Inexperienced bonds. Blue bonds. Brown bonds. Environmentally-conscious buyers could quickly have the ability to purchase a unique coloration of asset on daily basis of the week.

Report demand for sustainable finance is spurring this rainbow of debt sorts by governments and firms, to fund more and more particular methods of mitigating local weather change. Whereas inexperienced bonds — which pledge their proceeds to finance wind farms or photo voltaic parks — are the dominant species, a few of these labels have to this point remained comparatively area of interest.

Discover dynamic updates of the earth’s key information factors

That’s set to vary as a market now price over $2 trillion develops quickly, and as monetary engineers create new methods to model such debt. The better selection is a boon for the rising cohort of specialist funds with moral mandates, but additionally creates extra due diligence in an asset class already missing readability due to a scarcity of uniform requirements.

“It’s complicated,” mentioned Taimur Hyat, chief working officer for PGIM, including extra common guidelines and fewer fragmentation can be “extraordinarily useful” for PGIM to make use of its $1.5 trillion in property to help the transition to a greener planet. “Clear pointers may even keep away from the danger for the notion for any greenwashing within the trade.”

It’s solely 5 years because the world’s first inexperienced sovereign debt was issued by coal-reliant Poland, to assist transition to a lower-carbon financial system. Now the rising spin-offs embrace blue bonds to fund marine initiatives, brown or transition bonds for industries too soiled to do inexperienced, nature bonds for biodiversity and carbon impartial to attain net-zero emissions. Then there’s additionally social bonds to assist society and sustainability-linked bonds to set organization-wide targets.

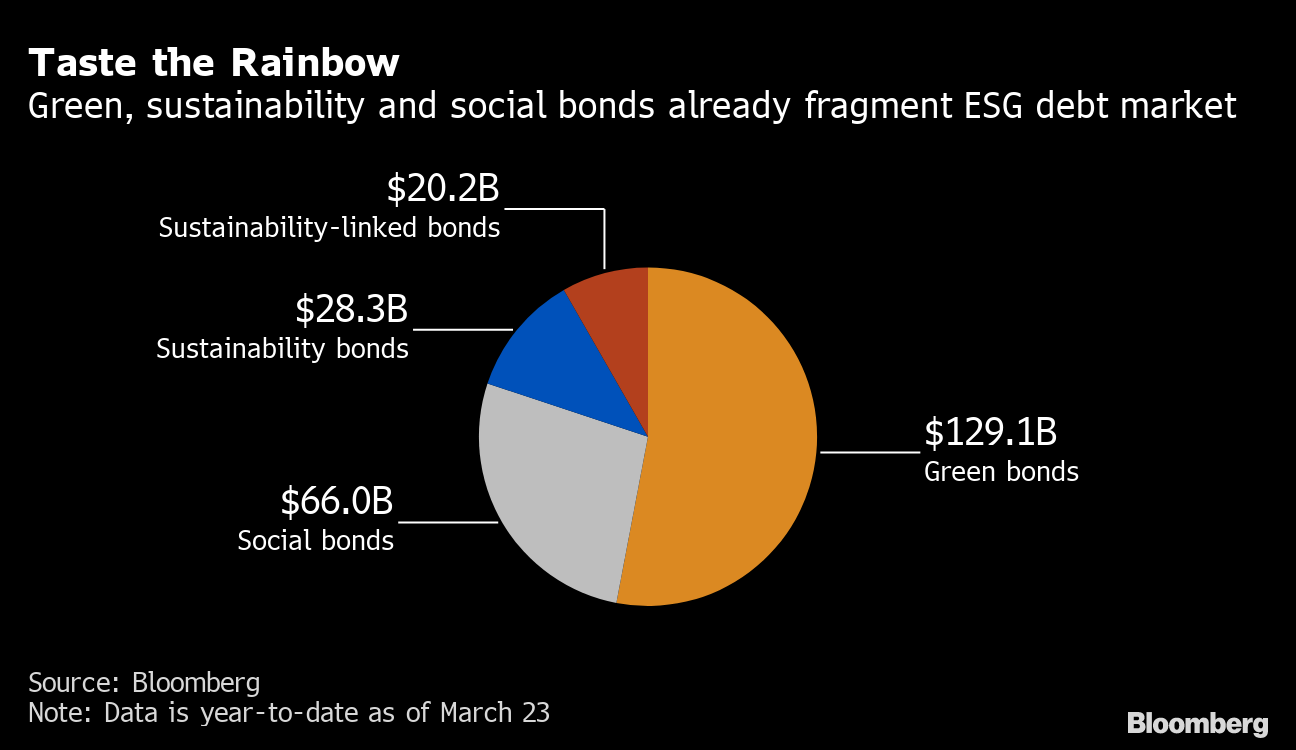

Style the Rainbow

Inexperienced, sustainability and social bonds already fragment ESG debt market

Supply: Bloomberg

Chinese language banks issued their first blue and carbon-neutral bonds in latest months. Junk-rated firms in Latin America are becoming a member of a European increase in SLBs given indicators they’ll get decrease borrowing prices, in addition to increase their picture. Pakistan is searching for debt aid by providing nature-performance bonds to rewild land this yr, whereas the World Financial institution could debut wildlife conservation bonds to defend rhinos in Africa.

The European Union has already damaged market demand data with its social bonds. Authorities stimulus to recuperate from the pandemic, along with a raft of net-zero ambitions, might “turbo-charge this pattern and contribute to a pointy rise in sustainability-linked loans and thematic bonds in 2021 and 2022,” mentioned Gabriel Wilson-Otto, international head of sustainability analysis at BNP Paribas Asset Administration.

Competing Guidelines

The growing fragmentation is at odds with calls by regulators for complete guidelines to make clear the credentials of debtors and their choices. The world’s largest trade physique for sustainable finance mentioned Thursday the trade wants international requirements and urged world leaders to behave this yr.

There are indicators worldwide coverage makers are rising to the problem. Joe Biden’s authorities is planning a U.S. inexperienced finance framework that ought to begin to take form by June, in accordance with folks familar with the matter. The U.S. and Europe might have an equivalent algorithm that decide what counts as inexperienced funding, French Finance Minister Bruno Le Maire mentioned this month.

Inexperienced bonds pledge their proceeds to finance wind farms or photo voltaic parks.

Photographer: Dwayne Senior/Bloomberg

And China can also be working with its European counterparts to announce a standard inexperienced taxonomy this yr, to outline and classify inexperienced initiatives. That problem might be mentioned at October’s Group of 20 conferences in Rome.

“It’s acknowledged that the plethora of thematic labels available in the market leaves room for confusion,” mentioned Esohe Denise Odaro, chair of inexperienced, social and sustainability-linked bond ideas on the Worldwide Capital Markets Affiliation, which is probably the most extensively adopted to this point. “Finally, it’s the choice of an issuer tips on how to model their bond. Traders are extra involved with the underlying integrity of the bonds.”

Even in Europe, the place sustainable bonds make up greater than 20% of this yr’s gross sales, there are not any set definitions on what constitutes a inexperienced undertaking. Particular person international locations have created their very own as they push forward with issuance earlier than the EU’s guidelines come out. Whereas these are anticipated to be rigorous, there are issues member states gained’t have to stick to them.

The Asia-Pacific area is much more liable to fragmentation. Singapore’s financial authority is consulting on a potential inexperienced taxonomy for Southeast Asia, although neighbors Malaysia and Indonesia have already got their very own plans. China, too, has a catalogue of acceptable initiatives that stress the necessity to sort out the nation’s specific ecological and useful resource pressures.

Spoiled for Selection

The proliferation is at the least offering environmental, social and governance buyers with a broader array of property than ever earlier than.

“We’re delighted to more and more be ‘spoiled for selection’ within the mounted revenue house, as for a few years this asset class lagged in its consideration to socially-responsible investing,” mentioned Ron Bates, managing director and portfolio supervisor at 1919 Funding Counsel. Analyzing the different sorts isn’t that completely different from buyers historically reviewing the tenor, rankings, and liquidity of each new deal, he mentioned.

However to realize broader acceptance to faucet international capital, the market could in the end must grow to be extra streamlined. Transition bonds had been touted as having large potential to assist oil firms transfer into renewables, but there are nonetheless few such offers to this point. Some corporations are sticking to inexperienced bonds — regardless of the scrutiny that entails.

And inside inexperienced bonds, there’s additionally a myriad of shades — mild to darkish inexperienced — as a brand new breed of rankings firms attempt to give buyers better readability on simply how kosher the choices are.

“If you wish to faucet into the mainstream capital markets, you could go the place the mainstream buyers are,” mentioned Christopher Kaminker, who leads the sustainable funding group at Lombard Odier Funding Managers, referring to the established inexperienced bond market. “We all know it’s confirmed that it’s mainstream and scalable.”

— With help by Todd Gillespie, and Tom Freke

(Updates with name for international requirements in eighth paragraph.)