When the rates of interest are hiked the savers are comfortable and debtors frown. Debt funds have a blended bag. Whereas the short-term centered debt funds classes resembling liquid and in a single day funds see their portfolio yields go up main to raised returns, the rising yields pull down the long-term bond costs, bringing the Web asset worth (NAV) of lengthy period debt funds.

When the rates of interest are hiked the savers are comfortable and debtors frown. Debt funds have a blended bag. Whereas the short-term centered debt funds classes resembling liquid and in a single day funds see their portfolio yields go up main to raised returns, the rising yields pull down the long-term bond costs, bringing the Web asset worth (NAV) of lengthy period debt funds.

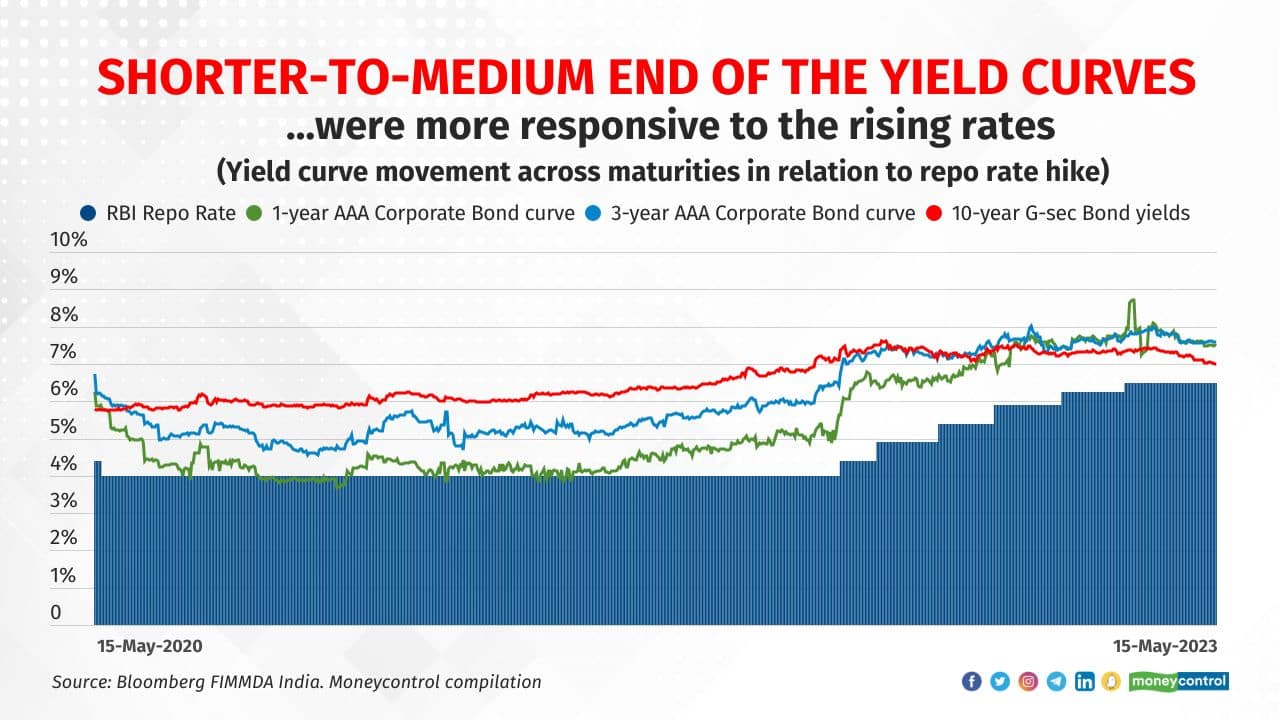

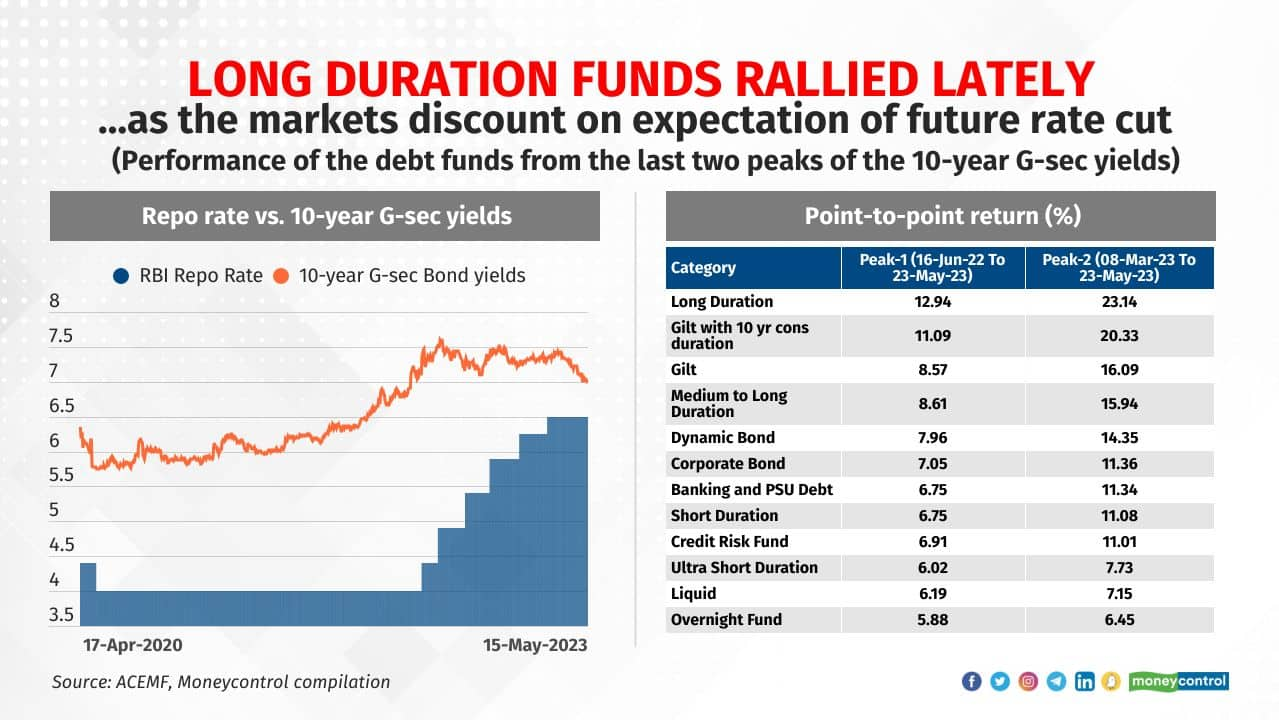

The Reserve Financial institution of India (RBI) has raised the rate of interest by mountaineering repo price by 250 foundation factors since Could 2022. (Learn right here: RBI pauses price hikes. Time to trip debt funds) The cash market charges took cue and began climbing up. The ten yr g-sec bond yield extra a market decided benchmark for the monetary market was slowly going up via CY2021 anticipating price hikes by central financial institution. Nevertheless, it peaked on June 16, 2022. The markets discounted future by adjusting the yields based mostly on the data circulation – be it communication from central banks or the macro-economic indicators resembling inflation and financial progress.

The Reserve Financial institution of India (RBI) has raised the rate of interest by mountaineering repo price by 250 foundation factors since Could 2022. (Learn right here: RBI pauses price hikes. Time to trip debt funds) The cash market charges took cue and began climbing up. The ten yr g-sec bond yield extra a market decided benchmark for the monetary market was slowly going up via CY2021 anticipating price hikes by central financial institution. Nevertheless, it peaked on June 16, 2022. The markets discounted future by adjusting the yields based mostly on the data circulation – be it communication from central banks or the macro-economic indicators resembling inflation and financial progress.

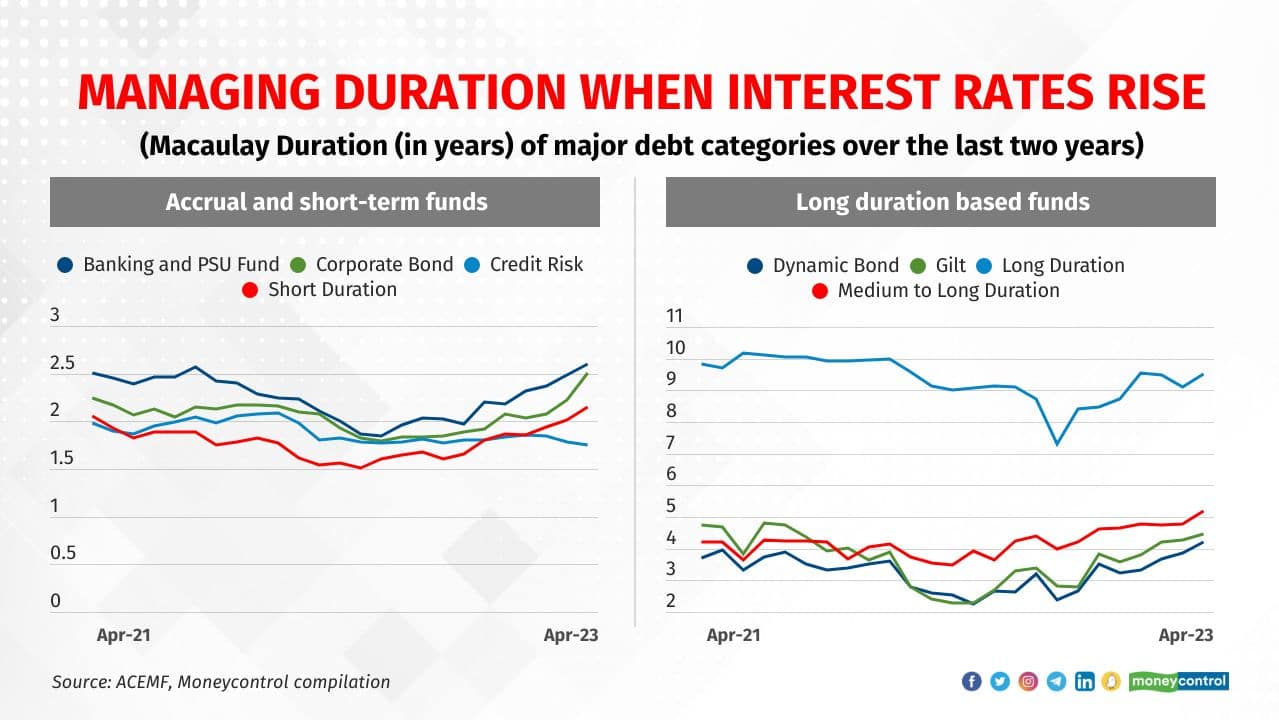

One of the best ways to handle a rising rate of interest cycle is to maintain the portfolio period low. Fund managers favor to stay invested in comparatively quick time period bonds, as these bonds see comparatively much less worth erosion when charges rise. For instance, amongst accrual merchandise like Banking and PSU debt funds in addition to Brief Length funds decreased their portfolio period (Macaulay Length) to 1.9 years and 1.5 years respectively in Could 2022, down from 2.5 years and 1.9 years respectively a yr in the past. Equally, gilt funds lower the portfolio period to 2.3 years in Could 2022 in comparison with 4.7 years in Could 2022.

One of the best ways to handle a rising rate of interest cycle is to maintain the portfolio period low. Fund managers favor to stay invested in comparatively quick time period bonds, as these bonds see comparatively much less worth erosion when charges rise. For instance, amongst accrual merchandise like Banking and PSU debt funds in addition to Brief Length funds decreased their portfolio period (Macaulay Length) to 1.9 years and 1.5 years respectively in Could 2022, down from 2.5 years and 1.9 years respectively a yr in the past. Equally, gilt funds lower the portfolio period to 2.3 years in Could 2022 in comparison with 4.7 years in Could 2022.

Nevertheless, as per the most recent information as of April 2023, these schemes have raised the portfolio period to 2.6 years, 2.1 years and 4.5 years respectively.

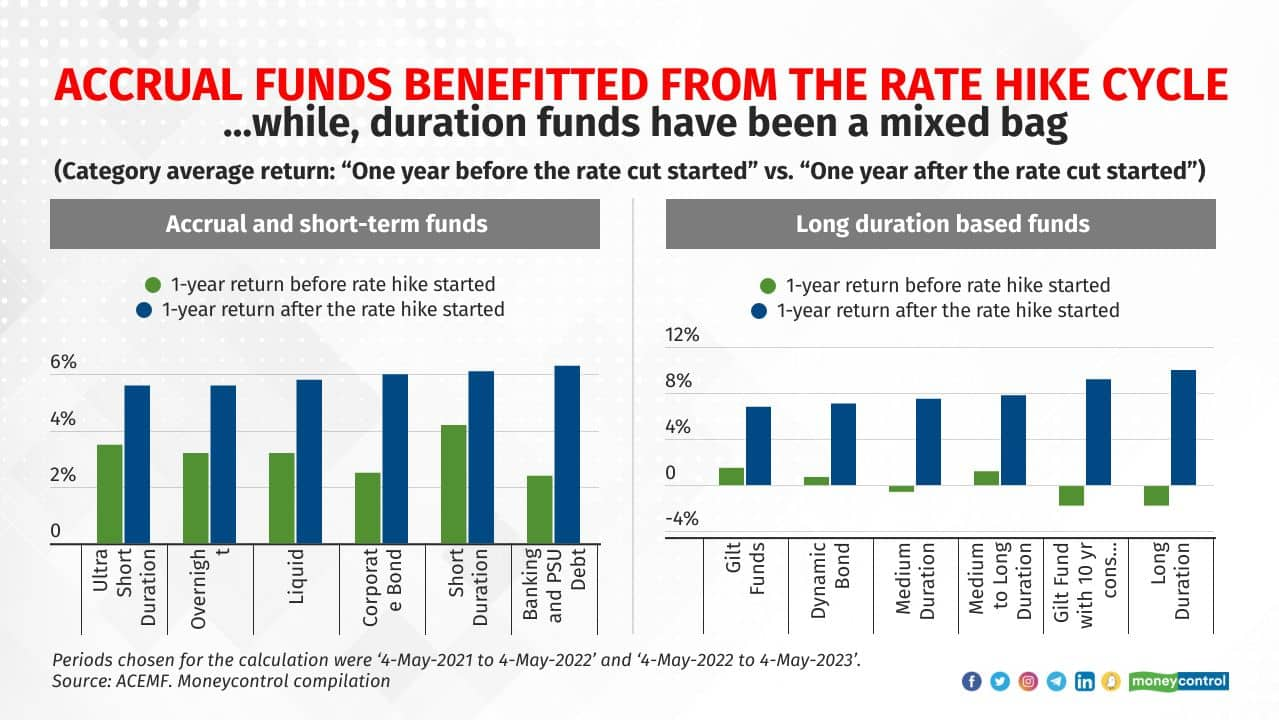

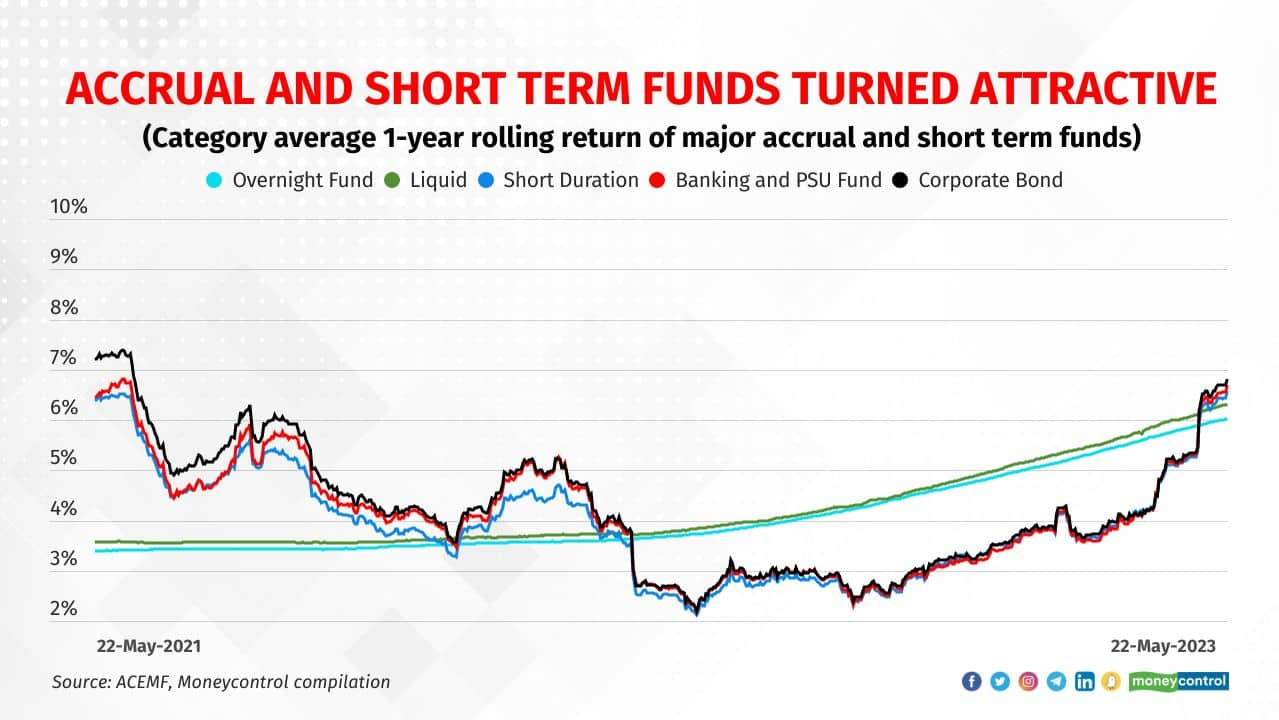

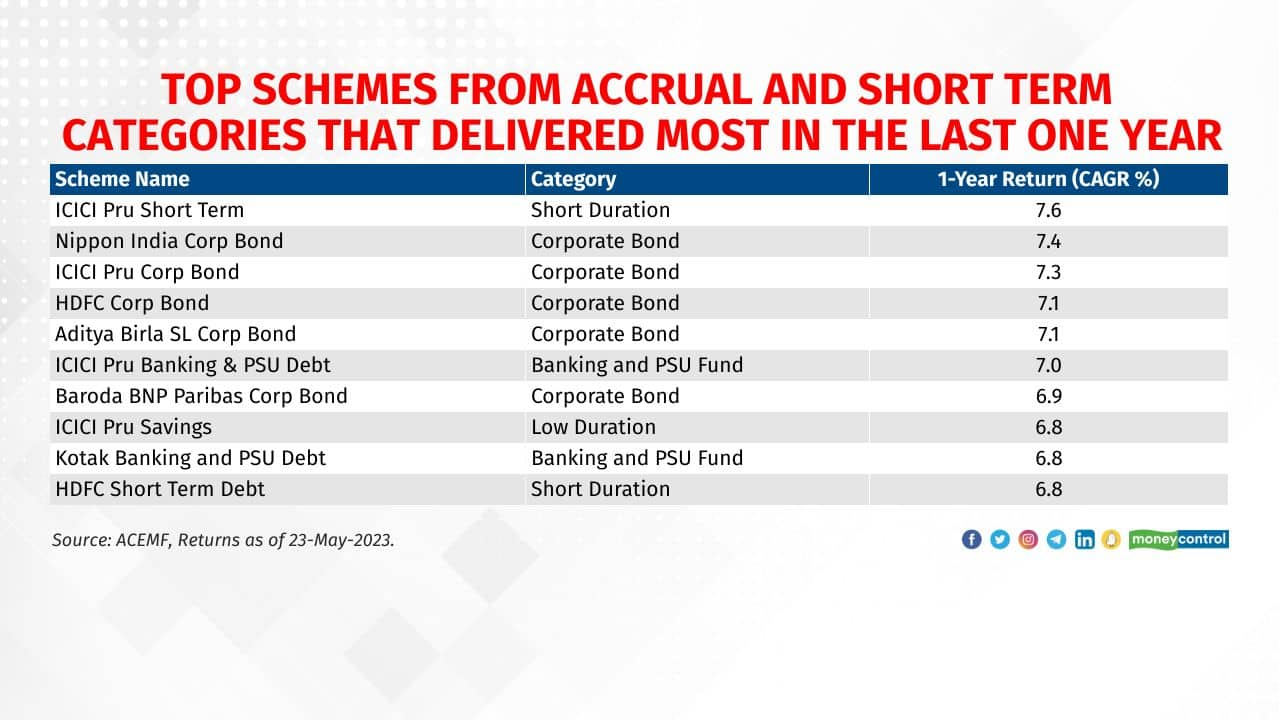

Accrual centered funds benefitted from the speed hike cycle. The returns they generated within the yr after the speed hike cycle begun exceeded the returns they generated in a yr earlier than the speed hike cycle begun. Debt funds schemes investing in lengthy period bonds nevertheless, have been a blended bag. The lively administration of period and the early peaking of 10 yr bond yields in June 2022 influenced the returns they provided.

Accrual centered funds benefitted from the speed hike cycle. The returns they generated within the yr after the speed hike cycle begun exceeded the returns they generated in a yr earlier than the speed hike cycle begun. Debt funds schemes investing in lengthy period bonds nevertheless, have been a blended bag. The lively administration of period and the early peaking of 10 yr bond yields in June 2022 influenced the returns they provided.

Additionally learn: Six fastened revenue merchandise for you on this excessive rate of interest situation

Pranay Sinha, Senior Fund Supervisor- Fastened Earnings, Nippon India Mutual Fund factors out that monetary markets are likely to low cost future. “The 10year yield moved up from 6.25 % to 7.55 % between the interval Oct 2021 to June 2022 whereas the precise repo price hikes occurred between Could 2022 to Feb 2023.” Equally the 10year charges have come down in anticipation of RBI stepping into pause and softening of macro-economic variables like shopper worth inflation and present account deficit. The motion in international yields and expectations of pause by international central banks have additionally performed a component, he added.

Pranay Sinha, Senior Fund Supervisor- Fastened Earnings, Nippon India Mutual Fund factors out that monetary markets are likely to low cost future. “The 10year yield moved up from 6.25 % to 7.55 % between the interval Oct 2021 to June 2022 whereas the precise repo price hikes occurred between Could 2022 to Feb 2023.” Equally the 10year charges have come down in anticipation of RBI stepping into pause and softening of macro-economic variables like shopper worth inflation and present account deficit. The motion in international yields and expectations of pause by international central banks have additionally performed a component, he added.

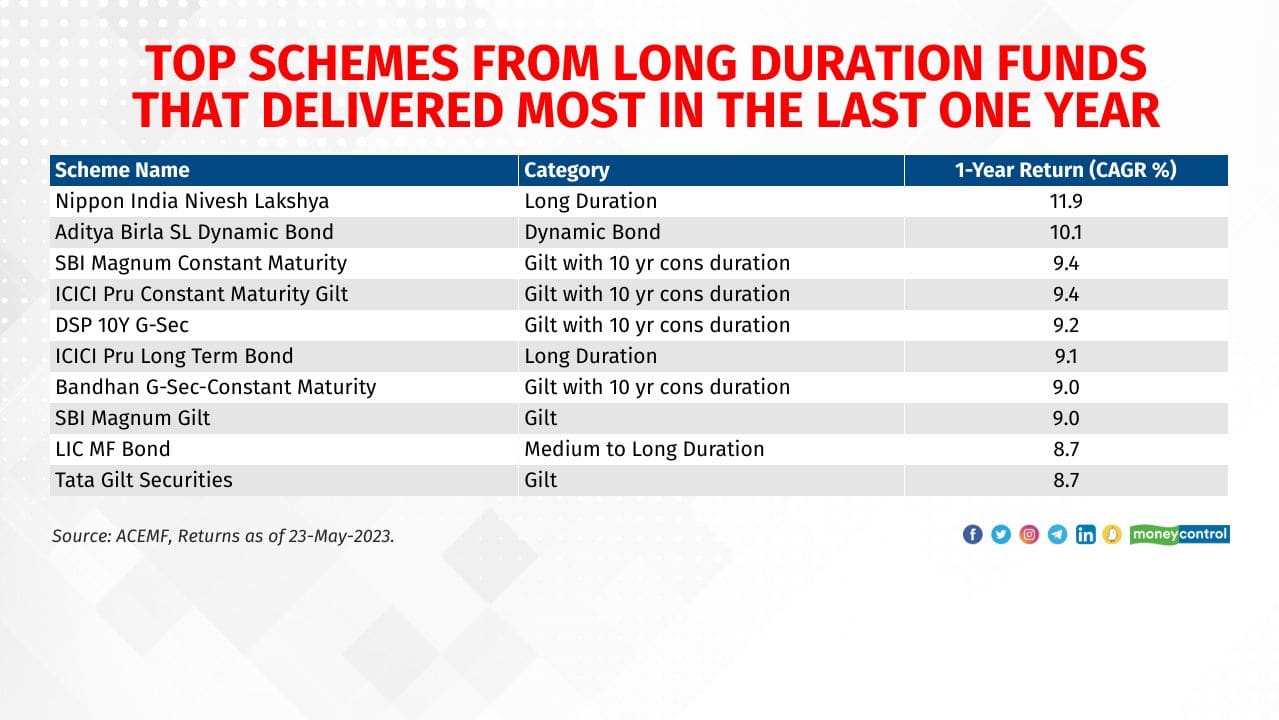

As the long run bond yields got here down, regardless of hike in repo price, the debt funds investing in long run bonds posted enticing returns, in extra of 8 %.

Accrual funds with period ranging between 2 to three years, noticed some brunt of expectations of rising rates of interest within the yr earlier than the repo charges began going up. Common 1-year rolling returns of each banking & PSU debt funds and company bond funds classes noticed a decline to 1.7 % in June 2022. The identical nevertheless climbed up progressively because the markets began constructing in a case of pause in price hikes.

Accrual funds with period ranging between 2 to three years, noticed some brunt of expectations of rising rates of interest within the yr earlier than the repo charges began going up. Common 1-year rolling returns of each banking & PSU debt funds and company bond funds classes noticed a decline to 1.7 % in June 2022. The identical nevertheless climbed up progressively because the markets began constructing in a case of pause in price hikes.

Manish Banthia, Deputy CIO – Fastened Earnings, ICICI Prudential AMC believes that RBI is approaching the fag-end of the speed hike cycle, with an elongated pause anticipated submit peak in rates of interest.

Joydeep Sen, company coach -debt, sees slim probability of a lower in repo price on this yr. “Nevertheless, if a repo price lower takes place then the yields on cash market devices and bonds with residual maturity of lower than one yr will even go down,” he provides.

If the quick time period charges proceed to stay elevated at present ranges, then accrual funds will profit.

Additionally Learn: MC30 Scheme Assessment | A debt fund is designed to ship higher returns throughout price cycles

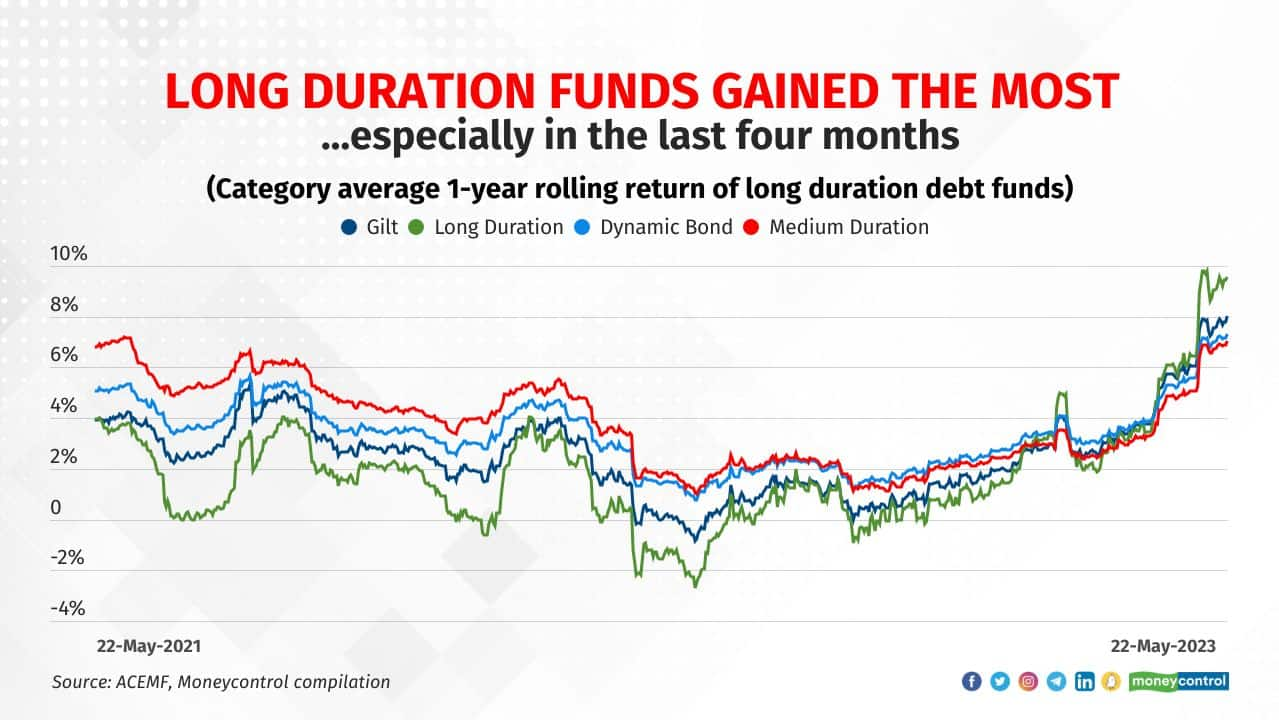

Debt schemes investing in comparatively long run bonds are extra prone to modifications in rates of interest. For instance, lengthy period funds noticed the one yr rolling returns fall to detrimental 2.7 % in June 2022 in comparison with constructive 4 % in June 2021. The expectations of price hike ensured that the bond costs fall and the NAVs are hit. Because the expectations of price hike gave solution to expectations of an early pause and attainable price lower in future, the lengthy period fund bounced again rapidly. As on Could 23, 2023, the one yr rolling returns stand at 10.5 %.

Debt schemes investing in comparatively long run bonds are extra prone to modifications in rates of interest. For instance, lengthy period funds noticed the one yr rolling returns fall to detrimental 2.7 % in June 2022 in comparison with constructive 4 % in June 2021. The expectations of price hike ensured that the bond costs fall and the NAVs are hit. Because the expectations of price hike gave solution to expectations of an early pause and attainable price lower in future, the lengthy period fund bounced again rapidly. As on Could 23, 2023, the one yr rolling returns stand at 10.5 %.

Sinha sees the ten yr benchmark bond yield pricing in pause in price hike cycle with a risk at of the subsequent transfer being a price lower. “Any deterioration in progress information domestically may put stress on RBI to chop charges and will result in fall in 10y benchmark yields,” he says.

Although liquid and in a single day funds have a tendency to learn from the rising rates of interest, the accrual centered schemes with portfolios of two to a few years period did higher. After MPC meet held in February 2023, the expectations of attainable pause in price hikes ensured that the yields of the bonds held come down and the NAVs of those schemes acquired some facelift. Funding demand for these bonds additionally went up because the traders determined to lock of their cash in comparatively much less dangerous debt fund choices after switching out from very quick time period centered merchandise resembling liquid and in a single day funds.

Although liquid and in a single day funds have a tendency to learn from the rising rates of interest, the accrual centered schemes with portfolios of two to a few years period did higher. After MPC meet held in February 2023, the expectations of attainable pause in price hikes ensured that the yields of the bonds held come down and the NAVs of those schemes acquired some facelift. Funding demand for these bonds additionally went up because the traders determined to lock of their cash in comparatively much less dangerous debt fund choices after switching out from very quick time period centered merchandise resembling liquid and in a single day funds.

Banthia attributes superior returns within the final couple of years to the fund home’s technique to scale back period with the thought that price hike cycle can be steep. “We prevented the quick finish of the curve because it was riskier than the lengthy finish of the curve. By this cycle, we have been obese floating price bonds which offered good margin of security. All of those calls performed out effectively and aided within the fund efficiency,” he provides.

Because the markets began discounting the expectations of early pause in price hikes, the lengthy period funds and 10 years fixed maturity funds emerged winners amongst debt funds that put money into comparatively lengthy tenured bonds. Many traders wish to put money into lengthy period bond funds and gilt funds. Nevertheless, not all discover 10 yr benchmark bond yield enticing at present sub-7 % ranges.

Because the markets began discounting the expectations of early pause in price hikes, the lengthy period funds and 10 years fixed maturity funds emerged winners amongst debt funds that put money into comparatively lengthy tenured bonds. Many traders wish to put money into lengthy period bond funds and gilt funds. Nevertheless, not all discover 10 yr benchmark bond yield enticing at present sub-7 % ranges.

“With RBI’s inflation goal shifting to six % now in comparison with 4 % earlier, the 10-year G-Sec can be enticing solely at a yield of shut to eight %,” Banthia says.

Sen advocates matching your time horizon with the period of the scheme if you’re eager to put money into lengthy period funds. “It helps in driving out interim volatility and you needn’t unnecessarily fear about timing,” he provides.

See right here: Dynamic bond funds: At a crossroads

Adblock check (Why?)