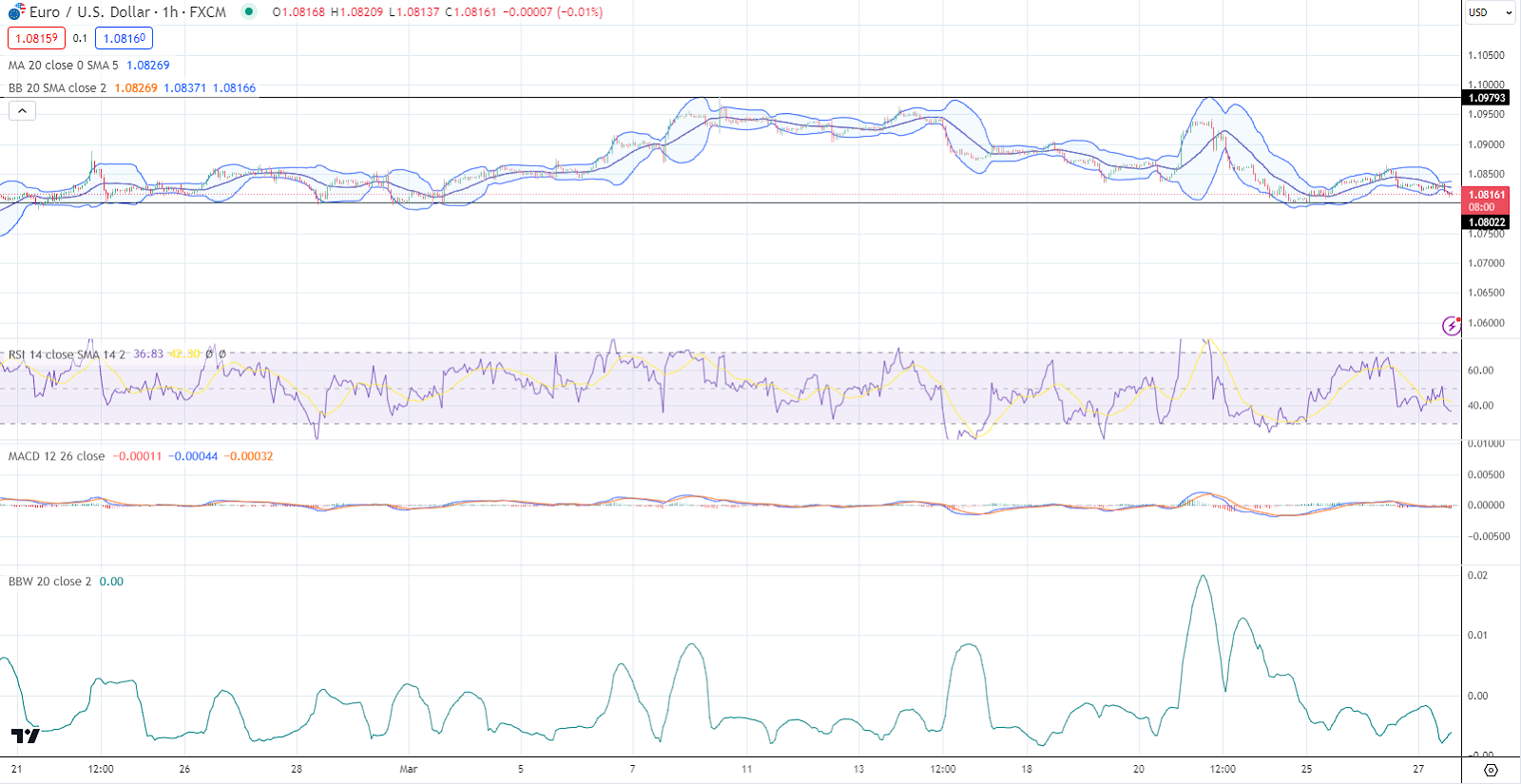

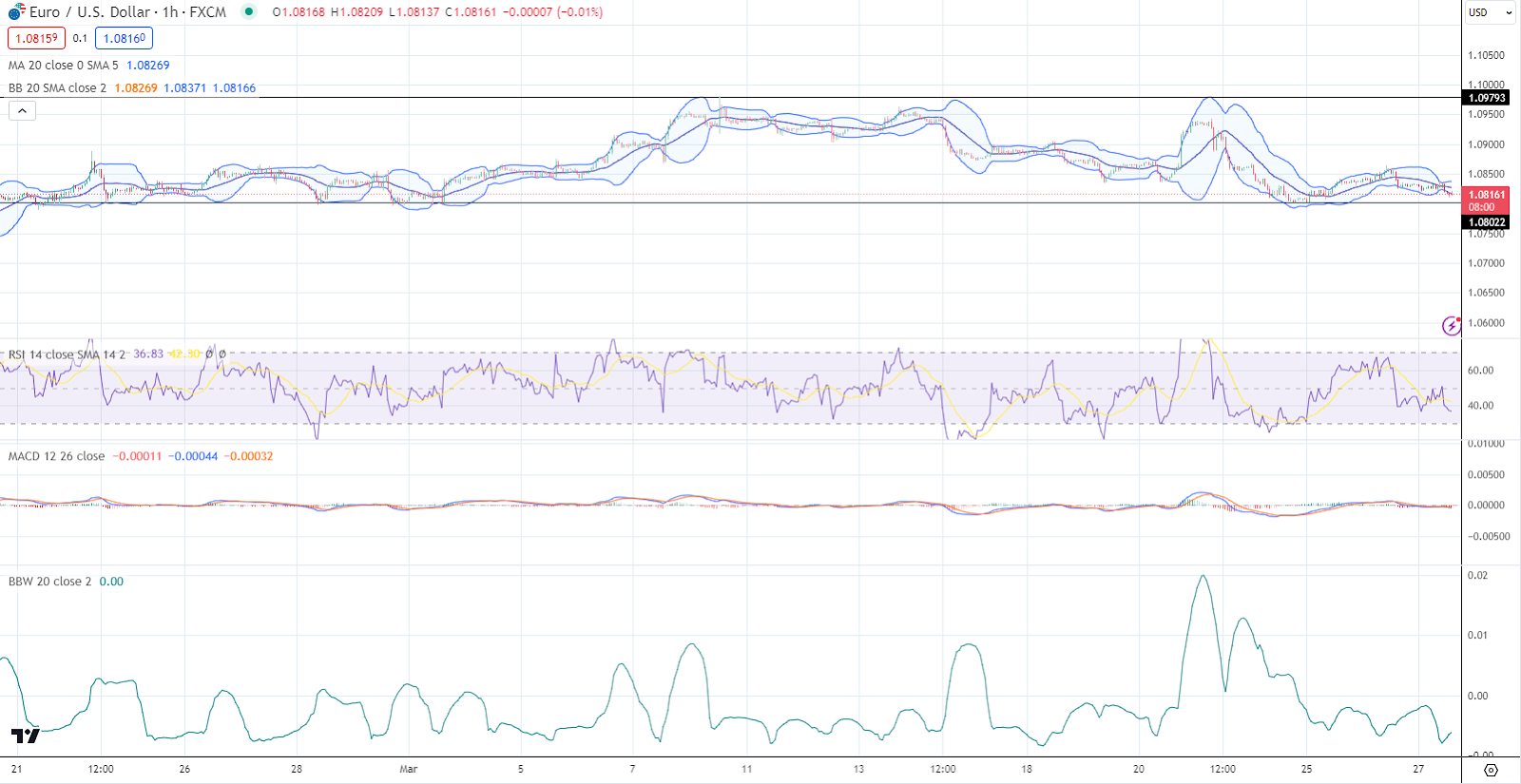

You may describe the motion of the EUR/USD forex pair throughout March as “going nowhere quick”. The change fee continued a rally in early February and peaked in mid-March, returning to ranges seen firstly of the quick rally (see chart). it from a broader perspective, you may see that the change fee has been rangebound after a selloff that started in July 2023. The short-term intra-day one-hour view of March additionally reveals costs are transferring sideways. Whereas the worth motion displays a sideways view of the change fee, the forex pair seems to have a bearish sample, which may result in a fast selloff.

What has helped transfer the change fee decrease?

The European Central Financial institution (ECB) has fine-tuned its financial coverage framework in response to shifting inflation developments and financial circumstances. The ECB has articulated that the central financial institution’s overarching intention is the sensible discount of inflation to align with the financial institution’s medium-term goal. Additional, the ECB president needs a resilient technique that depends on a scientific, data-informed coverage decision-making course of. Tightening seems within the rearview window, and easing is subsequent up. On the similar time, the Federal Reserve is transferring towards a impartial coverage. In keeping with the Federal Reserve’s dot plots and the market outlook mirrored by the CME Fed Device Watch, the following transfer is probably going a reduce.

The intra-day chart in March

The March intra-day chart reveals that costs all through the third month of the 12 months moved up and down, and month over month, they’re more likely to be unchanged. The change fee examined highs close to 1.0980 a couple of occasions and reversed and examined the underside finish of the intra-month vary at 1.08. A number of occasions, the FX commerce would have moved out of the hourly Bollinger bands, and the Bollinger band width is decrease than the 1-month vary.

What are Bollinger Bands

Bollinger Bands is a technical evaluation software developed by John Bollinger within the Eighties. They’re used to measure market volatility and to establish overbought or oversold circumstances for a safety. The software consists of three strains plotted in and across the value construction on a chart.

The center band is usually a easy transferring common (SMA) that serves as a base for the higher and decrease bands. Relying on the chart, it is typically set to twenty durations, which might be days, weeks, hours, and many others..

The higher band is calculated by including an ordinary deviation multiplier (often two commonplace deviations) to the center band (SMA). The decrease band is discovered by subtracting the identical commonplace deviation multiplier from the center band (SMA).

The width of the bands is a information to the asset’s volatility. Slender bands counsel low volatility and huge bands point out excessive volatility. When costs transfer nearer to the higher band, the asset could also be thought of overbought, and after they transfer nearer to the decrease band, it might be thought of oversold.

After a value transfer begins from one of many bands, it should typically attain the other band. This situation can be utilized to set revenue targets or entry/exit factors. A “Bollinger Band squeeze” is a technique that appears for durations of low volatility, indicated by the bands coming nearer collectively, as this is perhaps the precursor to a major breakout in both course. A Bollinger Band certain relies on the concept that the worth tends to return to the center of the bands. So, if the worth deviates to the decrease band and bounces again, merchants would possibly see it as a sign to purchase.

Bollinger Bands are sometimes used with different technical indicators to substantiate or deny a commerce sign. It is essential to notice that, like all buying and selling indicators, Bollinger Bands should not foolproof and are greatest used with different indicators and evaluation strategies.

What are Bollinger Band widths?

Bollinger Band Width is a technical evaluation indicator derived from Bollinger Bands. It measures the distinction between the higher and decrease Bollinger Bands, offering a quantitative worth indicating the diploma of market volatility. The bandwidth is solely the numerical distinction between the higher and decrease bands’ values at any time.

To calculate Bollinger Band Width, you subtract the worth of the decrease band from the worth of the higher band, Bollinger Band Width = Higher Band – Decrease Band.

The center band, often a easy transferring common, shouldn’t be concerned in calculating the Band Width.

A wider bandwidth signifies larger volatility, with the change fee transferring considerably and the bands increasing. Conversely, a narrower bandwidth suggests decrease volatility, with value actions turning into extra confined and the bands contracting.

Merchants and analysts use Bollinger Band Width for a wide range of functions. For instance, Figuring out durations of excessive or low volatility. Anticipating future volatility will increase (typically after durations of low volatility, generally known as a Bollinger Bands Squeeze). Making choices about entry and exit factors for trades primarily based on volatility circumstances. Like all indicators, Bollinger Band Width is greatest used with different indicators and methodologies to reinforce the reliability of buying and selling alerts and methods.

The patterns

The each day chart of the EUR/USD has been transferring sideways however appears to be forming a head-and-shoulders reversal sample. The purple arrows on the chart present the 2 shoulders, and the purple within the center is the top.

A head and shoulders sample is a chart formation utilized in technical evaluation to foretell a possible reversal within the present pattern. This sample is without doubt one of the extra dependable pattern reversal formations and is usually related to a change from a bullish to a bearish pattern. The sample has three tops, one greater than the opposite two within the center, the top within the center.

The left shoulder varieties throughout an uptrend as costs peak after which decline to a trough. After the trough, costs rise once more to kind the next peak earlier than falling once more, creating the ‘head,’ greater than the left shoulder. The worth rises once more after the top, however not as excessive as the top, forming the suitable shoulder. The height of the suitable shoulder is usually consistent with the left shoulder.

This help line is drawn by connecting the bottom factors of the 2 troughs (the trough between the left shoulder and the top and the trough between the top and the suitable shoulder). A head and shoulders sample is confirmed when the worth breaks under the neckline after forming the suitable shoulder.

The reversal sign is strongest when the neckline slopes down. The sample is full, and the sign is confirmed when the worth drops under the neckline after forming the suitable shoulder, indicating {that a} bearish pattern could comply with. The depth of the top from the neckline might be subtracted from the breakout level on the neckline to offer a possible value goal to the draw back.

In distinction, there may be an inverted head and shoulders sample, which alerts a reversal from a downtrend to an uptrend. It has the identical construction however flipped the wrong way up, with the top forming a trough, the shoulders forming decrease peaks, and the neckline being a degree of resistance damaged to substantiate the bullish pattern reversal.

Destructive momentum is accelerating

Destructive momentum is accelerating because the MACD (transferring common convergence divergence) index generated a promote sign in March. There are a lot of alternative ways to make use of the MACD to establish a promote sign. For instance, when the MACD line crosses under the sign line, as seen within the chart. The most typical promote sign inside the MACD framework happens when the MACD line (the distinction between the 12-period and 26-period EMAs) crosses under the sign line (the 9-period EMA of the MACD line). This crossover suggests a possible change from a bullish to a bearish pattern.

Moreover, if the MACD line crosses under the zero line, the 12-period EMA has crossed under the 26-period EMA, signifying a probably bearish pattern momentum.

When the worth of an asset makes greater highs, however the MACD makes decrease highs, it is referred to as a bearish divergence. This example is usually interpreted to imply the upward value momentum is weakening, and a downward reversal is perhaps imminent.

When the MACD histogram plots the space between the MACD line and the sign line. If the histogram strikes from optimistic to damaging (under the zero line), this may also be taken as a bearish sign.

The underside line

An absence of clear course can characterize the EUR/USD forex pair’s trajectory all through March, as its motion was comparatively stagnant. Taking a step again for a extra complete view reveals that after a decline beginning in July 2023, the change fee has been trapped inside a confined buying and selling vary. Regardless of the general sideways pattern discernible within the change fee’s current conduct, an underlying bearish sample can precipitate an abrupt downturn in worth if the top and shoulder sample results in a fast selloff.

This text is sponsored content material

Adblock check (Why?)