Debt funds are more likely to do nicely within the coming few years as rates of interest are anticipated to fall. Fund managers are making vital tweaks to their portfolios in anticipation of softening yields. Other than growing the length, some are rethinking the pursuit of rolldown methods of their portfolios.

In a roll-down method, a fund maintains a portfolio of bonds that each one mature on the similar future date. Because the maturity date attracts nearer, the tenure for which the fund holds bonds reduces (rolls down). Any recent bond purchases are additionally aligned with the remaining maturity of the portfolio. This follow makes returns from a bond portfolio comparatively predictable in a unstable rate of interest situation.

It was a very sought-after tactic in classes like company bond funds and banking & PSU bond funds. Not like the everyday open-ended funds, the place the fund supervisor actively shifts the length profile of the portfolio as per the given mandate, the passive investing method of the rolldown technique offers a level of predictability in returns amidst rate of interest fluctuations.

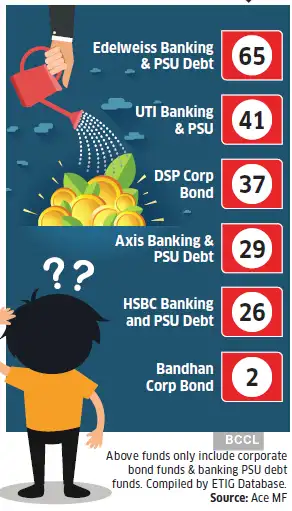

Fewer funds are choosing roll-down

Common maturity (months)

Word: Above funds solely embrace company bond funds & banking PSU debt funds. Compiled by ETIG Database. Supply: Ace MF

Nevertheless, some fund managers are actually trying to pivot away from the roll-down technique. There’s an rising consensus that rates of interest will begin falling in some unspecified time in the future this 12 months. This offers potential for substantial capital positive factors in portfolios with longer durations. Longer length bonds profit extra from falling rates of interest as bond costs and yields are inversely associated.

Standard in Wealth

A number of funds which have accomplished the earlier roll-down cycle have now shifted to a extra energetic administration of length. The argument is that falling yields will introduce reinvestment threat in portfolios maturing within the subsequent 1-3 years. This threat refers back to the chance that money flows obtained from the portfolio, reminiscent of coupon funds or maturity proceeds, must be reinvested at a a lot decrease price. So, even when the yield-to-maturity (YTM) of a debt fund holding three-year bonds is presently 7.5%, if curiosity payouts from the portfolio are reinvested at progressively decrease charges, the ultimate return on fund maturity can be decrease. On maturity, the fund can solely redeploy cash on the then prevailing decrease price.

Gautam Kaul, Senior Fund Supervisor, Fastened Earnings, Bandhan MF, asserts, “The predictability of return in a roll-down portfolio comes at a price. It exposes the investor to reinvestment threat because the fund will get nearer to maturity. Going ahead, the latter goes to be extra pronounced than the rate of interest threat.” Bandhan Company Bond Fund is within the final leg of its four-year roll-down began in early 2020. Going ahead, it is going to be actively managed inside a 1-4 12 months maturity band.

A senior govt from one other AMC, who didn’t want to be named, noticed, “Roll-down has misplaced a little bit of its sheen up to now few years. It’s a tactic that’s higher performed through goal maturity index funds.

Tightly outlined length limits for actively managed open-ended debt funds additionally restrict the scope for pursuing roll-down.” Whereas a roll-down is well deployed inside a closeended construction, it’s trickier to implement in an open-ended format, the place there are fixed outflows and inflows in a fund. For one, recent inflows have to be invested in bonds aligned with the remaining maturity of the fund portfolio, with out materially impacting its yield. Nevertheless, discovering bonds of strange tenures of, say, two years or six years to match the present maturity profile of the fund is tough. Additional, a debt fund that faces massive outflows a lot earlier than its goal maturity could also be compelled to redeem its bonds prematurely, probably at a loss.

Nevertheless, not everyone seems to be giving up on roll-down in debt funds. Some fund managers proceed to consider in its deserves. Dhawal Dalal, Head , Fastened Earnings, Edelweiss Mutual Fund, remarks, “We’re sticking to roll-down in our Banking & PSU debt fund. We pursue excessive length on this fund, which locations it above its friends within the class. Longer-term bonds lock in yields for an extended interval, bringing in a stage of certainty for the buyers.”

Sandeep Yadav, Head, Fastened Earnings, DSP Mutual Fund, believes in operating a rolldown technique in not less than one debt fund at any given time. The fund home runs a roll-down technique in two of its funds—DSP Financial savings Fund and DSP Company Bond Fund. Whereas the previous deploys a one-year roll-down, the latter deploys a three-year roll-down, with the continued roll-down ending in 2027. “Not all buyers need to go energetic in length. They need extra predictability in returns,” asserts Yadav. He argues that even when rates of interest harden later, incremental flows can be deployed for a brief residual maturity, which can restrict the hit on the portfolio. He’ll reassess the roll-down on the finish of the present cycle.

The rethinking of roll-down in some debt funds could also be a dampener for buyers who crave extra certainty in returns and are prepared to match their funding horizons to the approximate portfolio maturity. For many who don’t need the danger of incorrect calls by the fund supervisor, goal maturity funds supply a great different for the same expertise.

Adblock take a look at (Why?)