The inventory market operates in highs and lows. Merchants and buyers are introduced with alternatives and challenges because the market goes by varied traits in addition to fluctuations. Whereas a bullish market signifies rising costs and optimism, a bearish market signifies a downward development, with declining costs and pessimism. It’s usually assumed that most earnings may be made solely when the market is bullish. Nonetheless, a bearish market additionally has the potential to supply earnings if one makes knowledgeable selections based on the traits.

What’s a bearish market?

A bearish market, also referred to as a bear market, refers to a interval characterised by falling inventory costs and general pessimistic sentiments available in the market. It’s the reverse of a bullish market, the place costs rise, and investor confidence is excessive. In a bearish market, merchants are typically cautious and will dump their holdings, resulting in additional declines in costs. A bearish market is usually pushed by bearish indicators or elements reminiscent of financial downturns, geopolitical tensions, or destructive sentiment amongst market individuals. One of many key indicators of a bearish development is a sustained downtrend in main market indices. When Nifty and Sensex persistently present a downward trajectory, it suggests a bearish market sentiment. If these indices present patterns reminiscent of decrease lows and decrease highs, it signifies a bearish market development. Excessive buying and selling volumes throughout a downtrend counsel elevated promoting strain, reinforcing the bearish outlook.

Allow us to perceive some technical traits to be careful for throughout a bearish market:

1. Easy Shifting Common (SMA)

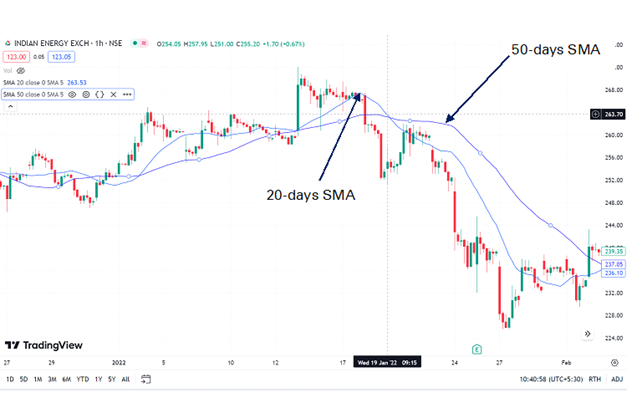

It calculates the typical value of a safety over a specified time interval by including collectively the closing costs for every interval and dividing the sum by the variety of durations. The SMA smooths out value fluctuations, offering merchants with a clearer image of the underlying development. It’s notably helpful for figuring out assist and resistance ranges, figuring out entry and exit factors, and confirming development reversals.

As a way to calculate SMA, you could choose a time-frame. For instance, you’ll be able to select 20-day, 50-day, or 200-day transferring averages. This means the typical value of the safety over the chosen time interval. When the value of the safety is above the safety line, it suggests an uptrend, whereas costs under the SMA point out a downtrend.

Help and Resistance ranges

Easy transferring averages can act as assist or resistance ranges for a inventory’s value motion. If the value persistently fails to surpass the SMA throughout an uptrend, it might point out a robust assist degree. Conversely, if the value persistently fails to surpass the SMA throughout a downtrend, it might point out a robust resistance degree.

Crossover

The crossover of two totally different easy transferring averages is commonly thought-about a big buying and selling sign. A bearish crossover happens when a shorter-term SMA (e.g.- 20-day) strikes under a longer-term SMA (e.g.- 50-day). This means a possible downward development. When such a development is seen on a chart, it is called a ‘Loss of life Cross.’

Within the above chart, we are able to decide the potential downtrend because the 20-day transferring common falls under the 50-day transferring common.

Since SMAs depend on previous information to generate indicators, they could not present well timed indications of fast value modifications or market volatility. Due to this fact, it may be sensible to make use of them along with different indicators.

2. Exponential Shifting Common (EMA)

Exponential transferring common assigns better weightage to latest value information, making it extra conscious of present market situations. Not like the straightforward transferring common, which assigns equal weightage to all information factors, EMAs give extra prominence to the latest costs.

EMAs are calculated by taking the closing costs of a safety over a specified interval and making use of a smoothing issue to the calculation. The smoothing issue determines the load given to the latest value information, with greater values leading to better responsiveness to latest value modifications.

Throughout a bearish market, EMAs may also help to find out the prevailing downtrend by analysing the connection between short-term and long-term EMAs. Usually, a typical method is to check the 50-day EMA (short-term) with the 200-day EMA (long-term). When the short-term EMA falls under the long-term EMA, it indicators a possible bearish development.

EMA crossovers

Analysing EMA crossovers also can assist in figuring out traits. When a short-term EMA, such because the 9-day or 20-day EMA, crosses under a longer-term EMA, such because the 50-day or 100-day EMA, it suggests elevated promoting strain and reinforces the bearish sentiment. These crossover indicators can be utilized as potential promoting alternatives or indicators to remain out of the market.

Within the above chart, when the 50-day EMA falls under the 200-day EMA, a bearish crossover is seen. There’s a downtrend within the share value after the crossover.

Resistance ranges

EMAs also can act as dynamic resistance ranges throughout a bearish market. When costs method the EMA line from above and get rejected, it signifies a possible promoting zone. Merchants use this to plan entry or exit factors and set stop-loss orders accordingly.

EMAs can be utilized as reference traces to determine potential short-selling alternatives. If the value persistently stays under a specific EMA, it signifies a robust bearish development, offering alternatives for short-selling or profiting from draw back actions.

3. Shifting Common Convergence and Divergence (MACD)

This indicator is used to evaluate the path and momentum of a safety. It consists of two traces: the MACD line and the sign line, together with a histogram.

The MACD line is calculated by subtracting the 26-day exponential transferring common from the 12-day exponential transferring common. It represents the distinction between the short-term and the longer-term transferring averages. Throughout a bearish market, the MACD line tends to say no, reflecting the downward momentum.

The sign line is a 9-day EMA of the MACD line. It acts as a set off for purchase or promote indicators. In a bearish market, the sign line usually stays under the MACD line, confirming the downward development.

The histogram is derived by plotting the distinction between the MACD line and the sign line. It offers visible illustration of the convergence and divergence between the 2 traces. When the histogram bars are destructive and growing in measurement, it signifies sturdy bearish momentum.

When the MACD line crosses under the sign line, it generates a bearish sign. This crossover means that the promoting strain is intensifying and that the downward development is gaining power. Merchants might take into account promoting or short-selling positions in such situations. As well as, when the histogram bars are persistently destructive and widening, it signifies growing promoting strain and a strengthening bearish market. This may very well be a chance to capitalise on the downward motion by taking brief positions or implementing bearish methods.

Conclusion

Often, bearish sentiments are thought-about a sluggish progress interval. Nonetheless, varied methods may be carried out throughout a bearish interval to protect beneficial properties. Recognising bearish reversal patterns with the assistance of those technical indicators may very well be helpful to navigate by a bearish market. Since these technical indicators reply to fast fluctuations, it’s advisable to make use of them along with different indicators reminiscent of Relative Energy Index (RSI).

FAQs on Bearish Tendencies:

Which technical indicator is taken into account Bearish?

One such technical indicator is the Shifting Averages indicator. It’s usually used to determine development reversals, which may result in the identification of a bearish interval. And identical to the transferring common indicator there are numerous different indicators that present development reversals, there are technical indicators for bullish durations too.

How do you determine a Bearish development?

Take Shifting Averages for instance. In a Easy Shifting Common, if the value of an asset is under the safety line, it signifies a downtrend, whereas in Exponential Shifting Common when the short-term EMA falls under the long-term EMA it indicators a possible bearish development. Completely different indicators have totally different strategies to research potential bearish traits.

Ought to I purchase throughout a Bullish or Bearish market?

Merchants use totally different methods to purchase shares, reminiscent of shopping for at assist ranges and promoting at resistance ranges, or just following the development. Nonetheless, timing the market is difficult. To make knowledgeable selections, use technical indicators and candlestick patterns to assist your analysis.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered workplace of I-Sec is at ICICI Securities Ltd. – ICICI Enterprise Home, Appasaheb Marathe Marg, Prabhadevi, Mumbai – 400 025, India, Tel No : 022 – 6807 7100. I-Sec is a Member of Nationwide Inventory Alternate of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Alternate of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Title of the Compliance officer (broking): Ms. Mamta Shetty, Contact quantity: 022-40701022, E-mail deal with: complianceofficer@icicisecurities.com. Investments in securities markets are topic to market dangers, learn all of the associated paperwork fastidiously earlier than investing. The contents herein above shall not be thought-about as an invite or persuasion to commerce or make investments. I-Sec and associates settle for no liabilities for any loss or harm of any sort arising out of any actions taken in reliance thereon. Such representations aren’t indicative of future outcomes. The securities quoted are exemplary and aren’t recommendatory. The contents herein above are solely for informational objective and might not be used or thought-about as a suggestion doc or solicitation of provide to purchase or promote or subscribe for securities or different monetary devices or some other product. Buyers ought to seek the advice of their monetary advisers whether or not the product is appropriate for them earlier than taking any choice. The contents herein talked about are solely for informational and academic objective.

Adblock take a look at (Why?)