On this article, I wished to provide you an entire squad of buying and selling ways for buying and selling The Wheel Technique, states Markus Heitkoetter of Rockwell Buying and selling.

I’ve compiled a listing of the questions I get most frequently. So right now we’re going to speak in regards to the 29 issues you should know when buying and selling the Wheel Choices Technique.

The Wheel Choices Technique Overview

Let’s briefly speak in regards to the fundamentals. The fundamentals of The Wheel Technique are literally fairly easy.

Listed here are the three steps that we have to do when buying and selling this technique:

Step Quantity One: We need to promote put choices and acquire premium.

Step Quantity Two: Right here, we could or could not get assigned.

Step Quantity Three: If we’re assigned, we’ll promote covered-call choices and acquire extra premium. If we’re not assigned, then we’ll keep at Step Quantity One and maintain promoting put choices to gather extra premium.

As you possibly can see, it’s actually not that difficult. I imply, wouldn’t you agree?

Now, I’ve divided this text into 4 sections: The Fundamentals, then Selecting the Proper Inventory, as a result of there’s a variety of questions on this matter, after which we will even discuss Promoting Calls After Getting Assigned, in addition to What to Do When a Commerce is in Bother.

The Fundamentals

1.) I’ve round $30,000 in my Interactive Brokers account. Is it sufficient to start out buying and selling The Wheel?

Right here is my advice. You need to have not less than $10,000 in money so as to get $20,000 in margin. I extremely advocate that you’re buying and selling a margin account.

When you’ve got lower than $10,000 in money, I don’t advocate that you simply commerce with The Wheel Technique.

When you’ve got a smaller account, I like to recommend that you simply do a most of three positions in your account. As your account grows, you possibly can go as much as 5 positions within the account.

2.) What’s the greatest expiration date when promoting choices?

What I personally love to do is go 1 to 2 weeks out, so this additionally signifies that I prefer to commerce weekly choices.

I’m searching for a very quick fuse right here as a result of I imagine that that is the place you have got probably the most management over the costs.

The thought is definitely to gather so-called “weekly paychecks,” and I put this in citation marks as a result of it all the time sounds so glamorous, proper?

Nevertheless, it’s actually necessary that you realize what you’re doing right here.

3.) Ought to I take advantage of margin to extend my shopping for energy?

My reply to that is sure, completely. I extremely advocate this, nonetheless, take into account that margin is a double-edged sword, which might be just right for you in addition to in opposition to you.

4.) How do I do know if I’ve sufficient capital if I get assigned?

It’s simple. Let’s say that you’re promoting a 100 put, which suggests a put with the strike worth of 100.

Which means if you’re getting assigned, it’s important to purchase 100 shares at $100 every totaling $10,000—that is how a lot capital you would wish.

All you’ll want to do is take the strike worth that you’re promoting of the put instances 100, as a result of choices are available in 100 packs, and multiply this quantity by the variety of choices that you simply’re promoting.

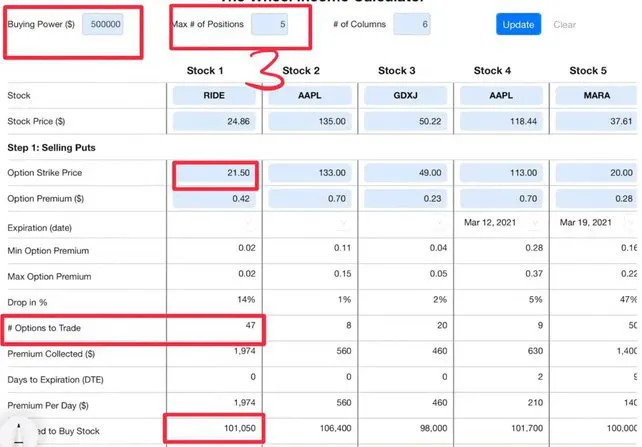

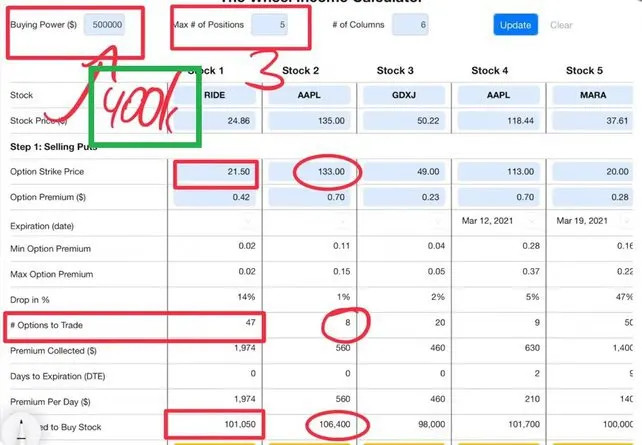

Let me offer you an instance. I not too long ago offered 8 put choices of Apple at a 133 strike worth. So how have you learnt whether or not you come up with the money for in your account?

Nicely, that is the place we’re taking the strike worth, 133 instances 100, instances 8. This implies you would wish to have $106,400 in your account. So please just remember to are sizing your account appropriately.

The excellent news is, for those who do have the PowerX Optimizer, which is the software that I’m utilizing, it can present you precisely what number of shares you possibly can commerce.

What you’ll want to do right here is fill in your shopping for energy, and once more, your shopping for energy may be totally different. What number of positions you need to take, and that is the place I mentioned you probably have a smaller account fill in three, you probably have a bigger account you need to fill in 4 or 5.

Based mostly on the strike worth that you’re promoting right here it can inform you precisely what number of choices you must commerce. Then, primarily based on what number of choices, it additionally tells you the way a lot cash you want, and the way a lot margin is required for those who had been to get assigned.

I extremely, extremely, extremely advocate that you simply do use a software, as a result of for those who do all the maths in your head, it may well go horribly fallacious.

The software that I personally use is the PowerX Optimizer. Lots of you have already got the software, lots of you’re accustomed to it.

5.) Is there a sure share you purchase to shut at? Some individuals say 50% revenue is greatest statistically too shut.

I like to shut a place at 90% of the max earnings. So for example, this morning (March 10, 2021) I offered places on DKS, Dick’s Sporting Items, and I offered them for $0.75.

That is the place proper now I’ve a working order in there to purchase this again at $0.07, which is 90% of $0.75. So sure, if I can get 90% of the max revenue right here, that is once I need to exit.

6.) Is there a rule of thumb of what share this account is tied up with the technique?

It actually will depend on what number of buying and selling methods you employ, proper? So proper now, I commerce two methods. I commerce the PowerX Technique and The Wheel Technique.

The PowerX Technique is ideal for a trending market, however the markets proper now are removed from trending. They’re tremendous uneven going up and down, due to this fact, proper now I’m dedicating all of my cash within the account to The Wheel Technique.

As soon as I begin buying and selling the PowerX Technique once more, that is the place I’d simply lower the shopping for energy right here and say as a substitute of utilizing the $500,000, I’d simply use, let’s say 400K, and use 100k for The Wheel Technique.

7.) What screening standards does the PowerX Optimizer use for the Wheel Technique?

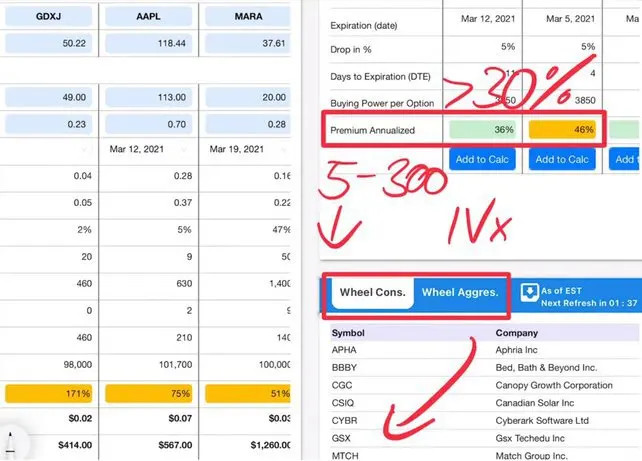

The PowerX Optimizer has a built-in scanner to search out one of the best candidates for The Wheel Technique, and there’s a conservative scanner in addition to an aggressive scanner.

On the underside proper, you possibly can see all of the symbols which are popping up on the scanner. What are the factors that we’re utilizing right here?

To start with, we’re utilizing worth as a criterion. We’re searching for shares between $5 and $300 right here.

We’re additionally searching for shares which have a down day, as a result of if you’re promoting put to gather premium, you need to just remember to’re promoting when the market goes down.

We’re additionally wanting on the implied volatility, as a result of we need to ensure that there’s sufficient premium there. Then most significantly, we need to ensure that the annualized premium is above 30%.

There are a couple of different minor standards. To start with, we solely search for shares which have weekly choices. That is what I defined briefly a little bit bit earlier, I’m not excited about buying and selling shares that solely have month-to-month choices.

8.) What can I anticipate? 30% yearly annualized primarily based on what capital?

The capital this could be primarily based on is the shopping for energy. In my account I’ve $500,000 shopping for energy. This implies if I’m searching for 30% primarily based on the shopping for energy, this could yield into 60% primarily based on the money that I put within the account. The money that I put within the account was $250,000.

So once I’m speaking in regards to the 30% yearly annualized, it’s primarily based on the shopping for energy. For those who don’t commerce with margin, then this could be primarily based in your money.

Selecting the Proper Inventory:

9.) Do you have got an outlined universe of shares which are your “good listing?”

Nicely, to begin with, I need to ensure that I’m buying and selling the shares from the PowerX Optimizer Scanner, after which I simply search for shares that I like total.

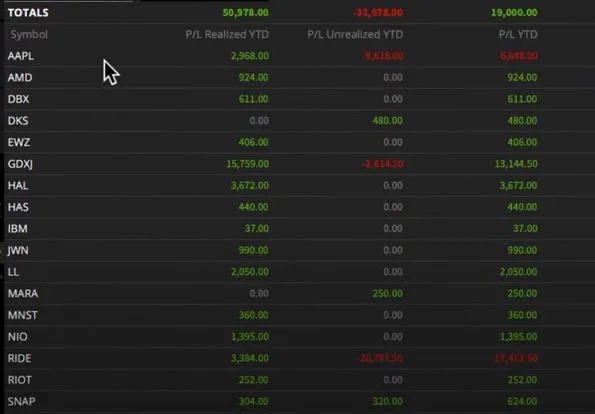

I’ll be comfortable to indicate you all of the shares that I’ve traded up to now this yr. Now we have right here DBX, DKS, GDXJ, HAL, HAS, IBM, JWN, LL, MARA, MNST, NIO, RIDE, RIOT, SNAP, and plenty of others.

These are shares that I actually prefer to commerce, and most of them are very well-known names, so I’m not buying and selling any unique shares. You additionally is not going to discover meme shares like GME or AMC on this listing right here.

10.) Is there a sure degree of IV, implied volatility, on a inventory that you simply gained’t go to? I’ve traded some 200% plus of IV. Is that too excessive?

Simply as a rule of thumb, the upper the IV the upper the danger. Which means inventory can actually swing forwards and backwards. What I really feel is a candy spot is that I prefer to see not less than 40% IV, however not more than 100%.

Generally I do take trades which are greater than 100, however truthfully, for me, the candy spot the place you discover most trades which are pretty protected is wherever between 60% to 80% implied volatility. That is the place I don’t have onerous guidelines right here, however I would like to love the inventory.

11.) Markus, have you ever modified out of your “Once I began I simply wished to know the image. I didn’t need to know something in regards to the firm, as it’d cloud my view. Commerce what you see, not what you suppose” mentality?

My reply is NO, for the PowerX Technique. I completely don’t need to know something in regards to the image. Nevertheless, for The Wheel Technique, the reply is YES. When buying and selling The Wheel Technique, I solely need to commerce super-solid shares.

12.) I observed that among the shares in your listing for The Wheel have very illiquid weekly choices. Do you look ahead to choices liquidity or simply the credit score restrict and hope to get stuffed?

For me I don’t care about open curiosity and quantity, and right here’s why. I’m promoting premium and I’m fantastic letting the choice expire nugatory, I don’t want to purchase it again. If I can purchase it again I’ll, in any other case no. So, that is the place right here I don’t care in regards to the open curiosity.

However once more, it actually will depend on the technique. I imply, for those who’re buying and selling a special technique open curiosity and quantity may be crucial to you. For me, it’s not.

13.) In addition to technical help/resistance ranges, how do you objectively determine that are one of the best shares? Do you keep in mind any elementary evaluation to filter out which underlying to commerce?

No. So here’s what I do, and that is fairly subjective, I don’t have goal standards right here. I need to like the corporate, as a result of the purpose is, you have to be OK proudly owning this firm, and I need to just like the story of the corporate.

That is the place I all the time use Peloton for example, as a result of I do know that many are buying and selling Peloton and it has a lot of premium in there. However you see for me, Peloton is an organization that I imagine can simply be ripped off, and in some unspecified time in the future, a significant competitor may swoop in.

I need to like the corporate and the story of the corporate. That is pretty subjective right here as a result of the hot button is that you simply have to be OK proudly owning that inventory on the strike worth.

14.) Since you’re suggesting to not promote places on leveraged ETFs, why are they then included in The Wheel Scanner?

This can be a nice query, and we really may exclude them in model 2.0 of the PowerX Optimizer. Proper now, I assumed you’re all adults, and as adults, you are able to do no matter you need. I didn’t need to limit you, however we’d exclude it or add an asterisk as a warning signal.

It’s suggestion, and I do know that some get blinded by premium on leveraged ETFs. I don’t commerce leveraged ETFs, something that has 2x or 3x within the description I keep away from this.

15.) Why do you choose progress shares solely as a substitute of a mixture of worth and progress shares? Appears that progress is in bother as a result of rates of interest.

Development shares provide enticing premiums, however worth shares not often do. I need to present you a really particular instance right here of IBM, as a result of IBM is without doubt one of the worth shares that I’ve traded.

I traded IBM after a large drop the place I offered the 117 strike. Normally in IBM you gained’t discover sufficient premium in there. The implied volatility currently is often round 34 or 29. So that is the quite simple motive why I’m going for progress shares as a result of I’m wanting for at least 30% annualized in premium.

Promoting Calls After Getting Assigned

16.) For those who promote a name decrease than your authentic put strike worth, can you continue to earn money?

That is really tremendous harmful, and right here’s why. While you offered a put you bought assigned, and also you had to purchase shares on the strike worth. I’m utilizing an instance of AAPL, and I used to be assigned Apple at $133 per share.

Now, if I’m now promoting a name, it signifies that I’ve to promote shares on the strike worth. If I’m promoting, let’s say a 125 name, it signifies that I’ve to promote the shares for $125.

Now right here’s the problem with this. I purchased them for $133 and now I’m promoting them proper now for $125. Which means I’m dropping $8 per share. While you’re buying and selling choices, they arrive in 100 packs, so which means you’ll lose $800 per choice.

That is the place you’ll want to watch out if you’re promoting a name decrease than your authentic strike worth. For those who do that, ensure that it’s above your price foundation, and we’ll discuss the associated fee foundation right here in only a second.

17.) Why are lined calls extra worthwhile in your expertise than cash-secured places? Are you focusing on a special share return?

No, I don’t. Right here’s a rule of thumb for what I do. Let’s leap to PowerX Optimizer and go to the Wheel Revenue Calculator.

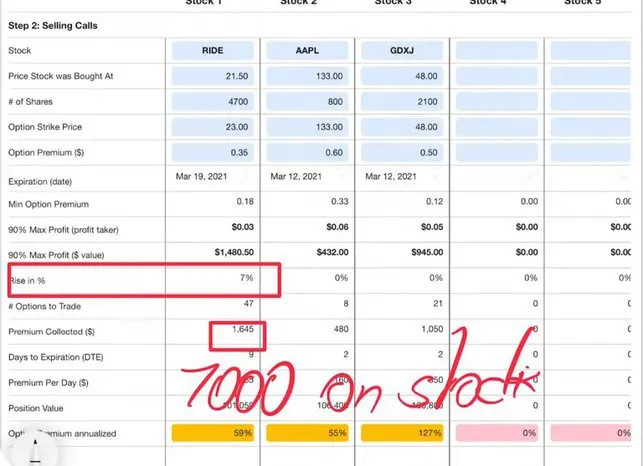

Right here is one thing that I did right now (March 10, 2021) the place I offered calls on RIDE.

So, on RIDE I offered calls that expire March 19, and I offered them for $0.35, and the calls that I offered had been at 23. By doing this, this really gave me an annualized return.

By default, I’m not going as many strikes out, as a result of all I would like right here proper now’s an increase of seven%. If you’re rising 7% right here, then I will earn money not solely on the premium that I collected, the 16.45, but in addition a further $7,000 on the inventory. So, this shall be a complete of $8,500.

It’s simply the character of the beast, as a result of if you’re promoting calls, you’re often nearer to the strike worth, and due to this fact, often greater premium for a better ROI.

Because of this I maintain telling you I’m all the time wanting ahead to getting assigned as a result of promoting calls is definitely extra worthwhile.

18.) While you promote calls to cut back the associated fee foundation, do you additionally embrace the premium acquired from promoting first the put to cut back the associated fee foundation?

Sure, I do embrace the premium.

19.) Is there a threat of the portfolio changing into nothing however shares and never having the ability to promote lined calls out of the cash (OTM) to hit your targets?

The reply to that is completely, sure. When buying and selling there’s threat, and there’s a risk that you simply personal a bunch of shares and you can not promote calls in opposition to.

It’s a must to maintain on to those, and so for a couple of weeks, it might completely occur that you simply’re not making any cash. I used to be not too long ago assigned shares of AAPL and haven’t been making any cash with them as a result of I’ve not been capable of promote calls.

However you see, regardless that I’ve one dud in my account, it’s solely considered one of my positions, and I nonetheless have been capable of make virtually $51,000 in about 8 or 9 weeks. Subsequently, it’ll even out.

So, is there a threat? Completely. When buying and selling there’s all the time threat. If you’re not keen to just accept the danger when buying and selling, don’t commerce, as a result of there’s all the time the danger of dropping cash.

20.) Markus, for those who haven’t offered a name in opposition to the Apple 103 strike worth haven’t you been lacking out on cash?

Not likely, and right here’s why. Proper now, if I’d attempt to promote a 133 name on Apple, that’s, for instance, expiring this week, I’d get $0.01. I’m not lacking out on any cash, proper? $0.01 interprets into $1. So, no, I’m not lacking out.

Even when I’d exit to subsequent week and I’m wanting on the 133, I’d solely get $0.14. That’s $14. For me, it’s not value it. Once more, all people’s totally different, you might need totally different guidelines. For me, nonetheless, it’s probably not value it.

21.) When operating a rescue mission on margin, how does one promote a lined name? My dealer requires money for any name that I promote.

If that is true, change the dealer instantly, and right here’s why. I personal Apple shares, and if proper now I need to promote calls in opposition to these Apple shares, let’s say 8 calls, it could not have any impact on my shopping for energy. It’s the other.

So right here I extremely advocate you alter the dealer if that is true. Your margin necessities must be lowered when promoting a lined name, that is the way it works.

22.) Why not nonetheless promote calls at your price foundation after the inventory drops?

As a result of generally there’s not sufficient premium. If there’s sufficient premium, I’ll do it, however generally there’s merely not sufficient premium after which you’re sitting in your fingers.

Subsequently I mentioned I’ve this one dud in my account, AAPL, that’s not making me any cash, however every little thing else IS making me cash.

I used to be capable of promote calls in opposition to GDXJ and RIDE. With DKS, MARA, and SNAP, I offered places. So every little thing else is making me cash. I can’t change the wind, I can solely alter my sails, and that is what I’m doing right here.

What to Do When a Commerce Is In Bother

23.) What do you imply by “rescue mission” for individuals who haven’t heard it earlier than?

A “rescue mission” is the place you have got been assigned shares, and now the commerce goes in opposition to you. You promote extra put choices beneath the assigned strike worth.

By doing this, you acquire extra premium. If you’re assigned you decrease your price foundation, making it simpler to get out of that commerce.

You solely ought to contemplate flying a “rescue mission” if the inventory is down not less than 30% out of your assigned worth.

24.) Why not nonetheless promote calls after your inventory drops?

As a result of there may not be sufficient premium in there. Quite simple, proper? If there’s, we are going to do it, if not like with AAPL for me proper now, then it’s what it’s.

25.) What occurs if you run out of shopping for energy and might’t promote calls at your goal?

To start with, you possibly can all the time promote lined calls, as a result of you’ll not run out of shopping for energy for promoting lined calls.

What they most likely meant is what about not having the ability to promote places, and there are two issues that you are able to do.

Primary, you possibly can wire extra money into your account, which isn’t all the time possible.

Quantity two, you possibly can merely shut some positions to liberate some shopping for energy.

26.) Is it doable to purchase choices fairly than promote choices as a result of promoting choices is meant to be very harmful?

Nicely, after all, and that might be the PowerX Technique. With the PowerX Technique, you’re shopping for choices if that is what you favor to do. For those who’re buying and selling The Wheel Technique, that is the place you’re promoting choices.

Choose your poison. I imply, you’ve obtained to do one or the opposite, both you’re shopping for choices otherwise you’re promoting choices. I’ve a technique for every of those.

27.) Any level in ready to ensure that the market has stopped dropping earlier than flying a rescue mission?

Sure! You don’t need to attempt to catch a falling knife. Wait till you see that the market or the inventory is stabilizing right here.

28.) I perceive beginning the rescue mission when the inventory drops 30%, how do you establish the brand new put strike worth to enter? The subsequent help degree?

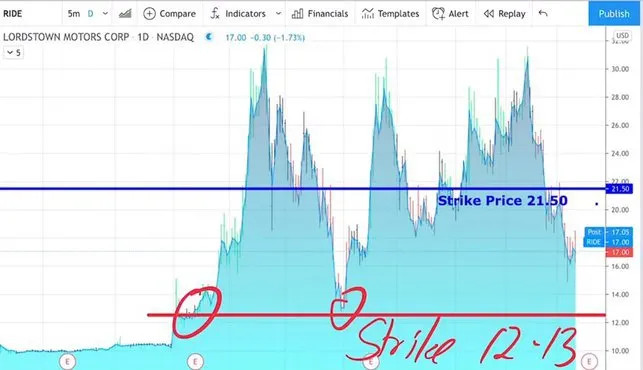

Sure, completely. This is able to be the following help degree that you simply’re . Let me present you an instance with RIDE.

I obtained assigned at 21.50, and if we’re wanting on the lengthy evaluation right here, then we see that the following doable help degree is at round I need to say 12 or 13. So this right here it could be a strike worth of 12-13, and that is the place I’d do it.

If we go to Apple, which is one other inventory that I’ve, I did get assigned right here at 133. As you possibly can see, the following help degree might be someplace round 108, proper? I’d most likely be most excited about promoting the 108 strike worth.

29.) It’s onerous to earn money on a small account except you get assigned.

Sure, it’s onerous to earn money on a small account, interval. I do know that many need to begin with a smaller account, like $500 or $1,000, however truthfully, it’s tremendous, tremendous, tremendous troublesome to earn money on such a small account.

With the intention to do that, you would need to commerce this account far more aggressively, which suggests that you’re principally risking an entire lot. If you wish to attempt to double a $500 account, you principally must threat the complete $500.

That is what many Robinhood merchants and these YOLO’ers do. It’s all-in, and possibly it doubles, otherwise you lose all the cash. So, sure, it’s completely troublesome.

Because of this the capital necessities; I extremely advocate that if you wish to commerce the PowerX Technique that you’ve not less than $5,000. If you wish to commerce The Wheel Technique, you must have not less than $10,000 in money, which provides you $20,000 in shopping for energy. That is tremendous necessary.

For those who do have smaller accounts, there may be buying and selling methods for you. I need to be trustworthy with you although. If there are, I don’t know them.

Once I began buying and selling, I began with an $8,000 account and I shredded that account into items all the way down to $1,600.

Then the second account that I used to be buying and selling was $16,000. Now that one, I additionally misplaced greater than half. I traded this all the way down to $8,000 and that is once I put some extra money in, introduced this as much as $12,000, and that is when it lastly clicked.

So once more, if proper now you have got a smaller account, good luck, there may be methods on the market. I want I had some for you. I promise, if I knew develop a $500 account, I’d inform you.

If proper now all I needed to commerce with was $500, I wouldn’t do it. I’d discover a means to save cash or make extra cash with Door Sprint, Insta Cart, or one thing like this till I’ve not less than $5,000.

I want that I might inform you one thing totally different, and sadly, I can’t. I’m not saying that it’s unattainable, all I’m saying is that I’m not the suitable individual to show you these methods as a result of I don’t know them.

Closing

If I didn’t cowl a query right here on this article that you will have, I promise I’ll reply them in an upcoming article.

Study extra about Markus Heitkoetter at Rockwell Buying and selling.