Photographer: Philip Fong/AFP/Getty Photos

Photographer: Philip Fong/AFP/Getty Photos

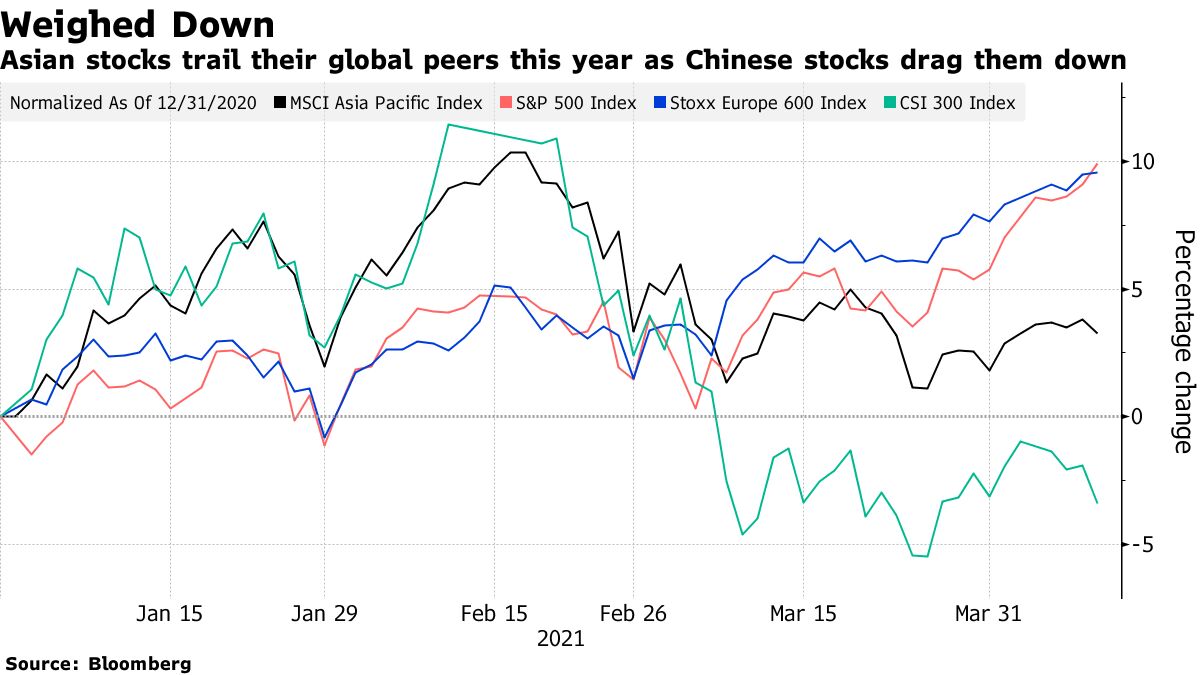

Asian shares have been regular Monday after a 3rd straight weekly Wall Avenue advance, with Federal Reserve Chair Jerome Powell flagging the prospect of stronger progress and hiring. The greenback ticked up.

Shares fluctuated in China and Hong Kong, with Alibaba Group Holding Ltd. rallying after the weekend imposition of a document antitrust effective eliminated a key supply of uncertainty. Markets have been little modified in Japan and barely decrease in Australia. U.S. fairness futures dipped after the S&P 500 Index closed above 4,100 as buyers braced for earnings stories this week.

The yield on 10-year Treasuries held Friday’s advance on stronger-than-expected producer-price inflation information and forward of a heavy week of provide.

China Led The Restoration Commerce; Now Virtually Everybody Is Cautious

Whereas the financial restoration from the pandemic is choosing up velocity, coverage makers are highlighting the necessity for extra progress earlier than they contemplate withdrawing distinctive help. Merchants are watching worth pressures, with market-based expectations at multiyear highs. U.S. consumer-price information are due this week.

The U.S. economic system is at an “inflection level” with stronger progress and hiring forward because of rising vaccinations and highly effective coverage help, Powell instructed CBS’s 60 Minutes in an interview aired Sunday. He warned {that a} resurgence of Covid-19 stays the principal danger to the economic system.

“The Fed goes to be extra involved concerning the labor market,” Sian Fenner, senior economist at Oxford Economics, instructed Bloomberg Information. “Undoubtedly inflation’s not spiraling uncontrolled.”

Buyers are cautious of provide stirring extra rates-market volatility, nevertheless. Bonds have rallied from the losses that roiled fairness markets earlier this yr, however one other heavy spherical of auctions may strain yields greater once more. The U.S. sells three-, 10- and 30-year Treasuries at the beginning of the week.

Oil inched again towards $60 a barrel after a 3.5% drop final week. Bitcoin eased from a rally previous $61,000 on the weekend. The forthcoming itemizing of cryptocurrency change Coinbase International Inc. within the U.S. has put the highlight again on the digital-token sector.

Some key occasions to look at this week:

- Banks and monetary companies start reporting first-quarter earnings, together with JPMorgan Chase & Co., Citigroup Inc., Financial institution of America Corp., Morgan Stanley, Goldman Sachs Group Inc.

- U.S. officers and firm executives are on account of focus on the worldwide scarcity of pc chips on Monday.

- The U.S. releases inflation information Tuesday.

- Chinese language commerce information are scheduled for Tuesday.

- Financial Membership of Washington hosts Fed Chair Jerome Powell for a moderated Q&A on Wednesday.

- U.S. Federal Reserve releases Beige Ebook on Wednesday.

- U.S. information together with preliminary jobless claims, industrial manufacturing and retail gross sales come Thursday.

- China financial progress, industrial manufacturing and retail gross sales figures are on Friday.

These are a few of the predominant strikes in monetary markets:

Shares

- S&P 500 futures dipped 0.2% as of 10:42 a.m. in Tokyo. The index rose 0.8% on Friday.

- Japan’s Topix Index was flat.

- China’s Shanghai Composite was up 0.1%.

- Hong Kong’s Hold Seng slipped 0.2%.

- South Korea’s Kospi climbed 0.2%.

- Australia’s S&P/ASX 200 slipped 0.3%.

Currencies

- The Bloomberg Greenback Spot Index edged up 0.1%.

- The yen was regular at 109.70 per greenback.

- The euro was at $1.1898.

- The offshore yuan was at 6.5629 per greenback.

Bonds

- The yield on 10-year Treasuries steadied at 1.66%.

- Australia’s 10-year yield climbed two foundation factors to 1.77%.

Commodities

- West Texas Intermediate crude was up 0.5% at $59.60 a barrel.

- Gold was down 0.2% at $1,741.10 an oz..

— With help by Ishika Mookerjee

(An earlier model corrected the day of the U.S. CPI launch.)