FOX Enterprise contributor and chief economics correspondent for The Wall Road Journal Jon Hilsenrath argues bond markets do not present warning indicators of inflation.

A rising refrain of Wall Road strategists is warning the U.S. inventory market is ripe for a pullback because the COVID-19 delta variant spreads throughout the globe amid probably the most troublesome two-month stretch for buyers.

The S&P 500 has rallied 96% since bottoming on March 23, 2020, reserving 61 document highs alongside the way in which. The benchmark index has all through the rally averted a correction, or decline of a minimum of 10%, which occurs a median of every year.

| Ticker | Safety | Final | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 4395.26 | -23.89 | -0.54% |

Strategists are rising extra involved that the elusive pullback is coming now that the delta variant has threatened to derail the economic system’s restoration.

“At this incipient stage of the unfold of the Delta variant and slowing of financial development, there are sufficient purple flags that prudent buyers have to begin contemplating de-risking,” wrote Scott Minerd, international chief funding officer at Guggenheim Companions.

FED’S PREFERRED INFLATION READING SHOWS PRICES JUMP 3.5% ANNUALLY

A report launched Thursday by the Commerce Division confirmed the U.S. economic system grew at a 6.5% annual tempo throughout the second quarter, beneath the 8.5% fee that was anticipated. Economists say development will sluggish from the present tempo as rising costs and supply-chain points proceed to disrupt the economic system amid a flare-up in delta variant infections.

Minerd referred to as current knowledge on the delta variant “extraordinarily disturbing,” noting that the R0, or quantity of people that will likely be contaminated because of one other contaminated individual’s actions, was six, which means it’s two to 3 instances extra transmissible than the unique COVID-19 pressure.

With a median of about 60,000 each day new circumstances that implies that in six to eight weeks there may be more likely to be greater than 200,000 new circumstances, like what was seen in December, he mentioned.

Considerations over the delta variant have triggered the Facilities for Illness Management and Prevention to reinstate masks suggestions for so-called hotspots.

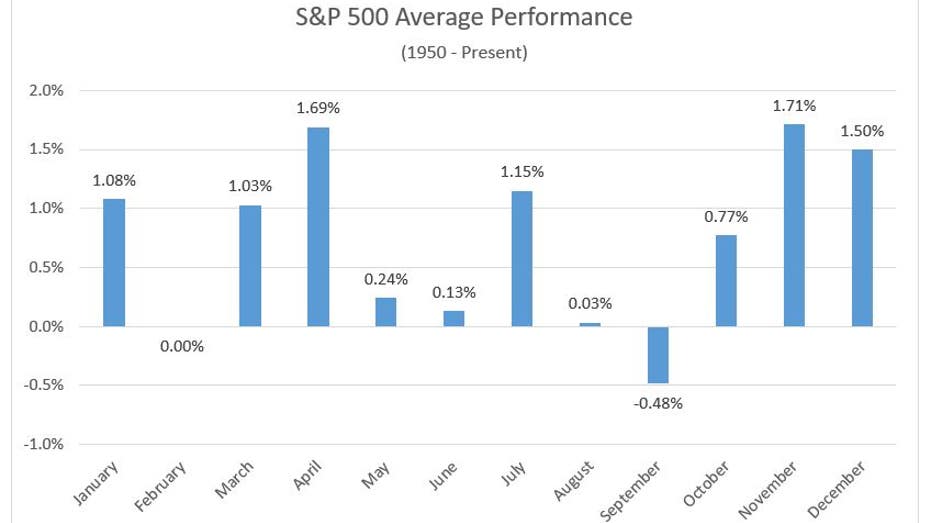

Economists and enterprise leaders fear a return of masking will weigh on confidence and lead to decrease gross sales, setting the stage for what is often the worst stretch of months for the inventory market.

BIPARTISAN INFRASTRUCTURE PLAN IS THE ‘TROJAN HORSE’ FOR MASSIVE TAX INCREASES

“Threat is little question growing as we head into the troublesome August and September months,” wrote Ryan Detrick, chief market strategist at LPL Monetary.

Supply: Dow Jones Market Information

The troublesome stretch for the inventory market kicks off with buyers having to navigate narrowing breath, or fewer listings collaborating within the rally, and valuations in some cases stretched to ranges final seen throughout the 1999-2000 tech bubble.

Michael Wilson, chief U.S. fairness strategist at Morgan Stanley, was among the many first Wall Road analysts to voice issues relating to the underwhelming market internals.

He believes buyers ought to “deal with relative worth throughout the market,” preferring prime quality versus low high quality shares, client staples over discretionary, well being care over tech and defensives over cyclicals.

Wilson has a base-case yearend S&P 500 goal of 4,225, 3.87% beneath Friday’s closing degree. His bear case is for the S&P 500 to complete the yr at 3,800.

Whereas their numbers are dwindling there are nonetheless bulls on Wall Road, however even they admit the inventory market is dealing with headwinds at these ranges.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

It is a “very logical time for the market to decelerate” as earnings meet up with costs, Brian Belski, chief funding strategist at BMO Capital Markets instructed FOX Enterprise’ Stuart Varney on Friday. He has a yearend S&P 500 goal of 4,500, or 2.39% above the place the index closed on Friday.

“We’re not calling for a deep correction like everyone else and their mom, brother, sister, cousin and uncle,” Belski mentioned. “We predict the market grinds greater, however nonetheless constructive, very constructive long term.”