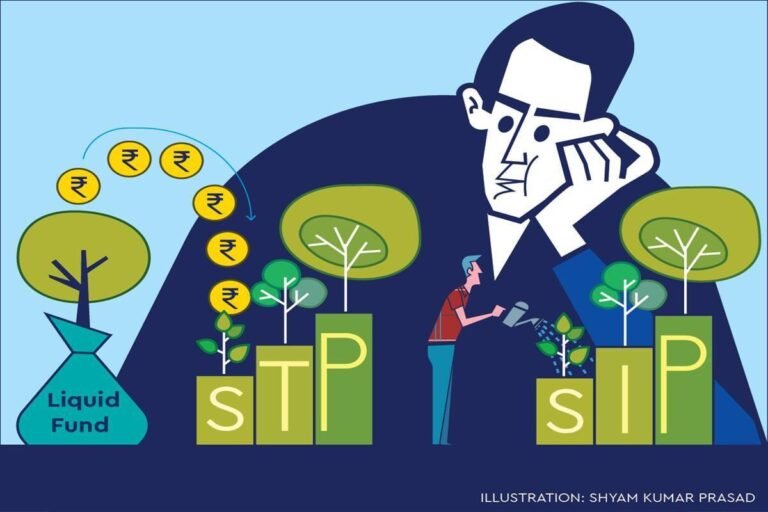

Systematic funding plan which is popularly generally known as SIP is a well-liked funding technique among the many traders. Below this technique, traders make a disciplined strategy to investing the place they will make investments a daily quantity each month as a long-term funding in trade traded funds and mutual fund schemes.

In actual fact, SIPs are the easiest way to deal with volatility in investments due to the rupee value averaging benefit. Nevertheless, allow us to focus on one other technique generally known as systematic switch plan or STP which is able to assist to realize your monetary objective within the desired goal of mutual fund funding.

Mechanics and benefits

To make certain, STP is a variant of SIP that gives traders a chance to switch a hard and fast sum at common intervals from one scheme to a different with the identical asset administration firm. This facility helps traders to rebalance their funding portfolio by switching seamlessly between totally different asset courses which is able to scale back volatility and assist to realize the specified monetary objectives.

Allow us to take an investor who earns a lumpsum of Rs 20,00,000 by way of sale of a property. He may make investments the whole quantity in a cash market or a liquid fund after which give a mandate to the fund home to switch Rs 1,00,000 each month into an fairness mutual fund over a interval of subsequent 20 months. It will assist to sort out volatility and scale back the price of acquisition.

This technique helps traders by spreading their lumpsum funding over a selected time frame in order that they don’t get caught in a fund at its peak Internet Asset Worth (NAV). The identical STP course of might be adopted on the opposite manner round, from an fairness fund to a debt fund whereas exiting from an fairness scheme upon retirement or reaching the specified monetary objectives.

Varieties of STPs

There are various kinds of STPs one may observe. As an example, beneath fastened STP, traders switch a hard and fast sum from one funding fund and switch it to a different fund. In capital appreciation STP, the traders take out the revenue that they’ve made on one funding and spend money on one other funding fund. In Flexi STP, traders may select to switch a variable quantity. The fastened quantity can be the minimal quantity and the variable quantity is dependent upon the volatility of the market.

STP vs SIP

As mentioned above, STP certainly works like a SIP mechanism the place a hard and fast quantity will get invested in a selected fund. Nevertheless, when you have a lumpsum quantity to speculate then it’s higher to speculate it by way of STP. So, it will be higher to speculate the lump sum in a low-risk debt fund after which schedule an STP to fairness funds of your alternative. Nevertheless, traders ought to verify the exit load cost imposed by the mutual fund homes if the cash is withdrawn earlier than sure specified intervals, typically one 12 months for fairness funds. Nevertheless, there is no such thing as a exit load on liquid funds and most STPs switch cash from a liquid fund to an fairness fund with none exit load.

To conclude, STP and SIP are two totally different funding methods with related advantages and limitations. STP fits traders who’ve a lumpsum quantity of their hand and wish to reap the benefits of value averaging and volatility.

The write is a professor of finance & accounting, IIM Tiruchirappalli