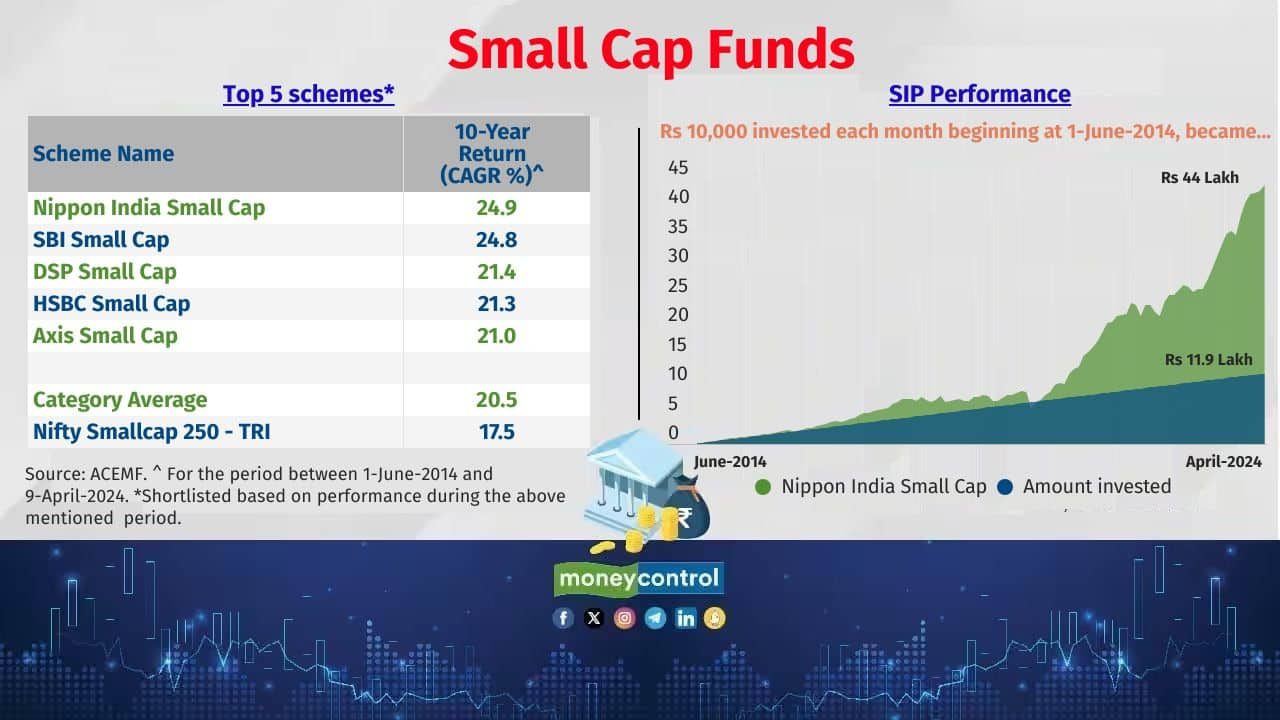

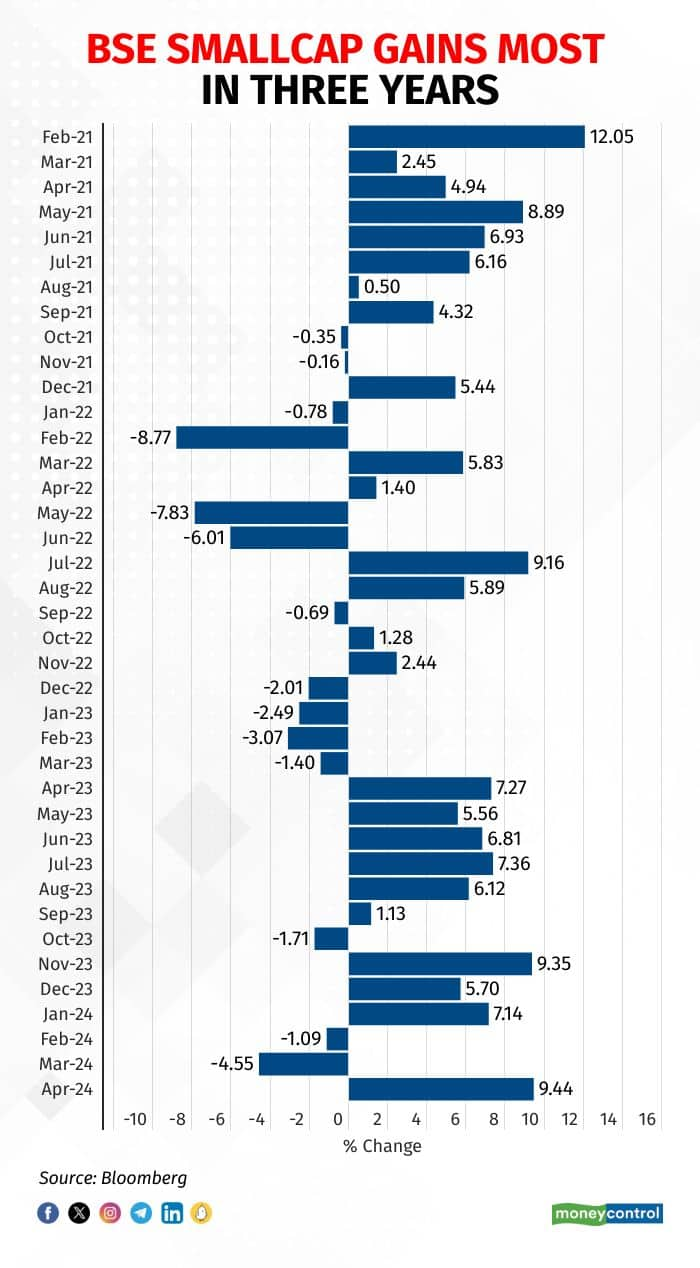

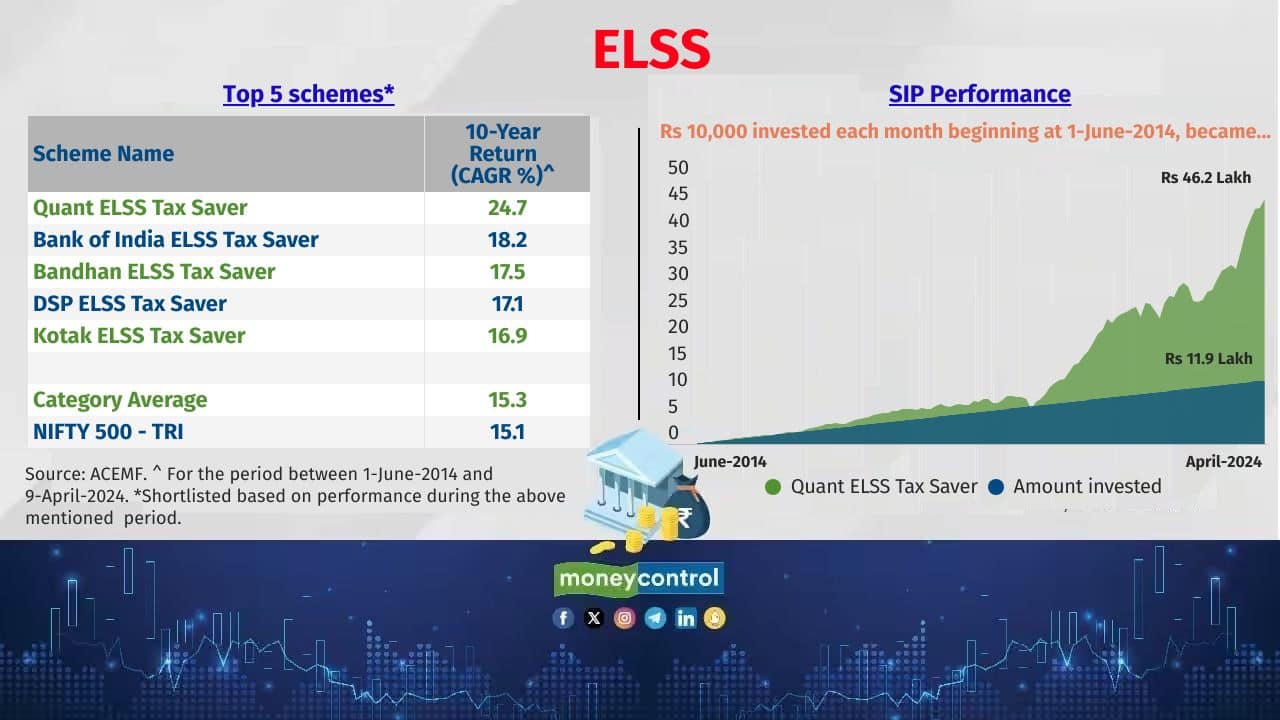

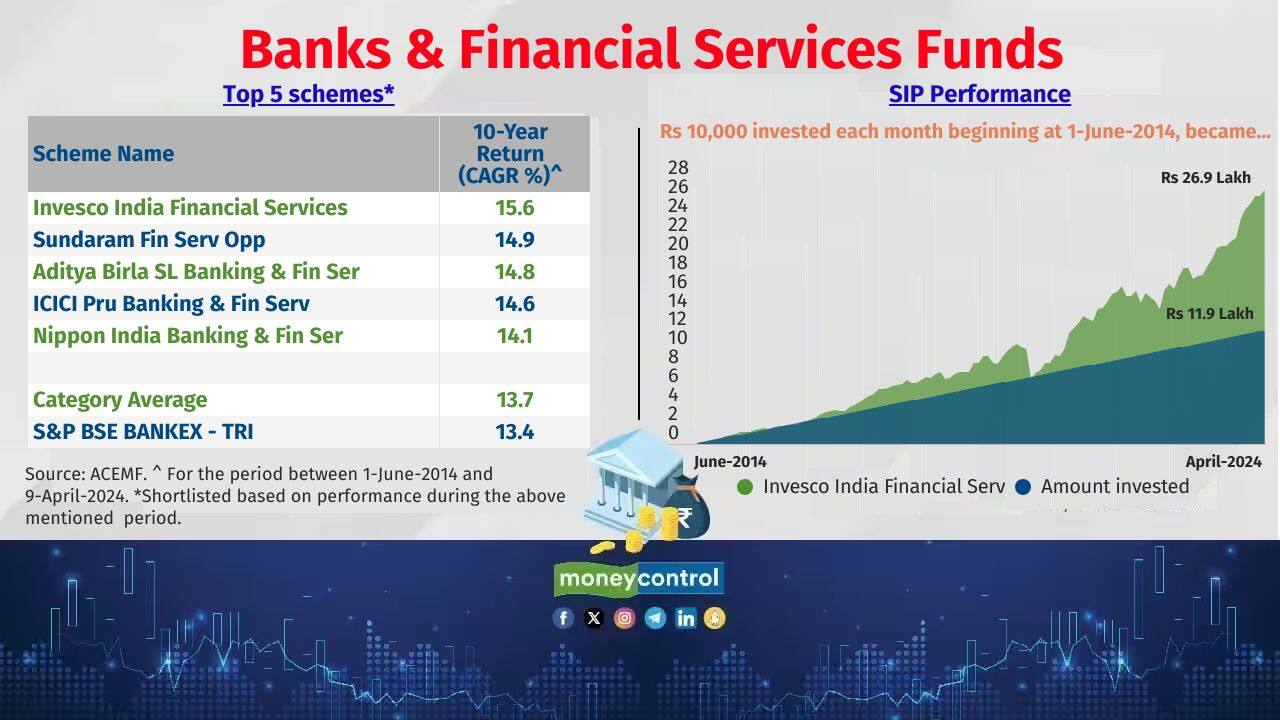

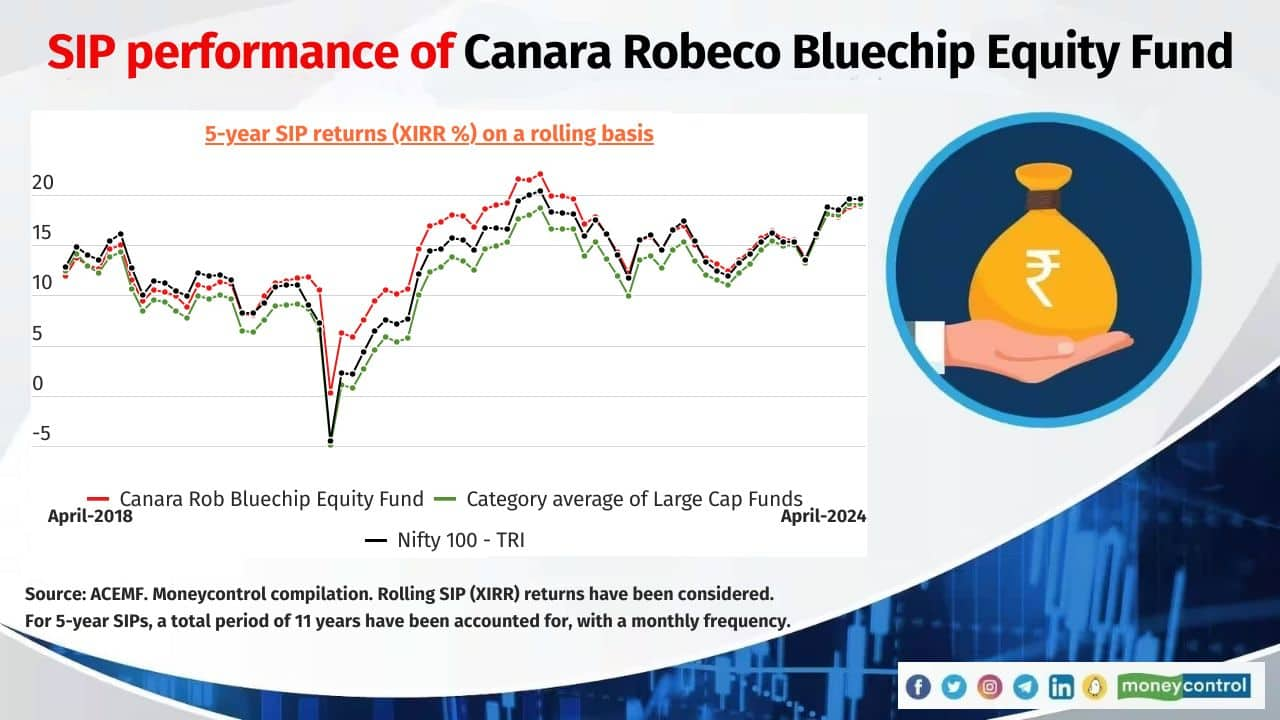

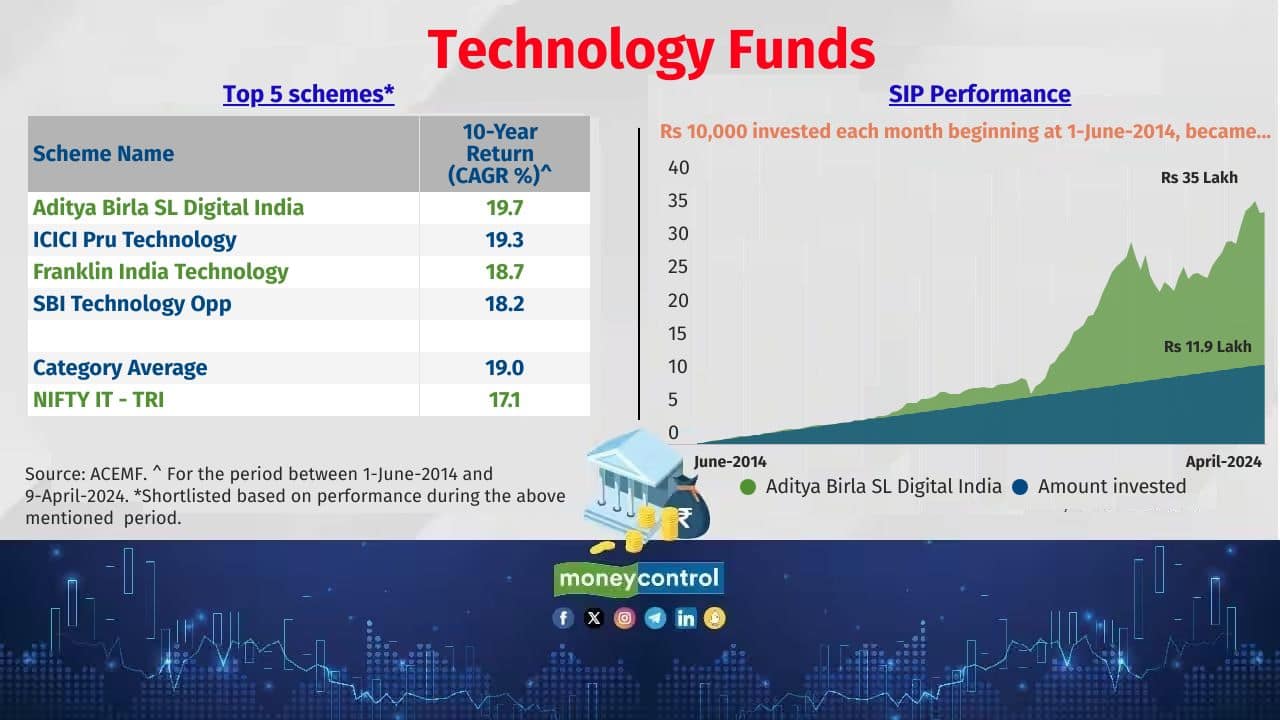

The fairness market has grown by practically 14 % on a 10-year foundation, commemorating Narendra Modi-led NDA authorities. That introduced retail buyers into mutual funds by the drove as fairness funds benefitted

Uncover the most recent enterprise information, Sensex, and Nifty updates. Acquire Private Finance insights, tax queries, and skilled opinions on Moneycontrol or obtain the Moneycontrol App to remain up to date!

<!–

(perform(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//join.fb.web/en_GB/sdk.js#xfbml=1&model=v2.10”;

fjs.parentNode.insertBefore(js, fjs);

}(doc, ‘script’, ‘facebook-jssdk’)); –>

Adblock take a look at (Why?)