The hole in weightage between Indian and Chinese language equities on the MSCI index has been narrowing with many world biggies selecting up shares on Dalal Road over these in Shanghai.

As Indian markets hit contemporary file highs in 2024, with the Sensex blazing previous 75,000 and the Nifty shifting in direction of 22,800, they’re turning up the warmth on world markets, outpacing a number of rising and even developed markets.

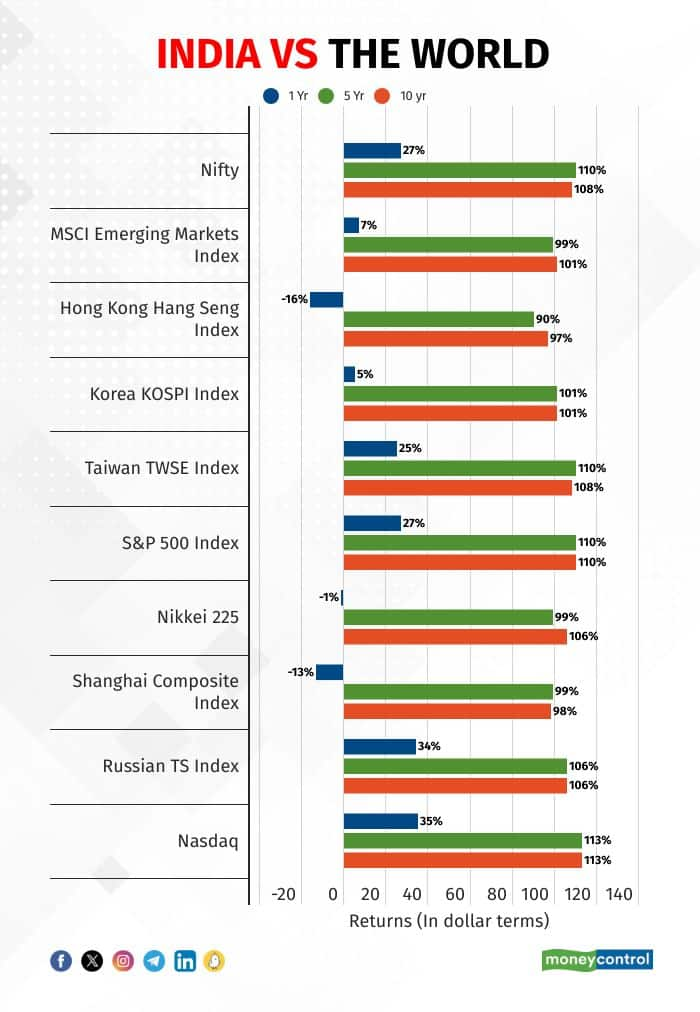

Over the previous yr alone, Nifty has soared 27 %, eclipsing the modest 7 % rise seen within the MSCI Rising Markets index, which was dragged by Chinese language heavyweights like Alibaba and Tencent.

Over longer time durations although, Sensex and Nifty have delivered returns consistent with world counterparts such because the US, China, Japan and Korea. Over the previous 10 years, Sensex and Nifty delivered greenback returns of 109 % and 110 %, respectively.

India’s outperformance is attributed to what analysts name the Goldilocks second, owing to beneficial macroeconomic situations, strong company earnings, stabilised rates of interest, manageable inflation, and constant coverage momentum.

Elements akin to digitisation, increasing manufacturing capabilities, and a burgeoning housing sector, all buoyed by regulatory reforms and a rising center class have additionally pushed the markets greater. Regardless of world financial uncertainties and inflation considerations, India’s resilience shines by, capturing the eye of traders worldwide.

It’s not simply the home development pull that’s main world traders to flock to Indian markets. India’s attract has been gaining momentum as world traders search substitutes for sickly Chinese language markets and as expectations develop that nationwide elections this yr will see Prime Minister Narendra Modi return for a uncommon third time period, assuring traders of each political and coverage continuity.

Moreover, Indian traders are additionally hooked to the inventory markets placing cash into Systematic Funding Plans (SIPs) of mutual funds that give them the heft to help markets throughout dips.

Story continues under Commercial

India versus the large EMs

The meltdown in China’s actual property business prompted a rout in equities pulling the Shanghai index down 13 % within the final one yr.

The hole in weightage between the Indian and Chinese language equities on the MSCI index has been narrowing with many world giants selecting up shares on Dalal Road over these in Shanghai.

Earlier this yr, India surpassed Taiwan within the MSCI Rising Markets index, securing the second place after China and affirming its standing as a sexy funding possibility in rising markets.

Additionally Learn | Market valuations could also be stretched however there are pockets of worth, say specialists

India’s share within the MSCI Rising Markets index noticed a big bounce over the past eight years, rising to 17.2 % and is projected to rise additional to twenty % this yr, in accordance with Nuvama Institutional Equities.

The relentless rally in Indian shares has coincided with a historic downturn in Hong Kong, dwelling to a few of China’s most influential and revolutionary companies.

The stringent Covid-related curbs, regulatory crackdowns on firms, a property-sector disaster and geopolitical tensions with the West mixed to erode China’s attraction because the world’s development engine, and triggering an equities rout with the Cling Seng index tanking 16 % within the final one yr.

Furthermore, new listings have dried up in Hong Kong, resulting in the Asian monetary hub shedding its place as one of many world’s busiest platforms for preliminary public choices. On the flip facet, India has seen a growth in IPOs, a few of which have been subscribed 60 occasions and even 100 occasions.

Japan’s Nikkei 225 this yr smashed the 40,000 mark for the primary time, persevering with its comeback after many years of stagnation. Nevertheless, the index has fallen 1 % within the final one yr, underperforming India Nifty because the Asian peer handled a shrinking inhabitants and inflexible labour drive, weighing on development.

Japan’s financial system formally entered recession earlier this yr, giving up its spot because the world’s third-largest financial system to Germany. The flows out of Japan additionally helped push Indian equities greater.

India versus the US

Regardless of greater bond yields, crimson sizzling inflation and fixed recession menace, Wall Road’s flagship index S&P 500 managed to maintain up with India’s Nifty, rising 27 % within the final one yr. Nifty outperformed Dow Jones by a margin. Nevertheless, tech-heavy Nasdaq outpaced with returns of 34 % throughout this era.

Whereas the US indices have managed to maintain up with the buoyant Indian indices, a stronger-than-expected CPI inflation studying, at each the headline and the core degree or a delay in rate of interest cuts by the Fed might find yourself triggering a correction, in accordance with analysts.

India’s outperformance to proceed?

A number of market specialists assert that the continuing bull run in India is unparalleled by way of wealth era, which is mirrored within the excessive market capitalisation of corporations. The nation’s mini-Goldilocks second is being supported by wholesome flows, and it now boasts a singular mixture of dimension and development, in accordance with Motilal Oswal.

Veteran investor Mark Mobius believes that China’s market slowdown will solely assist India with extra international investments. And traders appear pleased to miss dangers, such because the already lofty valuations and any political surprises.

Additionally Learn | Sensex @75K: 4 dangers traders mustn’t rule out

Worldwide brokerage Haitong stays satisfied of the power in Indian markets in the long run, and expects to see a robust pickup post-elections.

“We’d suggest taking a look at any dips as shopping for alternatives, as valuations are presently at all-time highs,” it mentioned. At the same time as development stays inventory and sentiment overwhelmingly optimistic, specialists advise warning in pockets the place valuations could also be completely out of whack with actuality.

Disclaimer: The views and funding suggestions expressed by funding specialists on Moneycontrol.com are their very own and never these of the web site or its administration. Moneycontrol.com advises customers to examine with licensed specialists earlier than taking any funding choices.

Adblock take a look at (Why?)