Nonetheless, time period insurance coverage merchandise themselves may be of various sorts.

Nonetheless, time period insurance coverage merchandise themselves may be of various sorts.

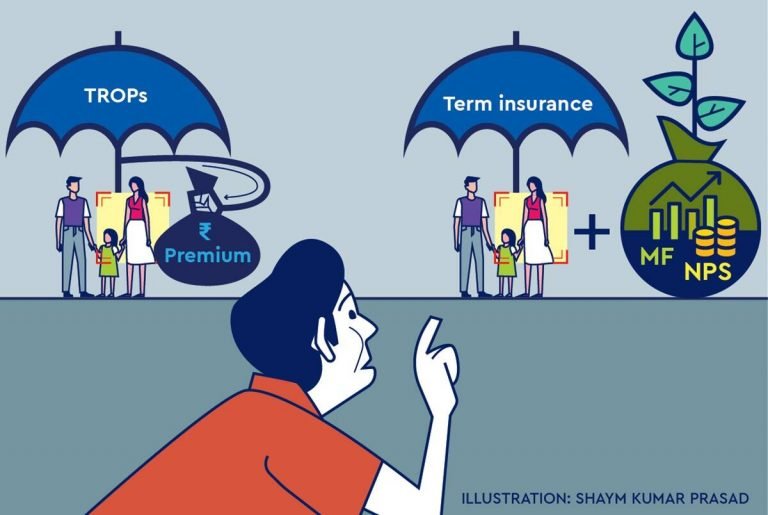

Having satisfactory life insurance coverage safety in place is a necessity in immediately’s day and age. It ensures that the dependent relations are usually not left within the lurch in case of the policyholder’s sudden incapacity or demise. That stated, it’s at all times wiser to maintain insurance coverage and funding separate. As such, it could be a greater concept to go along with an ordinary time period insurance coverage coverage than conventional life insurance coverage merchandise like endowment plans that supply comparatively decrease sum assured at greater premiums. The funds saved by choosing a time period insurance coverage coverage may be invested in line with one’s returns expectations and threat tolerance to earn greater general returns.

Nonetheless, time period insurance coverage merchandise themselves may be of various sorts. There are plain vanilla time period plans and likewise just a few variants that return the premium on the finish of the coverage tenure. So, do you have to go for them? Let’s focus on the options of a time period plan and a return of premium time period plan (TROP) to search out the reply.

Time period plan & time period plan with return of premium

A time period plan offers life cowl for a specified variety of years. The premium for a time period plan is set primarily based on the age of the insured and the coverage cowl measurement amongst different components. These premiums are often decrease than most different life insurance coverage merchandise as there are not any maturity advantages or funding bills for the insurer concerned. Time period plans come in numerous variants primarily based on the kind of premium and declare pay-outs.

Usually, you possibly can select the premium cost frequency to be month-to-month, quarterly, yearly, lump-sum at one time or for a sure interval. Equally, there are totally different pay-out plans too, like a set month-to-month pay-out plan, rising month-to-month pay-out plan, lump-sum cost, and so forth. You might select a time period plan primarily based on each these components as per the wants of your dependent relations. You too can embrace rider choices to your time period plan on the time of buy to make it extra complete, although this might make it costlier.

A time period plan with return of premium (TROP), alternatively, is a time period plan with an extra characteristic of a survival profit. This suggests that in case you, because the insured, survive until the maturity of the TROP, you’re going to get again your entire premium. You may additionally get a mortgage towards a TROP coverage relying on its paid-up worth and topic to relevant phrases and beneath the coverage—one thing which isn’t potential with an ordinary time period plan.

You too can pay the premiums for a TROP in instalments or at one shot at the start of the coverage. Nonetheless, the premium for a TROP is greater than an ordinary time period plan for a similar sum assured. It is because the price related to the TROP, be it the price of investing the premiums or administering the coverage, is greater than a vanilla insurance coverage coverage.

Which one do you have to go for?

The TROPs are sometimes marketed as “free life insurance policies” to draw consumers by exhibiting that the insured doesn’t must pay something if he survives the coverage tenure. Nonetheless, the fact might be barely extra difficult. In actual fact, TROPs often contain a lot greater premium obligations than a time period plan of similar cowl measurement. Additionally, the precise worth of the premium quantity returned on the finish of the coverage time period beneath a TROP will probably be a lot lesser resulting from inflation. As such, the distinction in premiums for a time period plan and a TROP with equal sum assured may as an alternative be invested in devices aligned with the insurer’s threat urge for food to construct a a lot greater corpus.

It’s not unusual for folks to put money into TROPs as a last-minute tax-saving measure with out placing a lot thought into it. It could be a greater concept to buy an ordinary time period insurance coverage product for an satisfactory sum assured at decrease premiums. The surplus funds may be invested in ELSS mutual funds, tax-saving FDs, PPF, NPS or VPF in keeping with your threat urge for food and liquidity necessities to construct a much bigger corpus whereas additionally serving to you to exhaust the tax-deduction advantages at your disposal.

The author is CEO, BankBazaar.com

Are you aware What’s ? FE Information Desk explains every of those and extra intimately at Monetary Categorical Defined. Additionally get Stay BSE/NSE Inventory Costs, newest NAV of Mutual Funds, Greatest fairness funds, High Gainers, High Losers on Monetary Categorical. Dont neglect to attempt our free Earnings Tax Calculator device.

![]() Monetary Categorical is now on Telegram. Click on right here to affix our channel and keep up to date with the newest Biz information and updates.

Monetary Categorical is now on Telegram. Click on right here to affix our channel and keep up to date with the newest Biz information and updates.