Pivot factors are one of the vital common technical instruments amongst merchants. Find out how they work right here, together with the best way to calculate pivot factors and an instance pivot level buying and selling technique.

Pivot level that means

In technical evaluation, a pivot level means an space at which a market’s worth is extra more likely to reverse. They’re plotted on technical charts utilizing the earlier session’s worth information and are used to foretell the place future help and resistance ranges would possibly lie.

Pivot factors are hottest amongst day merchants, who intention to by no means hold any positions open in a single day. This short-term buying and selling fashion requires holding positions open for brief intervals, so figuring out when markets would possibly reverse over the course of the day is essential.

Be taught extra about the best way to learn charts.

How do pivot factors work?

Pivot factors work by performing calculations on the final session’s worth motion: often the day past, though you need to use pivot factors over hours, weeks or months too. These calculations generate a P line plus potential new help and resistance ranges, that are then plotted onto a chart.

If a market is buying and selling above the P line, it’s typically taken as a bullish sign. Whether it is beneath P, it’s typically thought of bearish.

The help and resistance ranges, in the meantime, can inform your buying and selling over the course of the day. Then, at the start of the following session, you’ll be able to calculate a brand new set primarily based on the earlier worth motion.

Find out how to calculate pivot factors

To calculate pivot factors, you carry out a sequence of mathematical capabilities on the earlier session’s worth information. Every perform gives you a brand new pivot level stage, with some calculating help areas and others resistance.

While you’re buying and selling, you received’t must carry out any of those calculations your self – the pivot factors indicator does it for you mechanically. However understanding the maths behind the indicator may also help you determine whether or not pivot level buying and selling is for you.

Pivot factors system

There are a sequence of pivot level formulation, every giving a unique line. The primary provides the road P, which is the idea of the remainder of the calculations. The system for P is:

P = (Excessive + Low + Shut) / 3

So P is a median of the market’s earlier excessive, low and shutting costs. If the FTSE 100 hits a excessive of 7100, a low of seven,050 and closed at 7,120, P could be (7100 + 7050 + 7120 = 21,270 / 3) 7090.

From right here, you’ll be able to calculate the help and resistance ranges, typically labelled S1, S2, R1 and R2. Listed here are the formulation for every:

S1 = (P x 2) – Excessive

S2 = P – (Excessive – Low)

R1 = (P x 2) – Low

R2 = P + (Excessive – Low)

To see how this works in motion, we are able to plug within the figures from our FTSE instance above:

S1 = (7090 x 2) – 7100 = 7080

S2 = 7090 – (7100 – 7050) = 7040

R1 = (7090 x 2) – 7050 = 7130

R2 = 7090 + (7100 – 7050) = 7140

Find out how to commerce utilizing pivot factors

The most typical technique of buying and selling utilizing pivot factors is to make use of the P line to gauge the market’s present development and momentum. If an asset’s worth is above P, then it’s a signal that bulls have management, whether it is beneath P then bears are in cost.

Typically, you would possibly see a market hovering across the P line however struggling to interrupt via it. This could imply indecision amongst consumers and sellers, with a attainable development in both route as soon as one facet wins out.

Help and resistance with pivot factors

As soon as a development takes maintain, merchants will use the S1, S2, R1 and R2 strains as potential areas of help and resistance. Vary merchants, for instance, would possibly purchase a market as soon as it drops to S1, then promote it as soon as it rises to R1. Otherwise you would possibly search for breakouts via any of the help or resistance strains as alerts of latest forming traits.

As with all technical software, pivot factors are finest used at the side of different indicators and alerts. You’ll need to verify that the P, S & R strains correlate to earlier identified ranges of help and resistance, or verify for a reversal sample for a stronger sign that sentiment might change.

Instance pivot level buying and selling technique

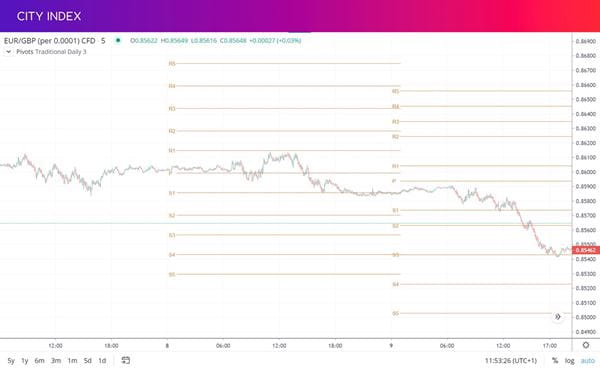

Let’s take a look at an instance vary buying and selling technique utilizing pivot factors on EUR/GBP.

To start with, you’d use the pivot factors indicator to calculate the P, S and R strains in your chart. Then you’ll be able to verify with EUR/GBP is above or beneath P. Which ought to give a sign of the market’s present sentiment.

At this level, it’s additionally price checking whether or not any of the strains correlate with earlier key ranges of help or resistance. This makes it extra probably that Chunnel will reverse there – that means a chance for our vary buying and selling technique.

After hovering round P, EUR/GBP rallies in direction of R1, which strains up with a earlier stage of resistance. The sign turns into stronger because the market assessments R1 a number of instances, however by no means breaks out. At this level, we would take into account opening a brief place with a cease between R1 and R2 and a revenue goal at both P or S1.

As you’ll be able to see, the commerce would’ve been worthwhile, enabling us to seize 28 pts of revenue.

Begin buying and selling with pivot factors

Then to start out buying and selling pivot factors with Metropolis Index, comply with these steps:

- Open your Metropolis Index buying and selling account

- Log in to our award-winning on-line buying and selling platform, obtain our cell buying and selling apps or entry third-party instruments together with MT4 and TradingView

- Choose pivot factors from the record of indicators on any of our charts

- Open your place

Or you’ll be able to take a look at out your pivot level buying and selling technique with a free demo account. This offers you digital funds to check out buying and selling our full vary of markets, with entry to all our indicators and instruments.

Pivot level calculator

In addition to plotting pivot factors on a chart, you’ll be able to shortly see the degrees for any given market by checking its pivot level calculator. On the Metropolis Index website, you’ll be able to see the pivot level calculator for any market beneath its chart. See the factors for the Dow Jones (Wall Avenue), EUR/USD and gold – or seek for your chosen market within the bar above.

Are pivot factors dependable?

Pivot factors are a well-liked indicator, so plenty of merchants might be taking a look at the very same ranges on their chart as you. This could make them self-fulfilling, growing their reliability – particularly on extremely liquid markets.

Nonetheless, they solely present tough areas at which a market will reverse. As we’ve lined above, they’re stronger when mixed with further technical evaluation. Confirming that the S & R ranges align with earlier help or resistance, or ready for a market to repeatedly take a look at a line will each give a greater sign.

Pivot factors vs Fibonacci retracements

Pivot factors are much like Fibonacci retracements, and each indicators use earlier worth motion to calculate predicted reversal areas on a chart. Nonetheless, they work in numerous methods.

The Fibonacci retracement software plots identified Fibonacci ratio ranges on a chart primarily based on a earlier vital transfer. So, if the FTSE 100 performs a significant rally then reverses, you need to use Fibonacci retracements to plot the place the reversal would possibly finish primarily based on Fibonacci principle.

As we’ve seen, pivot factors carry out calculations primarily based on the earlier session’s worth information. So that they don’t want a big transfer to work, they usually don’t use Fibonacci evaluation.

Some merchants mix pivot factors and Fibonacci retracements – in any case, if a pivot line falls on the identical stage as a Fib, you’ve got a a lot stronger sign of a reversal.

Adblock take a look at (Why?)