Greater OI was seen in each 1200 CE and PE, together with 1240 CE and 1250 CE exhibiting an extended construct up

Bharti Airtel’s inventory momentum continues to favour bulls, regardless of the general market exhibiting disconcert on international cues. The inventory worth closed increased on Monday, with an addition of seven lakhs in Open Curiosity (OI), totalling over 3 crore.

Based on Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox, “Greater OI was seen in each 1200 CE and PE, together with 1240 CE and 1250 CE exhibiting an extended build-up. The buying and selling quantity stands at 67 lakhs, and the worth trades at a 6-point premium.”

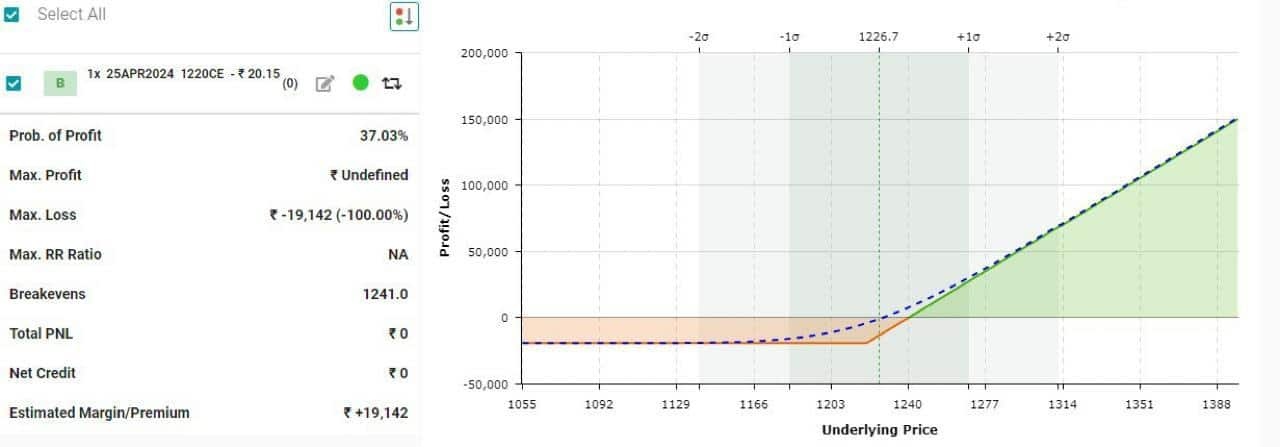

Bagkar recommends taking an extended place in 1220 CE round 21, with a cease loss at 15 and concentrating on ranges of 30 and 37 inside a one-week timeframe.

Payoff chart of 1220 CE lengthy place

Technical view

“A considerable focus will be seen in 1200 CE and 1250 CE, highlighting a development within the lengthy path. Greater OI was seen in each 1200 CE and PE, together with 1240 CE and 1250 CE exhibiting an extended construct up. Whereas there seems a hurdle across the 1250 mark, technical indicators are exhibiting a breakout over it, ” stated Bagkar.

Bagkar highlights that the April sequence is exhibiting rise IO for Bharti Airtel, regardless of the worth motion taking a sideways development. The PCR stands at 0.46 for the April contract.

Story continues under Commercial

“The buying and selling quantity stands at 67 lakhs and the worth trades at 6 factors premium. Extra participation is anticipated as soon as the worth crosses the 1,250 mark, delivering breakout in direction of 1320 ranges.”

Disclaimer: The views and funding ideas expressed by funding consultants on Moneycontrol.com are their very own and never these of the web site or its administration. Moneycontrol.com advises customers to verify with licensed consultants earlier than taking any funding choices

Adblock take a look at (Why?)