Buyers are fretting over Treasury yields and questioning when a price rise might begin to crimp a stock-market rally, although they weren’t but frightened sufficient Tuesday to forestall main benchmarks from notching one other spherical of all-time peaks.

So when does the ache of rising yields, which makes it tougher to justify stretched fairness valuations, begin to make a distinction? With the yield on the 10-year Treasury word

TMUBMUSD10Y,

transferring again above 1.2%, a problem of the 1.5% space, which is the equal of the dividend yield on the S&P 500

SPX,

might quickly be in retailer, wrote Sean Darby, international head of technique at Jefferies, in a Tuesday word.

That occasion “will in all probability coincide with the primary check for the valuations of the upper PE shares and the relative efficiency of the S&P 500 versus extra loftier valued indices such because the Nasdaq-100,” he wrote, referring to the P/E, or price-to-earnings ratio, a standard measure of inventory market valuations.

Traditionally, low Treasury charges have been seen justifying lofty valuations for equities, as buyers have little alternative however to look to shares for returns. Whereas Treasury yields stay low, the transfer larger might threaten equities with probably the most stretched valuations, strategists have warned. Yields and bond costs transfer in reverse instructions.

However Darby delves deeper, arguing that monetary markets have seemingly undergone a “regime change” as buyers adapt to the Federal Reserve’s average-inflation focusing on setup, which might see the central financial institution enable inflation to overshoot its goal and the financial system to run sizzling earlier than transferring to tighten coverage.

That regime change amid expectations for considerable liquidity could also be illustrated by the continued rally in junk, or high-yield, company bonds. These yields have fallen sharply, even buying and selling beneath Treasurys on an inflation-adjusted foundation for the primary time in historical past, he famous.

In the meantime, the U.S. greenback, whereas seeing a modest bounce to start 2021, hasn’t but staged a convincing turnaround after its steep 2020 slide, analysts mentioned. A weaker greenback is mostly seen as favorable for shares by serving to to maintain international monetary situations unfastened.

“In actuality the worst case situation for fairness buyers could be a selloff in [Treasurys] accompanied by widening credit score spreads and a powerful greenback,” Darby mentioned. “Up to now, larger U’S’ bond yields haven’t been capable of arrest the decline within the dollar — actual rates of interest are nonetheless unfavourable.”

So what ought to stock-market buyers anticipate?

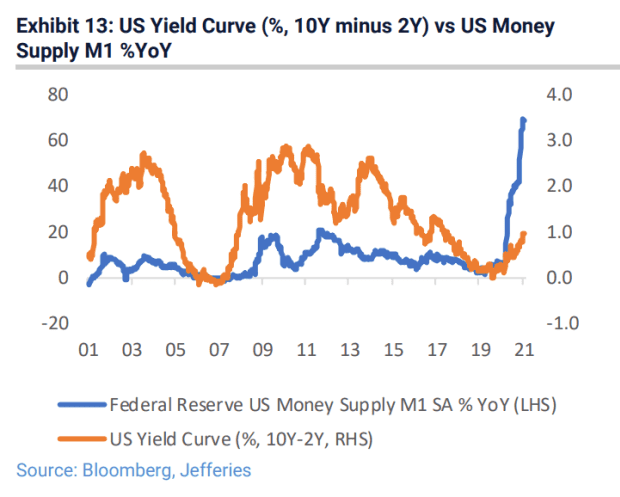

First off, “a lot larger yields,” he mentioned, noting that every one three of Jefferies’ indicators on the path of the 10-year yield — the 10-year vs. 2-year U.S. yield curve vs. inflation expectations; the yield curve vs. U.S. M1 cash provide; and the yield curve vs. the copper/gold ratio — are all pointed vertical, notably the connection between cash provide and the yield curve (see chart beneath).

Jefferies

Jefferies expects the 10-year yield to hit 2% by year-end, Darby famous.

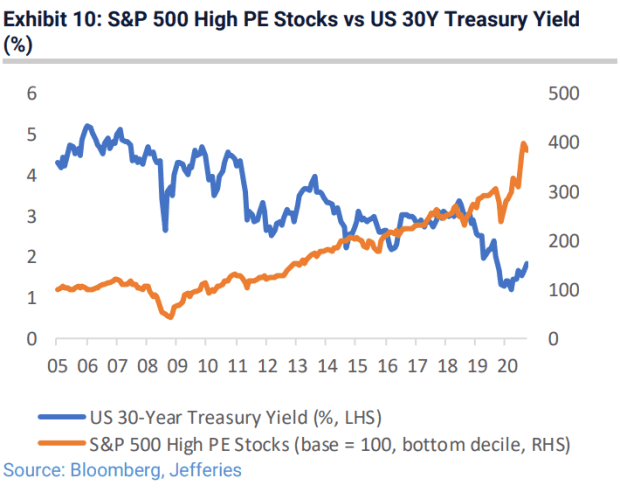

Secondly, excessive price-to-earnings ratio shares within the S&P 500 noticed a pointy absolute return because the 30-year Treasury yield

TMUBMUSD30Y,

plunged, Darby mentioned (see chart beneath), noting the identical was true for the tech-concentrated Nasdaq-100

NDX,

Jefferies

“These are probably the most delicate to larger U.S. long-term charges,” he mentioned, noting that equities are lengthy length property.

The 30-year yield jumped 8.6 foundation factors to a more-than-one-year excessive 2.089% Tuesday, whereas the 10-year yield rose 9.8 foundation factors to 1.298%. The Dow Jones Industrial Common

DJIA,

eked out a achieve of 64.35 factors, or 0.2%, in uneven commerce, constructing on final Friday’s file shut as buyers returned from a three-day vacation weekend. The S&P 500 ended 0.1% decrease, whereas the Nasdaq Composite

COMP,

shed 0.3%.