Supply: Aditya Birla Solar Life AMC Ltd.

Supply: Aditya Birla Solar Life AMC Ltd.

Certainly one of India’s high fund managers is popping bullish on higher-yielding rupee company bonds based mostly on the view that the nation’s restoration will outpace the consensus estimate of economists.

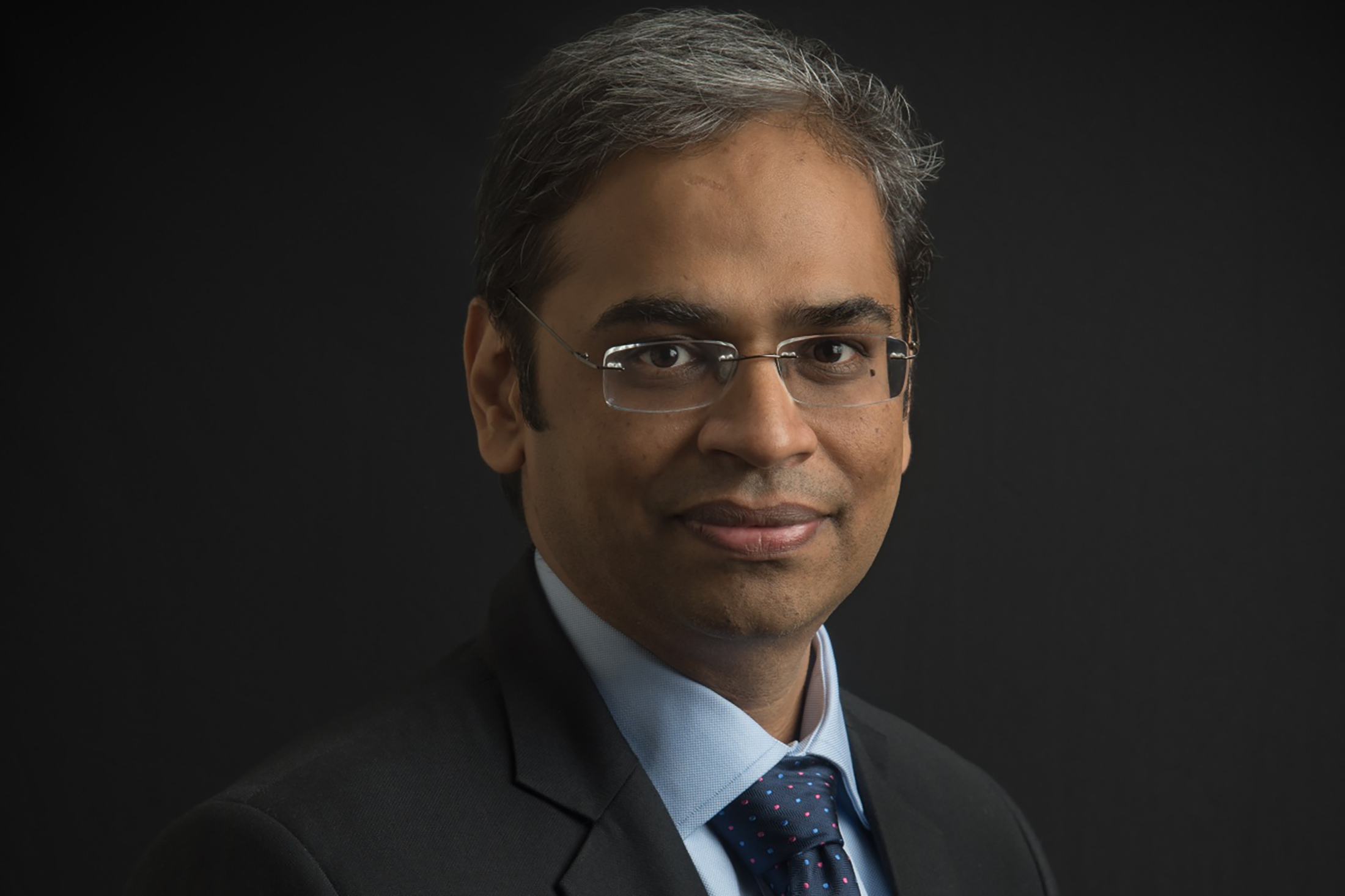

Maneesh Dangi, who oversees $25 billion of debt property at Aditya Birla Solar Life AMC Ltd., expects India’s economic system to develop by 13% within the fiscal yr beginning April, in contrast with a median forecast of 9% by economists surveyed by Bloomberg. Dangi bases his outlook partly on optimism in regards to the jobless charge falling after lockdowns have been eased in addition to coverage steps serving to reduce insolvencies.

Aditya Birla Solar Life Company Bond Fund is the third-best performer amongst India’s mutual funds targeted on the corporate word class previously yr with an 11.4% return on its common funding plan, based on information from the Affiliation of Mutual Funds in India.

“We’ll begin dialing up AA threat,” stated Dangi, 44, referring to company bonds with credit score scores within the AA class. “High quality AA rated papers the place yields haven’t compressed to pre-Covid ranges are providing engaging returns.”

That method should cope with quite a few dangers. Whereas the federal government has stated financial indicators recommend a broad-based restoration forward, it forecasts the worst contraction since 1952 for the present fiscal yr. Latest Covid-19 resurgence in nations that, like India, had success after strict earlier lockdowns can be a reminder of how unpredictable the disaster will be. And the nation is nonetheless house to one of many world’s largest outbreaks globally.

Dangi stated the “greatest threat” to his technique could be any untimely withdrawal of assist measures to counter the pandemic, and he careworn that officers face a fragile activity in speaking with debt markets.

Final week introduced a stark warning on that account. Yield premiums on rupee company bonds jumped after falling to report lows in 2020, following an announcement by the central financial institution that it might drain money from the market in an effort to normalize liquidity operations.

Dangi had been lowering holdings of all however the most secure company bonds lately till of late. He had finished so due to a credit score disaster triggered by the failure of a giant shadow financial institution in 2018 that stung native markets even earlier than the pandemic.

Examine RBI assuring bond traders over its straightforward financial stance

Now, although, he’s eager on shopping for debt from corporations which might be more likely to get upgraded to AA within the close to future. He has additionally shortlisted just a few non-AAA rated debtors from sectors together with commodities, chemical substances and car parts, which may gain advantage from any sharp financial restoration.