Summary

Local weather stabilization requires the deployment of a number of low-carbon choices, a few of that are nonetheless not out there at massive scale or are too pricey. Governments should make vital choices on find out how to incentivize Analysis and Improvement (R&D). But, present assessments of local weather neutrality sometimes don’t embody research-driven innovation. Right here, we hyperlink two built-in evaluation fashions to check R&D funding pathways in step with local weather stabilization and counsel a constant financing scheme. We concentrate on 5 low-carbon applied sciences and on power effectivity measures. We discover that well timed R&D funding in these applied sciences lowers mitigation prices and induces constructive employment results. Attaining 2 °C (1.5 °C) requires a worldwide 18% (64%) improve in cumulative low-carbon R&D funding relative to the reference state of affairs by mid-century. We present that carbon revenues are enough to each finance the extra R&D funding necessities and generate financial advantages by lowering distortionary taxation, resembling payroll taxes, thus enhancing job creation.

Introduction

Attaining the Paris Settlement purpose of limiting world warming to effectively under 2 °C implies peaking anthropogenic emissions as quickly as potential by way of the phase-out of conventional fossil-based power and the quick deployment of low-carbon and negative-emission applied sciences. These embody renewable power and carbon seize and storage (CCS)1,2. To realize such a fast transition, the tempo of power innovation and expertise diffusion should be scaled up considerably3,4. Importantly, a big share of the greenhouse gasoline (GHG) emissions reductions in step with 2 °C and under 2 °C situations depend on applied sciences that aren’t absolutely market-ready right now5.

Public analysis, growth and demonstration (R&D) investments play a essential function in fostering technological progress in all sectors, together with power5,6. Public investments present “affected person capital”, and permit to beat the uncertainty which is intrinsic within the means of non-incremental power innovation7,8,9. The advantages related to learning-by-research dynamics are significantly vital for much less mature applied sciences10. Certainly, state-funded investments for innovation, supported by coherent coverage frameworks which embody supply-side in addition to demand-side insurance policies, contributed to the event of cost-competitive low-carbon applied sciences, resembling wind, photo voltaic LEDs and batteries for electrical automobiles7,11,12,13. The literature supporting this thesis is wealthy, and outcomes are largely constant: R&D investments contribute to decreasing power expertise prices14.

Decisions in public R&D funding amongst a number of low-carbon applied sciences at totally different phases of growth—resembling Carbon Seize and Storage (CCS), batteries for electrical automobiles and superior biofuels—are instrumental to reaching the transition15. Informing such decisions requires an understanding of the complicated interactions between a number of low-carbon choices, as tailor-made expertise portfolios should be recognized relying on the geographical specificities and pure useful resource endowments of a given area and nation16,17. Given the very long time horizon which characterizes the power system and climate-related impacts, choices on R&D investments should be optimized intertemporally18. The timing of such funding is essential to extend the chance of limiting world warming over the subsequent a long time19. Moreover, a non-trivial query pertains to the mechanism by way of which RD&D investments will be financed20,21,22.This latter facet is neglected in most built-in modeling assessments of local weather stabilization.

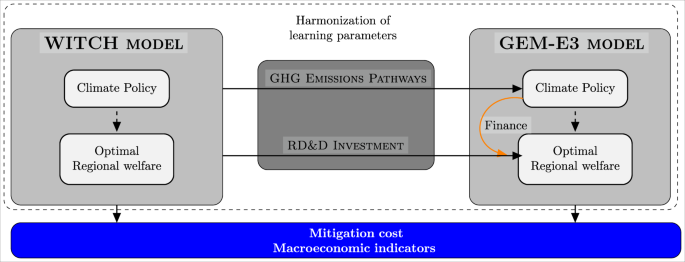

This paper offers insights to tell the selection of power expertise portfolios, the timing of R&D investments, and a potential financing mechanism within the context of a fast power transition to restrict world warming to effectively under 2 °C. We soft-link two well-established Built-in Evaluation Fashions (IAMs): WITCH23—to determine innovation investments for 5 key decarbonization applied sciences and on a package deal of measures selling power effectivity—and GEM-E324 to check a mechanism for low-carbon R&D investments by way of the recycling of carbon revenues. Using a dynamic mannequin (WITCH) permits calculating the optimum stage of R&D funding taking into consideration the time lag with which decrease expertise prices accrue on account of analysis investments25. Optimum R&D investments are these that are cost-effective for every area, i.e., the least-cost choice maximizing every area’s welfare, with or and not using a carbon finances constraint or an R&D finances constraint. Via WITCH, we account for the substitution and complementarity of various low-carbon expertise choices and permit for a full-century definition of the R&D funding pathways. Using a computable basic equilibrium (CGE) mannequin with an in depth illustration of the economic system (GEM-E3) permits us to check the R&D financing coverage and perceive the economy-wide competitiveness and employment implications of various funding decisions. Particularly, GEM-E3 consists of 67 manufacturing sectors—10 of which relate to the manufacturing of low-carbon applied sciences—and a illustration of employment dynamics within the labor market.

Our outcomes present insights on 4 fronts: world innovation methods compliant with Paris targets, a possible choice for the financing of R&D by way of carbon revenues, macroeconomic repercussions of the R&D methods, and the implications for the worldwide mitigation price of local weather insurance policies.

Outcomes

Our evaluation generates detailed outcomes for various applied sciences and areas and for every of the situations explored. All regional outcomes will be explored and in contrast utilizing an open entry on-line software we developed (https://datashowb.shinyapps.io/web_shiny/). Right here we summarize the principle insights rising from the evaluation by way of (a) world pathways, (b) the financing of extra R&D investments in stringent decarbonization situations and (c) regional macroeconomic results. We additionally talk about (d) world local weather coverage prices with optimum R&D methods.

International pathways

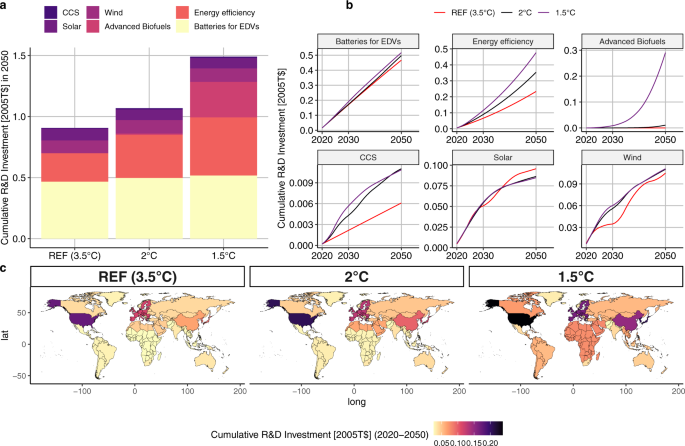

Determine 1 summarizes our outcomes by way of world cumulative optimum funding from 2020 to 2050 for every expertise (panel a), time profile (panel b) and complete cumulative R&D funding in chosen areas (panel c). 4 essential messages emerge.

a exhibits the worldwide cumulative R&D funding as much as 2050; b exhibits the worldwide cumulative investments per expertise from 2020 to 2050; c exhibits the whole R&D low-carbon investments for the WITCH areas by state of affairs.

First, whereas optimum R&D investments in all situations fund a various portfolio of applied sciences, the relative significance of a given expertise is totally different relying on the stringency of the carbon finances. In all three situations, the largest share of investments is allotted to batteries for EDVs and power effectivity. Within the REF state of affairs and within the 2 °C goal, wind and photo voltaic symbolize respectively the third and fourth largest R&D investments. Within the 1.5 °C goal, superior biofuels is the third most funded expertise, earlier than wind and photo voltaic, consistent with historic shares5. For CCS and Wind, the outcomes are extra delicate to the presence of a carbon finances than to the magnitude of the finances itself. The CCS share of R&D investments stays low in comparison with different applied sciences; this result’s mentioned extra intimately under.

Second, for extra mature applied sciences, the general optimum R&D low-carbon investments in stringent decarbonization situations don’t essentially imply extra cumulative R&D funding for every expertise, however somewhat earlier R&D funding (Fig. 1b). Certainly, complete cumulative investments for photo voltaic and wind over the century within the REF and coverage situations are comparable, i.e., optimum funding doesn’t require massive scale-up in a coverage state of affairs as in comparison with REF (see additionally Supplementary Figs. 10 and 11 of the Supplementary Info). Two issues assist clarify this consequence. On the one hand, these applied sciences are characterised by excessive learning-by-researching and learning-by-doing charges. However, as we talk about under, in stringent decarbonization situations these applied sciences compete with CCS. Importantly, nevertheless, R&D investments for mature applied sciences in each local weather coverage situations are carried out earlier somewhat than later. Within the case of photo voltaic, as an illustration, imposing a extra stringent local weather coverage ends in a displacement of photo voltaic R&D investments from the later years to 2030. Related dynamics are obvious, to some extent, for wind. This consequence, rising from an ideal foresight mannequin (WITCH), confirms that R&D is a key element of the local weather coverage portfolio and that, for extra mature applied sciences, it isn’t solely its quantity but additionally the timing of such funding that issues in reaching extra stringent targets at decrease prices. Word that the 2–issue studying curve formulation included in WITCH contributes to reaching this consequence (see Equation 3 of Supplementary Info part 1). As talked about above, the two-factor-learning curve formulation accounts for price decreases arising from each R&D investments (by way of the information inventory) and from growing deployment (by way of cumulative capability). In the beginning of the century, optimum R&D investments are bigger and lead to decrease set up prices, consequently resulting in sooner deployment. This improve in put in capability, in flip, additional lowers set up prices. The cumulative impact of those dynamics is extra pronounced for applied sciences with excessive learning-by-doing charges, resembling photo voltaic and, to a sure extent, wind (see Supplementary Fig. 6 of the Supplementary Info part 3). Importantly, as we talk about under, in stringent decarbonization situations these applied sciences compete with CCS.

Third, for much less mature applied sciences, there are substantial variations within the optimum R&D investments within the REF versus the decarbonization situations. CCS is the least mature of the applied sciences analyzed right here, and one which has not but registered massive R&D investments relative to the opposite applied sciences. The truth that returns on R&D funding are calibrated with historic information and that for much less mature applied sciences a profitable technological consequence is extra unsure explains the decrease funding ranges in comparison with these of different applied sciences. But, investments in CCS in 2030 are double and a pair of.6 occasions bigger within the 2 °C and 1.5 °C situations, respectively, as in comparison with REF. This in flip provides rise to a fast lower in the price of fossil power with CCS, illustrating the significance of this expertise choice to assist the fast emission reductions within the early years. Certainly, the provision of low-cost fossil power with CCS has vital implications for the time profile of power demand from different low-carbon applied sciences. Particularly, it interprets into barely decrease deployment of renewables, even when the R&D investments have lowered the price of photo voltaic and wind. Whereas state of affairs literature means that CCS is a vital element of reaching the two °C and 1.5 °C decarbonization targets26, our research highlights that CCS applied sciences compete with renewable power sources. In a different way from CCS, batteries for automobiles see solely a timid improve in R&D funding within the presence of a local weather coverage, as in comparison with REF. Nevertheless, on condition that this expertise has the very best learning-by-researching and learning-by-doing charges even small will increase in investments and capability result in nice price reductions (see Part 4 of the Supplementary Info for sensitivity to studying charges).

Fourth, complete cumulative R&D investments are heterogeneous throughout totally different areas on the planet (Fig. 1c). In all situations, the very best contributors to R&D investments are the USA, the EU and Japan and South Korea (jpnkor). When local weather coverage is applied (2 °C and 1.5 °C) all areas improve their R&D investments (Supplementary Fig. 19 of the Supplementary Info). Except the USA, Russian and the previous Soviet Union and the MENA area, the change in R&D investments required to attain 2 °C relative to REF is decrease than the one required to attain 1.5 °C relative to 2 °C. That’s, reaching the 1.5 °C goal requires a deeper change in power programs than reaching the two °C goal (Supplementary Fig. 19 of the Supplementary Info). Reaching the 1.5 °C goal entails a 64% improve in world cumulative R&D investments as in comparison with the 18% wanted in 2 °C. Within the 1.5 °C state of affairs the worldwide R&D common (2020–2050) funding estimate is eighteen.8 2005$ billions. In keeping with UNEP27 the estimation of unpolluted R&D spending within the COVID-19 restoration packages is 28.9 2005$ billions, that’s 65% of the annual estimated wants to succeed in 1.5 °C.

Evaluating the present public investments supplied by13 for the areas the place information is out there, within the USA, Oceania, Japan and South Korea, the EU, and Canada the estimated low-carbon R&D funding wants in 2050 symbolize greater than double of the present low-carbon R&D investments by way of Share of GDP (Supplementary Fig. 19 of the Supplementary Info part 10). Word that R&D in EDV is excluded from this comparability as13 stories information on public expenditures whereas our evaluation of EDVs consists of each non-public and public information, as defined earlier, so such a comparability can be deceptive. In China, Japan and South Korea, Southeast Asia, Latin America and sub-saharan Africa reaching 1.5 °C implies at the least doubling the R&D funding with respect to REF. These will increase are associated to investments in superior biofuels (Supplementary Fig. 14 of the Supplementary Info). The EU and the USA have excessive R&D investments in batteries for EDVs within the REF state of affairs in addition to in low-carbon situations. Conversely, in China, the MENA area, and to some extent the reforming economies, R&D investments on this expertise are triggered solely by stringent local weather coverage (Supplementary Fig. 10 of the Supplementary Info). CCS R&D investments see vital will increase in Latin America (besides Brazil), Canada, USA, China and the reforming economies (Supplementary Fig. 12 of the Supplementary Info).

Financing low-carbon R&D by way of carbon revenues

Financing the power transition is a problem21 state that R&D is barely a small share of the general financing necessities of the low carbon transition. Our estimated extra low-carbon R&D funding necessities to succeed in 2 °C (1.5 °C) for low- and mid-income nations symbolize 3.0–3.2% (12–13%) of the local weather finance estimated by the OECD in 202128 (see Supplementary Fig. 22 of the Supplementary Info).

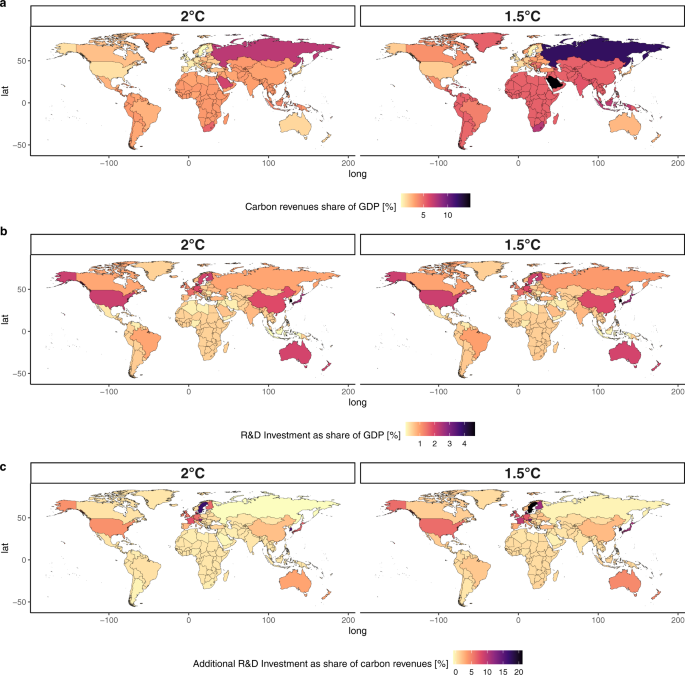

Right here, we don’t take into account the choice of worldwide monetary transfers, however somewhat concentrate on home financing by way of devoted local weather fiscal instruments. Carbon revenues represent a fiscal software that may be redirected to the economic system to facilitate double dividends, present enabling situations for the low-carbon transition, improve innovation or take away present financial distortions. In our evaluation with the GEM-E3 mannequin, we assume that carbon revenues might be used to finance the extra R&D wants for every coverage state of affairs as in comparison with the REF state of affairs, and that any remaining carbon income is directed to decreasing payroll taxes. Determine 2 summarizes the outcomes with respect to the financing of the R&D investments.

a exhibits carbon revenues as a proportion share of GDP by nation for the two temperature targets; b exhibits the all sector R&D Funding as a share of GDP; c exhibits the extra all sector R&D Funding expressed as a proportion share of carbon revenues; supply: GEM-E3 mannequin. All of the panels consult with the 12 months 2050.

Panel a of Fig. 2 exhibits that carbon revenues as a proportion of GDP range considerably by nation in each carbon finances situations, relying on the regional carbon depth and the respective effort required to attain the emission reductions. Total revenues attain 2.5% and 4.1% of world GDP in 2050 within the 2 °C and 1.5 °C situations, respectively. In carbon-intensive fossil gasoline producing nations, resembling Saudi Arabia and Russia, carbon revenues are a a lot larger share of GDP, reaching 14% in 2050. Determine 2b exhibits that estimated complete R&D investments in all sectors and applied sciences, together with these focus of this research, as a share of GDP in 2050 are comparable within the two temperature goal situations. Importantly, in all areas the estimated complete R&D wants, together with low-carbon, symbolize a share of GDP consistent with present ranges, except for Argentina and South Korea (Supplementary Fig. 20 of the Supplementary Info). In oil exporting nations, Russia, and sub-saharan Africa R&D funding represents a decrease GDP share than the present (2019) share of fossil fuels subsidies (Supplementary Fig. 20 of Supplementary Info). On this case, a redirection of presidency funds would suffice to finance the R&D wanted. Attaining stringent coverage situations requires restricted elevated R&D investments, as defined above. Determine 2c exhibits that for almost all of areas, this extra R&D funding is barely a small share of carbon revenues, starting from 0.5% in Argentina to 21% in Sweden within the 1.5 °C state of affairs. The remaining carbon revenues are redirected to the economic system through a discount of payroll taxes. Our evaluation exhibits that, on the world stage, extra R&D investments between the REF and the low-carbon situations will be financed utilizing 2% of world carbon revenues. Total, our outcomes verify that R&D investments are an environment friendly technique for carbon income recycling. As soon as that is mixed with the discount of labor-related taxation, wider co-benefits can emerge. Utilizing carbon revenues to finance low-carbon R&D constitutes an efficient solution to implement the “polluter pays” precept in follow, permitting even the poorest areas to make sure some financing transactions from the polluters to the clear expertise sectors. The optimum trajectory of R&D investments is effectively aligned with the provision of carbon revenues, given that top carbon revenues are anticipated within the early years of the mitigation motion, when R&D ought to be extra intense. As soon as the economic system decarbonizes, carbon revenues grow to be low, however R&D necessities are much less pronounced.

Importantly, our state of affairs implementation considers solely the financing of extra R&D investments by way of carbon revenues and never your entire quantity which additionally consists of the R&D investments of the REF state of affairs. Conversely, the remainder of the R&D investments are financed by way of the federal government finances, as within the REF state of affairs. Financing your entire R&D investments (and never solely the extra scenario-related funds) by way of carbon revenues would quantity to 57 and 35% of world carbon revenues in 2050 within the 2 °C and 1.5 °C situations, respectively. Nevertheless, in a number of nations, carbon revenues wouldn’t be enough to finance your entire R&D investments, significantly within the 2 °C state of affairs.

We notice that the GEM-E3 evaluation doesn’t embody the extra R&D investments for power effectivity enhancements which are described within the earlier part as a result of methodological limitations in linking the 2 fashions on this respect. To deal with this limitation, we carried out post-processed calculations to evaluate if power effectivity investments may be financed by the carbon revenues. Certainly, as proven in Supplementary Fig. 16 of the Supplementary Info, all extra R&D investments (i.e., together with power effectivity) will be financed by the carbon revenues. On a regional stage, financing your entire R&D investments requires a most of 18% (22% within the 1.5 °C state of affairs) of carbon revenues in 2050. Accounting for power effectivity R&D investments nonetheless permits a big share of carbon revenues to scale back payroll taxes.

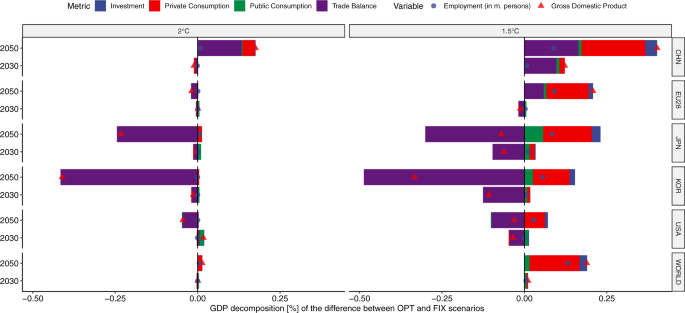

Regional macroeconomic results in main economies

R&D investments decrease the prices of unpolluted applied sciences; this in flip reduces the price of mitigation. These price reductions enhance total world financial exercise in addition to the competitiveness of sure areas. Determine 3 exhibits regional macroeconomic implications of the optimum R&D methods in relation to the non-optimal (FIX) ones for each temperature goal situations estimated with the GEM-E3 mannequin. Within the 2 °C state of affairs, GDP impacts are small as the rise of R&D investments from REF/FIX ranges by 2050 is proscribed for all applied sciences thought of by GEM-E3 mannequin, except for CCS (Fig. 1 panel b). Word that power effectivity R&D investments aren’t thought of within the GEM-E3 mannequin runs, as mentioned above. Globally, small GDP positive factors are registered in 2030 and 2050. Conversely, on the regional stage financial outcomes are extra numerous and pushed primarily by adjustments in competitiveness for clear expertise items. For instance, Japan exhibits a GDP lack of 0.23% and South Korea of 0.4% each from the respective 2 °C_FIX ranges, as a result of decrease exports of batteries to the advantage of China, whereas the latter registers a 0.18% improve in GDP in 2050 because of the larger export ranges (Supplementary Fig. 10 within the Supplementary Info).

Indicators are proven for chosen areas and for each local weather targets, supply GEM-E3 mannequin.

GDP positive factors are extra pronounced within the extra stringent 1.5 °C state of affairs. Increased R&D investments improve world GDP by 0.2% relative to the REF state of affairs in 2050 because the low-carbon transition turns into more cost effective. China is among the many nations which profit most, with a rise of 0.4% in GDP in 2050 relative to 1.5 °C_FIX ranges. This arises from the truth that the manufacturing of batteries and electrical automobiles turns into extra aggressive and thus will increase the provision in the direction of each the home and worldwide markets. Equally, the EU28 sees a 0.25% improve in GDP in 2050, as a result of each larger export ranges (significantly of superior biofuels) and to larger non-public consumption ranges. Particularly, the cheaper price of electrical energy and transportation ensuing from decrease expertise prices permits for the consumption of extra items and providers as in comparison with 1.5 °C_FIX ranges. Adjustments within the world superior biofuels markets account for a lot of the constructive macroeconomic impacts of nations resembling Argentina, Indonesia and Brazil, which present GDP positive factors of 1.2%, 0.7% and 0.13% in comparison with 1.5 °C_FIX ranges in 2050, respectively.

Globally, employment results are constructive as financial actions improve. The induced results on employment are driving outcomes regardless of the decrease availability of climate-related fiscal revenues to scale back payroll taxes because of the financing of R&D. On a regional stage, employment ranges are larger than the corresponding FIX ranges, even in instances the place financial exercise falls. Our estimates counsel that financing R&D actions brings a constructive direct multiplier impact because of the excessive labor depth of the R&D course of.

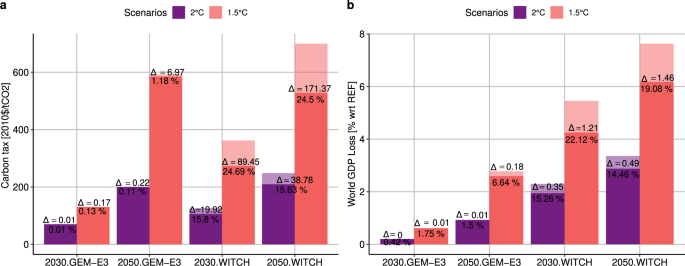

International local weather coverage prices with optimum R&D methods

Optimum R&D methods enhance the feasibility of local weather insurance policies by decreasing expertise prices and thus lowering the extent of the required carbon tax and the related world mitigation price (i.e., GDP loss as proven in Fig. 4). This result’s strong throughout each fashions and is extra pronounced in probably the most stringent local weather goal of 1.5 °C, the place emission cuts are sooner and deeper: in these instances coverage prices drop by 7–19% by mid-century. GEM-E3 outcomes point out that every $ of R&D invested corresponds to a 1.64 and eight.01 2005$ improve in GDP for a 2 °C and 1.5 °C insurance policies in 2050, respectively. Equally, for every 2005M$ of R&D funding, 7 and 96 extra persons are employed in 2050 for a 2 °C and 1.5 °C insurance policies, respectively.

a refers to GEM-E3 and b refers to WITCH. Shaded bars symbolize the FIX situations with frozen R&D investments whereas full coloured bars symbolize the optimum situations. The delta (Δ) represents the worth distinction between the 2. A constructive worth means larger GDP loss or carbon value within the FIX state of affairs with frozen R&D investments.

Dialogue

On this paper we present how optimization determination instruments can be utilized to assist coverage makers in selecting optimum R&D methods and in assessing the macroeconomic implications of R&D investments. We implement a constant multi-model framework to check optimum R&D methods to succeed in the Paris Settlement’s long-term local weather stabilization targets. This modern method combines the strengths of two well-established built-in evaluation fashions. The WITCH mannequin offers intertemporal optimization of the R&D investments; the GEM-E3 mannequin allows an in depth macroeconomic evaluation of R&D pathways and respective financing mechanisms.

Our outcomes will be summarized as follows. Impartial of the stringency of the decarbonization goal, the largest share of funding in R&D goes to batteries for automobiles and power effectivity as much as 2050. Investments in R&D ought to begin early–scaling-up in 2025–and ramp up step by step so as to permit a more cost effective transition. That is in step with earlier research29, the place an preliminary funding peak is required to begin the transition after which R&D funding can slowly lower because the learning-by-doing impact takes over within the two-factor studying curve equation. Vitality effectivity R&D investments develop steadily all through the century, as these are utilized step by step to all of the power demand sectors contributing to lowering complete power demand. The relative significance of different low carbon applied sciences differs relying on the stringency of the carbon finances: photo voltaic and wind investments are larger within the much less stringent decarbonization goal, whereas CCS is larger within the extra stringent local weather state of affairs.

For applied sciences which are already on the deployment stage, resembling wind and photo voltaic, the timing of investments is pivotal. We discover that it’s the early funding motion somewhat than excessive funding ranges that matter most to succeed in the Paris Settlement targets. Conversely, for applied sciences which are at present much less market-ready, resembling CCS, reaching stringent decarbonization targets implies a rise in R&D ranges. The relative significance of various applied sciences in numerous areas adjustments relying on the stringency of the decarbonization goal, and the dynamics of competitors between applied sciences emerge. On the one hand, the broader the portfolio of applied sciences supported by way of R&D, the decrease the worldwide prices of compliance with the long-term targets of the Paris Settlement. However, investing in much less mature (substitute) applied sciences resembling CCS reduces the necessity to put money into extra mature renewable choices.

Total, optimum R&D methods improve the feasibility of the local weather targets, decreasing carbon costs and the prices of mitigation. These outcomes are strong throughout each fashions and present the extent to which R&D is an enabler of local weather insurance policies. GDP positive factors are extra pronounced within the extra stringent 1.5 °C state of affairs. On a worldwide stage, every 2005$ of R&D invested corresponds to a 1.64 and eight.01 2005$ improve in GDP for two °C and 1.5 °C insurance policies in 2050, respectively. Equally, for every 2005M$ of R&D funding 7 and 96 extra persons are employed in 2050 for two °C and 1.5 °C insurance policies, respectively. The two °C employment effectiveness estimates are consistent with the IMF (2021)30 estimates of the restoration packages. Except South Korea, our estimated complete R&D funding wants in 2050 are decrease than the present complete R&D investments by way of share of GDP. Nevertheless, low-carbon innovation should improve considerably in all OECD nations to succeed in 1.5 °C (Supplementary Fig. 20 of the Supplementary Info). To place the extent of funding necessities into context, we present that, for oil exporting nations (e.g., Russia), the R&D investments wanted are decrease than present fossil gasoline subsidies.

Lastly, optimum R&D efforts to fulfill the two °C and 1.5 °C targets will be financed through carbon revenues at decrease world prices and with constructive results on employment. Carbon revenues allow an software of the ‘polluter pays’ precept whereas guaranteeing double dividends occurring from the elimination of pre-existing distorting taxation, resembling payroll taxes. This method mitigates the issue of uncertainty associated to much less mature applied sciences, on condition that public R&D, like another public funding, obtained from the carbon revenues, represents “affected person” capital, which is usually required/used to cowl extra dangerous and long run investments, together with these of much less mature low-carbon applied sciences resembling CCS. Particularly in the event that they create double dividends as within the case of low-carbon applied sciences. Redirecting the carbon revenues for the financing of R&D investments permits even the poorest areas to make sure the financing of innovation methods, whereas avoiding transfers to carbon-intensive investments. The perfect trajectory of R&D investments is effectively aligned with the provision of carbon revenues, given that top carbon revenues are anticipated within the early years of the mitigation motion when R&D ought to be extra intense. As soon as the economic system decarbonizes, carbon revenues grow to be low, however R&D necessities decrease as effectively. Since we solely assess one financing technique, additional analysis on the low-carbon R&D financing methods is required, together with methods to foster low-carbon R&D investments in nations with low financing capability. Nonetheless, the research factors to the centrality of innovation methods in guaranteeing the decarbonization is quick and equitable.

Strategies

RD&D investments and applied sciences

Our evaluation focuses on 5 decarbonization applied sciences—batteries for automobiles, superior biofuels, photo voltaic, wind energy, CCS—and on a package deal of measures selling power effectivity. This selection is dictated by two causes. First, these applied sciences have vital mitigation potential in key sectors of the economic system, together with the facility sector, transport and power demand providers 31. Second, we concentrate on these particular applied sciences as a result of they’re modeled as a part of the IAMs we depend on and since detailed and lengthy datasets on R&D investments and patents can be found for mannequin calibration. This naturally implies that another probably very related applied sciences aren’t thought of as a part of our research. These embody, for instance, Direct Air Seize and hydrogen. The previous is just not included as a result of its innovation dynamics are at present too unsure and never simply modeled 32. The latter, whereas being much less unsure, raises vital issues given its excessive energy-intensive manufacturing course of, which can certainly invalidate its potential relevance for a sustainable low-carbon transition 33. We, subsequently, don’t take into account the (at present extremely speculative) chance that the large-scale availability of DAC applied sciences or hydrogen could have the potential to shift investments away from renewables and different low-carbon applied sciences 34. In any case, notice that DAC depends on CCS applied sciences, that are included within the R&D funding portfolio thought of in our evaluation.

The estimates we generate relate to public R&D, except for batteries for Electrical Pushed Automobiles (EDV’s) the place a lot of the R&D investments have been carried out by the non-public sector.

Fashions

A basic description of the fashions used on this evaluation will be discovered 23(WITCH) and 24 (GEM-E3). An in depth description of how each fashions depict technological change dynamics is supplied in Supplementary Info sections 1 and a pair of. Right here we point out two essential options of the fashions that are related for this evaluation. First, each mannequin formulations embody two-factor studying curves, i.e., prices modeled as a reducing operate of put in capability and investments in R&D 35. This enables accounting for 2 essential determinants of innovation and related prices discount, particularly funding in analysis and of rising markets (i.e., capability). The previous is extra related within the early phases of innovation, the latter turns into more and more vital as applied sciences mature and enter the market 36. Significantly, learning-by-doing can result in expertise enhancements over time37. Certainly, the two-factor studying curve captures price decreases arising from each the information inventory, by way of R&D funding, and from expertise diffusion by way of larger deployment. Second, each fashions additionally combine information spillovers to mirror the function of overseas information in home innovation23,38,39. This key function permits to mannequin R&D funding choices that construct on the constructive information externality arising from R&D 40.

All the educational charges used have been taken from literature, as proven in Desk 1. The educational fee values are considerably normative. As well as, at this stage of technological element, learning-by-doing and learning-by-researching charges are sometimes estimated individually, i.e., by totally different research specializing in both the previous or the latter. This raises potential issues of at the least partially double counting. Given all this, it’s subsequently essential to carry out sensitivity evaluation on these studying fee parameters to validate the robustness of outcomes and to focus on the extent of potential change to various assumptions. Sensitivity is offered in Part 4 of the Supplementary Info. This sensitivity exhibits that, except for superior biofuels and wind, R&D investments aren’t very delicate to adjustments in studying charges. Superior biofuels and wind, alternatively, present sensitivity to adjustments of their studying charges. For superior biofuels this solely occurs within the 1.5 °C state of affairs, that means that the stringency of the goal is the essential parameter and studying charges solely provoke adjustments in R&D funding quantities and never a lot in deployment. For wind, R&D investments could range considerably however this stays a low share of the R&D low-carbon investments. The time lag from funding to information technology is 5 years; the assumed information shares depreciation fee is 0.05. Each are consistent with the out there literature. Moreover, we’ve got harmonized the expertise ground prices and the preliminary information shares.

Determine 5 summarizes the soft-linking method adopted on this research, which permits us to mix an estimation of the optimum trajectory for R&D investments with a constant evaluation of financing insurance policies and price estimations. Particularly, the method allows the calculation of the optimum stage of R&D funding considering all specificities of the innovation course of (time lag characterizing the returns to R&D funding, substitution and complementarity of various low-carbon expertise choices, full-century optimization) whereas integrating an R&D financing coverage through carbon revenues. This enables us to discover and talk about the macroeconomic and employment implications of various funding decisions.

The orange arrow represents the revenues from the local weather coverage being recycled to finance the R&D investments.

The sequencing of our methodology is as follows. First, WITCH calculates the worldwide and regional R&D optimum funding stage by expertise and local weather coverage goal. This serves as enter for the GEM-E3 mannequin. Particularly, to ascertain a harmonized mannequin framework, WITCH offers the next inputs to the GEM-E3 mannequin: (i) the worldwide CO2 emission pathways, (ii) the R&D information inventory by expertise and area, (iii) the R&D funding by expertise (except for power effectivity measures) and area. Second, the GEM-E3 mannequin offers an in depth evaluation of the funding mechanism to assist R&D investments and examines the monetary feasibility of the optimum R&D pathways. The GEM-E3 mannequin options excessive sectoral and regional element and endogenous bilateral commerce in a closed CGE framework. This arrange ensures a constant financing of R&D funding and the evaluation of macroeconomic and competitiveness impacts 41.

When it comes to carbon value ranges, the carbon tax is estimated within the WITCH mannequin by iteration till the coverage targets are reached, and endogenously in GEM-E3 (to attain the emission trajectory supplied in every state of affairs).

Eventualities

The Reference (REF) state of affairs, which serves as some extent of comparability, has the next traits: for the WITCH mannequin, it’s equal to the SSP2 “center of the street’ baseline state of affairs as outlined in42, assuming no improve in coverage stringency. The SSP2 state of affairs has been broadly utilized by IAMs as their baseline reference state of affairs42,43,44. For the GEM-E3 mannequin, the REF state of affairs consists of present insurance policies as described in ref. 45 for the quick time period, incorporating local weather and power insurance policies legislated as of 2017; inhabitants and socioeconomic projections are consistent with the European Fee Ageing Report 2019 and the projections by UN and OECD. After 2030, assumptions are in step with SSP2, as described above.

Desk 2 illustrates the coverage situations modeled in our evaluation, whose key traits are widespread to each fashions. A standard local weather coverage state of affairs that contains a stylized world mitigation motion in step with constraining world common temperature improve by 2100 to effectively under 2 °C. That is achieved by imposing a carbon finances (CB) of 1460 and 710 GtCO2 for the interval 2011–2100 (for particulars see ref. 2). Each fashions simulate two variants of this local weather goal state of affairs. The primary assumes the enabling of optimum R&D funding (“OPT”); the second doesn’t permit for R&D funding on the chosen low-carbon applied sciences; as an alternative, R&D investments are fastened on the REF ranges (“FIX”).

The carbon budgets are the cumulative CO2 Emissions counting from the 12 months 2010 to 2100, particularly the quantity of carbon emission that coverage makers’ can nonetheless “spend” so as to obtain a given temperature goal with a 66% likelihood. Coverage makers can select to spend the carbon finances otherwise over time. As an example, if by the 12 months 2050 the carbon finances is already spent, all of the emissions from 2050 to 2100 must be web zero if the given goal must be achieved. Within the WITCH mannequin, the carbon finances is achieved by imposing a worldwide carbon tax that’s discovered iteratively till the focused finances has been reached. Within the GEM-E3 mannequin, carbon taxes are endogenously estimated by the mannequin so as to obtain the worldwide emission pathway supplied by WITCH.

Knowledge availability

The information generated on this research have been deposited within the zenodo database underneath accession code DOI 10.5281/zenodo.7755725.

Code availability

We used the WITCH Built-in Evaluation Mannequin together with the MAGICC v6. The MAGICC mannequin will be downloaded in https://magicc.org/. The WITCH mannequin (https://doc.witchmodel.org/) has an open-source model out there in https://github.com/witch-team/witchmodel (https://doi.org/10.5281/zenodo.7734713). The GEM-E3 mannequin is just not out there open-source.

References

-

Gambhir, A., Rogelj, J., Luderer, G., Few, S. & Napp, T. Vitality system adjustments in 1.5C, effectively under 2C and 2C situations. Vitality Technique Rev. 23, 69–80 (2019).

Google Scholar

-

Luderer, G. et al. Residual fossil CO2 emissions in 1.5C pathways. Nat. Clim. Change 8, 626–633 (2018).

Google Scholar

-

UNFCCC, Technological Innovation for the Paris Settlement, TEC Temporary #10, https://unfccc.int/ttclear/misc_/StaticFiles/gnwoerk_static/brief10/8c3ce94c20144fd5a8b0c06fefff6633/57440a5fa1244fd8b8cd13eb4413b4f6.pdf, (2017).

-

UNFCCC. Expertise framework underneath Article 10, paragraph 4, of the Paris Settlement (2021).

-

I. E. A. Monitoring Clear Vitality Innovation, https://www.iea.org/stories/tracking-clean-energy-innovation (2020).

-

Blanford, G. J. R&D funding technique for local weather change. Vitality Econ. 31, S27–S36 (2009).

Google Scholar

-

Mazzucato, M. Entrepreneurial State Debunking Public vs. Personal Sector Myths, Anthem Press (2015).

-

Worldwide Vitality Company, I. E. A. Particular Report on Clear Vitality Innovation—Vitality Expertise Views, OECD. (2020).

-

Anadon, L. D., Baker, E., Bosetti, V. & Reis, L. A. Skilled views – and disagreements – concerning the potential of power expertise R&D. Clim. Change 136, 677–691 (2016).

Google Scholar

-

Jamasb, T. Technical change concept and studying curves: patterns of progress in electrical energy technology applied sciences. Vitality J. 28, 51–71 (2007).

Google Scholar

-

Nemet, G. F. How Photo voltaic Vitality Grew to become Low-cost, Routledge (2019).

-

IEA. International EV Outlook 2021. https://www.iea.org/stories/global-ev-outlook-2021 (2021).

-

IEA. RD&D Funds, Vitality Expertise RD&D Statistics (database), OECD Publishing (2021).

-

Peñasco, C., Anadón, L. D. & Verdolini, E. Systematic evaluate of the outcomes and trade-offs of ten sorts of decarbonization coverage devices. Nat. Clim. Change 11, 257–265 (2021).

Google Scholar

-

Anadón, L. D., Baker, E. & Bosetti, V. Integrating uncertainty into public power analysis and growth choices. Nat. Vitality 2, 17071 (2017).

Google Scholar

-

Edler, J. & Fagerberg, J. Innovation coverage: what, why, and the way. Oxf. Rev. Financial Coverage 33, 2–23 (2017).

Google Scholar

-

Markard, J. The following section of the power transition and its implications for analysis and coverage. Nat. Vitality 3, 628–633 (2018).

Google Scholar

-

Grossman, G. M. & Shapiro, C. Optimum dynamic R&D packages. RAND J. Econ. 17, 581 (1986).

Google Scholar

-

Heuberger, C. F., Staffell, I., Shah, N. & Dowell, N. M. Impression of myopic decision-making and disruptive occasions in energy programs planning. Nat. Vitality 3, 634–640 (2018).

Google Scholar

-

Stram, B. N. A brand new strategic plan for a carbon tax. Vitality Coverage 73, 519–523 (2014).

Google Scholar

-

Polzin, F. & Sanders, M. Methods to finance the transition to low-carbon power in Europe?. Vitality Coverage 147, 111863 (2020).

Google Scholar

-

Steffen, B. & Schmidt, T. S. Strengthen finance in sustainability transitions analysis. Environ. Innov. Societal Transit. 41, 77–80 (2021).

Google Scholar

-

Emmerling, J. et al. The WITCH 2016 Mannequin – Documentation and Implementation of the Shared Socioeconomic Pathways. (2016).

-

P. Capros, D. Van Regemorter, L. Paroussos and P. Karkatsoulis, GEM-E3 mannequin guide. https://e3modelling.com/modelling-tools/gem-e3/ (2017).

-

Bakker, G. Cash for nothing: how companies have financed R&D-projects because the industrial revolution. Res. Coverage 42, 1793–1814 (2013).

Google Scholar

-

Rogelj, J. et al. Vitality system transformations for limiting end-of-century warming to under 1.5 textdegreeC. Nat. Clim. Change 5, 519–527 (2015).

Google Scholar

-

UNEP, Programme, United Nations Setting, Emissions Hole Report 2021: The Warmth Is On – A World of Local weather Guarantees Not But Delivered, 2021-10.

-

OECD, Ahead-looking Eventualities of Local weather Finance Supplied and Mobilised by Developed International locations in 2021-2025, OECD, 2021.

-

Marangoni, G. & Tavoni, M. The clear power R&D technique for 2C. Clim. Change Econ. 05, 1440003 (2014).

Google Scholar

-

I. M. F. Worldwide Financial Fund, PUBLIC INVESTMENT FOR THE RECOVERY. (2020).

-

Rogelj, J., et al. Mitigation Pathways Suitable with 1.5 °C within the Context of Sustainable Improvement. In: International Warming of 1.5 °C. An IPCC Particular Report on the impacts of world warming of 1.5 °C above pre-industrial ranges and associated world greenhouse gasoline emission pathways, within the context of strengthening the worldwide response to the specter of local weather change, sustainable growth, and efforts to eradicate poverty. https://www.ipcc.ch/web site/belongings/uploads/websites/2/2019/02/SR15_Chapter2_Low_Res.pdf (2018).

-

Grant, N., Hawkes, A., Mittal, S. & Gambhir, A. The coverage implications of an unsure carbon dioxide elimination potential. Joule 5, 2593–2605 (2021).

Google Scholar

-

Lane, B., Reed, J., Shaffer, B. & Samuelsen, S. Forecasting renewable hydrogen manufacturing expertise shares underneath price uncertainty. Int. J. Hydrog. Vitality 46, 27293–27306 (2021).

Google Scholar

-

van Vuuren, D. P. et al. Different pathways to the 1.5C goal cut back the necessity for destructive emission applied sciences. Nat. Clim. Change 8, 391–397 (2018).

Google Scholar

-

Paroussos, L., Fragkiadakis, Okay. & Fragkos, P. Macro-economic evaluation of inexperienced development insurance policies: the function of finance and technical progress in Italian inexperienced development. Climatic Change 160, 591–608 (2019).

Google Scholar

-

Bettencourt, L. M. A., Trancik, J. E. & Kaur, J. Determinants of the tempo of world innovation in power applied sciences. PLoS ONE 8, e67864 (2013).

Google Scholar

-

Arrow, Okay. J. The financial implications of studying by doing. Rev. Financial Stud. 29, 155 (1962).

Google Scholar

-

Fragkiadakis, Okay., Fragkos, P. & Paroussos, L. Low-carbon R&D can increase EU development and competitiveness. Energies 13, 5236 (2020).

Google Scholar

-

Verdolini, E. & Galeotti, M. At dwelling and overseas: an empirical evaluation of innovation and diffusion in power applied sciences. J. Environ. Econ. Manag. 61, 119–134 (2011).

Google Scholar

-

Caballero, R. J. & Jaffe, A. B. How Excessive are the Giants’ Shoulders: An Empirical Evaluation of Data Spillovers and Artistic Destruction in a Mannequin of Financial Development. 1993.

-

Vrontisi, Z., Charalampidis, I. & Paroussos, L. What are the impacts of local weather insurance policies on commerce? A quantified evaluation of the Paris Settlement for the G20 economies. Vitality Coverage 139, 111376 (2020).

Google Scholar

-

Riahi, Okay. et al. The Shared Socioeconomic Pathways and their power, land use, and greenhouse gasoline emissions implications: an summary. Glob. Environ. Change 42, 153–168 (2017).

Google Scholar

-

Roelfsema, M. et al. Taking inventory of nationwide local weather insurance policies to judge implementation of the Paris Settlement. Nat. Commun. 11, 2096 (2020).

Google Scholar

-

van Soest, H. L. & Aleluia Reis, L. et al. International roll-out of complete coverage measures could assist in bridging emissions hole. Nat. Commun. 12, 6419 (2021).

Google Scholar

-

Vrontisi, Z., Fragkiadakis, Okay., Kannavou, M. & Capros, P. Vitality system transition and macroeconomic impacts of a European decarbonization motion in the direction of a under 2C local weather stabilization. Clim. Change 162, 1857–1875 (2019).

Google Scholar

-

Handayani, Okay., Krozer, Y. & Filatova, T. From fossil fuels to renewables: an evaluation of long-term situations contemplating technological studying. Vitality Coverage 127, 134–146 (2019).

Google Scholar

-

European Fee, E. C.; Joint Analysis Centre, J. R. C. Value growth of low carbon power applied sciences: state of affairs based mostly price trajectories to 2050, 2017 version., Publications Workplace (2018).

-

Verdolini, E., Anadón, L. D., Baker, E., Bosetti, V. & Reis, L. A. Future prospects for power applied sciences: insights from knowledgeable elicitations. Rev. Environ. Econ. Coverage 12, 133–153 (2018).

Google Scholar

-

Louwen, A., Junginger, M. & Krishnan, A. Technological Learningin Vitality Modelling:Expertise Curves. https://reflex-project.eu/wp-content/uploads/2018/12/REFLEX_policy_brief_Experience_curves_12_2018.pdf (2018).

-

Rubin, E. S., Azevedo, I. M. L., Jaramillo, P. & Yeh, S. A evaluate of studying charges for electrical energy provide applied sciences. Vitality Coverage 86, 198–218 (2015).

Google Scholar

-

Mayer, T., Kreyenberg, D., Wind, J. & Braun, F. Feasibility research of 2020 goal prices for PEM gasoline cells and lithium-ion batteries: a two-factor expertise curve method. Int. J. Hydrog. Vitality 37, 14463–14474 (2012).

Google Scholar

Acknowledgements

This work has acquired funding from the 2D4D ERC PROJECT (E.V.) underneath the Grant settlement No 85348; the European Union’s Horizon 2020 analysis and innovation program underneath grant settlement no. 821471 (ENGAGE) (Z.V. and Okay.F.), no. 730403 (INNOPATHS) (L.A.R.), no. 821124 (NAVIGATE) (M.T.); and the H2020 DEEDS challenge underneath the grant settlement 642242 (L.A.R. and Z.V.).

Creator data

Authors and Affiliations

Contributions

L.A.R. carried out the WITCH modeling work, made the figures, participated within the evaluation and dialogue of the outcomes and wrote the article. Z.V. participated within the evaluation and dialogue of the outcomes and wrote the article. Okay.F. carried out the GEM-E3 modeling work. E.V. ready the empirical information for the WITCH growth. E.V. and M.T. participated within the evaluation and dialogue and wrote the paper.

Corresponding authors

Ethics declarations

Competing pursuits

The authors declare no competing pursuits.

Peer evaluate

Peer evaluate data

Nature Communications thanks Nadia Ameli and the opposite, nameless, reviewer(s) for his or her contribution to the peer evaluate of this work.

Further data

Writer’s notice Springer Nature stays impartial with regard to jurisdictional claims in revealed maps and institutional affiliations.

Supplementary data

Supplementary Info

Rights and permissions

Open Entry This text is licensed underneath a Artistic Commons Attribution 4.0 Worldwide License, which allows use, sharing, adaptation, distribution and copy in any medium or format, so long as you give applicable credit score to the unique creator(s) and the supply, present a hyperlink to the Artistic Commons license, and point out if adjustments have been made. The pictures or different third celebration materials on this article are included within the article’s Artistic Commons license, until indicated in any other case in a credit score line to the fabric. If materials is just not included within the article’s Artistic Commons license and your meant use is just not permitted by statutory regulation or exceeds the permitted use, you have to to acquire permission immediately from the copyright holder. To view a duplicate of this license, go to http://creativecommons.org/licenses/by/4.0/.

Reprints and Permissions

About this text

Cite this text

Aleluia Reis, L., Vrontisi, Z., Verdolini, E. et al. A analysis and growth funding technique to attain the Paris local weather settlement.

Nat Commun 14, 3581 (2023). https://doi.org/10.1038/s41467-023-38620-4

-

Obtained: 04 February 2022

-

Accepted: 10 Might 2023

-

Revealed: 16 June 2023

-

DOI: https://doi.org/10.1038/s41467-023-38620-4

Feedback

By submitting a remark you comply with abide by our Phrases and Group Tips. If you happen to discover one thing abusive or that doesn’t adjust to our phrases or tips please flag it as inappropriate.

Adblock take a look at (Why?)