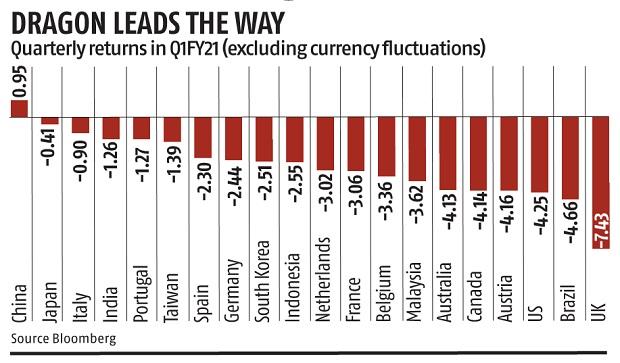

China’s authorities bonds outpaced their opponents within the first quarter, as their haven standing helped them stand out as a bulwark amid the worldwide stoop. Japan’s securities led amongst developed nations, although nonetheless handing traders a slender loss.

The 2 north Asian markets helped traders protect worth as indicators of a burgeoning international restoration amid the rollout of vaccines pushed up debt yields world wide.

A Bloomberg Barclays index of worldwide bonds slid 5.5 per cent within the first three months of the yr — the worst quarter in 4 years.

China and Japan had one other factor of their favour — that they had the bottom volatility amongst 44 debt markets tracked by Bloomberg.

Chinese language sovereign bonds rose 1 per cent within the first quarter, the one ones to rise among the many 20 largest international debt markets, based mostly on information on the Bloomberg Barclays indices.

Their lack of correlation with abroad bonds labored of their favour because it created an alternate for traders to park funds in, amid the debt sell-off.

The securities made the majority of their quarterly achieve in March, after they rose 0.9 per cent, as they bounced again from earlier weak point attributable to concern about potential tighter funding.

“The debt tumbled too rapidly earlier than the Lunar New 12 months vacation, as merchants guess the Folks’s Financial institution of China would tighten liquidity,” mentioned Tommy Xie, head of Larger China analysis at Oversea-Chinese language Banking Corp in Singapore.

“Now, with tighter financial coverage being priced in, the bonds have turn out to be resilient and regular.”

BOJ backing

Japan’s bonds handed traders a lack of 0.4 per cent, however that put them comfortably at second spot. Declines have been restricted by the Financial institution of Japan’s dedication to maintain yields low and steady. They have been additionally supported by the nation’s superior exterior stability.

“Japan and China each have giant current-account surpluses, which give steady native funding for presidency expenditures and hold bond market volatility in test,” mentioned Kiyoshi Ishigane, chief fund supervisor at Mitsubishi UFJ Kokusai Asset Administration Co in Tokyo.

Pricey Reader,

Pricey Reader,

Enterprise Customary has all the time strived onerous to offer up-to-date info and commentary on developments which might be of curiosity to you and have wider political and financial implications for the nation and the world. Your encouragement and fixed suggestions on the best way to enhance our providing have solely made our resolve and dedication to those beliefs stronger. Even throughout these troublesome instances arising out of Covid-19, we proceed to stay dedicated to retaining you knowledgeable and up to date with credible information, authoritative views and incisive commentary on topical problems with relevance.

We, nonetheless, have a request.

As we battle the financial influence of the pandemic, we’d like your assist much more, in order that we will proceed to give you extra high quality content material. Our subscription mannequin has seen an encouraging response from lots of you, who’ve subscribed to our on-line content material. Extra subscription to our on-line content material can solely assist us obtain the objectives of providing you even higher and extra related content material. We consider in free, honest and credible journalism. Your assist by means of extra subscriptions may also help us practise the journalism to which we’re dedicated.

Help high quality journalism and subscribe to Enterprise Customary.

Digital Editor