That is the second in a collection on how Joe Biden’s $1.9tn stimulus plan will have an effect on the US, markets and the worldwide financial system.

America’s huge spending programme has added gasoline to a robust upheaval in world shares, boosting shares in firms that have been shunned throughout the peak of the pandemic.

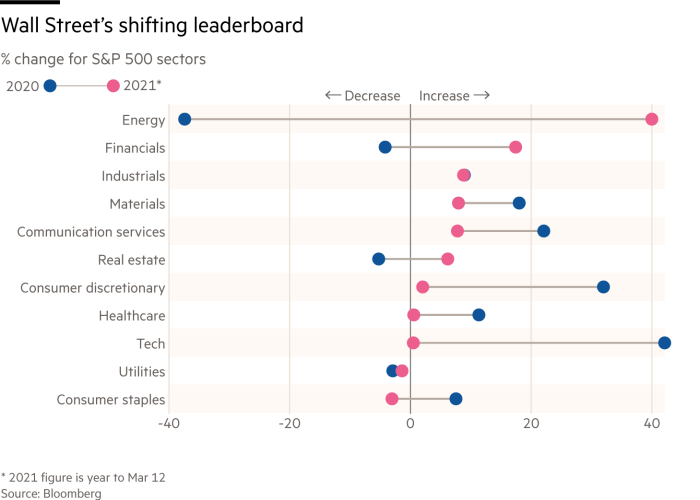

The benchmark US shares index, the S&P 500, is usually easily pushing greater, because it has achieved for months. However some tech shares, particularly, have pulled again laborious. As a substitute, lengthy unloved sectors like banks and vitality firms are taking the lead, reordering market dominance on bourses from New York, to London and Frankfurt.

The shake-up means that the $1.9tn US spending invoice handed by America’s Congress and signed into legislation by the president final week, mixed with vaccine rollouts and the reopening of the world’s main economies, will kick off a markedly totally different section in markets to the rally of the previous 12 months.

“There’s not all that a lot occurring on the floor however beneath it’s violent and ugly,” stated Meghan Shue, head of funding technique at Wilmington Belief.

Traders have piled into banks, that are thought of notably delicate to fluctuations on the planet financial system. MSCI’s index of shares in lenders throughout world developed markets, soared practically 30 per cent within the last three months of final 12 months and has added one other 20 per cent in 2021.

The sturdy run for banks highlights the shift in buyers’ outlook prompted partially by the Biden administration’s plan to pump cash into the world’s largest financial system and into the pockets of many Individuals. The president’s announcement final week that he would search to deliver a way of regular again to America by July 4 bolstered this attitude.

It has boosted expectations for progress and inflation within the US and all over the world, and pushed borrowing prices sharply greater — a boon to banks that had languished as central banks lower rates of interest final 12 months to prop up economies after the collapse in output brought on by the pandemic.

Traders have additionally stampeded into sectors reminiscent of supplies, commodities, client items and industrials in latest weeks, sending costs greater.

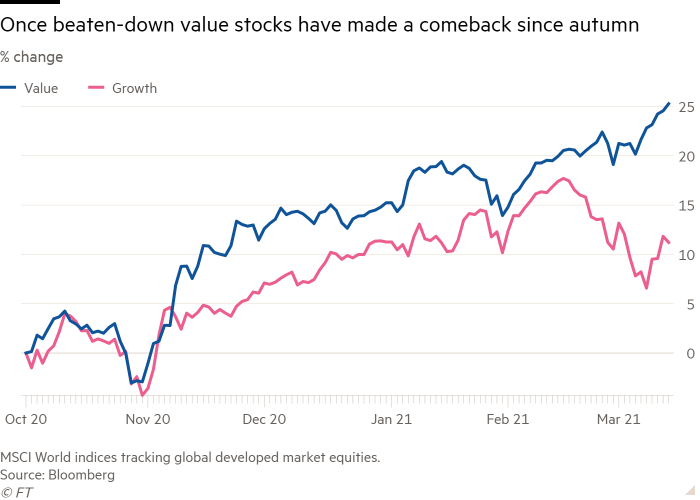

MSCI’s world worth index, which tracks firms that commerce at low ranges in contrast with measures of their honest worth, has risen 8.7 per cent for the reason that begin of the 12 months, and reached an all-time excessive final Thursday. This marks a change from final 12 months, when the index fell 3.6 per cent, extensively trailing an MSCI barometer of quickly rising firms that soared 33 per cent.

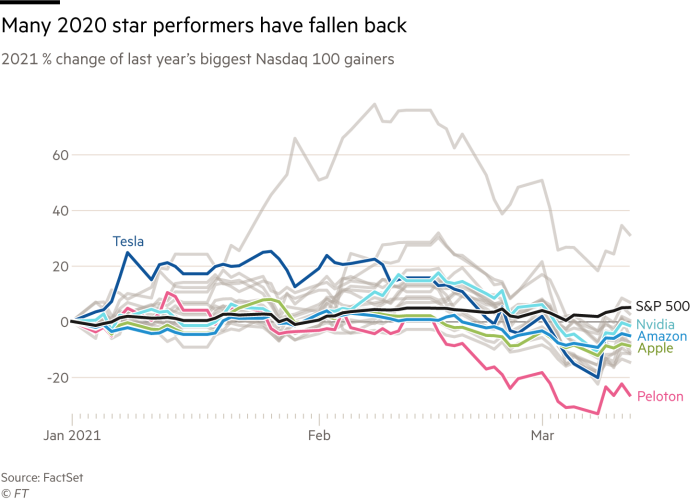

Final 12 months’s star performers like electrical carmaker Tesla, at-home health group Peloton, tech large Apple, ecommerce website Amazon and graphics chipmaker NVdia have stumbled from their peaks.

America’s S&P 500 vitality, monetary, industrial and supplies sectors have all shone. That has come as a various group of economically-sensitive firms like oil main ExxonMobil, heavy equipment maker Caterpillar, lender Wells Fargo and miner Freeport-McMoRan have recorded lofty beneficial properties.

“Final 12 months, progress was scarce and progress shares have been doing properly, and now progress is ample and essentially the most underpriced shares are those which might be doing properly,” stated Juha Seppala, director of macro asset allocation technique at UBS Asset Administration. “This 12 months, that rotation goes to proceed and worth goes to outperform progress.”

Worth funds, which are sometimes closely invested in among the sectors that have been hit laborious prior to now 12 months, have additionally seen a flood of latest cash. US-domiciled open-ended and exchange-traded worth funds tracked by Morningstar Direct recorded $6.3bn in internet inflows in February alone, up from $1.3bn in January after nearly a full 12 months of internet outflows all through the pandemic. Progress funds sustained $18bn in internet outflows in January, earlier than pulling in $3bn in February.

“Folks rotating out of large-cap progress and momentum and into these extra worth, cyclical-type elements . . . has positively ramped up,” stated Michael Lewis, head of US fairness money buying and selling at Barclays. “It’s grow to be one thing that everyone’s targeted on prior to now two months.”

Juliette Cohen, funding strategist at Paris-based CPR Asset Administration, expressed comparable optimism about Europe’s outdated financial system firms. “European firms which might be uncovered to world markets are actually uncovered to the reopening commerce,” she stated.

Europe’s Stoxx 600 fairness benchmark has risen 6 per cent up to now in 2021, placing it inside touching distance of its pre-pandemic excessive final February. The economic items and companies subsector of the index, comprising firms reminiscent of German conglomerate Siemens and plane producer Airbus, has risen 8 per cent.

The UK’s FTSE 250, a domestically targeted index with heavy weightings of monetary, industrial and client companies is “in regards to the purest reopening commerce on the planet,” added Savvas Savouri, associate and chief economist at London-based hedge fund Toscafund.

The gauge is up 5 per cent in 2021, including to a climb of round 1 / 4 within the last three months of 2020. “It’s all firms that want our bodies to be transferring across the financial system. You’ve got acquired brickmakers, housebuilders, retailers, eating places. It’s actually bricks and mortar,” he stated.

Goldman Sachs Asset Administration can be taking a look at pockets within the expertise sector to play the reopening commerce.

“So, not your Amazons, the Facebooks or Apples, however relatively the businesses which might be making all of the chips and make the semiconductors,” stated Tim Braude, a senior funding supervisor at GSAM.

“From our perspective, it’s not too late to get in,” he stated in regards to the reopening commerce. “We predict that we’re simply beginning.”