Crypto arbitrage is a novel buying and selling technique utilized by traders throughout all types of asset buying and selling markets. The aim is for traders to capitalize on slight value discrepancies of digital property throughout quite a lot of a number of markets and throughout quite a few exchanges.

Within the case of the OKEx trade, there are a selection of various arbitrage buying and selling choices; these are Cross-market arbitrage, supply contract arbitrage, capital fee arbitrage, lending after shopping for + contract hedging arbitrage, and foreign money mining.

All of most of these buying and selling methods differ when it comes to danger degree, however all of them might be carried out by beginner merchants with low capital for funding. So, with out additional adieu, let’s dig deeper into the kinds of arbitrage buying and selling.

1. Cross-market arbitrage

OKEx Saving →FTX

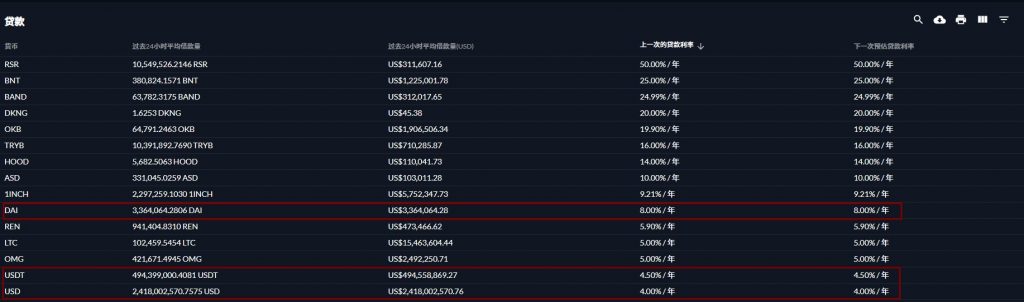

FTX’s UDST rate of interest is about at 4-5%, which means customers can deposit BTC, ETH, amongst different common currencies on the OK platform. This distinctive platform transfers USDT by means of a cross-currency margin account, deposits to the FTX platform for a mortgage, and offers an revenue. Customers can work together with different small cash in the same means, providing the prospect to borrow low-interest charges cash from the OK platform and deposit to FTX to lend.

FTX→OKEx Saving

Since FTX’s OKB rate of interest is decrease than OK’s 36.5%, merchants might think about borrowing OKB from FTX and depositing it in Financial savings.

Dangers and Countermeasures

The value of collateral can rapidly fluctuate, in addition to the very fact it takes time to redeem and shut positions. The countermeasure is to make use of an API to watch value fluctuations in real-time or the platform to supply customers with alarm messages/emails. This enables customers to maintain monitor of market actions and it means they will redeem and shut their positions upfront.

2. Supply Contract Arbitrage

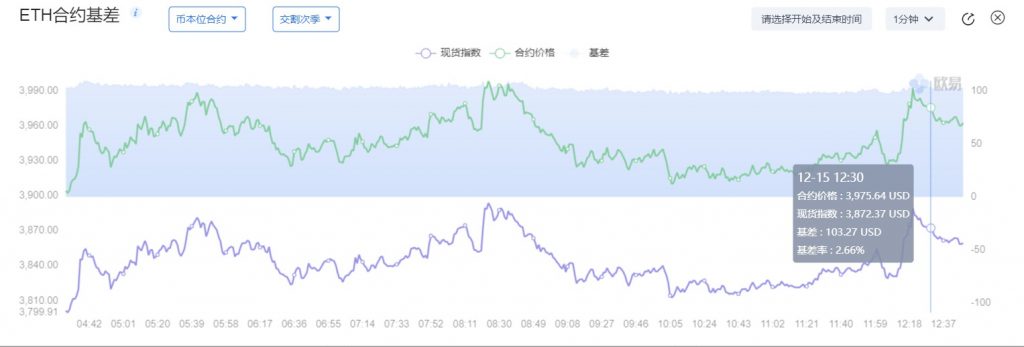

ETH within the second quarter contract for example, there’s a foundation of roughly 2.66%. Because the contract is nearer to the supply date, the value is nearer to the spot value. So, as time goes by, the unfold will regularly return to zero.

Subsequently, you possibly can borrow USDT leverage to realize an extended place with ETH, with a USDT borrowing rate of interest of 1%, merchants can quick an ETH second-quarter contract on the identical time. Then, shut or watch for supply (when supply is approaching) and acquire revenue.

Dangers and Countermeasures

1. If the idea expands throughout this era—floating losses could happen, however so long as it persists till supply—the ultimate foundation have to be zero. The countermeasure is to contemplate a specific amount of floating loss tolerance when opening a place or getting ready an emergency fund as a contingency. To assist with this, the platform additionally has a corresponding alarm message.

2. Throughout this era, the price of borrowing cash elevated. On this case, no satisfactory consumer countermeasures have been considered in the interim. Usually talking, conventional markets use rate of interest forwards or use rate of interest derivatives to hedge dangers.

3. Capital Price Arbitrage

At present appropriate for customers who’ve the power to make use of the API. This may change as soon as the arbitrage began has launched, which means most customers will be capable of make use of the API.

Constructive Funding Price Arbitrage

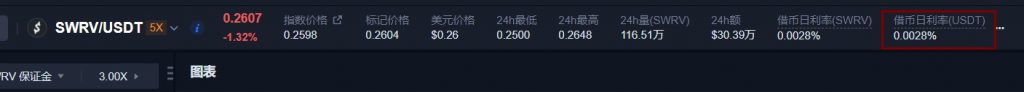

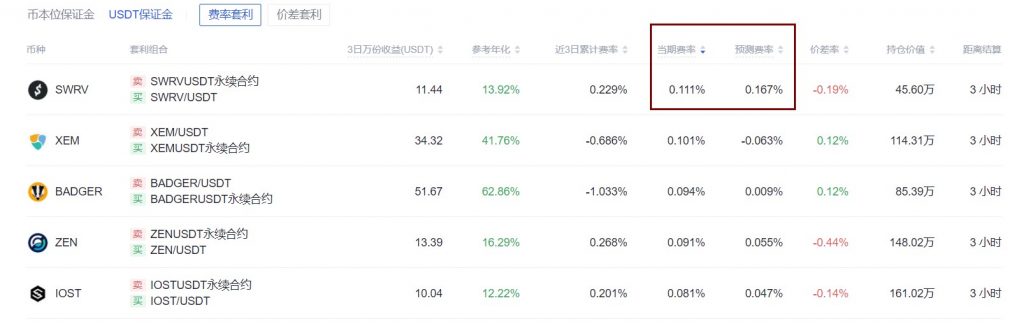

For instance, SWRV’s present funding fee is comparatively excessive, so you possibly can think about shorting the SWRV contract to earn a funding fee. Nonetheless, as a result of arbitrageurs don’t need to bear the losses attributable to the rise in SWRV costs, they will think about shopping for SWRV spot hedges, however the utilization fee of funds isn’t significantly excessive. Within the case of low USDT rates of interest, merchants can borrow USDT with leverage at a really low price, purchase SWRV with leverage, and quick SWRV contracts on the identical time to earn funding charges.

Adverse Funding Price Arbitrage

For instance, the SLP rate of interest is 1%, however not too long ago the funding fee has stabilized and is detrimental. For one of these foreign money, SLP might be bought with leverage, whereas the contract is lengthy SLP. As such, the value fluctuation of SLP won’t convey revenue or loss. You may profit purely from the funding fee.

Dangers and Countermeasures

1. Funding fee arbitrage is appropriate for customers with low dealing with charges, as a result of open legs and an elevated quantity of transactions.

2. It’s mandatory to regulate the variety of positions on each side to be principally the identical. At present, it’s also mandatory to make use of the API for stock administration, which can be utilized instantly after the arbitrage technique is launched.

3. Usually, small foreign money fund charges are comparatively excessive, and when the fund fee is unstable or reversed, though foundation revenue might be generated, it isn’t simple for big funds to enter and exit. The countermeasure is to regulate positions and distribute them to numerous currencies appropriate for arbitrage.

4. Lending After Shopping for + Contract Hedging Arbitrage

For currencies with increased rates of interest, you possibly can think about instantly shopping for and depositing Yubibao to make a revenue. Nonetheless, as the value of small cash could fall and trigger losses, you possibly can think about shorting contracts to hedge dangers.

Dangers and Countermeasures

Dangers and Countermeasures

1. The contract capital fee could also be detrimental. If the capital fee loss is bigger than the borrowing revenue, the arbitrage will lose cash as an alternative.

2. When the foreign money value rises quickly, Yubibao’s inner cash can not act as a margin, which can trigger the contract aspect to be liquidated. The countermeasure is to permit Yubibao’s funds to behave as a margin for platform growth.

5. Forex Mining

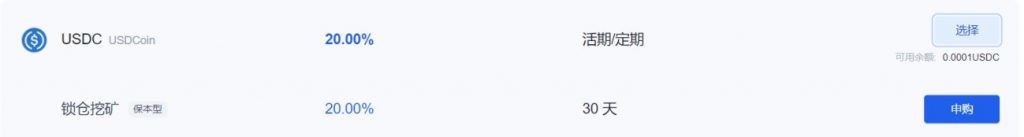

You may think about using BTC and ETH to borrow USDT and trade it for USDC lock-up mining.

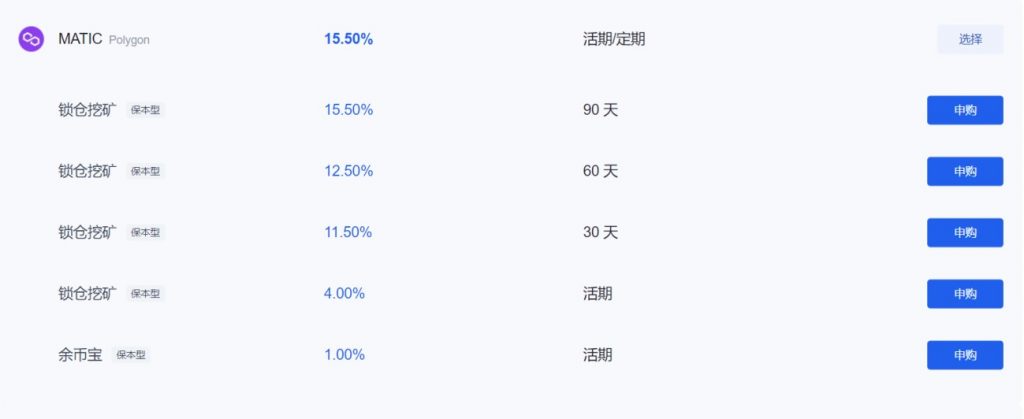

Take MATIC for example. Numerous currencies have spot mining, and you may think about borrowing the foreign money on to put money into lock-up mining.

Closing ideas

Whether or not you’re beginning out in buying and selling or a seasoned veteran of the crypto market, the fantastic thing about arbitrage buying and selling is that exchanges like OKEx enable customers to automate the method of discovering the commerce value discrepancies throughout varied currencies. With using the native API, OKEx customers will be capable of monitor value fluctuations in real-time and begin benefiting from arbitrage buying and selling.