Market Replace | The Indian benchmark fairness indices, Sensex and Nifty traded close to day’s low Wednesday afternoon amid sharp promoting in IT, FMCG and auto shares. The Sensex was buying and selling at 48,028.49, down 409.29 factors, or 0.84 p.c, whereas Nifty declined 83.00 factors, or 0.58 p.c, to 14,116.50 at 2:07 pm. Weak spot in index heavyweights comparable to Reliance Industries, ITC and Bajaj Finance dragged Nifty under the 14,150 stage. Barring Nifty Metallic, all different sectoral indices had been buying and selling within the pink.

Buzzing | Right here’s why Tata Elxsi is seeing an upmove

Tata Elxsi has superior by as a lot as 26 p.c during the last 10 days, outperforming the Indian IT index which is up 13 p.c in the identical interval in addition to Nifty200.

Tata Elxsi’s 10-day common volumes are 33 p.c increased than the 3-month every day common volumes. Supply volumes are up 13 p.c as in comparison with 3-month every day common volumes.

The inventory is rising on expectations of a restoration in its largest vertical – automotive sector, and media in addition to medical gadget verticals. Watch right here.

Standout Brokerage Report: Macquarie raises value targets on these NBFCs

Macquarie has come out with a report on non-banking monetary corporations (NBFCs). The brokerage home believes that the gathering knowledge ought to maintain up properly in Q3 for a lot of the NBFCs whereas the expansion outlook is a bit weak.

Based on Macquarie, the auto business ought to see a margin growth and therefore the brokerage agency has raised the goal value on Mahindra and Mahindra Monetary Companies, Shriram Transport Finance and Cholamandalam Funding and Finance. Watch right here.

Bitcoin breaks above $35,000 to the touch new excessive

Bitcoin traded above $35,000 for the primary time in Asia on Wednesday, rising to a excessive of $35,879 and lengthening a rally that has seen the digital foreign money rise greater than 800 p.c since mid-March, Reuters reported. The world’s hottest cryptocurrency crossed $20,000 for the primary time ever on December 16.

Knight Frank releases residential actual property knowledge for the second half of 2020. Based on the report, pan-India gross sales & launches decline, October-December quarter levels restoration. Mumbai & Bengaluru greatest and worst performer respectively@KnightFrank_IN #realestate pic.twitter.com/nATD6iJ4Hx

— CNBC-TV18 (@CNBCTV18Live) January 6, 2021

Fitch charges Shriram Transport’s bonds at BB (EXP)

Fitch Scores has assigned India-based Shriram Transport Finance Firm Restricted’s (STFC, BB/Unfavourable) proposed US dollar-denominated senior secured notes an anticipated score of ‘BB(EXP)’.

Crude Oil hits 11-month excessive after Saudi Arabia pledges voluntary output minimize

Oil costs rose on Wednesday to their highest since February 2020 after Saudi Arabia agreed to scale back output greater than anticipated in a gathering with allied producers, whereas business figures confirmed U.S. crude stockpiles had been down final week, a Reuters report mentioned.

Brent crude rose as a lot as practically 1% to $54.09 a barrel, the very best since Feb. 26, 2020. It was at $53.87 a barrel at 0536 GMT after leaping 4.9% on Tuesday.

U.S. West Texas Intermediate (WTI) futures reached $50.24 a barrel, additionally the very best since Feb. 26, earlier than slipping to $50. The contract on Tuesday closed up 4.6%.

Saudi Arabia, the world’s largest oil exporter, agreed on Tuesday to make further, voluntary oil output cuts of 1 million barrels per day (bpd) in February and March, after a gathering with the Group of the Petroleum Exporting International locations (OPEC) and different main producers that kind the group generally known as OPEC+.

The reductions agreed by Saudi Arabia had been included in a deal to steer different producers within the OPEC+ group to carry output regular.

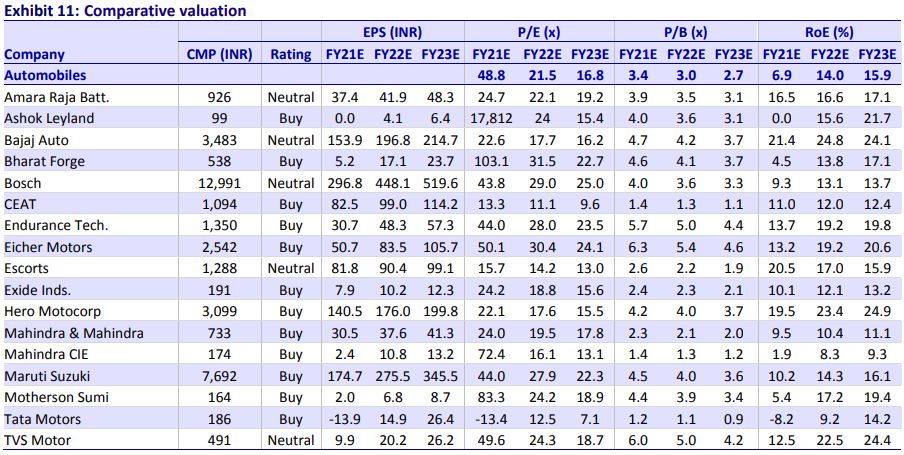

Motilal Oswal on Car Sector | We’re revising our FY22E EPS estimates to consider quantity upgrades in addition to substantial commodity value inflation. We improve Tata Motors (+28%), Ashok Leyland (+11%), Bharat Forge (+11%), Motherson Sumi Techniques (+14.5%), and Escorts (+6%), whereas downgrade Hero MotoCorp/Mahindra & Mahindra (-8%).

Being a seasonally gradual month, Dec’20 noticed first rate demand (at par YoY) regardless of reductions being decrease by ~50% YoY. Valuations are reflecting a restoration in 4QFY21, leaving a restricted margin for security from any unfavorable surprises. Therefore, we want corporations with: a) increased visibility by way of a requirement restoration, b) a powerful aggressive positioning, c) margin drivers, and d) steadiness sheet power. Mahindra & Mahindra and Hero MotoCorp are our prime OEM picks. Amongst auto Part shares, we want

Market Watch: Ruchit Jain of Angel Broking

First is a purchase name in CONCOR, a contemporary lengthy formation immediately within the derivatives phase, technically the earlier swings have been damaged. The every day common quantity has already been surpassed within the first half of the commerce itself so it is a very constructive signal so purchase CONCOR with cease under Rs 417 for goal of Rs 445.

Since banking is trying constructive on midcap financial institution that’s CSB Financial institution, it’s buying and selling round its help on a every day in addition to the weekly charts so we expect some pullback transfer on this counter. Purchase CSB Financial institution with cease loss under Rs 220 first goal can be Rs 240 and as soon as that surpasses Rs 250 can be on the banks.

Buzzing | BEML share value jumps over 4% on orders from Ministry of Defence

Shares of BEML rallied over 4 p.c in early commerce on Wednesday after the corporate bagged an order from Ministry of Defence for the availability of excessive mobility autos, at an approximate worth of Rs 758 crore.

The tools can be manufactured at BEML’s Palakkad plant in Kerala and would provide the autos to Indian Military in a span of 1 yr. These Excessive Mobility autos would play a key position within the logistics administration of the Indian Military leveraging on its distinctive cross nation capabilities, the corporate mentioned.

These autos would allow armoured combating autos, troops, ammunitions and shops to be moved to far-flung, tough terrains in operational areas, it added.

Bharti Airtel | The telecom main has moved Supreme Courtroom searching for reducing of AGR dues. The corporate has cited miscomputation by DoT in AGR dues demand. Bharti Airtel claims that whole AGR dues payable on account of license payment is proscribed to Rs 21,000 crore. DoT has slapped demand of Rs 43,989 crore and Bharti Airtel has paid Rs 18,004 crore as AGR dues.

India’s companies sector loses extra steam in December, job cuts resume

Progress in India’s dominant companies business continued to lose momentum in December as a resurgence in coronavirus infections weighed on new enterprise and employment, a personal survey confirmed on Wednesday. Asia’s third-largest economic system has been regularly recovering from a coronavirus-induced recession however is just not anticipated to return to pre-pandemic ranges quickly, particularly throughout the service business – the engine of financial development and jobs within the nation, a Reuters report mentioned.

The Nikkei/IHS Markit Companies Buying Managers’ Index fell to 52.3 in December from November’s 53.7 however held above the 50-mark separating development from contraction for a 3rd straight month.

“A spike in COVID-19 instances was reported as a key issue limiting development of recent work intakes amongst service suppliers, which in flip curbed the rise in output and led to elevated enterprise uncertainty in regards to the outlook,” Pollyanna De Lima, economics affiliate director at IHS Markit, mentioned in a launch.

Buzzing | Titan jewelry enterprise data 15% development in Q3FY21; Shares hit 52-week excessive

Jewelry and watches maker Titan Firm on Wednesday mentioned that the corporate witnessed a superb festive season with the Jewelry division crossing the restoration section to enter the expansion section. In its December quarter replace, the corporate mentioned that the Q3 didn’t disappoint.

The corporate already introduced the 15 p.c development within the 30-day festive interval from Dussera to Diwali. The expansion pattern was seen even after the festive season ended and the division has recorded shut to fifteen p.c development (excluding sale of uncooked gold of – Rs 334 crore) in Q3.

“The quarter additionally witnessed a well-rounded restoration with enchancment in walk-ins and choose up of sale in metros, sub 1-lakh class and studded phase. The studded combine in Q3 improved although nonetheless decrease than ranges seen within the earlier yr,” the corporate mentioned.

Tanla Platforms | The corporate will launch digital CPaaS platform with world scale on January 20. The US Patent & Trademark Workplace has authorised three patents for a similar. Microsoft Company was the event companion who architected & constructed this platform for Tanla.

Manish Hathiramani, Proprietary Index Dealer and Technical Analyst, Deen Dayal Investments

14,200-14,250 can pose as a resistance patch for the Nifty. If we will preserve above 14,250, we may journey to 14,350. Since we’re in unchartered territory, merchants ought to commerce cautiously and replace their stops on a steady foundation. 13,950-14,000 is nice help.

Amazon Vs Future Case | Arbitral Panel within the case has been constituted in Singapore and it is going to be headed by Former Judicial Commissioner of Supreme Courtroom Of Singapore, Michael Hwang. Listening to is prone to start in per week, reviews @AshmitTejKumar pic.twitter.com/3uEJdsdLpy

— CNBC-TV18 (@CNBCTV18Live) January 6, 2021

Bharat Dynamics | The corporate has obtained Konkurs-M ATGM order together with launchers and take a look at equipments price Rs 632.88 crore ( Together with Taxes). The order e-book of the corporate now stands at round Rs 8,100 crore.

Fitch charges State Financial institution of India’s proposed senior bonds ‘BBB-(EXP)’

Fitch Scores has assigned a ‘BBB-(EXP)’ anticipated score to State Financial institution of India’s (SBI, BBB-/Unfavourable) proposed senior unsecured notes, which can represent its direct, unconditional, unsubordinated and unsecured obligations and can always rank pari passu amongst themselves and with all of SBI’s different unsubordinated and unsecured obligations. The notes can be issued by SBI’s London department.

Market Watch: VK Sharma, HDFC Securities

Purchase 2,520 Name of Apollo Hospitals at Rs 99 with a cease lack of Rs 70 and goal of Rs 150.

Purchase 1,620 Name of Bata at Rs 55 with a cease lack of Rs 43 and goal of Rs 80.

Purchase 122 Name of NMDC at Rs 5.90 with a cease lack of Rs 4.80 and goal of Rs 8.

Purchase 290 Name of State Financial institution of India (SBI) at Rs 8.50 with a cease lack of Rs 6.50 and goal of Rs 13.

Purchase 540 Name of ICICI Financial institution at Rs 18.55 with a cease lack of Rs 15 and goal of Rs 25.

Opening Bell | Indian fairness benchmark fairness indices opened increased on Wednesday led by features in monetary and steel shares amid combined world cues.

At 9:15 am, the Sensex opened 0.37 p.c, or 178.88 factors, increased at 48,616.66, whereas the Nifty50 index opened at 14,240.95, up 41.45 factors, or 0.29 p.c.

Broader markets outperformed the benchmarks with Nifty Smallcap100 and Nifty Midcap100 indices up 0.96 p.c and 0.71 p.c, respectively.

Amongst sectoral indices, the Nifty Metallic, Nifty PSU Banks and Nifty Auto gained whereas Nifty IT was underneath strain.

NMDC | The corporate has elevated costs once more, sources mentioned. NMDC has raised fines value by Rs 200 and lumps by Rs 500 per tonne. Iron ore scarcity and world iron ore value surge are causes of the value hike, sources added.