So, after accessing your wants, determine on the particular riders to purchase and make your life insurance coverage cowl a complete one.

So, after accessing your wants, determine on the particular riders to purchase and make your life insurance coverage cowl a complete one.

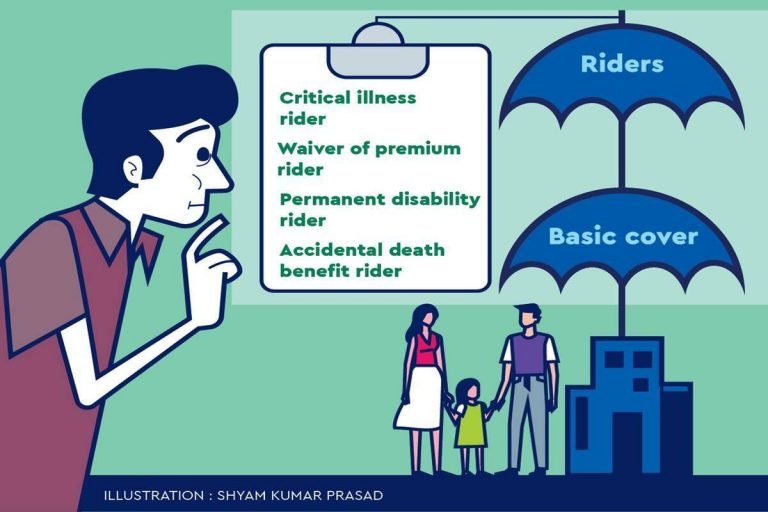

Since we purchase life insurance coverage to guard our household in the long term, it’s useful to purchase sure key riders together with the bottom coverage by paying an additional premium. Riders are further advantages which a policyholder can go for together with the essential cowl to develop his life insurance coverage protection. Riders will help in customising the life insurance coverage coverage, give further safety in opposition to threat on high of the essential sum and may be helpful in instances of economic crises, particularly at a time when the Covid-19 pandemic has taken lives of many breadwinners.

Whereas some life insurance coverage corporations supply plans which have in-built riders within the fundamental plans, others have flexible-plans and a policyholder can select in response to his wants. Life insurers supply varied forms of riders resembling important sickness, everlasting incapacity, unintended demise and waiver of premium riders. In truth, unintended disabilities and life-threatening sicknesses, which entail costly remedies, could cause monetary stress to the insured and his household.

Riders can mitigate that to a big extent.

Shopping for a rider is way more inexpensive than shopping for a separate insurance coverage coverage and the insured can get tax deductions underneath Part 80C, 10(10D),115BAC and different provisions of the Revenue Tax Act, 1961. Policyholders should buy riders to any insurance coverage plan—time period plan, endowment plan and even unit-linked plan. Nevertheless, the premium on the important sickness riders can not exceed 100% of the premium underneath the essential product and premiums underneath all different life insurance coverage riders in whole can’t be over 30% of premium paid underneath the essential coverage.

Essential sickness rider

Beneath this rider, the insurance coverage firm pays a lump sum or give periodic payouts, over and above the sum assured, in case the policyholder is recognized with any of the desired important sicknesses listed within the coverage doc resembling coronary heart assault, most cancers, mind tumour, kidney failure, and many others. Policyholders should see your entire listing of important sicknesses coated within the coverage because it varies from firm to firm. The lump sum can be utilized for medical remedy and even for family bills and paying mortgage EMIs.

Because the policyholder will endure lack of earnings due to the important sickness, the pay-out will assist him pay for the remedy prices, assist his household financially and compensate for the lack of earnings instantly. After cost of the lump sum, the insurer terminates the extra rider. Nevertheless, the policyholder’s base coverage continues. Consultants say important sickness rider has gained quite a lot of traction after the Covid-19 pandemic due to its multi-organ results.

Waiver of premium rider

Beneath this hottest rider, if an insured particular person dies in the course of the coverage time period, or suffers a incapacity and is unable to pay future premiums on the coverage, the insurer pays all premiums due if the insured had opted for the waiver of premium rider. On maturity, the beneficiary of the deceased policyholder will obtain the complete maturity advantages in response to the phrases of the coverage. The waiver of premium rider is offered together with the unintended and everlasting incapacity or the important sickness rider. Nevertheless, if the insurance coverage firm will not be providing it then the insured should buy it individually.

Everlasting incapacity rider

This rider helps in case the insured is completely disabled because of an accident which renders them incapable of working for a residing. The insurer pays a sure sum assured for a interval relying on the coverage phrases. Usually, most insurers pay a share of the advantages accrued because of the rider each month for a specified variety of years. Furthermore, all future premiums on the bottom insurance coverage coverage are waived off by the corporate. If the coverage holder dies in the course of the tenure of the coverage after having suffered from the everlasting incapacity, the excellent sum assured is paid to the nominee of the policyholder.

Unintended demise profit rider

If the life insured dies because of an accident, the nominee is paid the demise sum assured along with the essential sum assured of the coverage. So, if one doesn’t have a separate private accident insurance coverage coverage, then this rider is usually a very-cost efficient one to buy to guard the household financially.

If you’re planning to purchase a life insurance coverage coverage, take a look at the riders which are supplied by your insurance coverage firm, perceive the inclusions and exclusions and the extra premium that you need to pay. Take a look at the maturity interval of the riders as some riders like important sickness might expire earlier than the maturity of the bottom life cowl. So, after accessing your wants, determine on the particular riders to purchase and make your life insurance coverage cowl a complete one.

Have you learnt What’s ? FE Information Desk explains every of those and extra intimately at Monetary Categorical Defined. Additionally get Reside BSE/NSE Inventory Costs, newest NAV of Mutual Funds, Finest fairness funds, High Gainers, High Losers on Monetary Categorical. Dont overlook to strive our free Revenue Tax Calculator device.

![]() Monetary Categorical is now on Telegram. Click on right here to affix our channel and keep up to date with the newest Biz information and updates.

Monetary Categorical is now on Telegram. Click on right here to affix our channel and keep up to date with the newest Biz information and updates.