Blink and also you may need missed the stock-market selloff blamed on the White Home’s purported plans to hike the capital-gains tax fee on America’s wealthiest buyers.

After falling greater than 320 factors, or 0.9%, for its greatest one-day drop since early March, the Dow Jones Industrial Common

DJIA,

on Friday took again a piece of these losses. The S&P 500

SPX,

which additionally tumbled 0.9% on Thursday, ended with a acquire of 1.1% after briefly buying and selling above its its document closing excessive from April 16.

The drop, which got here Thursday afternoon, was extensively blamed on information studies that President Joe Biden would suggest mountaineering the capital-gains tax fee on folks incomes greater than $1 million a yr from 20% to 39.6%. Mixed with an present surcharge, excessive revenue people would face a capital-gains fee of as excessive as 43.4%, Bloomberg famous.

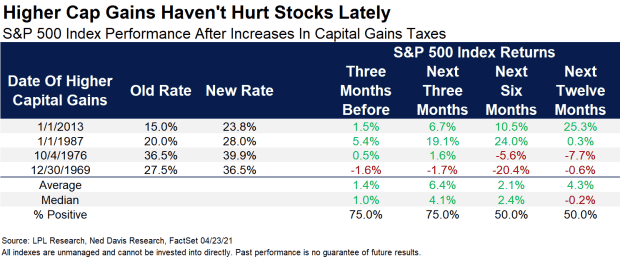

Cue the quantity crunchers, who have been fast to level out an necessary reality about modifications within the capital-gains tax fee: historical past exhibits they don’t have a lot, if any, impact on stock-market returns.

In the latest instance, capital-gains tax charges jumped by practically 9 proportion factors in 2013 however shares rose 30% that yr, famous Mark Haefele, chief funding officer for world wealth administration at UBS, in a word.

“As well as, we discover no correlation between capital-gains tax charges and fairness market valuations,” Haefele wrote. “Value-to-earnings multiples have been as little as 10x when the capital-gains tax fee was 20%, and as excessive as 18x when it was 35%. In the end, different elements such because the outlook for financial progress, financial coverage, and rates of interest are way more highly effective drivers of fairness market returns and

valuations.”

Within the chart under, LPL Monetary’s Ryan Detrick broke down the S&P 500’s efficiency following 4 previous hikes within the capital-gains fee going again to 1969:

LPL Monetary

“Effectively, on the floor you’d suppose larger taxes wouldn’t be factor, however that’s truly not actuality,” Detrick stated, in a word. “The truth is, the previous two instances we had a rise within the capital-gains tax shares did rather well for the subsequent six months in 1987 and 2013.”

TaxWatch: Biden has pledged to tax the wealthy — however exactly how will he try this? Consultants take into account his choices

Shares did poorly after the hikes of 1969 and 1976, which appears to make for a blended bag. However Detrick famous that the financial system was already performing poorly in 1969 and 1976, whereas it was wholesome in 1987 and 2013.

Detrick stated for now he would facet with a powerful financial system and accommodative Federal Reserve permitting the market to take tax hikes in stride.

There’s additionally uncertainty over what is going to in the end move Congress. Some congressional Democrats, to not point out most Republicans, are prone to oppose the proposed improve. Economists at Goldman Sachs predicted the speed would possible rise to twenty-eight% reasonably than the proposed 39.6%.

That doesn’t imply it received’t have any impact in the marketplace. There’s uncertainty over when the tax can be prone to take impact. If not retroactive, the hike would possible set off a bout of promoting earlier than it takes impact. Goldman analysts famous that the wealthiest households offered 1% of their equities when the speed rose in 2013.

Have to Know: Prepare for $178 billion of promoting forward of the capital-gains tax hike. These are the shares most in danger

“If it’s handed for this tax yr, we may see some promoting in the direction of the tip of 2021 as buyers get forward of the change,” stated Callie Cox, senior funding strategist for Ally Make investments, in a word.

“However on this interval of excessive progress, we’d count on the market to digest a capital-gains fee change simpler than extra materials dangers like an inflation scare or a Fed coverage change,” she stated.

Analysts additionally famous that the proposal, as reported, was largely consistent with Biden’s 2020 election marketing campaign pledges and shouldn’t have come as a shock. The preliminary market response could say extra about investor psychology.

“With a number of excellent news already priced into markets, shares might be susceptible to unfavorable surprises, whether or not from progress disappointments, larger inflation, or coverage missteps,” Haefele stated. “Because of this, the plan may contribute to pockets of volatility forward.”

However Cox stated the market’s response appeared like a “wholesome growth.”

“It’s an indication that buyers aren’t too exuberant they usually’re desirous about what might be lurking across the nook,” she wrote. “That could be an impediment for features within the short-term, however a wholesome degree of concern may in the end hold this bull rally intact.”