A definitive listing of buying and selling methods would require a number of shelf-filling volumes. There are nearly as many approaches to investing on the market as there are merchants. Chances are high for those who speak to 5 completely different merchants, you’ll hear 5 other ways they’ve made cash buying and selling shares.

That’s a part of the fantastic thing about the inventory market. It’s arguably the best wealth-building machine humanity has ever seen. And throughout the latest longest bull market in historical past, the oldsters that missed out essentially the most have been those who determined to not play.

Now that the markets have bounced again and the following bull market has reared its head, no one with a couple of bucks to spare ought to miss out on this chance. The enjoying subject has by no means been so stage. Brokerage charges are all however a distant reminiscence. And as we noticed with the saga surrounding GameStop (NYSE: GME), it’s not simply hedge funds which can be profiting.

Whether or not you’ve acquired $100 or $100,000 to speculate, a brokerage account and technique is all you’ll want to begin placing your cash to work. By doing so that you’ll have likelihood at outperforming the lowly rates of interest offered to most financial savings accounts. In case you haven’t already, it’s excessive time you choose a method and begin your journey in the direction of monetary freedom.

An Introduction to Buying and selling Methods

Any funding technique value its salt entails cautious consideration of some completely different parts. For starters, you’re going to want to know:

- How a lot you’re keen to speculate

- What course you suppose the safety you’ve focused is heading price-wise

- An exit technique

These bullet factors are the muse that the simplest and most complex buying and selling methods are constructed on. When you’ve discovered these three parts, the remaining is straightforward. The downfall is that every one three may be surprisingly troublesome. That’s why good traders look past the muse. And that’s the place our listing of buying and selling methods comes into play.

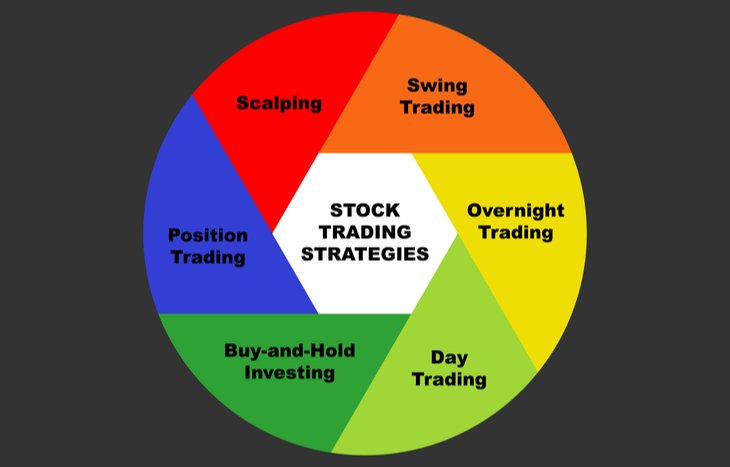

The Fast Listing of Buying and selling Methods for Quick-term Buyers:

- Day Buying and selling

- Place Buying and selling

- Scalping

- Swing Buying and selling

- Momentum Buying and selling

Over the previous 140 years, U.S. shares have averaged 10-year returns of 9.2%, in keeping with knowledge compiled by Goldman Sachs. The S&P 500 has carried out even higher, with a mean annual return of 13.6%.

Lengthy-term traders in search of regular returns like these want look no additional than the likes of the Vanguard 500 Index Fund ETF (NYSE: VOO) or SPDR S&P 500 ETF Belief (NYSE: SPY). They’re each completely superb methods to develop a nest egg. However what long-term investing has in safety, it lacks within the means to develop capital through a fast succession of successful trades. Annualized returns of 13.6% are nice and all. However grabbing these type of positive factors on a day by day or weekly foundation can supply the increase a portfolio must go from extraordinary to extraordinary.

Day Buying and selling

Day buying and selling isn’t for the meek. It’s a fast-paced full-time job (for many) that comes with equal components threat and reward. On prime of the dangers and rewards, there are additionally a number of guidelines to pay attention to.

Day buying and selling may be summed up because the act of getting out and in of an funding in a single day. A easy instance and motive for day buying and selling can be anticipating an organization is about to interrupt out.

Let’s say BioNano Genomics (Nasdaq: BNGO) is having its earnings name whereas the markets are open. The inventory had been pretty quiet, however primarily based on the corporate’s latest product rollout, you’re anticipating it to beat estimates. You choose up a number of hundred shares within the morning. Your instinct proves right. After the earnings name, share worth spikes, and also you promote earlier than the top of the day… Pocketing a wholesome achieve alongside the way in which. And by getting out of the place on the finish of the day, it protects the dealer from any after-market fluctuations. That’s a simple instance of day buying and selling.

Day buying and selling has been rising extra in style. Thanks partly to vanishing brokerage charges. That’s why it tops our listing of buying and selling methods for short-term merchants. However that is simply the tip of the buying and selling iceberg. Day merchants can depend on something from a hunch to difficult chart patterns to search out their subsequent commerce. In truth, this technique has many underlying methods of its personal to contemplate.

Place Buying and selling

This can be one of many extra controversial gadgets on our listing of buying and selling methods for short-term merchants. That’s as a result of from some vantage factors, place buying and selling is a buy-and-hold, long-term technique. However in actuality, it may be fairly effectual as a short-term technique.

Place buying and selling is all about tendencies. Many place merchants will have a look at charts to attempt to work out securities by way of worth. And extra energetic merchants can use these charts to search out and assess positions which have one of the best motion that may be taken benefit of.

For example, place merchants can look to one thing so simple as a string of upper highs (or decrease lows) as a budding pattern. As soon as established, that pattern can change into an actionable sequence of occasions. If a given inventory is on the way in which up, an investor can see that as a time to speculate and journey the upward wave. One of many keys to utilizing this technique is to pay shut consideration to (and alter) their trailing stops.

If a inventory you’ve invested in is trending upwards properly, a near-constant adjustment of the trailing cease may be extraordinarily helpful. For each 5% a inventory strikes upwards to new highs, adjusting the trailing cease alongside the identical line may be helpful to maximise earnings… and reduce losses. And that makes this one of many simpler buying and selling strategies on our listing of buying and selling methods

Scalping

This one is all about pace. And to a lesser extent, quantity. A key to utilizing this technique to your benefit is knowing the distinction between the bid-ask unfold and understanding use restrict orders.

When you’ve acquired these fundamentals down, the most straightforward clarification is that this technique focuses on shopping for a safety on the bid value and rapidly promoting it on the ask value. On some securities, the unfold between the bid and ask value may be fairly large. However on the subject of scalping, it’s essential to not concentrate on the unfold an excessive amount of. Liquidity may be much more essential.

If the unfold on a safety is just too giant and there isn’t a lot liquidity, it could actually hamper the power to promote. If there aren’t any patrons, on the ask value, the scalping technique falls aside. However right here’s the way it can work correctly… And result in earnings in a matter of minutes.

Let’s say you log into your brokerage account and discover {that a} inventory’s bid value is $20 and the ask value is $21. The liquidity is excessive sufficient that’s seems like filling a restrict order shouldn’t be an issue. So, you place a restrict order for 100 shares at $20. The order is stuffed, and similar to that you simply’ve acquired $2,000 value of shares. As soon as affirmation comes by and the inventory is in your place, you are able to do no matter you need with it. Together with promoting it.

If the ask value remains to be at $21 when you’ve acquired possession, you possibly can promote the inventory you simply purchased with a restrict order of $21. And if it goes by, increase! You simply scored $100 in a matter of minutes.

If the bid-ask unfold is bigger than a greenback, it could actually result in even bigger, short-term positive factors. However simply be aware of liquidity. If there’s not sufficient curiosity on each side of the commerce, it could actually finish in holding positions longer than anticipated.

Swing Buying and selling

Like most short-term buying and selling methods, swing buying and selling depends on tendencies. However the profit to this model of investing is you don’t need to be glued to a display all day, monitoring each up and down within the markets. However you do want to concentrate. Whereas day buying and selling could be a full-time job, swing buying and selling is akin to a passionate part-time job.

Entries or exits from a place can occur at any time. And infrequently, this necessitates lots of technical evaluation. Moreover, it could actually name for using quantitative instruments to set off trades. And holding occasions may be anyplace from a few days to some weeks… It simply relies upon what and the place the markets are shifting.

When executed proper, a swing dealer can seize short- or medium-term positive factors by following a inventory’s (or any monetary instrument’s) up and down routine. In different phrases, it boils right down to enjoying off swings in value that observe a sample of some type.

When executed effectively, swing merchants can predict the possible short-term course a inventory’s value is heading and revenue on it. And that goes for whichever course it seems prefer it’s going.

If the patterns analyzed point out a bullish course, the swing dealer will take a “lengthy” place. This may be so simple as shopping for shares of a standard inventory, choosing up some name choices or shopping for futures contracts.

However, if a swing dealer sees a bullish sample, they’ll take a “quick” place. This may quantity to shorting a inventory, quick futures contracts or shopping for put choices. If the worth continues its downward trajectory, any of those can flip a wholesome, short-term revenue.

As our personal swing buying and selling knowledgeable Nicholas Vardy shared, “Understanding Mr. Market’s irrational temper swings gave [Warren] Buffett a large edge in timing his investments.” And with the ability to spot and act upon irrationality can present a serious leg up on the competitors. Which is why having the ability to take action put swing buying and selling in a distinguished place on our listing of buying and selling methods for short-term merchants.

Momentum Buying and selling

Talking of tendencies, momentum buying and selling is the clearest (and presumably most simple) instance of utilizing them to your benefit on this listing of buying and selling methods. However the magnificence doesn’t simply lay within the simplicity. It’s additionally within the efficacy. Research have confirmed again and again that momentum shares are inclined to outperform the broader markets.

When the markets begin to rise, it tends to maintain getting into that course. When it begins to fall, identical story. It seems Newton’s first regulation of movement additionally applies to the inventory market.

The issue with this technique is that it could actually contain shopping for a inventory at or close to its excessive value level. If momentum is pushing the worth of a inventory constantly upwards, that may scare off traders. Nonetheless, if that inventory has momentum on its aspect, the newest excessive might show to be subsequent 12 months’s low.

The opposite problem with momentum buying and selling is that the “push” behind a given inventory can change on a dime. Naturally, meaning a profitable momentum dealer could have to spend so much of time in entrance of their monitor monitoring a inventory’s motion. And figuring out the distinction between a fluke and momentum takes some apply.

Sturdy gross sales and earnings progress. High quality administration. Share buybacks and institutional assist. All of those can spell out the very important distinction between a fluke and precise momentum.

As Chief Funding Strategist (and momentum advocate) Alexander Inexperienced wrote, a momentum inventory may be seen as one that’s main the market in each revenue progress and value motion. And the factor that powers them increased? Innovation. Leaders in a sector which can be currying the favor of institutional traders are nearly definitely making our lives simpler, longer, more healthy, safer and richer. And that proper there’s momentum value investing in.

The Backside Line on Our Listing of Buying and selling Methods for Quick-Time period Merchants

This isn’t anyplace close to a complete listing. However all 5 of those methods are confirmed winners… When correctly executed. However that may be a serious dangle up – particularly for brand new traders.

In case you’re new to the funding world, we recommend signing up for our Commerce of the Day e-letter to assist get a greater grasp on revenue off of short-term actions available in the market… And begin cashing in on them.