Angst has been the inventory market story of late. It soars, it plunges, and all of the whereas buyers fret over sky excessive valuations and pour over information to determine when inflation will deliver the home of playing cards crashing down. However typically, like now, the issue is way easier than that: an excessive amount of provide and never sufficient demand.

Corporations have raised over $170 billion via preliminary public choices on U.S. exchanges in 2021, in line with information compiled by Bloomberg. IPOs are so scorching they’re on observe to high final 12 months’s $180 billion haul, the most since not less than the 2008 monetary disaster.

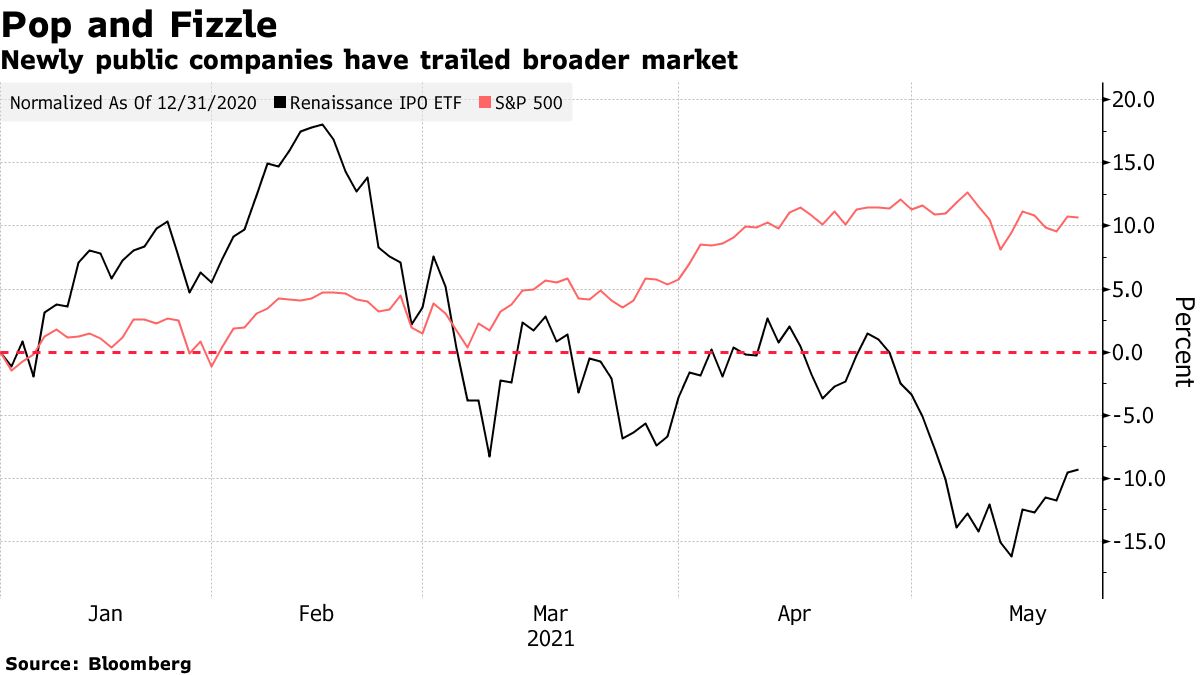

However whereas the market voraciously consumed 2020’s debuts, tastes are altering. The Renaissance IPO ETF (ticker IPO), which tracks newly public corporations, is down 9.3% this 12 months after hovering 107% in 2020. Whereas the broader market has held up up to now, there’s an ever-present menace of a seemingly limitless fairness provide overwhelming treasured demand. Sure, the S&P 500 is up almost 10% greater year-to-date. Nevertheless it’s dropped virtually 2% from the all-time excessive it reached earlier this month.

“There may be definitely one thing to the concept that demand for shares is moderating,” stated Nicholas Colas, co-founder of DataTrek Analysis. “The IPO window is all the time extensive open till it shuts with a bang. That makes it one thing of a self-correcting a part of the market.”

Fund flows replicate this waning urge for food. Whereas fairness exchange-traded funds have taken in $288 billion year-to-date, the most important — the $355 billion SPDR S&P 500 ETF Belief (ticker SPY) — has shed $12.5 billion.

Even with IPOs coming at a report tempo, latest tremors within the inventory market tremors are beginning to spook some potential issuers. At the least two deliberate listings have been delayed this month due to the volatility. Ought to that turn into a development, or if debuts begin getting canceled outright, it could be a troubling signal, Colas stated.

“When offers begin getting pulled, you’ll know the availability facet of the inventory market equation is beginning to reset,” Colas stated.

Learn extra: The Decade of Shrinking World Inventory Markets Is Lastly Over

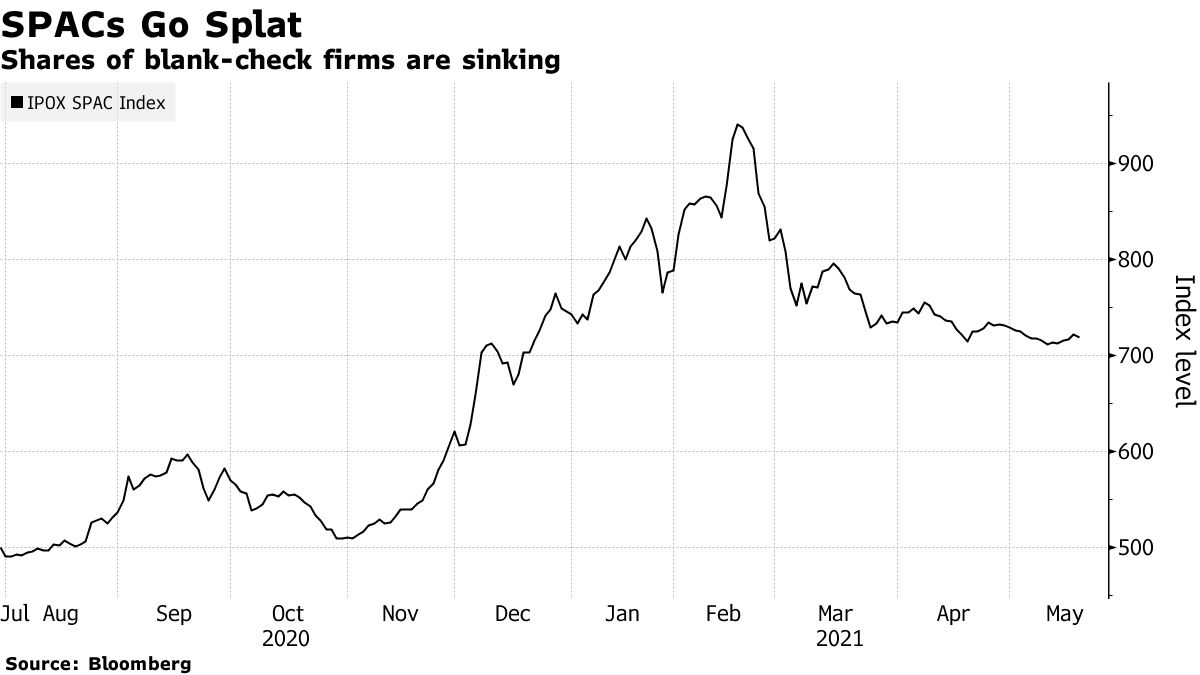

The majority of IPO provide is coming from a growth in particular goal acquisition corporations. Clean-check listings account for extra greater than half of this 12 months’s market, in line with information compiled by Bloomberg.

However SPACs have struggled in latest weeks. The IPOX SPAC Index (ticker SPAC), which tracks the efficiency of a broad group of blank-check corporations, has plunged almost 23% from its mid-February peak.

Past the supply-demand imbalance, there’s additionally an issue with the sorts of corporations which are making their market debuts. Most of the latest IPOs have been tech outfits with shaky fundamentals, in line with Kim Forrest, chief funding officer of Bokeh Capital Companions.

“The provision-demand drawback is actual, however it’s exacerbated by nearly all of the businesses being in tech — and the type of tech that has ‘not out there’ for many of the ratios that buyers have a look at,” Forrest stated. “So lots of this 12 months’s IPOs have indefinite time intervals for revenue.”

— With help by Lu Wang, and Drew Singer