Completely happy, Thursday! Inflation continues to be a persistent theme in monetary markets. And for a great motive.

A studying of shopper value inflation for June on Tuesday confirmed that the price of residing leapt by the most important quantity since 2008 as inflation unfold extra broadly by means of the economic system. In the meantime, the tempo of wholesale value will increase over the previous 12 months rose to 7.3% from 6.6% in Might, marking the best degree for the reason that producer-price index was overhauled in 2010, and certain representing one of many highest readings for the reason that early Nineteen Eighties.

So what does that imply for exchange-traded markets and the way can traders play that dynamic because the Federal Reserve Chairman Powell insists that pricing pressures are transitory, or non permanent, and that the U.S. central financial institution has all of the instruments essential to beat it again ought to it show unwieldy?

Take a look at: ETFs set to smash a 2020 file of $504 billion internet inflows and it’s solely July

MarketWatch’s ETF Wrap spoke to Gargi Pal Chaudhuri, head of iShares funding technique Americas at BlackRock Inc.

BLK,

to glean some key ETF and macro insights from the inflation professional.

As per regular, ship suggestions, or suggestions, and discover me on Twitter at @mdecambre to inform us what we have to be leaping on. Enroll right here for ETF Wrap.

The best way to play inflation

For a little bit of context, to say that Chaudhuri is an inflation professional could also be a little bit of an understatement.

She spent 9 years on Wall Road constructing out U.S. inflation buying and selling desks for Jefferies & Co., rising the establishment’s Treasury inflation-protected securities enterprise. Within the early 2000s, she was on the buying and selling desk of Merrill Lynch (now part of Financial institution of America

BAC,

) making a market in TIPs and Treasurys.

Nonetheless, she advised ETF Wrap that she’s by no means had extra questions on inflation than she has had on this latest interval.

“In 20 years, principally centered on inflation, I [have] by no means been requested extra questions than I’ve over the past three or 4 months…on the upper inflation regime,” she mentioned.

Chaudhuri mentioned that traders are confounded by the decrease transfer for yields that has taken the 10-year Treasury

TMUBMUSD10Y,

market to round 1.33%, as of late-morning Thursday from round 1.7% in Might. Inflation is anathema to Treasurys as a result of it chips away at its mounted worth.

The iShares professional additionally mentioned that purchasers are uncertain of methods to play the following six months of this section of the financial restoration cycle from COVID, significantly in mild of rising considerations round variants of the coronavirus, which, by the way, might also be an element driving some demand for Treasurys, and a inventory market that has the Dow Jones Industrial Common

DJIA,

the S&P 500 index

SPX,

and the Nasdaq Composite Index

COMP,

buying and selling close to data regardless of some latest softness.

“How ought to traders and purchasers place their portfolios in a world that’s trying past simply the restart, ”Chaudhuri mentioned.

The analyst and supervisor mentioned that iShares 0-5 12 months TIPS Bond ETF

STIP,

has turn out to be a preferred commerce amongst purchasers and one which she endorses, particularly given considerations about inflation. STIP, referring to the ETF’s ticker image, has been round since 2010, is up 1.9% on the yr, and carries an expense ratio of 0.05%, which signifies that traders can pay 50 cents yearly for each $1,000 invested. She warned, nevertheless, that traders ought to acknowledge that inflation-protected notes additionally carry length dangers if yields finally swing increased.

Chaudhuri additionally mentioned she expects financials to proceed to carry out properly because the economic system improves and as yields head again towards 1.7% and 1.8% towards the tip of 2021. The iShares U.S. Financials ETF

IYF,

up to now, is up 23% up to now this yr and over 1% within the month to this point, FactSet information present. Its expense ratio is 0.42%.

Though the latest drop in yields has known as into query the so-called reflation commerce, Chaudhuri says traders ought to anticipate worth to outperform progress.

“We nonetheless like the worth commerce and lots of that’s based mostly on the view that inflation and progress can be strong within the U.S.,” she mentioned. The BlackRock government additionally sees alternatives in small-caps

IJR,

IJR’s expense ratio stands at 0.06%.

She recommends that traders additionally assume outdoors the U.S., pointing to iShares Core MSCI Europe ETF

IEUR,

as a great diversification play. IEUR prices 90 cents yearly for each $1,000 invested.

The nice and the dangerous

| Prime 5 gainers of the previous week | %Return |

|

VanEck Vectors Uncommon Earth/Strategic Metals ETF REMX, |

8.7 |

|

International X Lithium & Battery Tech ETF LIT, |

6.8 |

|

Invesco DB Oil Fund DBO, |

5.3 |

|

United States Oil Fund LP USO, |

5.1 |

|

Invesco Optimum Yield Diversified Commodity Technique No Okay-1 ETF PDBC, |

3.1 |

| Supply: FactSet, by means of Wednesday, July 14, excluding ETNs and leveraged merchandise. Consists of NYSE, Nasdaq and Cboe traded ETFs of $500 million or higher |

| Prime 5 decliners of the previous week | %Return |

|

VanEck Vectors Vietnam ETF VNM, |

-5.8 |

|

iShares U.S. House Development ETF ITB, |

-4.8 |

|

Amplify Transformational Knowledge Sharing ETF BLOK, |

-4.6 |

|

ProShares On-line Retail ETF ONLN, |

-4.6 |

|

SPDR S&P Homebuilders ETF XHB, |

-3.2 |

| Supply: FactSet |

Visible of the week

Bespoke Funding Group

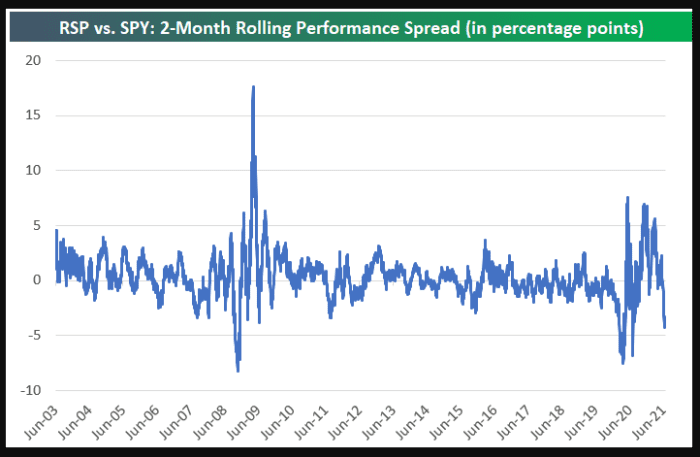

The analysts at Bespoke are recognizing some inner weak point out there as mirrored within the underperformance of the favored SPDR S&P 500 ETF Belief

SPY,

versus the Invesco S&P 500 Equal Weight ETF

RSP,

The connected chart reveals the rolling 2-month efficiency unfold between RSP and SPY since RSP started buying and selling in 2003.

Bespoke analysts say that there have solely been two different durations the place we’ve seen the 2-month efficiency unfold flip extra destructive for RSP versus SPY.

Large Knowledge

On Wednesday, the oldsters at Defiance ETFs launched the Defiance Subsequent Gen Large Knowledge ETF

BIGY,

on the Intercontinental Alternate

ICE,

-owned New York Inventory Alternate’s Arca platform.

Defiance describes the exchange-traded asset as a “rules-based ETF that provides publicity to world corporations in information science and analytics who’re powering this digital revolution.”

The ETF relies on a proprietary ETF that tracks corporations valued at $500 million or extra that derive not less than 1 / 4 to half of their revenues from the manufacturing, storage or processing of huge information units, as ETF.com describes it.

There are a variety of opponents aiming at an analogous theme however Defiance is trying to supply a fund with cheaper charges. Its expense ratio for the large information fund is 0.45%.

We requested Defiance concerning the launch and so they mentioned that large information goes past simply funds centered on cloud-based information.

“BIGY is exclusive in that it provides traders entry to corporations concerned very particularly with information science and analytics,” Sylvia Jablonski, Co-Founder and CIO of Defiance ETFs, advised ETF Wrap in emailed feedback.

“It’s a means to offering alternatives to make the most of new and current information, and discovering new methods to make use of new information to make a distinction within the enterprise operations of many corporations throughout numerous sectors together with healthcare, manufacturing, infrastructure, agriculture to call a couple of,” the CIO mentioned.

“A variety of the aggressive funds on the market have relatable merchandise however are typically centered extra on one side of this, like cloud for instance, Jablonski mentioned.

“One other distinction between our fund and others on the market, is that we’re a passive index based mostly 1940 Act ETF, with decrease administration charges than these charged by opponents,” she mentioned.

Clever Bitcoin ETF?

Is there a bitcoin ETF, but?

No!

Earlier this week, the Securities and Alternate Fee delayed its choice on Knowledge Tree’s Bitcoin ETF, asking for extra commentary and including the supplier to a rising checklist of corporations together with VanEck and others who’ve seen the regulator punt on approving a bitcoin

BTCUSD,

fund with an ETF wrapper.

The SEC stays involved about the potential for manipulation within the nascent and unstable crypto market.