This text is a part of the FT’s Runaway Markets sequence

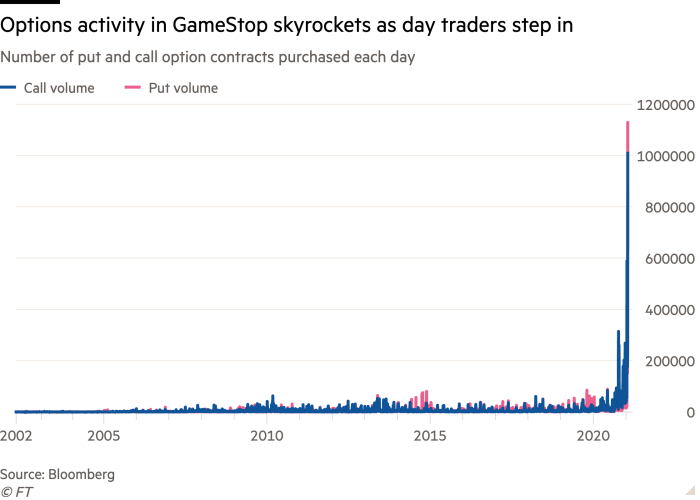

GameStop’s rocket-fuelled buying and selling this month, which has taken the inventory’s achieve in 2021 to virtually 1,800 per cent, is a vivid instance of how a brand new military of day merchants have “weaponised” monetary derivatives to their benefit.

The sport retailer’s inventory had catapulted 135 per cent by noon buying and selling in New York on Wednesday, to $353, extending a latest spree of positive factors that despatched it zooming greater from its 2020 closing worth beneath $19 a share.

One consumer with the moniker DeepFuckingValue on the favored Reddit discussion board WallStreetBets posted screenshots on Tuesday exhibiting how he had turned about $50,000 value of GameStop name choices — which give the holder a proper to purchase a inventory at a sure worth, and performance very like a leveraged wager — into almost $23m this 12 months.

But GameStop is simply probably the most seen instance of as we speak’s options-fuelled inventory market mania. Whereas the growing use of derivatives has been a trademark of earlier retail buying and selling frenzies — such because the late Nineties dotcom increase — the present reputation is alarming even seasoned observers.

“What we’ve seen over the previous few buying and selling classes borders on insanity,” stated Steve Sosnick, chief strategist at Interactive Brokers. “You might all the time get loopy issues happening in particular person shares, however while you see it metastasising by means of an entire vary of different shares, that’s an indication of actual froth.”

Choices are notably highly effective buying and selling instruments, as a result of they can be utilized to wager on and in opposition to monetary securities, and might amplify returns and losses, which has made them wildly widespread among the many new era of retail merchants.

In return for a premium, calls give holders a proper to purchase a inventory at an agreed “strike” worth inside a sure date. Places give the best to promote at a sure worth, and performance as insurance coverage in opposition to declines. However on web boards there may be largely solely urge for food for calls to punt on shares rising “to the moon”, because the frequent chorus goes.

Extra worryingly to some analysts, the extra subtle merchants additionally appear to be actively harnessing among the distinctive traits of choices, typically denoted with Greek letters resembling “delta” and “gamma” by Wall Road professionals, and utilizing them to drive costs greater.

Runaway Markets

In a sequence of articles, the FT examines the exuberant begin to 2021 throughout world monetary markets

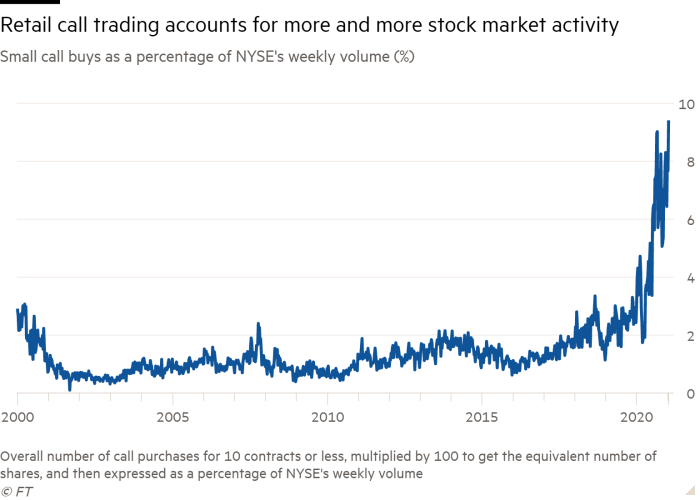

Choices buying and selling volumes have exploded over the previous 12 months, but the upswing has been notably highly effective in small trades of 10 name contracts or much less — usually the type of commerce measurement dominated by retail traders reasonably than large establishments.

The amount of cash spent on premiums for name choices trades of this measurement declined final autumn after a record-shattering summer time frenzy, however is now again to close a file of $34.2bn on a rolling four-week foundation, in accordance with analysis by Jason Goepfert of Sundial Capital Analysis.

The explanation why choices can have an outsized affect on the underlying inventory is due to their distinctive dynamics. The vendor of an possibility, usually a financial institution or one other large monetary establishment, is obliged to ship the promised shares if name strike costs are triggered, or shopping for the shares within the case of places. Sellers will subsequently regularly hedge themselves by shopping for — or promoting — the underlying safety.

This could set off suggestions loops, particularly when shares begin transferring in the direction of the strike worth and banks are pressured to hedge their “gamma” publicity — as it’s referred to as in dealer jargon. Gamma measures how a lot the worth of an possibility accelerates when the worth of the safety it’s primarily based on modifications.

Some analysts and traders say that many retail traders have learnt that by banding collectively to blitz-purchase calls, they can assist drive the worth of the underlying inventory as much as the strike costs by compelling sellers to hedge their very own publicity.

“Weaponised gamma is a superbly affordable method of describing it,” stated Benn Eifert chief funding officer of QVR Advisors, a hedge fund. “You see quite a lot of snide feedback that these are simply dumb individuals. However there are clearly subtle, intelligent, considerate individuals doing this as nicely.”

Mr Sosnick agreed, and stated the suggestions loops may develop into notably highly effective when the gamma hedging of sellers was mixed with small shares that had a restricted proportion of freely tradable shares and had been topic to large brief positions — resembling GameStop.

“It’s like an ant colony. Every particular person ant might not have the ability to transfer a lot, however you probably have sufficient of them they’ll transfer a exceptional quantity,” he stated. “If sufficient individuals purchase $40 calls on a $35 inventory, the market-makers should hedge ultimately . . . Within the brief time period you possibly can actually make your self proper.”

The query is to what extent these dynamics are affecting not just a few particular person shares, however the inventory market as an entire. Analysts say that the retail frenzy has migrated from large names resembling Apple, Google and Tesla that had been widespread final summer time to extra recondite corners of the fairness market, the place the affect is extra highly effective however extra idiosyncratic.

Nonetheless, the general marketwide affect of the choice frenzy is prone to be “significant”, in accordance with Chris Murphy, co-head of derivatives technique at Susquehanna Worldwide Group.

“It’s not simply the general quantity numbers — that are spectacular in themselves — nevertheless it additionally has knock-on results throughout totally different components of the market,” he stated.