When Wall Avenue is afraid, the world is dazzled by gold. That is what occurred in August and September when COVID-19 panic pushed gold costs above $2,000 an oz. Gold outperformed shares throughout the unstable 12 months of 2020, with gold costs rising 24.6%, in contrast with the 18.4% complete returns delivered by the S&P 500 index. .

Investing in gold based mostly in your short-term prediction for shares is sheer hypothesis. However investing a small quantity in gold shares or funds could be a invaluable inflation hedge and portfolio diversifier. This is when investing in gold is sensible, and why it has nothing to do with what’s taking place within the inventory market.

Picture supply: Getty Photos.

1. It has been valued all through human civilization

International demand for jewellery was down 29% within the third quarter of 2020 12 months over 12 months, in response to the World Gold Council. The drop is basically attributed to the financial devastation of the pandemic, coupled with the skyrocketing worth of the dear steel.

However gold has been extremely wanted for hundreds of years throughout cultures. The Historical Egyptians thought of it the flesh of the gods. The Incas referred to as it the sweat of the solar. In the present day, demand for gold jewellery is very sturdy in rising markets, notably China, the place it is often gifted for particular events and the Chinese language New 12 months. It is also valued in India, the place wedding ceremony season and the competition of Diwali generally set off a shopping for frenzy. These markets accounted for the most important pandemic-related declines.

Nonetheless, gold’s cultural and historic significance all through civilization is not going to be reversed by the coronavirus. You’ll be able to depend on gold holding its worth, even when a worldwide recession tanks jewellery demand within the brief time period.

2. The provision stays scarce

If all of the gold mined in human historical past had been melded collectively, it might match right into a dice of simply 21 meters, or 69 toes, on both sides. That is roughly sufficient to fill 3.7 Olympic-size swimming swimming pools. Opposite to common perception, although, the Earth truly has ample quantities of gold. It is simply that mining it’s extremely troublesome, and most sources do not include sufficient gold to make mining cost-effective.

Solely 0.1% of mine prospects truly get developed right into a mine. The exploration and improvement phases usually take a decade or extra earlier than gold can truly be mined. Given the complexities of gold mining with present know-how, the worldwide provide stays restricted, which retains costs excessive.

3. It has decrease volatility than most different commodities

Traders have a tendency to hunt out commodities as a result of they’ve a low correlation with shares, so their costs do not transfer in tandem. Many commodities have returns that have a tendency to maneuver in the other way of the inventory market. Commodities are additionally a standard inflation hedge as a result of costs usually rise when inflation goes up. Traditionally, gold costs have carried out higher on common within the U.S. when inflation is above 3%.

However commodities as an entire are extremely unstable, on condition that unpredictable components like climate, pure disasters, and political instability can drive large short-term modifications in provide and demand. Gold costs will also be unstable within the brief time period as investor sentiment drives costs up and down, however the steel tends to be among the many most steady commodity investments.

Total, gold demand is fairly fixed. Jewellery, which accounts for 50% of its use, tends to be a gentle supply of demand, although it clearly drops throughout financial downturns. Central banks and buyers, together with people and exchange-traded funds (ETFs), drive about 40% of demand, although after all this peaks throughout downturns. Since it is so troublesome to find and develop a gold supply, mining exercise would not reply rapidly to cost fluctuations, so the provision holds regular.

4. Its industrial utilization is proscribed

Gold has numerous makes use of in fields like electronics, medication, and dentistry. However solely about 10% of worldwide gold demand is pushed by industrial manufacturing. In consequence, gold is comparatively insulated from a producing recession, although it isn’t shielded from a shopper recession the place spending plummets. Against this, greater than half of silver mined worldwide is used for trade, which is why the white steel is extra prone to transfer up and down with the inventory market.

5. Rates of interest are prone to keep low

When rates of interest are low, gold usually is sensible for these on the lookout for a safe-haven asset as a result of buyers cannot get a lot return from different safe-haven investments, like U.S. Treasuries. The Fed has signaled that it plans to maintain rates of interest close to zero by not less than 2023. In consequence, gold might proceed to carry its attraction for a number of years to come back. As soon as rates of interest creep again up, investing in bonds will make extra sense for these looking for returns that may outpace inflation.

Must you put money into gold?

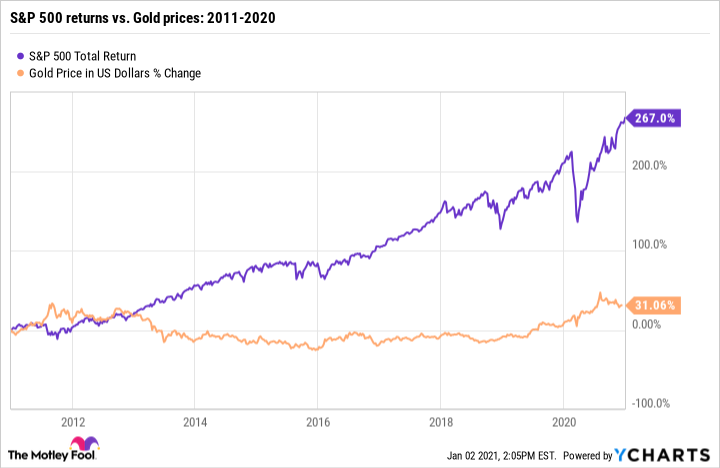

Gold could outperform shares in unstable years like 2020, however the S&P 500 has traditionally crushed the returns gold delivers over longer holding durations.

^SPX knowledge by YCharts.

Should you’re frightened about shares crashing, staying invested in shares and committing to a very long time horizon is a greater technique than gold. However when you’re looking for a short-term bear market hedge, allocating a small share of your portfolio to gold can provide some peace of thoughts. The bottom line is that it is solely an efficient technique when you make investments earlier than the panic has set in. The worst factor you are able to do is purchase gold when a widespread case of investor nerves has pushed gold to a file excessive that is prone to be short-lived.

Should you do wish to put money into gold, proudly owning bodily steel might be a problem. You will need to take care of supply logistics, together with storing and insuring the steel. Investing in gold shares or ETFs that personal gold shares, bodily steel, or a mixture of the 2 is far easier.

The vital factor to recollect is that the most effective time to put money into gold will at all times be if you’re not listening to concerning the worth of gold within the information daily.