The inventory market declined final week because it was forecasted in my earlier SP500 technical and elementary evaluation. Furthermore, the index has nearly reached our second goal at 3770. So, is it time to purchase?

Elementary evaluation

One other steep rise in 10-year Treasury yields is attracting plenty of blame for latest market weak point. There’s additionally an terrible lot of cash shifting and sloshing round proper now as merchants attempt to place themselves for the “reopening” financial system, and these strikes may very well be inflicting a number of the spikes in bond yields in addition to swings in different markets this week.

The present fear on Wall Avenue is that when the financial system totally fires again up and native and state governments carry restrictions shopper spending habits are going to shift and alter. Individuals will begin spending extra money on gasoline, daycare, extra flights will likely be booked, extra money spent at eating places, live shows, and many others… This cash must circulate out of someplace. Will it’s out of issues like Zoom, Peloton, and different stay-at-home shares?

Who actually is aware of for certain, however we’re seeing some pretty heavy rotation out of shares that noticed huge development within the “pandemic financial system,” significantly tech corporations and different crowded trades pushing steep valuations. Furthermore, plenty of that cash seems to be shifting into slower-growing “worth” shares the place traders see larger potential for development because the financial system reopens. There’s additionally plenty of discuss amongst previous merchants who needed to work via the dot.com bubble bursting and the related fallout. It’s not a lot the very fact we’re referencing similarities between the tech corporations however the reality the 911 terrorist assaults and massively greater gasoline value actually exasperated that fallout available in the market.

In different phrases, at this lofty degree within the tech market what occurs if we catch a few unexpected adverse macro occasions? I’m not saying something adverse will occur. However the bears are apprehensive a few new administration in Washington some nations may attempt to flex their muscle mass or see if we’re going to name any bluffs. With the market, this excessive bears prefer to level out how unhealthy it’s going to harm if we take an enormous tumble. The financial system itself continues displaying indicators of enchancment with weekly jobless claims hitting the bottom ranges since November. In different phrases, it’s indicating the labor market is recovering from the brutal winter coronavirus surge that pressured many companies and cities to close down once more.

The massive take a look at comes subsequent Friday with the Labor Departments February Employment Report. Furthermore, the following week is definitely full of financial information, with different key releases together with ISM Manufacturing and Development Spending on Monday; ADP’s February Employment Report, ISM Non-Manufacturing, and the Fed’s Beige E book on Wednesday; Manufacturing unit Orders on Thursday; and Client Credit score on Friday.

On the earnings entrance, traders are wanting to see outcomes from Berkshire Hathaway. Most traders are much more excited to see the corporate’s annual shareholder letter, which is penned yearly by legendary investor and Berkshire founder Warren Buffett. The 90-year previous famously shares his ideas on the yr behind and forward and passes alongside his well-earned knowledge.

It’s thought of required studying by most of the world’s prime traders. Additionally, earnings subsequent week will carry a number of huge names, together with Zoom and Nio on Monday; AutoZone, Hewlett Packard, Kohls, Nordstrom, Ross Shops, and Goal on Tuesday; Greenback Tree, Snowflake, and Vroom on Wednesday; and Broadcom, Burlington Shops, Costco, Hole, and Kroger on Thursday.

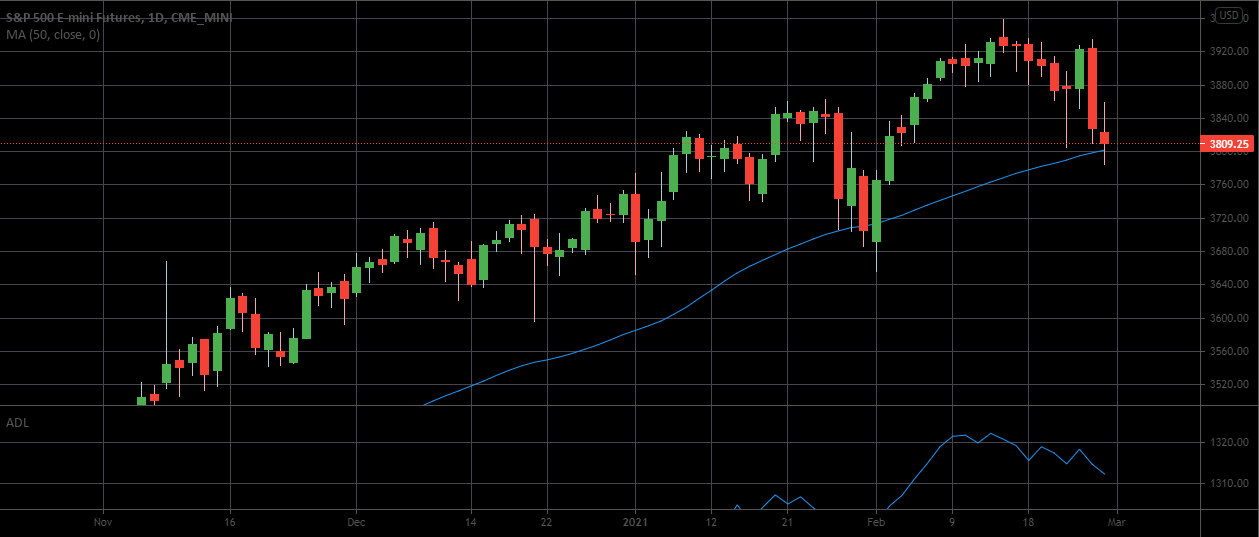

Regardless of the sell-off, SP500 nonetheless trades in channel up. Taking into consideration the brand new stimulus package deal, I can’t be shocked to see a spot up or bounce up at the start of this week. Additionally, the worth touched MA50 on the every day chart. In different phrases, it’s one other indication of a doable bounce. Nevertheless, that rally probably will likely be short-lived. Cycles, Advance-Decline Line, and Intermarket Forecast nonetheless level to the draw back. So, we aren’t searching for swing longs but. I need to pay your consideration they’re timing instruments and don’t give any concept about amplitude or momentum. That’s to say, we will see a deeper pullback or very uneven buying and selling until Could. I believe the approaching few periods will kind a sample for short-term merchants. So, let’s commerce following primary worth motion.