When his mother and father first discovered that Vishal Baveja, a 27-year-old physician of forensic drugs, had invested a few of his financial savings in Indian fairness mutual funds, they have been fearful concerning the danger. These fears abated once they noticed the revenue these investments produced. Then, because the coronavirus pandemic took maintain final 12 months, they supported his resolution to start out shopping for particular person blue-chip shares.

“The tables have turned,” says Baveja, a local of Bhopal who works in neighboring Indore. “The inventory market now all the time comes up in my each day telephone conversations with my mom.”

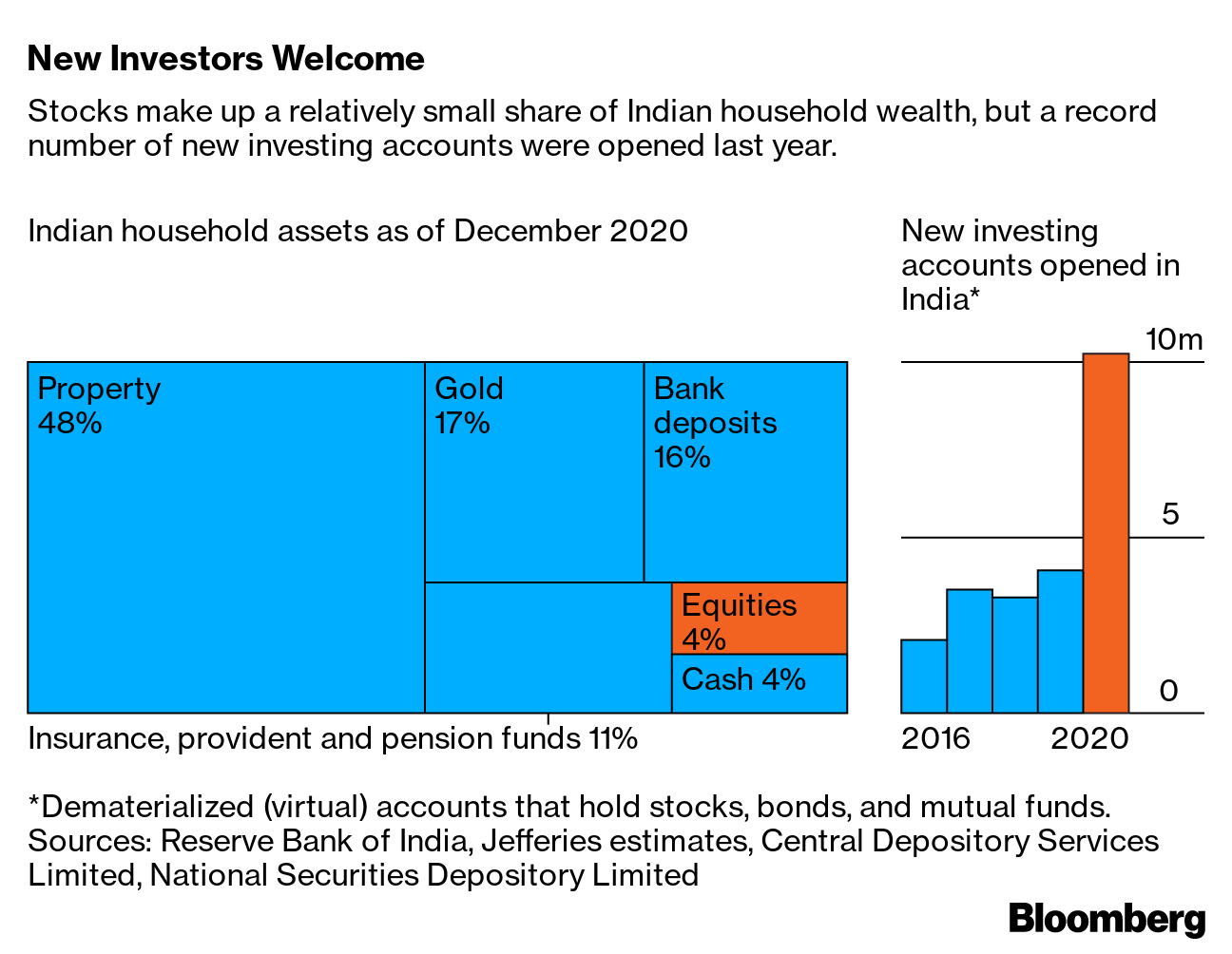

Hundreds of thousands of younger Indians similar to Baveja have taken to inventory buying and selling through the pandemic, elevating hopes that the urge for food for equities on the planet’s second-most-populated nation is lastly rising. Lively investor accounts rose by a document 10.4 million in 2020, in line with knowledge from the nation’s two fundamental depositories. Retail possession in additional than 1,500 corporations listed on the Nationwide Inventory Change of India Ltd. jumped to 9% within the third quarter of 2020, the best since March 2018.

Angel Broking Ltd., a securities agency established in 1987, says 72% of the 510,000 clients it added from October to December had by no means traded shares earlier than. Of India’s 1.36 billion individuals, solely about 3.7% put money into equities, in contrast with about 12.7% in China, in line with inventory depository knowledge on the variety of funding accounts (and assuming one account per individual). Within the U.S., against this, a ballot discovered about 55% of the inhabitants owns shares both individually or by means of a mutual fund.

“When it comes to retail investor participation, China might be a mannequin of what you may count on will occur in India,” says Mark Mobius, the veteran emerging-market investor. “India might simply equal China’s market cap within the subsequent 5 to 10 years as a result of going ahead, progress in India’s market will in all probability be quicker. China, due to its dimension, will in all probability develop extra slowly.”

As in different elements of the world, India’s retail buying and selling growth has been fueled by pandemic-driven restrictions and job losses that left hundreds of thousands of individuals at dwelling with little to do. The relentless inventory market rally since March 2020 has drawn in additional buyers. And expertise, together with the rise of low cost buying and selling apps and social media—YouTube influencers, Twitter, and Telegram stock-tipping discussion groups—has attracted hordes of day merchants into low cost brokers similar to Zerodha Broking Ltd.

However in contrast to throughout earlier retail investing booms, lots of the new entrants dwell outdoors of Mumbai and New Delhi, the most important cities. Greater than half of Angel Broking’s new clients within the quarter that resulted in December have been from smaller cities and cities, the agency says.

“The adoption of web and on-line entry goes deeper into the nation,” says Peeyush Mittal, a co-manager of the Matthews India Fund in San Francisco. “What we hear from corporations within the brokerage area is Tier 2 and Tier 3 metropolis buyers are extra long run of their view of the market. Each time the markets are down, they have a tendency to place in more cash in comparison with individuals within the greatest cities.”

Baveja, the physician from Indore, says he began with about 10,000 rupees ($138) in February 2020, then piled additional into Indian shares after the market plunged in March. “My investments rose to a wholesome six-figure mark by April,” he says, including that he plans to be a long-term investor.

At the same time as lots of the pandemic restrictions that India imposed in March have been lifted, the retail investing fervor continued. Central Depository Companies (India) Ltd. opened a document 1.47 million accounts in January, up greater than threefold from the identical month in 2020, and 1.36 million in February.

India’s mutual fund business has focused small cities by means of tv, social media, and billboard promoting. Investments by people in fairness funds jumped 16% in February from the identical month a 12 months earlier, in line with knowledge from the Affiliation of Mutual Funds in India.

The strikes are a part of a broader shift away from conventional bodily property similar to actual property and gold, in addition to financial institution deposits. Rural farmers and the city working class have historically relied on gold as each an insurance coverage coverage and a retirement plan in a rustic that lacks strong social welfare methods or widespread entry to formal credit score. However Indian millennials are extra inclined to take dangers out there.

Apoorv, a 30-year-old director at a nongovernmental group who declined to offer his final identify for privateness causes, is amongst them. He says he took to buying and selling shares after realizing how simple it was to do on Zerodha and different platforms.

“I by no means thought energetic day merchants could be buying and selling out of a cell [phone], however they do typically, like 100 trades a day,” says Nithin Kamath, chief govt officer at Zerodha, which began in 2010 and is now India’s largest dealer, with greater than 4 million clients. “In 2015, 95% of our enterprise was from the desktop-trading platform. Now 75% is from cell.”