Discover the idea of theta in choices with this information and uncover three buying and selling methods targeted on time decay, additionally known as theta decay.

Picture by TD Ameritrade

Key Takeaways

- Theta measures the speed at which an choice will theoretically decay in worth

- All else equal, theta accelerates as expiration approaches

- Choices methods that focus on theta decay embrace brief vertical spreads, iron condors, and calendar spreads

Received a bit time? Focused on choices buying and selling methods that focus on the passage of time? This text is for you.

Choice merchants know there are two methods for an choices place to revenue:

- When a protracted choice goes up in worth

- When a brief choice goes down in worth

If the choice strikes in the other way, the place loses cash. The identical is true of spreads, that are made up of multiple leg, however one should take a look at the internet worth of the commerce.

Don’t confuse this with what you need the underlying inventory to do. As an example, if you happen to’re brief a put, you need the underlying to go up, which ought to decrease the worth of your put, thus permitting you to both purchase it again for a lower cost or let the choice expire nugatory.

What precisely is it, then, that makes choices costs (and thus spreads) go up or down in worth? For the brief reply, observe the choices greeks. These danger metrics may also help quantify the connection between an underlying inventory and its choices costs. Delta and gamma relate to the motion of the underlying. Vega pertains to adjustments in implied volatility. After which there’s theta.

What’s theta decay (aka why am I melting)?

“What’s theta in choices,” you ask? Theta in choices addresses the inevitable loss in worth that choices expertise as time passes. Of all these danger measures, the passage of time is the one factor that’s sure. Time marches on, which signifies that most choices costs will proceed to “decay,” or lose worth over time. And if an choice goes to lose worth over time, then it’s potential to revenue from that choice by shorting it.

Notice that the opposite greeks are enjoying an element in how choices costs change, however we’ll assume every little thing stays the identical for the needs of this text.

Should you purchase an choice, your theta worth is unfavorable. Theta decay is without doubt one of the few consistencies that choice merchants can depend on. Lengthy choices lose time worth as they close to their expiration date. All else equal, the speed of theta decay accelerates the nearer you get to contract expiration. Nonetheless, if you happen to’re brief an choice, time is in your facet as a result of your theta worth is constructive.

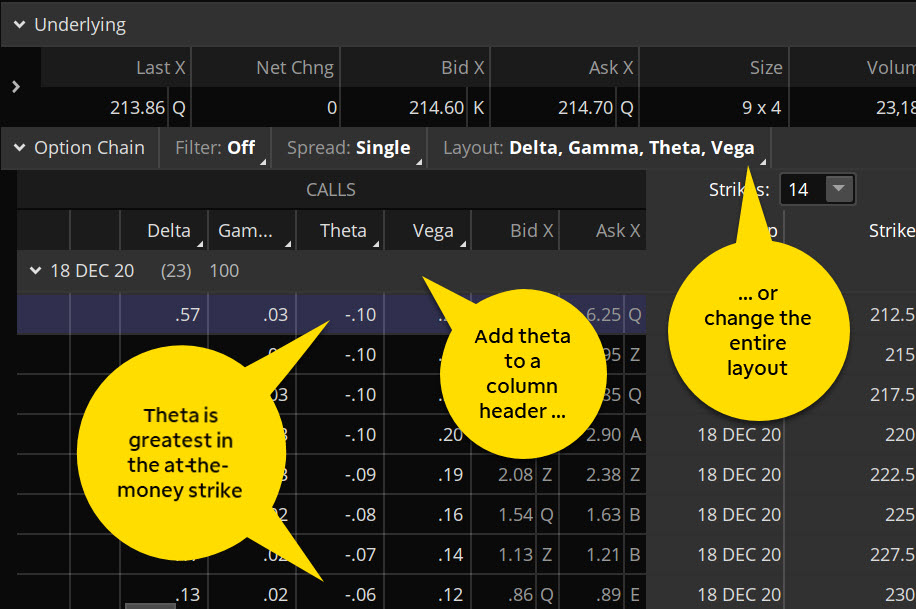

Check out the choice chain in determine 1. You may set it as much as show the theta of every choice by choosing a column header, then Choice Theoreticals & Greeks > Theta. Need your structure to show otherwise? Open the drop-down menu beneath Format and select from the preselected structure units, or create your personal by choosing Customise.

Extrinsic worth and the dynamics of choices theta

How a lot is an choice anticipated to lose every day on account of time decay? Test the theta within the choice chain. For instance, the 212.5-strike and 215-strike calls in determine 1 present a theoretical decay of $0.10 per day. The 230-strike name, which is out of the cash (OTM), has a theoretical decay of solely $0.06 per day. The additional out of the cash the choice is, the much less worth there may be to decay.

However theta isn’t nearly worth. That’s, an in-the-money (ITM) choice gained’t have a better theta than an at-the-money (ATM) choice regardless of having a better worth. Why? The worth of an choice is damaged down into two elements: intrinsic worth and extrinsic worth. Intrinsic worth is the distinction between the inventory worth and strike worth of an ITM choice. It’s additionally the quantity the choice could be value if it have been exercised right this moment. Extrinsic worth is the distinction between the choices premium and the intrinsic worth.

At expiration, an choice has no extrinsic worth. It’s both ITM by an quantity equal to its intrinsic worth, or it’s zero and expires nugatory. That’s why many choice merchants check with extrinsic worth as its “time worth” or “time premium.”

In search of theta-based choices methods? Listed here are 3 to contemplate

Some choices methods search to reap the benefits of the passage of time. Every has its personal targets—and its personal set of dangers. Be sure you perceive them earlier than leaping in.

Right here’s the setup: Recall from above that point decay isn’t the identical for each strike. ATM choices have the best price of decay (all else equal). As choices transfer both OTM or ITM, the speed of decay drops and approaches zero. Additionally, shorter-term choices decay quicker than longer-term choices (once more, all else equal). This price of choices decay quickens as an choice will get nearer to expiration.

It’s these two sides that merchants put to work when searching for to revenue from the next methods.

Technique #1: Brief OTM vertical unfold

A brief vertical unfold entails promoting an choice that’s ATM or barely OTM and shopping for an choice that’s additional OTM. A name vertical unfold is made up of two name choices; a put vertical is made up of two put choices. Vertical spreads have a directional bias within the underlying inventory—a brief name vertical is bearish, and a brief put vertical is bullish (see determine 2).

Technique #2: Iron condor

An iron condor is a four-legged unfold made up of a brief OTM name vertical unfold and a brief OTM put vertical unfold in the identical expiration cycle. Sometimes, each vertical spreads are OTM and centered across the present worth of the underlying. Much like a single vertical unfold, the danger is decided by the space between the strikes of the vertical.

However in contrast to the vertical spreads themselves, the directional bias of an iron condor is impartial (see determine 3). Within the best-case situation, the worth of the underlying stays between the 2 brief strikes by means of expiration, and each vertical spreads expire nugatory. The utmost loss would happen if the inventory moved outdoors the lengthy strikes of the brief name or brief put spreads. That loss could be the space between the strikes of the vertical unfold minus the credit score obtained from the sale of the iron condor and any transaction prices.

FIGURE 3: TARGET THE MIDDLE WITH AN IRON CONDOR. Notice the world of most revenue is a “mesa” between the 2 brief strikes, and the max loss falls outdoors the lengthy strikes. For illustrative functions solely.

Technique #3: Calendar unfold

Notice that when buying and selling vertical spreads and iron condors, the strikes are all inside the similar expiration cycle. They aim the factors of most theta inside a cycle by putting the brief strikes nearer to ATM than the lengthy strikes. Calendar spreads, nonetheless, goal the opposite rule of theta—theta tends to speed up as you method expiration.

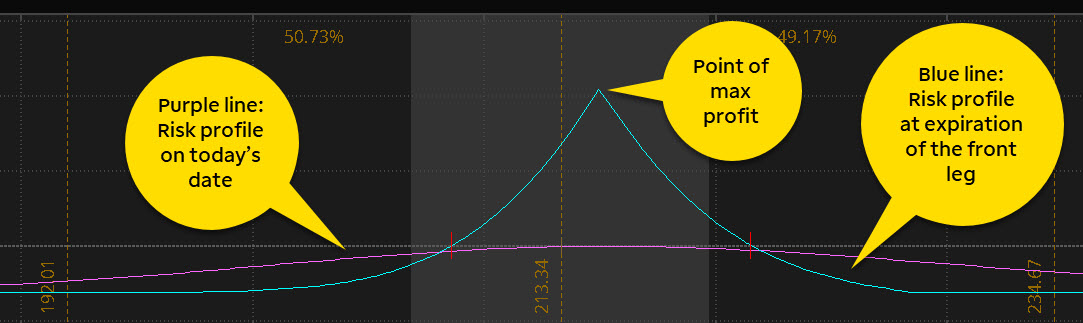

A calendar unfold entails the sale of an choice (a name or a put) with a near-term expiration date and the acquisition of the identical choice sort and strike worth however with a later-dated expiration date. It’s a defined-risk technique, with the danger sometimes restricted to the quantity you paid for the unfold, or the debit. The most effective-case situation is for the underlying to be proper on the strike worth upon expiration of the brief choice, the near-term expiration date (see determine 4). The worst-case situation could be realized if the underlying inventory moved far sufficient away out of your strike worth upon expiration of the short-term choice. Right here, the loss could be the debit paid for the calendar unfold plus any transaction prices.

When buying and selling calendar spreads, cautious commerce administration is required because the expiration date of the near-term choice approaches. Whereas brief choices will be assigned at any time, they’re extra prone to be assigned if they’re nearer to ITM. If the brief choices expires (whether or not ITM or OTM), the later-dated choice lingers on. It turns into a protracted single-leg choice. Many merchants decide to liquidate or roll a calendar unfold not less than a number of days earlier than the primary expiration date rolls round. Nonetheless, take into account that closing or rolling the place will entail extra transaction prices, which can have an effect on any potential return. Within the case of the brief choice being assigned at or earlier than expiration, the ensuing place could be the later-dated choice plus lengthy or brief 100 shares of the underlying inventory. This might considerably change the delta publicity of the unique calendar unfold and require commerce administration.

Backside line on choices theta and decay methods

Though every of the above methods contain lengthy choices that have their very own time decay, if the commerce goes as deliberate, then the brief choices carry in additional than the lengthy choices lose to internet out a revenue. But when there’s an antagonistic transfer within the underlying, like when a brief OTM vertical unfold strikes ITM, then the online time decay of the commerce can work in opposition to you. Or within the case of a calendar unfold, if the implied volatility of the entrance leg have been to rise relative to the volatility within the later-dated leg (all else equal), the unfold worth would go in opposition to you.

Nonetheless, time marches on. Methods that search to revenue from the inevitable choices decay is a method for choice merchants to place time on their facet and probably have it work of their favor. Nonetheless, do take into account that these are superior choices methods that require understanding of the dangers and the energetic commerce administration concerned.

Adblock take a look at (Why?)