Testing a buying and selling method centered on the PVI indicator on Microsoft inventory with the goal of surpassing the inventory’s efficiency. The Optimistic Quantity Index is an collected metric using quantity shifts to establish areas the place institutional traders could also be lively.

The PVI aids in evaluating the vigor of a development and doubtlessly confirming worth reversals, relevant not solely to particular person securities but additionally to widespread market indices.

Right this moment, I’m inspecting a technique for Microsoft that comes with the Optimistic Quantity Indicator alongside the Relative Energy Indicator. The technique is simple, highlighting the efficacy of simplicity in buying and selling methods and the potential for achievement with out resorting to complicated machine studying fashions. Let’s delve deeper!

“Within the monetary realm, rising quantity alerts optimism, propelling inventory costs upward and setting the stage for prosperity.” — Richard D. Wyckoff

The Optimistic Quantity Index Components

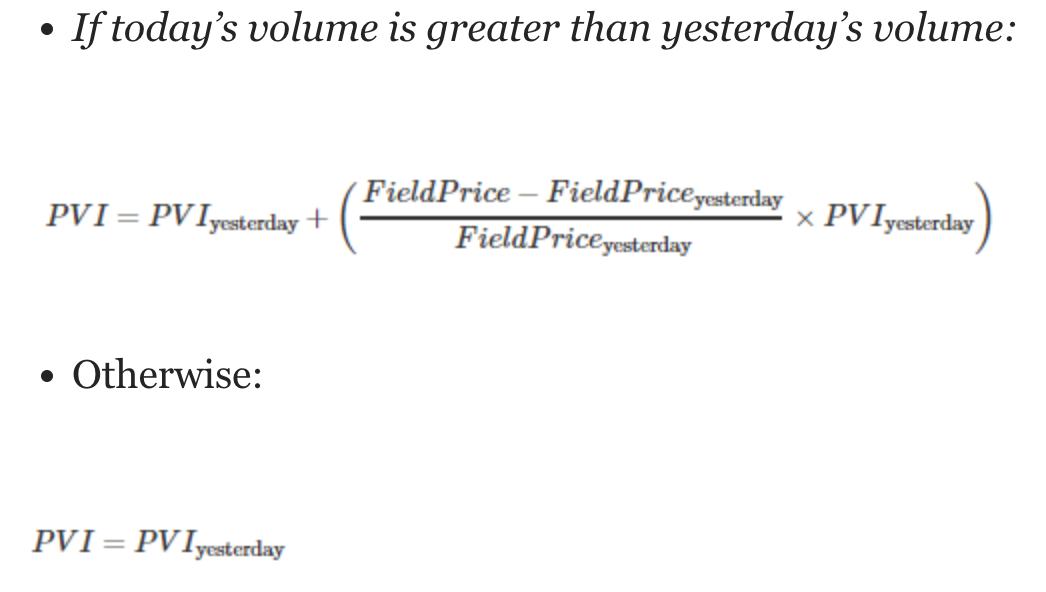

When computing the Optimistic Quantity Index (PVI) for at present, we think about the chosen worth sequence, which may very well be, as an example, the Shut Worth. If at present’s quantity exceeds yesterday’s quantity, we make use of the primary components; in any other case, we make the most of the second components.

Let’s Get In To It

1. Load packages, obtain information and calculate Technical Indicators.

msft_prices = pd.read_csv('path_to_the_file/msft_1hour_data.csv')msft_prices['date'] = pd.to_datetime(msft_prices['date'])

msft_prices = msft_prices.set_index('date')

msft_prices['pvi'] = pandas_ta.pvi(shut=msft_prices['close'],

quantity=msft_prices['volume'],

size=20)

msft_prices['rsi'] = pandas_ta.rsi(shut=msft_prices['close'],

size=20)

msft_prices['rsi_lag_1'] = msft_prices['rsi'].shift()

msft_prices

2. Outline The Buying and selling Sign Lengthy & Quick.

msft_prices['signal_1'] = msft_prices['pvi'].diff().apply(lambda x: 1 if x>1 else (-1 if x<-1 else np.nan))msft_prices['signal_2'] = msft_prices.apply(lambda x: 1 if (x['rsi_lag_1']<50)&(x['rsi']>50)

else (-1 if (x['rsi_lag_1']>50)&(x['rsi']<50) else np.nan), axis=1)

Right here’s the technique breakdown based mostly on the plotted alerts:

- Lengthy alerts are denoted by inexperienced triangles, whereas quick alerts are represented by purple triangles.

Technique Situations:

- If Signal_1 equals 1 AND Signal_2 equals 1, we enter a LONG place.

- If Signal_1 equals -1 AND Signal_2 equals -1, we enter a SHORT place.

Take Revenue and Cease Loss:

- Take Revenue is about at 2%.

- Cease Loss is about at 2%.

Intraday Expectations:

- Intraday methods sometimes goal to seize short-term actions, necessitating tight take revenue and cease loss ranges.

3. Plot the outcomes

Sharpe ration: 0.92

The technique began with a portfolio worth of $100,000 and ended with a ultimate portfolio worth of $126,312, yielding roughly a 26.3% return over the previous two years.

Whereas the technique seems promising, there’s room for enhancement. Further filters might be integrated to weed out unfavorable trades or refine sign situations. Discovering efficient methods calls for meticulous effort and a focus to element.

Apparently, regardless of the prevailing hype surrounding Machine Studying (ML) and superior methods, it’s evident {that a} tremendous complicated mannequin isn’t essentially required to generate potential returns. Many people are eager on implementing ML methods, assuming they will simply combine ML into their buying and selling methods. Nevertheless, it’s price noting that the method is extra intricate than merely counting on automated options like ChatGPT. Success in buying and selling calls for a complete method and a radical understanding of market dynamics.

You possibly can save as much as 100% on a Tradingview subscription with my refer-a-friend hyperlink. While you get there, click on on the Tradingview icon on the top-left of the web page to get to the free plan if that’s what you need.

➡️Subscribe Me right here ➡️ https://medium.com/@aamurtazin/subscribe

I’ve acquired loads to share in my upcoming blogs.

Adblock check (Why?)