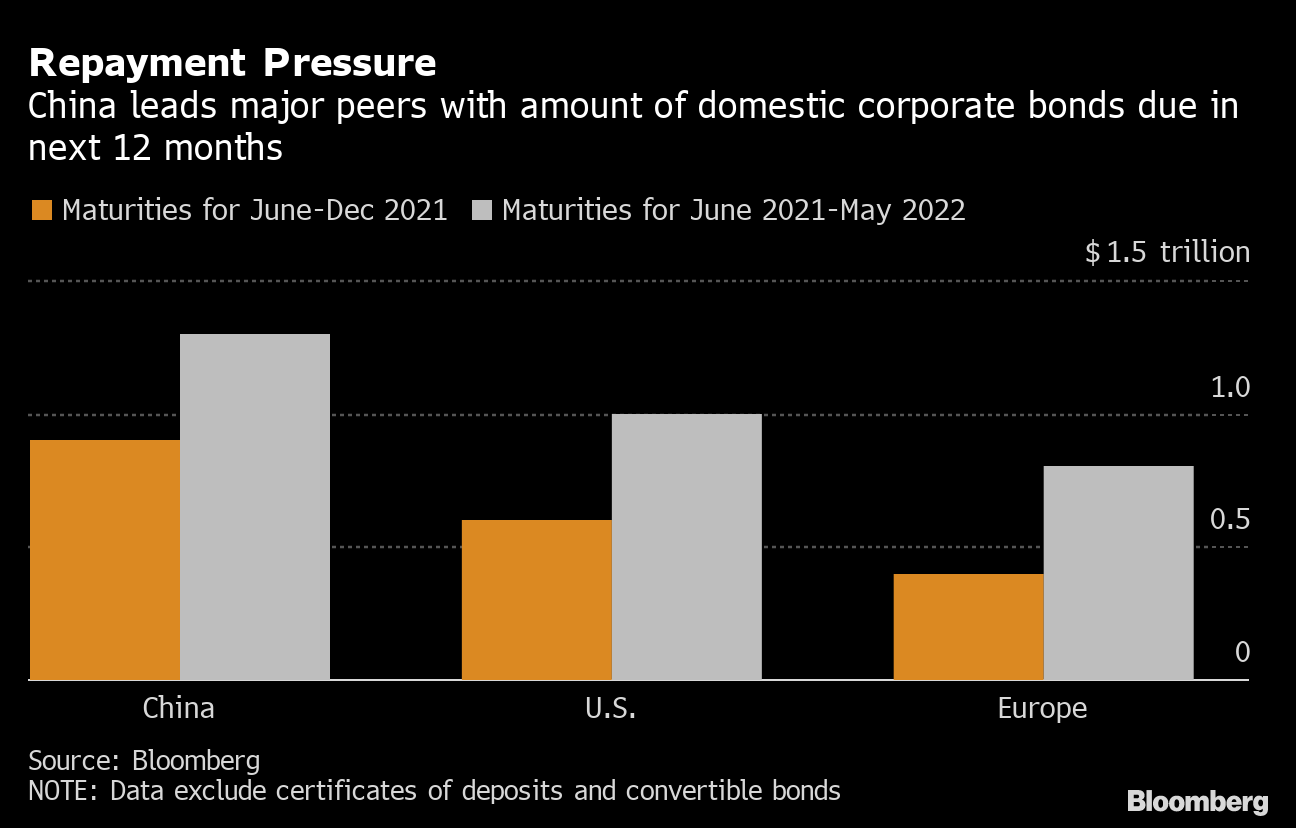

Even by the requirements of a record-breaking world credit score binge, China’s company bond tab stands out: $1.3 trillion of home debt payable within the subsequent 12 months.

That’s 30% greater than what U.S. firms owe, 63% greater than in all of Europe and sufficient cash to purchase Tesla Inc. twice over. What’s extra, it’s all coming due at a time when Chinese language debtors are defaulting on onshore debt at an unprecedented tempo.

The mixture has buyers bracing for an additional turbulent stretch for the world’s second-largest credit score market. It’s additionally underscoring the problem for Chinese language authorities as they work towards two conflicting objectives: lowering ethical hazard by permitting extra defaults, and turning the home bond market right into a extra dependable supply of long-term funding.

Reimbursement Strain

China leads main friends with quantity of home company bonds due in subsequent 12 months

Supply: Bloomberg

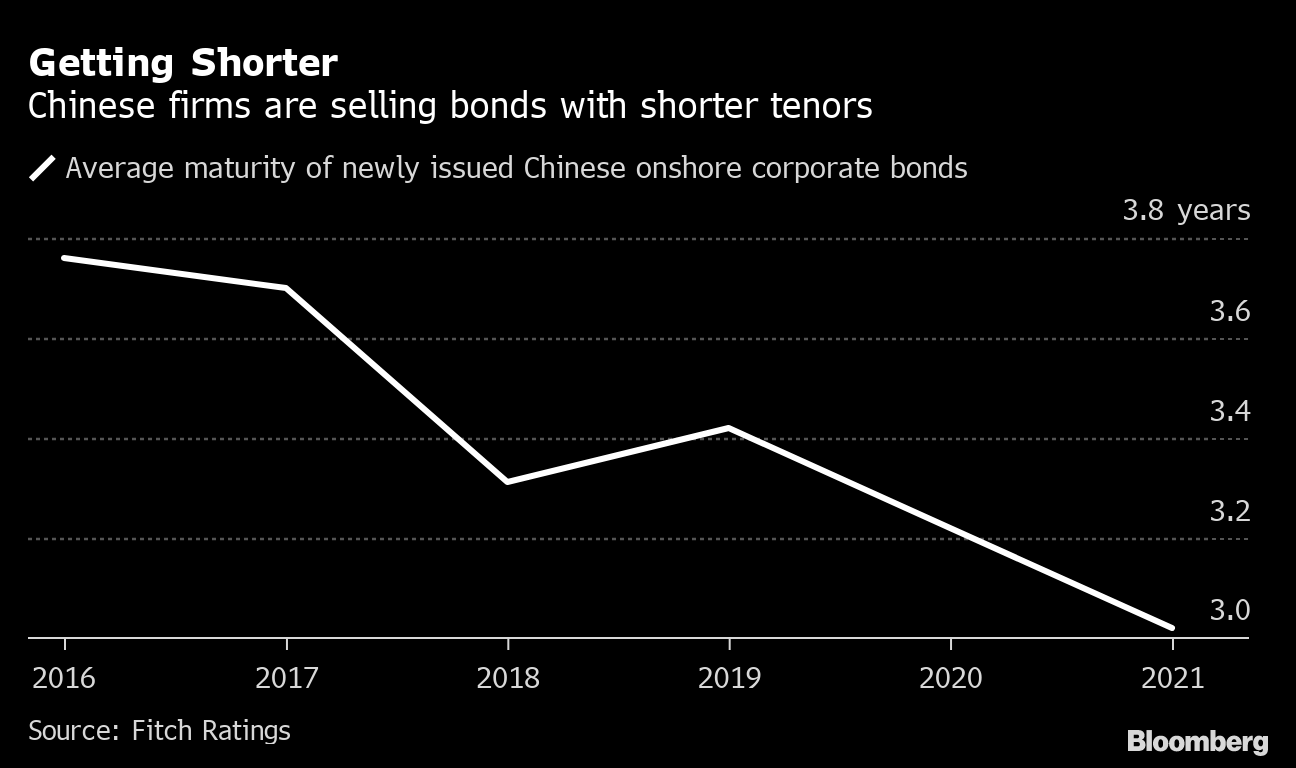

Whereas common company bond maturities have elevated within the U.S., Europe and Japan in recent times, they’re getting shorter in China as defaults immediate buyers to scale back threat. Home Chinese language bonds issued within the first quarter had a mean tenor of three.02 years, down from 3.22 years for all of final 12 months and heading in the right direction for the shortest annual common since Fitch Rankings started compiling the information in 2016.

“As credit score threat will increase, everybody needs to restrict their publicity by investing in shorter maturities solely,” mentioned Iris Pang, chief economist for Larger China at ING Financial institution NV. “Issuers additionally need to promote shorter-dated bonds as a result of as defaults rise, longer-dated bonds have even larger borrowing prices.”

The transfer towards shorter maturities has coincided with a Chinese language authorities marketing campaign to instill extra self-discipline in native credit score markets, which have lengthy been underpinned by implicit state ensures. Traders are more and more rethinking the extensively held assumption that authorities will backstop massive debtors amid a string of missed funds by state-owned firms and a selloff in bonds issued by China Huarong Asset Administration Co.

Getting Shorter

Chinese language companies are promoting bonds with shorter tenors

Supply: Fitch Rankings

The nation’s onshore defaults have swelled from negligible ranges in 2016 to exceed 100 billion yuan ($15.5 billion) for 4 straight years. That milestone was reached once more final month, placing defaults on monitor for an additional report annual excessive.

The ensuing desire for shorter-dated bonds has exacerbated one in all China’s structural challenges: a dearth of long-term institutional cash. Even earlier than authorities started permitting extra defaults, short-term investments together with banks’ wealth administration merchandise performed an outsized function.

Social safety funds and insurance coverage companies are the principle suppliers of long-term funding in China, however their presence within the bond market is proscribed, mentioned Wu Zhaoyin, chief strategist at AVIC Belief Co., a monetary agency. “It’s tough to promote long-dated bonds in China as a result of there’s a lack of long-term capital,” Wu mentioned.

Chinese language authorities have been taking steps to draw long-term buyers, together with international pension funds and college endowments. The federal government has in recent times scrapped some funding quotas and dismantled international possession limits for all times insurers, brokerages and fund managers.

However even when these efforts achieve traction, it’s not clear Chinese language firms will embrace longer maturities. Many want promoting short-dated bonds as a result of they lack long-term capital administration plans, in accordance with Shen Meng, director at Chanson & Co., a Beijing-based boutique funding financial institution. That applies even for state-owned enterprises, whose senior managers usually get reshuffled by the federal government each three to 5 years, Shen mentioned.

The upshot is that China’s home credit score market faces a close to fixed cycle of refinancing and reimbursement threat, which threatens to exacerbate volatility as defaults rise. An analogous dynamic can also be enjoying out within the offshore market, the place maturities whole $167 billion over the subsequent 12 months.

For ING’s Pang, the cycle is unlikely to alter anytime quickly. “It could final for an additional decade in China,” she mentioned.

— With help by Hong Shen, and Tongjian Dong