The fairness Mutual Fund schemes have witnessed a steady internet outflow, primarily as a result of profit-booking, for eight consecutive months in February 2021, even because the fairness AUMs have stored on rising as a result of rally in fairness markets.

Based on the information launched by the Affiliation of Mutual Funds In India (AMFI), buyers offered fairness mutual funds value Rs 4,534 crore in February. The quantity stood at Rs 9,253 crore within the earlier month.

The Systematic investments plans or SIPs’ contribution additionally dipped to Rs 7,528 crore in February as in comparison with Rs 8,023 crore in January.

Nevertheless, the Mutual Fund trade’s whole Belongings underneath Administration (AUMs) elevated 3.7 p.c month-on-month (MoM) and reached an all-time excessive of over Rs 31.6 lakh crore on the finish of February 2021.

February noticed a notable change within the sector and inventory allocation of funds. On a MoM foundation, the weights of PSU Banks, Metals, Oil & Fuel, Personal Banks, Utilities, Cement, NBFC, Capital Items, Actual Property, Retail, and Infrastructure elevated, whereas weights of Know-how, Healthcare, Client, Telecom, and Vehicles moderated, a Motilal Oswal report stated.

Client’s weight has continued to average for the final months to a 34-month low of seven.1 p.c. Because of this, the sector slipped to the fifth place in MF allocation, making approach for the Oil & Fuel sector within the fourth place.

PSU Banks’ weight – after hitting an all-time low in September 2020 to 2 p.c – noticed constructive curiosity amongst MFs, with a rise in weight for 4 consecutive months to three.3 p.c (+70 bps MoM, -40bp YoY).

IndusInd Financial institution, Tata Motors, DLF and United Spirits have been among the many prime 10 buys in largecaps by the mutual funds.

Supply: ICICI Direct

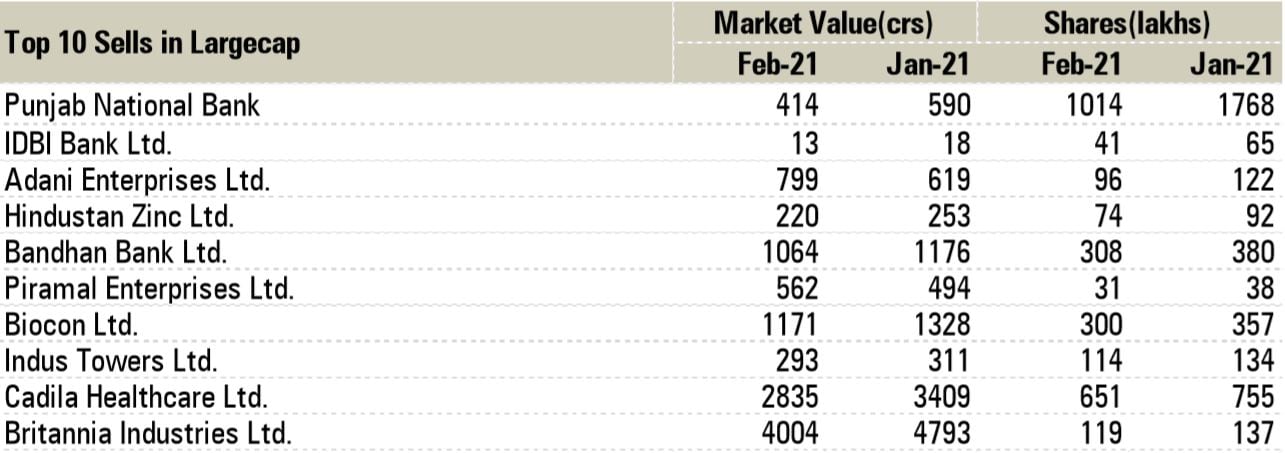

Prime 10 sells in largecaps included Punjab Nationwide Financial institution, IDBI Financial institution, Adani Enterprises, Hindustan Zinc and Bandhan Financial institution.

Supply: ICICI Direct

Listed here are the highest 10 buys in Midcaps

Supply: ICICI Direct

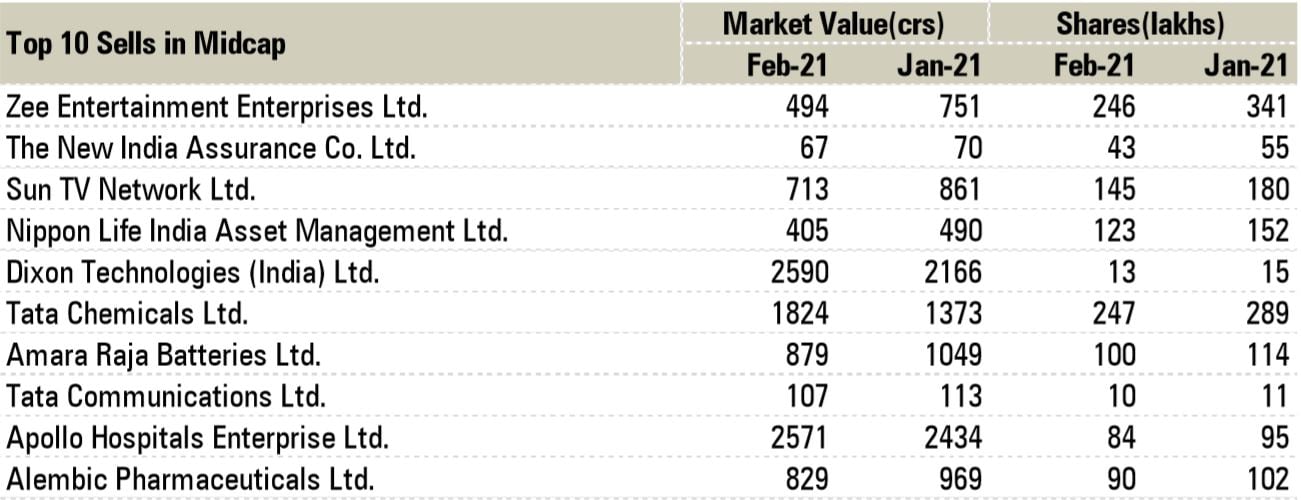

Listed here are the highest 10 sells in Midcaps

Supply: ICICI Direct

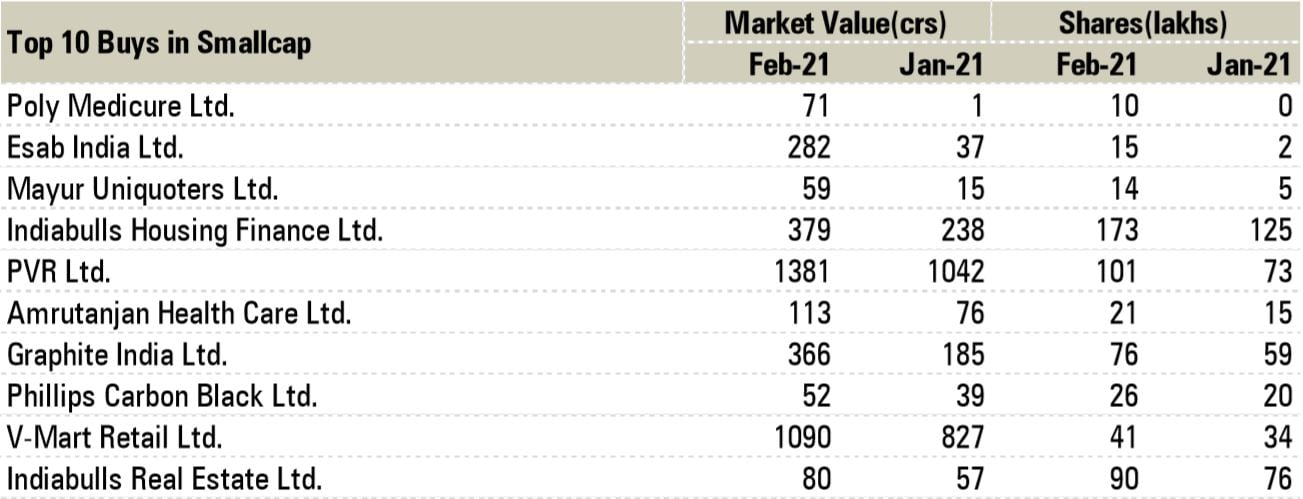

Amongst Smallcaps, MFs purchased Poly Medicure, Esab India, Mayur Uniquoters, Indiabulls Housing Finance, amongst others essentially the most.

Supply: ICICI Direct

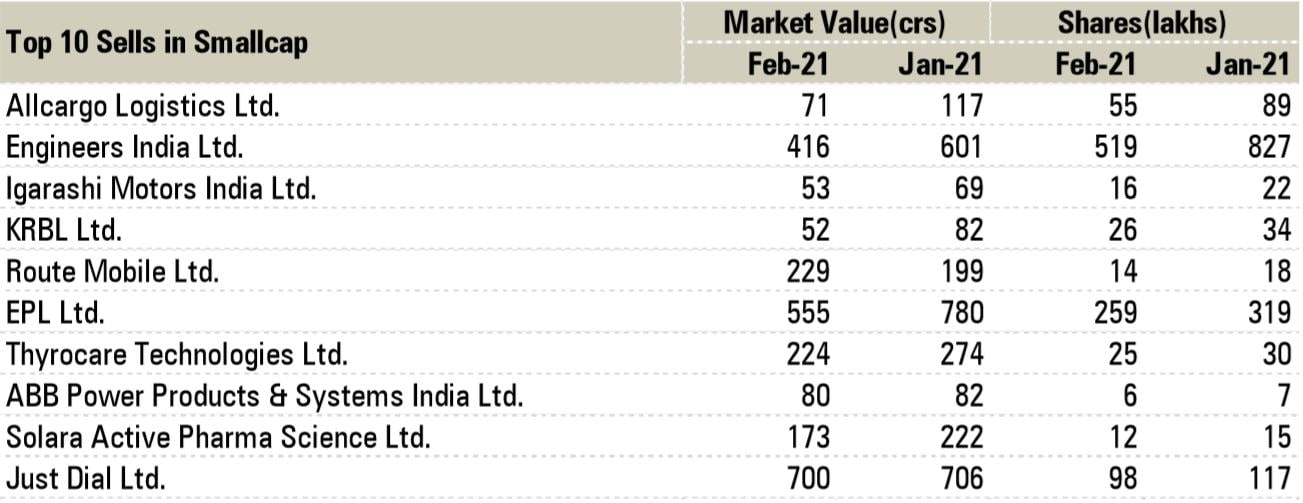

MFs offered Allcargo Logistics, Engineers India, Igarashi Motors India, KRBL and Route Cellular essentially the most amongst Smallcaps.

Supply: ICICI Direct

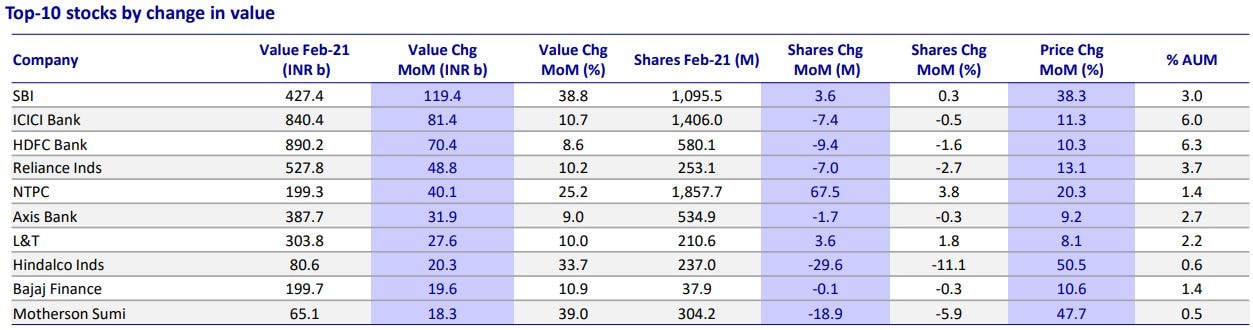

By way of worth enhance MoM, 5 of the highest 10 shares have been from Financials: SBI (Rs 119.4 billion), ICICI Financial institution (Rs 81.4 billion), HDFC Financial institution (Rs 70.4 billion), Axis Financial institution (Rs 31.9 billion), and Bajaj Finance (Rs 19.6 billion).

Supply: Motilal Oswal

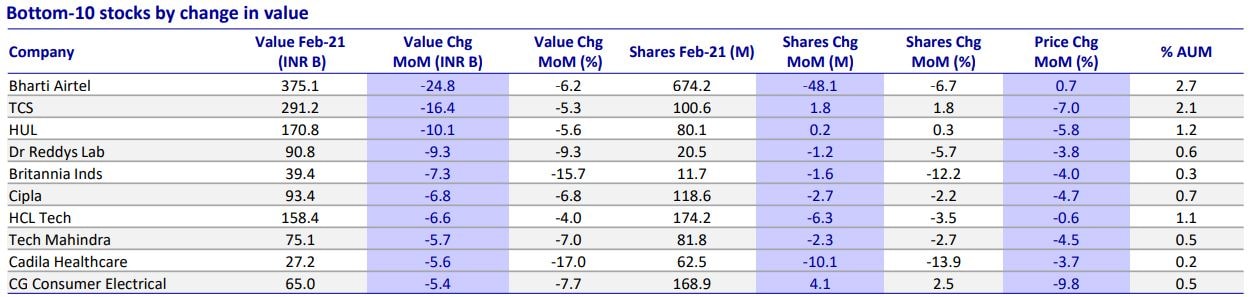

Shares exhibited a most decline in worth MoM: Bharti Airtel (Rs 24.8 billion), TCS (Rs 16.4 billion), HUL (Rs 10.1 billion), Dr Reddy’s Laboratories (Rs 9.3 billion), and Britannia Industries (Rs 7.3 billion).

Supply: Motilal Oswal

Supply: Motilal Oswal