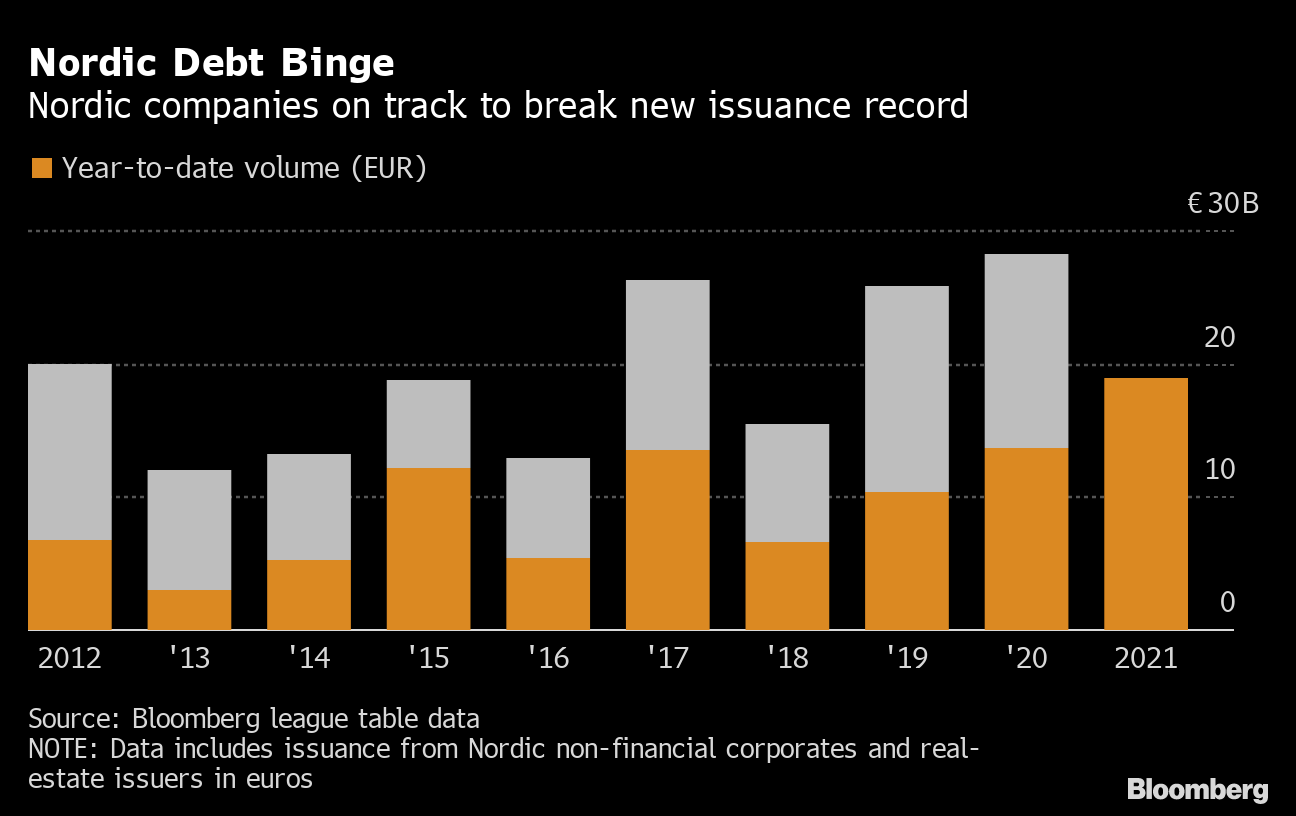

By no means earlier than have Nordic firms flooded the euro bond market with a lot debt.

As issuance throughout the remainder of Europe slows or dips, non-financial and real-estate corporations within the Nordic area are barreling forward, with an more and more leveraged property market and a rash of offers driving the development.

“It appears that evidently we’re on observe for a new document provide from the Nordics,” stated Antti Saha, head of debt capital markets at Nordea Markets in Helsinki.

Saha, who estimates Nordic firms will promote as a lot as 40 billion euros ($50 billion) of bonds this yr, says a “key driver” is real-estate debt. Issuers which might be removed from family names exterior Scandinavia, like Fastighets AB Balder and Samhallsbyggnadsbolaget i Norden AB, have been among the many sector’s most lively debtors this yr.

Nordic Debt Binge

Nordic firms on observe to interrupt new issuance document

Supply: Bloomberg league desk knowledge

However it’s not simply the area’s scorching property market that’s feeding issuance. In accordance with Martin Edemalm, a portfolio supervisor at SEB Funding Administration., there’s additionally “excessive M&A exercise,” a lot of which has been debt financed. And he factors to more durable financial institution capital necessities as a development that’s pushed extra debtors to capital markets.

Offers like Danfoss A/S, which final month issued 1.9 billion euros price of bonds to finance a takeover of Eaton Corp.’s hydraulics unit, imply Nordic corporates have now raised extra debt in euros within the first 5 months of the yr than ever earlier than, over an analogous interval. Company debtors within the area have offered about 19 billion euros of debt, a 33% soar on the identical interval final yr, in keeping with knowledge compiled by Bloomberg.

Inexperienced Push

A lot of the debt being offered carries some type of environmental, social or governance label. “ESG is a transparent driver amongst company issuers total for the time being,” Nordea’s Saha stated.

First-time issuers EQT AB and Hennes & Mauritz AB every offered debut bonds this yr, and selected to take action in euros and with sustainability-linked options connected.

Nordic issuance has created additional enterprise for an funding banking neighborhood that’s confronted a decline elsewhere within the euro-bond market. Bond gross sales within the single forex from European corporates (together with property corporations) exterior the Nordic area have dropped by about 27% when in comparison with final yr, the info present.

In the meantime, some buyers are beginning to query whether or not bond costs within the euro market might need peaked.

Offers at the moment are “priced to perfection,” in keeping with Ville Talasmaki, chief funding officer of the newly created $29 billion asset administration arm of Mandatum.

Talasmaki says the market “leaves no room for error,” as even a small enhance in yields will hand losses to buyers. He additionally notes that almost all investment-grade funds are already within the purple up to now this yr.

SEB’s Edemalm agrees. “Dangers are clearly tilted to the draw back as spreads are low and we now have acquired the potential for tapering and rising charges,” he stated.

Learn additionally: Junk-Bond Gross sales Soar 122% in Nordics as Europe Bids Pile In