Surveying the current stretch of data for the S&P 500 Index, you’d be tempted to assume that on the subject of markets, every thing is superior. Inflation fears have eased, financial indicators are strengthening and the Federal Reserve stays accommodative.

However look previous the sunshine and lollipops, and also you’ll discover a rising sense of defensiveness.

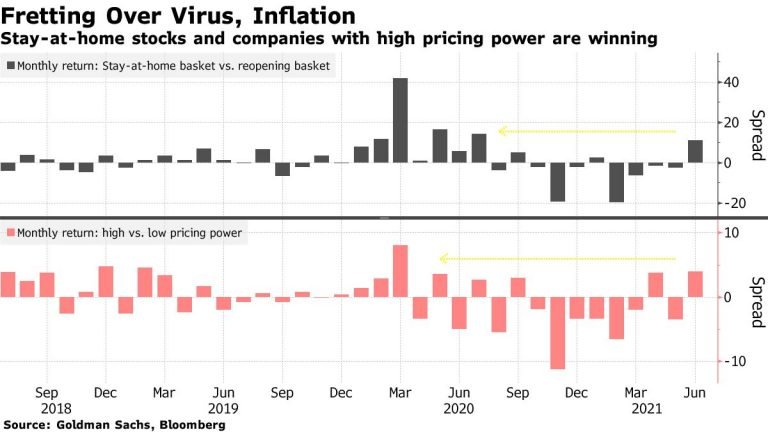

Buyers are taking danger off the desk because the fast-spreading delta variant of the coronavirus causes contemporary outbreaks in lots of elements of the world. Airline and cruise shares are being dumped whereas there’s a renewed embrace of the stay-at-home commerce. Companies’ hiring woes have elevated considerations over rising wages, prompting a pivot towards pricing energy. Sectors seen as hardy growers, like expertise, are again on high.

There are even indications that the S&P 500’s 90% rally from the pandemic backside might be due for a pause, since fewer shares are collaborating within the newest leg up. This has helped put a halt to huge fairness inflows and pushed a pointy demand for presidency bonds.

“What the market is beginning to acknowledge is that each one the excellent news can’t be good in each single manner,” Daniel Skelly, head of market analysis and technique at Morgan Stanley Wealth Administration, stated in an interview on Bloomberg TV and Radio. “There’s a realization that earnings revisions are beginning to plateau and roll over.”

The S&P 500 superior for a fifth week in six, closing above 4,300 for the primary time in historical past. The tech-heavy Nasdaq 100 Index outperformed, rounding out seven straight weekly beneficial properties, the longest streak since November 2019. Economically delicate shares lagged and the Russell 2000 of smaller firms fell.

The distinction between tech and small-caps is the newest instance of traders shortly adjusting their positions in anticipation of stronger headwinds. On this playbook, security is the secret.

Trade-traded funds specializing in U.S. shares misplaced nearly $6 billion within the week via Thursday, a departure from the primary few months of the 12 months, after they lured greater than $200 billion of contemporary cash, knowledge compiled by Bloomberg present. In the meantime, demand for secure havens spurred the second-highest month-to-month inflows to the iShares 20+ Yr Treasury Bond ETF (ticker TLT).

Skilled speculators additionally began to rein in danger. Within the closing days of June, hedge funds lowered their lengthy positions whereas overlaying their shorts. Mixed, their risk-off exercise reached the very best degree since late January, prime dealer knowledge compiled by Goldman Sachs Group Inc. present. Nonetheless, with web leverage sitting larger than 90% of the time over the previous 12 months, positioning is hardly bearish.

Whereas the record of worries is lengthy, there is no such thing as a scarcity of causes to remain invested. Development could also be peaking, however company earnings are nonetheless anticipated to develop via not less than 2023. Fed coverage makers have proven a hawkish tilt, but say they’re a good distance from elevating rates of interest.

To Liz Ann Sonders, Charles Schwab Corp.’s chief funding strategist, the market outlook stays murky.

“Did the pandemic pause the cycle that was in play within the financial system and the market up till February final 12 months, or did it finish one cycle and begin a brand new one?” Sonders stated in an interview on Bloomberg TV. “We’ll begin to get solutions to that within the subsequent few months once we transfer previous the bottom results by way of financial knowledge and inflation knowledge.”

Buyers usually are not ready to search out out. With inflation rising, firms seen as higher outfitted to cross on prices to clients with out hurting their enterprise are in vogue. Their shares, as tracked by Goldman, final month beat a cohort with low pricing energy by probably the most since March 2020, the beginning of this bull market.

In the meantime, brooding over a possible financial slowdown sparked a rotation again to progress shares out of worth, a mode dominated by cyclical shares. The Russell 1000 Development Index outperformed its worth counterpart in June by probably the most in twenty years.

The reopening commerce that’s frolicked since November’s vaccine rollout has been quieted because the delta variant spreads from Europe to Asia. A Goldman basket of shares poised to learn from a return to regular financial exercise simply suffered its worst month since final July relative to the stay-at-home basket.

“Persons are actually nervous about something that would see a resurgence in instances or a return to a few of the shutdowns,” stated Chris Gaffney, president of world markets at TIAA Financial institution. “It’s only a reminder that this Covid continues to be on the market and will elevate its head once more.”

— With help by Vildana Hajric, and Melissa Karsh

Adblock check (Why?)