Regardless of the narrowing unfold of yields between the benchmark 10-year Indian authorities bond and the 10-year US Treasury bond, overseas portfolio traders (FPIs) are persevering with to spend money on the home debt market this yr, a report by Enterprise Normal said. It added that the pattern is backed by a steady foreign money and a much less unstable bond market.

FPIs have been web patrons within the debt market in 2023 thus far, marking the primary time in 4 years, since 2019, knowledgeable BS, including that the latest occasion of FPIs being web patrons was recorded in 2019, once they invested ₹25,882 crore in bonds.

As per the report, traders acquired Indian authorities and company bonds amounting to a complete of ₹21,831 crore in 2023 till Monday, in response to knowledge from the NSDL. Except March, FPIs had been web patrons of Indian debt each month this yr. FPIs’ debt influx reached its highest in June, standing at ₹9,178 crore, marking the very best month-to-month influx within the present calendar yr, highlighted the report.

“Many abroad traders understand that whereas funding into the nation carries the foreign money danger, the rupee depreciation might not be at a stage that returns might flip destructive over a interval,” Gopal Tripathi, president & head of treasury at Jana Small Finance Financial institution, was quoted as saying.

The rupee was largely steady in 2023, depreciating 0.12 % thus far, as in comparison with 2022 when the Indian foreign money weakened greater than 10 % following the warfare in Europe and rate of interest tightening in superior economies, famous the report.

Though FPIs have been web purchasers, they’ve scarcely utilised the Reserve Financial institution of India’s established thresholds for presidency and company bonds, the report identified. It talked about that eligible FPIs had solely made use of 29.5 % of the desired ceiling of ₹2.68 lakh crore for central authorities securities as of Tuesday. Equally, the utilisation of the higher restrict of ₹6.68 lakh crore for company bonds was much more minimal, standing at 15.34 %, BS additional mentioned.

Some market individuals consider that the inflows would possibly cut back going ahead. “As a result of the foreign money was steady, the curiosity hole, which is at a low stage, was not being eaten into by the depreciation of the foreign money. Now that the foreign money has depreciated, these returns will certainly be eaten into,” Indranil Pan, chief economist at YES Financial institution, was quoted as saying.

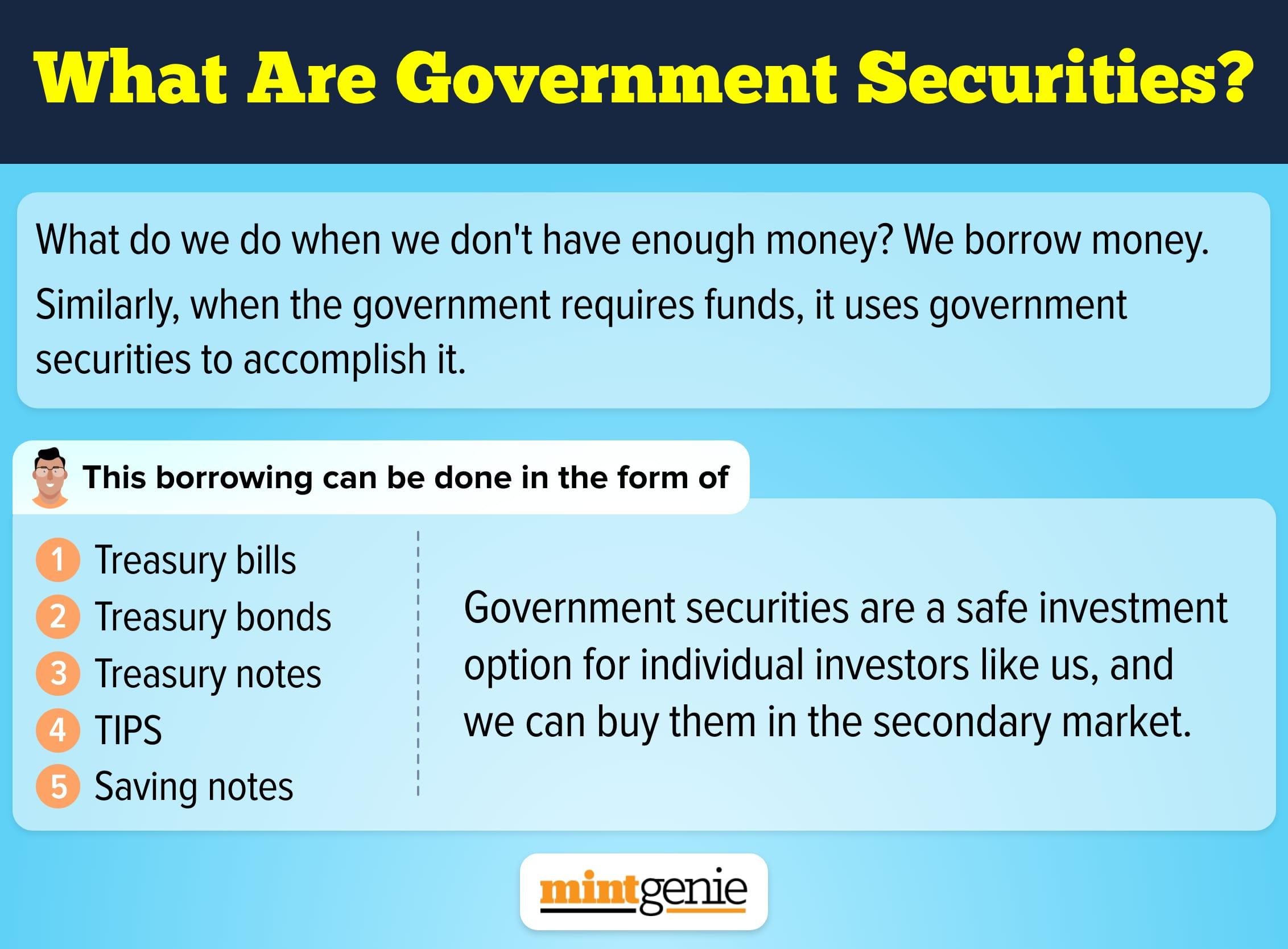

Authorities securities are tradable debt devices that the federal government presents within the type of bonds, treasury payments, or notes.

First Printed: 09 Aug 2023, 01:57 PM IST

Subjects to observe

Adblock check (Why?)