U.S. futures drifted and Treasuries gained on Friday as merchants awaited key American employment knowledge amid promising developments on the vaccine entrance.

Contracts on the S&P 500 had been little modified forward of Friday’s month-to-month payrolls report, which might be intently watched for hints on when the Federal Reserve would possibly begin withdrawing assist. Information that Johnson & Johnson’s vaccine neutralizes the fast-spreading delta variant helped enhance sentiment. The Stoxx 600 Index gained, led by miners and journey companies.

In Asia, Chinese language and Hong Kong equities slid although Japan pushed greater. WTI crude oil traded round $75 a barrel, close to the very best since 2018, after OPEC+ infighting solid doubt on an settlement that might ease a surge in costs. The greenback was regular.

Buyers are parsing knowledge prints just like the upcoming payrolls report for a way of how shut the Fed is to tapering coverage lodging as employment improves and inflationary pressures construct. The Worldwide Financial Fund mentioned the Fed will seemingly start to cut back asset purchases within the first half of 2022, and doubtless wants to lift rates of interest later that yr or early 2023.

“If all goes nicely, principally the Fed is on observe to announce some type of a taper earlier than the top of the yr,” Selena Ling, head of treasury analysis and technique at Oversea-Chinese language Banking Corp., mentioned on Bloomberg Tv. “Everyone seems to be Jackson Gap for Fed Chair Powell to truly point out what are the intentions going ahead.”

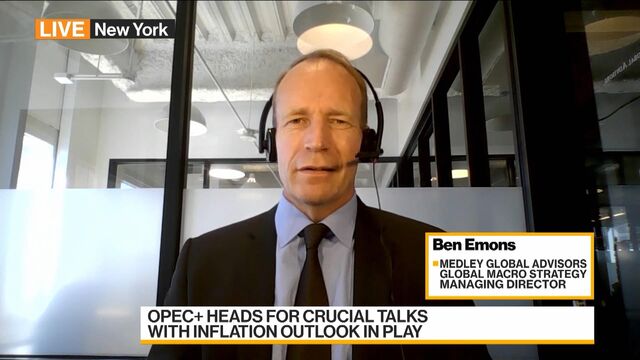

Ben Emons, Managing Director of Macro Technique at Medley International Advisors, says markets commerce the “peak inflation narrative” however the dangers of inflation haven’t dissipated. (Supply: Bloomberg)

Listed here are some occasions to look at this week:

- ECB President Christine Lagarde speaks Friday

- The U.S. jobs report is due Friday

These are a number of the most important strikes in markets:

Shares

- Futures on the S&P 500 had been little modified as of 6:48 a.m. New York time

- Futures on the Nasdaq 100 rose 0.2%

- Futures on the Dow Jones Industrial Common had been little modified

- The Stoxx Europe 600 rose 0.3%

- The MSCI World index was little modified

Currencies

- The Bloomberg Greenback Spot Index was little modified

- The euro fell 0.2% to $1.1831

- The British pound fell 0.2% to $1.3741

- The Japanese yen was little modified at 111.43 per greenback

Bonds

- The yield on 10-year Treasuries declined two foundation factors to 1.44%

- Germany’s 10-year yield declined 4 foundation factors to -0.24%

- Britain’s 10-year yield declined 4 foundation factors to 0.69%

Commodities

- West Texas Intermediate crude fell 0.2% to $75.05 a barrel

- Gold futures rose 0.5% to $1,786.50 an oz

— With help by David Wilson

Adblock check (Why?)