Rising Treasury yields have contributed to a selloff by the inventory market’s pandemic high-fliers, however in all probability received’t be sufficient to spoil the attraction of shares over bonds in 2021, in response to one analyst.

U.S. fairness traders “have turn into targeted on the latest enhance in 10-year Treasury yields over the previous week, that are all the best way again to mid-February 2020 ranges,” wrote Lori Calvasina, head of U.S. fairness technique at RBC Capital Markets, in a Tuesday word. Yields and bond costs have an inverse relationship.

The ten-year Treasury yield

TMUBMUSD10Y,

is coming off its largest rise in six weeks, which has been blamed for sparking a pullback led by tech-oriented shares that had benefited most from the stay-at-home dynamic created by the COVID-19 pandemic.

Associated: Can the bull market in shares survive rising inflation, bond yields? Right here’s what historical past says

The connection was on show in reverse Tuesday because the rise in yields relented following testimony by Federal Reserve Chairman Jerome Powell, permitting main benchmarks to erase or trim vital losses. The tech-heavy Nasdaq Composite

COMP,

which has led the best way decrease, trimmed a lack of almost 4% to finish down 0.5% as yields declined; the S&P 500

SPX,

eked out a acquire to snap a five-day shedding streak, whereas the extra cyclically oriented Dow Jones Industrial Common

DJIA,

erased a lack of greater than 360 factors to finish barely increased.

In the meantime, Calvasina stated a take a look at what shares are providing by way of dividend and earnings yield relative to bonds, in addition to a reminder of what kind of bond strikes have spelled bother for equities, provides some reassurance that 2021 is unlikely to show right into a down 12 months, she stated.

Dividend yield

On the subject of dividend yield, RBC measured the share of corporations that proceed to exceed the 10-year Treasury yield. Whereas that has fallen to 51.5% from 64% in the beginning of the 12 months, it’s nonetheless inside a spread sometimes adopted by a 17% acquire for the S&P 500 over the next 12 months, she stated.

Earnings yield

The S&P 500’s earnings yield has additionally deteriorated, transferring to the low finish of the vary in place for the reason that finish of the monetary disaster. It now stands close to the extent seen in 2017-’18, however stays in a spread that’s been adopted by 9.3% common beneficial properties by the S&P 500 over the subsequent 12 months, Calvasina stated.

“In different phrases, this evaluation is acknowledging the case for a short-term pullback within the S&P 500, however isn’t essentially signaling that longer-term traders ought to head for the exit,” she wrote.

Calvasina additionally highlighted an “necessary distinction” between 2018, when the commerce warfare posed a menace to the U.S. and international economies, and now, when gross home product forecasts are rising quickly.

Treasury yields and shares

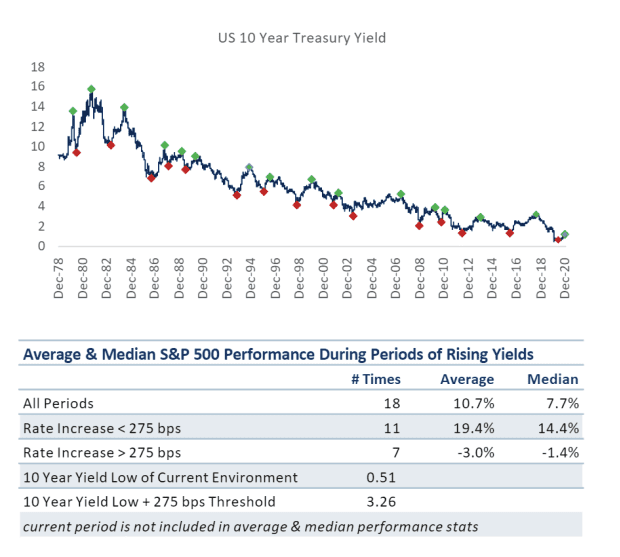

Lastly, what in regards to the rise in Treasury yields itself? In any case, many market watchers have argued that whereas yields stay low by historic requirements, it’s the scale of the rise which may be most regarding for equities. Calvasina broke down the connection between yield strikes and stock-market efficiency within the chart under:

RBC Capital Markets

Calvasina stated U.S. equities have tended to wrestle when the 10-year yield rises greater than 275 foundation factors, or 2.75 share factors. Coming off its low of 0.51%, a 275-basis-point transfer would take the yield to round 3.26%. The ten-year ended Tuesday at 1.363%.