“An excessive amount of data” normally refers back to the inappropriate sharing of extreme private particulars, however TMI can sabotage your portfolio too. TMI very a lot is an issue on Wall Road, the place it poses a completely totally different type of problem: Analysts grow to be paralyzed by a endless seek for an increasing number of data, in hopes that yet one more indicator or econometric evaluation will present that essential edge.

Researchers have discovered that this quest not solely rapidly reaches the purpose of diminishing returns, it really turns into counterproductive. The proper is the enemy of the nice, in different phrases. You’re prone to do higher over time by choosing an honest technique and following it with self-discipline than by consistently second-guessing your chosen technique in hopes of perfecting it.

Among the best illustrations of this phenomenon is a research carried out almost 50 years in the past by Paul Slovic, a professor of psychology on the College of Oregon. (I used to be reminded of this research by a current put up on Macro Ops, a market analysis agency.) Slovic got down to measure whether or not our predictions grow to be extra correct as we analyze an increasing number of items of knowledge. He discovered that they didn’t.

Slovic reached this conclusion upon analyzing a gaggle {of professional} horse handicappers chosen for his or her experience. They have been introduced with an inventory of 88 variables from which they may select a handful that may be the premise of their predictions of which horses would win in numerous 10-horse races. For one set of races they have been allowed to decide on simply 5 of these 88 variables. They have been allowed to concentrate on progressively extra variables within the second-, third- and fourth units — 10, 20 and 40, respectively.

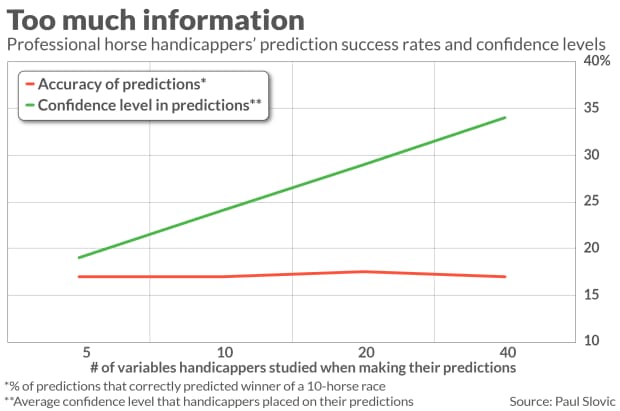

Slovic discovered that these handicappers’ common success fee stayed the identical throughout all 4 units — 17%. On the one hand their success fee was spectacular, since in the event that they have been no higher than a coin flip you’d have anticipated them to be proper simply 10% of the time. Then again, rising the variety of variables had no impact on their predictive success.

That’s sobering sufficient, but it surely’s what Slovic measured subsequent that’s actually miserable. In every of the 4 units of races, he requested the handicappers the boldness they’d within the accuracy of their predictions. As you possibly can see from the chart under, their confidence stage grew markedly as they have been in a position to concentrate on an increasing number of variables. So the online impact of the extra evaluation the handicappers have been in a position to conduct was to grow to be more and more overconfident.

To make sure, Slovic is fast to confess, horse racing shouldn’t be the identical as investing. However they’re not as totally different as many buyers wish to admit. Horse racing has newsletters and tip-sheets, simply as does investing. The horse racing newsletters are crammed with tables and charts slicing and dicing every horse’s previous efficiency. “It doesn’t take an excessive amount of creativeness to see the similarities between these sorts of charts and the info sources utilized in some types of monetary evaluation,” Slovic writes.

Affirmation Bias

You would possibly surprise why the skilled handicappers didn’t enhance their predictive prowess when specializing in extra variables. One reply, as outlined within the Macro Ops article, is what’s referred to as affirmation bias — outlined by Wikipedia as “the tendency to seek for, interpret, favor, and recall data in a method that confirms or helps one’s prior beliefs or values.”

Right here’s how that may work: By the point they’d digested their 5 favourite variables, the handicappers had already come to not less than a tentative conclusion concerning the horses on which they needed to guess. When further variables above and past these 5 pointed to that very same conclusion, the handicappers turned extra assured that their authentic judgment was appropriate. When further variables pointed to a distinct prediction, they gave these variables much less weight or ignored them altogether.

Affirmation bias can be widespread within the inventory market, in fact. Investing is anxiety-provoking, so it’s pure that we gravitate to arguments and research that verify our currently-held outlook. This course of is usually unconscious, however nearly all of us undergo from it. The bulls look to justifications for being bullish even because the bears search for arguments for why they need to be bearish.

Having spent greater than 40 years monitoring the every day arguments of tons of of funding newsletters, I can guarantee you that there by no means is a scarcity of arguments on both aspect of any situation conceivable. It’s extremely tough to maintain an open thoughts within the face of those myriad conflicting arguments.

That’s why the endless seek for yet one more indicator or historic evaluation is usually so futile. The idea of that search is that there’s a excellent strategy or technique, and our job is to seek out it. However that assumption is mistaken. And the search to which that assumption leads causes us to lose the self-discipline that may make a superb (however not excellent) technique worthwhile over the long term.

Persistence and self-discipline

The secret is to select an funding technique that has a superb long-term document after which comply with it by means of thick and skinny. It received’t at all times be on the prime of the efficiency sweepstakes, so you could develop the self-discipline to keep it up by means of the tough patches. In any other case, you will see your self consistently second-guessing your strategy, which is simply the other of getting persistence and self-discipline.

Give it some thought this manner: Even when your endless quest really found the “excellent” technique, it wouldn’t assist your long-term efficiency should you didn’t comply with it with persistence and self-discipline. Actually, you in all probability would find yourself making much less with it than you’ll with a technique that is likely to be imperfect on paper however which you comply with diligently.

Persistence and self-discipline can flip a merely first rate technique right into a winner, whereas the shortage of these two qualities can flip a “excellent” technique right into a loser.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Scores tracks funding newsletters that pay a flat charge to be audited. He could be reached at mark@hulbertratings.com

Extra: Why Era ‘I’ — YOLO buyers who’ve by no means seen a bear market — ought to fear us all

Additionally learn: Why the ‘Fed put’ makes low-volatility shares a pretty substitute for bonds