In an period the place healthcare prices are rising steadily, having enough medical health insurance protection has turn out to be important for people and households. Whereas conventional medical health insurance insurance policies cowl hospitalization bills, they might not deal with the day-to-day bills incurred throughout hospital stays.

That is the place a hospital money insurance coverage coverage comes into play, providing a novel and supplementary resolution to handle extra bills throughout hospitalization.

What’s a hospital money insurance coverage coverage?

A hospital money insurance coverage coverage is a specialised medical health insurance plan designed to offer policyholders with a hard and fast money profit for every day they’re admitted to a hospital on account of sickness or harm.

Not like conventional medical health insurance that reimburses precise medical bills, this coverage supplies each day money allowances to cowl non-medical bills arising throughout hospitalization. The money advantages obtained from the coverage are normally tax-free and can be utilized on the policyholder’s discretion.

Day by day money profit

The each day money profit is the first characteristic of a hospital money insurance coverage coverage, offering essential monetary assist to the insured throughout their hospital keep. As a policyholder, the person is entitled to obtain a hard and fast money profit for every day of hospitalization. This quantity is predetermined on the time of buying the coverage and varies relying on the particular coverage chosen.

No restrictions on bills

Not like conventional medical health insurance plans that usually prohibit protection to particular medical bills, this coverage permits the insured to make use of the money obtained for any non-medical bills incurred throughout their hospitalization.

Which means that the money profit will be utilized for varied incidental prices, comparable to transportation bills to and from the hospital, meals in the course of the keep, and even lodging bills for relations who may accompany the insured.

Flexibility

The pliability supplied by a hospital money insurance coverage coverage is a significant benefit for policyholders. They’ve full autonomy over how they make the most of the money profit, permitting them to deal with their speedy monetary wants arising on account of hospitalization.

This degree of freedom supplies a way of management and empowers the insured to deal with their scenario with out being burdened by monetary stress throughout an already difficult time.

Complete protection

Hospital money insurance coverage coverage acts as supplementary protection to an ordinary medical health insurance plan. Whereas conventional medical health insurance insurance policies cowl hospitalization bills associated to medical remedies, surgical procedures, and diagnostics, they might not deal with the each day dwelling bills that usually come up throughout hospital stays.

Hospital money insurance coverage fills this hole by offering a gentle money circulation to the insured, permitting them to handle their life-style bills with out worrying about extra monetary strains.

No pre approval required

One other important benefit of hospital money insurance coverage is that it doesn’t require pre-approval for money advantages to be availed. Not like conventional medical health insurance claims that usually necessitate pre-authorization for particular medical procedures.

Hospital money insurance coverage permits the insured to entry the money profit with out such necessities. This streamlined declare course of simplifies the general expertise and ensures that policyholders obtain well timed monetary help after they want it essentially the most.

As healthcare prices proceed to rise, a hospital money insurance coverage coverage serves as an integral part of a well-rounded monetary plan, making certain that healthcare wants are adequately met with out compromising on each day dwelling bills.

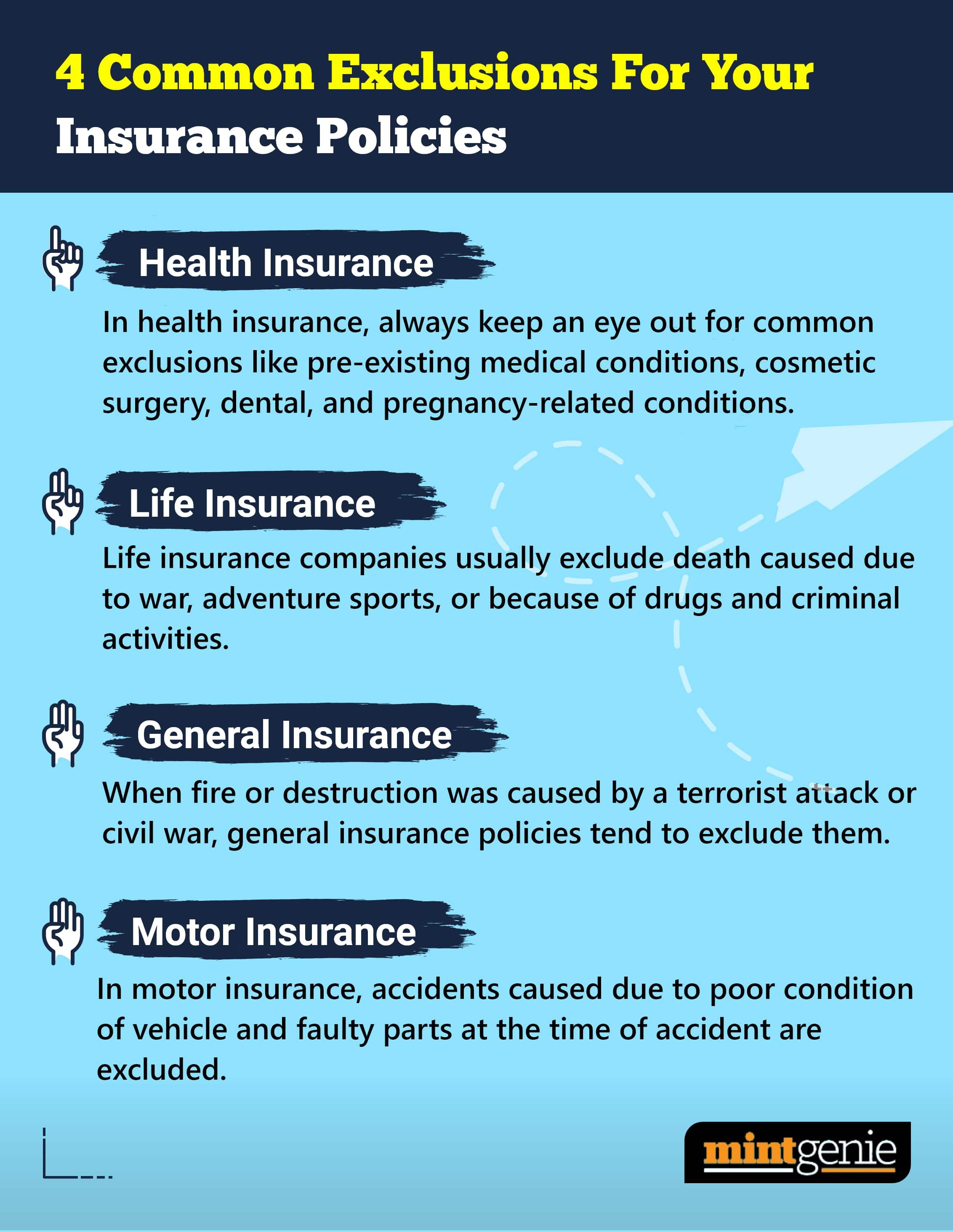

Right here we describe the frequent exclusions for well being, life, motor and common insurance coverage insurance policies.

First Printed: 09 Aug 2023, 08:37 AM IST

Matters to comply with

Adblock check (Why?)