U.S. fairness futures and shares posted modest beneficial properties Monday as traders ready for a key Federal Reserve assembly later within the week. The rally in Treasuries appeared to lose steam.

S&P 500 futures signaled the gauge was poised so as to add to Friday’s contemporary file. European equities opened increased, led by shares in power companies. The benchmark 10-year yield inched as much as round 1.46% after hitting three-month lows on Thursday amid the largest weekly slide since December.

With nervousness concerning the Fed’s plans to reduce month-to-month stimulus injections ebbing, bulls are reasserting their dominance. Traders anticipate the central financial institution will reaffirm the tempo of bond purchases this week, even when it delivers projections for interest-rate liftoff in 2023, based on economists surveyed by Bloomberg. The choice is due Wednesday.

“The FOMC continues to see the bounce in inflation as transitory, and will acknowledge, even on the margin, that they’re discussing the tempo of month-to-month purchases however received’t but decide to a date for slowing the purchases,” mentioned Prudential Monetary Inc. strategist Quincy Krosby in emailed feedback.

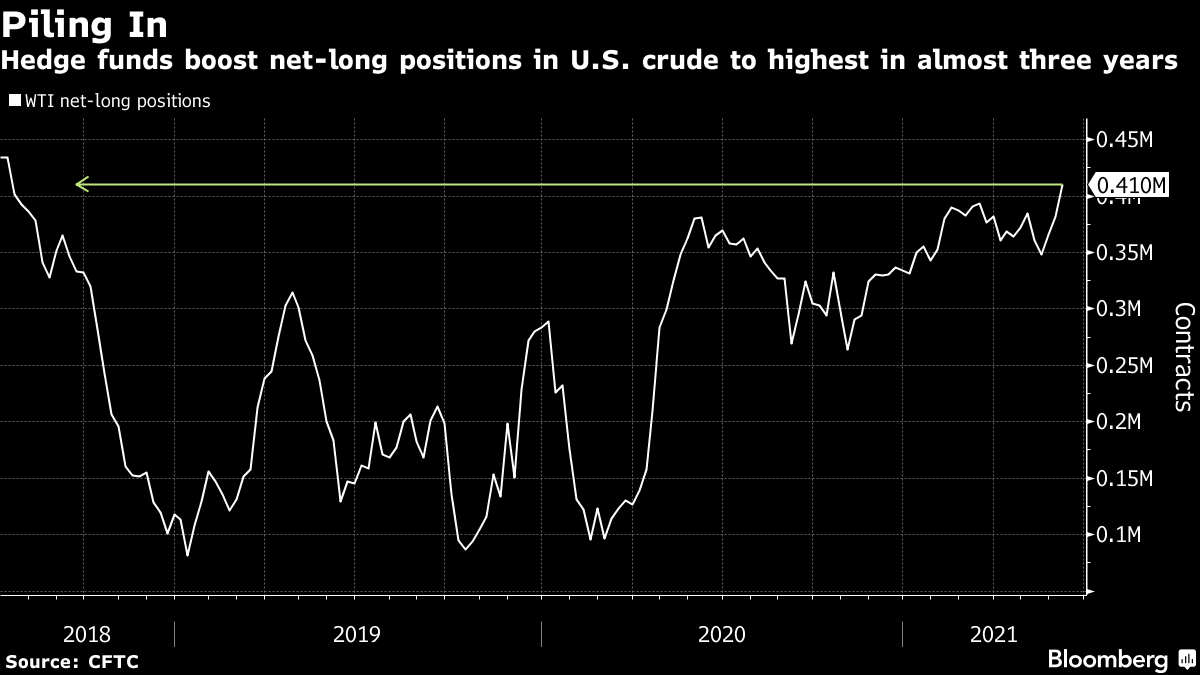

Oil prolonged a run of three weekly beneficial properties on optimism that financial reopenings will increase summer time demand within the U.S. and Europe. Hedge funds boosted net-bullish positions to a virtually three-year excessive, based on the most recent Commodity Futures Buying and selling Fee information.

The greenback was regular within the wake of a Group-of-Seven management assembly that emphasised unity. In the meantime, Bitcoin jumped over the weekend after Elon Musk mentioned Tesla would resume transactions with the cryptocurrency when mining it’s completed with extra clear power.

For market commentary, comply with the MLIV weblog.

Listed below are some key occasions to look at this week:

- NATO holds a summit on Monday

- An EU-U.S. summit takes place in Brussels on Tuesday

- Information on U.S. industrial manufacturing, producer costs and retail gross sales come Tuesday

- The Federal Open Market Committee fee determination comes on Wednesday, with a information convention from Jerome Powell after

- U.S. President Joe Biden and Russia’s Vladimir Putin meet Wednesday in Geneva

- U.S. Treasury Secretary Janet Yellen testifies earlier than a Home panel Thursday on the federal funds

- Charge choices come from Switzerland and Norway on Thursday

- The Financial institution of Japan’s financial coverage determination is on Friday

These are among the important strikes in markets:

Shares

- Futures on the S&P 500 Index elevated 0.1% as of 9:02 a.m. London time.

- The Stoxx Europe 600 Index rose 0.3%.

- The MSCI Asia Pacific Index was little modified.

- The MSCI Rising Market Index declined 0.1%.

Currencies

- The Bloomberg Greenback Spot Index was little modified.

- The euro rose 0.1% to $1.2116.

- The British pound declined 0.1% to $1.4099.

- The onshore yuan weakened 0.1% to six.399 per greenback.

- The Japanese yen was little modified at 109.69 per greenback.

Bonds

- The yield on 10-year Treasuries jumped one foundation level to 1.46%.

- The yield on two-year Treasuries climbed lower than one foundation level to 0.15%.

- Germany’s 10-year yield gained lower than one foundation level to -0.27%.

- Japan’s 10-year yield gained one foundation level to 0.041%.

- Britain’s 10-year yield elevated lower than one foundation level to 0.711%.

Commodities

- West Texas Intermediate crude climbed 0.8% to $71.45 a barrel.

- Brent crude elevated 0.9% to $73.34 a barrel.

- Gold weakened 1% to $1,858.74 an oz.

— With help by Cormac Mullen