Mumbai: The Reserve Financial institution of India (RBI) might must take a contemporary have a look at its long-standing caps for international possession of governmentdebt as lumpy inflows anticipated over the following couple of years as a result of international bond index inclusion alter a important panorama for the Centre’s debt supervisor.

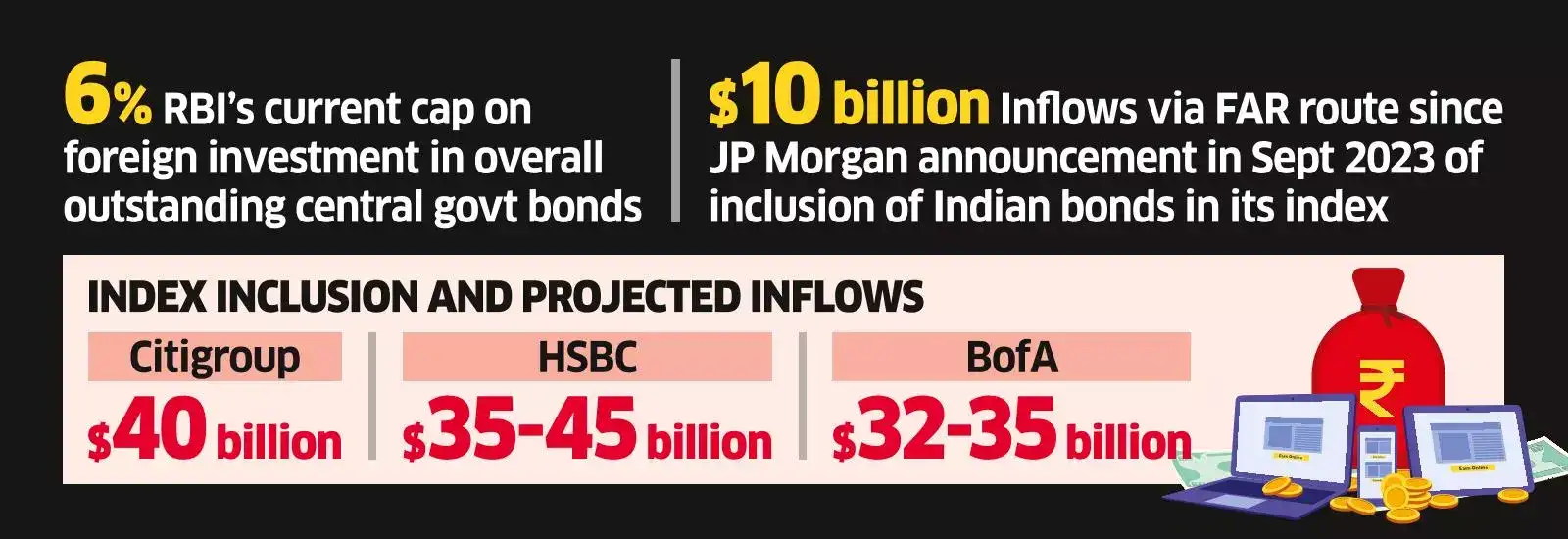

In March 2020, the RBI launched a brand new class for international funding in central authorities bonds – the Totally Accessible Class (FAR). Sovereign bonds falling on this class are totally open for funding with out restrictions. In the meantime, in a possible supply of ambiguity, the RBI’s present cap for international funding in central authorities bonds is 6% of the excellent inventory of securities. This restrict was laid out in an April 2022 notification.

Whereas the FAR class didn’t entice massive international flows for 3 years, abroad gamers have poured nearly $10 billion into the FAR bracket since JP Morgan stated in September 2023 that Indian bonds can be included on its rising market index from June of this yr.

Businesses

BusinessesWith Bloomberg additionally having introduced inclusion of Indian bonds in one in every of its indices beginning 2025 and different index managers doubtless to take action going forward, readability on what occurs to the 6% restrict could also be required.

“As soon as the FAR securities have been launched, the idea of the restrict turned redundant. Clearly, it was a choice taken in session by the federal government and the RBI. The thought have to be that they will at all times calibrate the issuance of FAR bonds at a later date if wanted. That have to be the thought course of behind the introduction of FAR securities,” stated A Prasanna, head of analysis at ICICI Securities Major Dealership.

Sources conscious of the developments stated that over the previous yr, the RBI has had held inner discussions on the matter of the restrict, with the central financial institution doubtless in some unspecified time in the future to make clear a brand new place.

Fashionable in Markets

An e mail despatched to the RBI searching for touch upon the matter didn’t obtain a response until the time of publication.

As on March 13, mixed FPI funding within the basic class, the long-term class and the FAR class was at Rs 2.5 lakh crore, Clearing Company of India information confirmed. The most recent place for the whole excellent inventory of central authorities bonds is Rs 102.65 lakh crore, RBI information confirmed.

Citigroup’s CEO lately projected inflows price $40 billion from index inclusion, whereas HSBC estimated flows price $35-45 billion over 15 months. Financial institution of America’s head of India buying and selling predicted flows price $32-35 billion.

Within the 11 years since indicators of a tighter US financial coverage sparked a ‘taper tantrum’ of international outflows and wreaked havoc on the rupee and the home bond market, the RBI has stored a really shut eye on abroad funding in authorities bonds.

Over the past couple of years, the RBI has adroitly managed large-scale abroad fund outflows within the wake of aggressive US fee hikes, with the central financial institution’s formidable arsenal of international alternate reserves making certain that the rupee stays comparatively unscathed amongst its peer currencies.

Adblock take a look at (Why?)