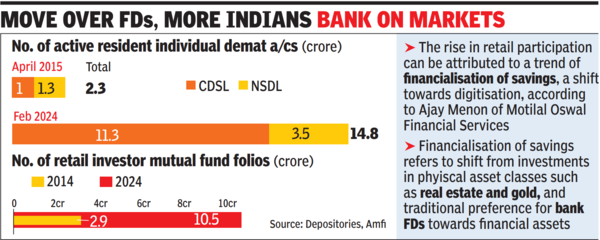

MUMBAI: A military of retail traders has discovered a powerful footing on Dalal Road during the last decade due to a bullish market and a pandemic-driven digital push. In April 2015, India had simply over 2 crore particular person demat accounts – the precise variety of traders would have been even much less as one individual can maintain a number of accounts. As of Feb 2024, the tally has grown over seven occasions to just about 15 crore.

Oblique retail participation in equities has additionally seen a stellar rise in a decade because the variety of mutual fund folios has grown from lower than 3 crore in March 2014 to over 11 crore as of Dec 2023. Retail traders, together with excessive networth people, account for 91% of the Indian fund business’s almost Rs 22-lakh-crore fairness belongings underneath administration.

“Previously decade, mutual fund fairness AUM demonstrated a powerful 30% CAGR. Furthermore, month-to-month SIPs surged from a modest Rs 1,200 crore in 2014 to over Rs 19,000 crore in 2024. This exceptional development in fairness mutual funds displays the substantial surge in fairness investing tradition amongst Indian traders,” mentioned Radhika Gupta, MD and CEO, Edelweiss MF.

The SIP-driven rise of particular person traders has offered mutual fund firms with ammunition, which they’ve deployed successfully amid bouts of international fund selloffs. Primarily, retail traders have emerged as a counterbalance to deep-pocketed international fund managers. “The resilience within the Indian market is pushed by vibrant participation from the home retail phase. The continued rise in retail participation may be attributed to an ongoing pattern of financialisation of financial savings, a shift in the direction of digitisation, and ease of doing funding with cell platforms & UPI,” mentioned Ajay Menon, MD & CEO (broking & distribution), Motilal Oswal Monetary Providers.

Whereas India added over 12 crore demat accounts in a decade – which is roughly the inhabitants of Japan – the share of retail inventory market traders at round 10% of the inhabitants pales when in comparison with the almost 60% share within the US.

Adblock take a look at (Why?)