This

article is dedicated to a well-known tech evaluation instrument, which is divergence.

No matter being so well-known and standard amongst merchants, divergences

introduced lots of people to a lamentable state. I feel, it’s because loads

of merchants who had a foul expertise with divergences in Foreign exchange, futures, or

inventory markets, used it for catching reversals. And looking reversals with any

kind of tech evaluation is sort of tough. That’s the reason we’ll step except for this

doubtful subject and focus on buying and selling the development.

Indicators for catching

divergences by development

Open and AUD/USD chart and set up to it two most

standard indicators for locating divergences – the MACD and Stochastic. I in contrast their efficacy within the

similar market scenario and, actually, Stochastic is not any worse than the MACD for

catching divergences; quite the opposite, typically it even does a greater job.

Therefore, for figuring out divergences in uptrends and downtrends, we’ll use the

Stochastic Oscillator.

Allow us to

depart the parameters commonplace for neither you not me to get confused. There’s

no want altering issues that work fairly properly. So long as the indicator seems to be

like two traces, I’ll point out it individually that I draw a divergence by way of

the very best tops/deepest bottoms whatever the line that varieties them.

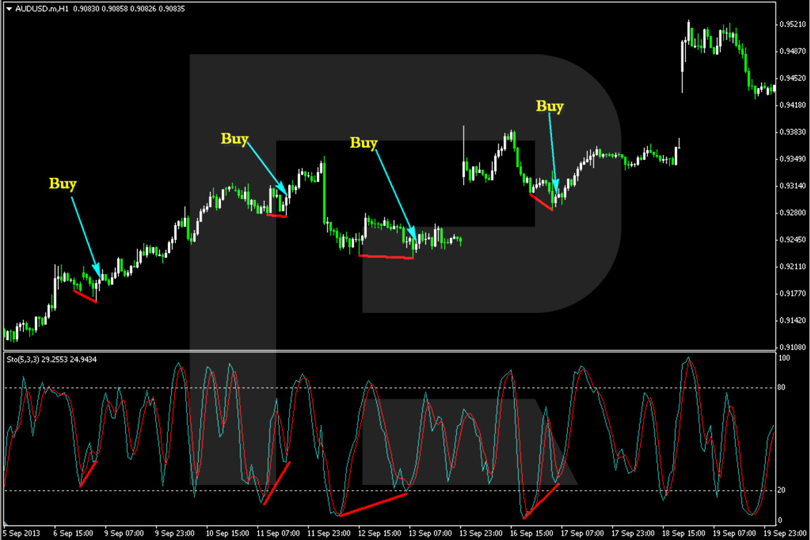

A sign to purchase from a

divergence by development

In an

uptrend, when a divergence by the development varieties, a sign to purchase will seem if:

- The

second native low of the 2 essential for a divergence by the development is

full; - The

second native low of the 2 essential for a divergence by the development on the

Stochastic is full as properly; - The

traces drawn by way of the 2 native lows on the chart and Stochastic are

converging to their proper.

Judging by

these divergences I managed to search out within the Aussie earlier than I began this

article, it’s no value relying on getting into at a greater worth than the one you

see when the sign seems.

Typically

the value pulls again a bit throughout a candlestick or two, however usually no deeper

than the tip of the primary low of the 2 that create the divergence. Therefore,

higher enter by the market worth, proper after the sign seems or by a

pending order on the smallest potential distance from the present worth.

By the best way,

it’s tremendous fascinating that the second excessive broke falsely by way of the extent

of the primary one. If the breakaway is true, the chance that the bullish

sign will work is likely to be decrease.

Examples of

a sign to purchase:

As you see,

solely the second entry sign by the development to the left might lie idle, however you

could switch the place to the breakeven many occasions, so this sign can be

thought of optimistic.

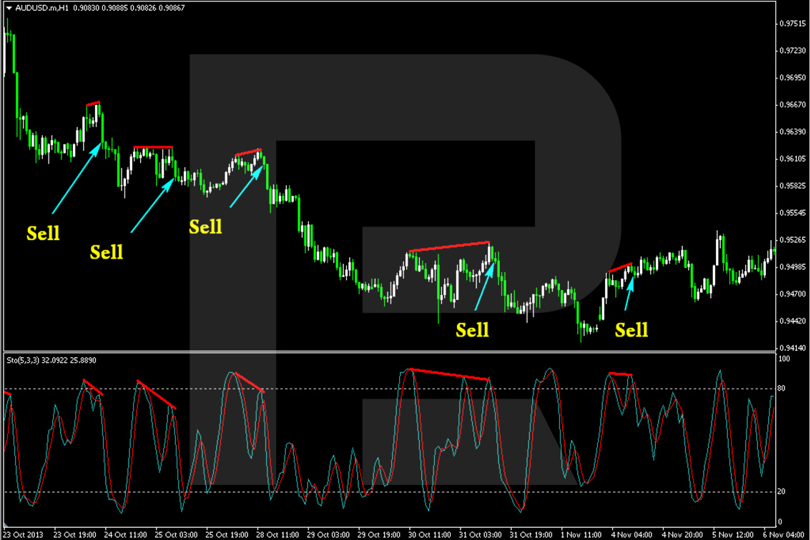

A sign to promote from a divergence

by development

In a

downtrend, with a divergence shaped by the development, a sign to promote can be a

second when:

- The

second native excessive of the 2 essential for a divergence by the development is

full; - The

second native excessive of the 2 essential for a divergence by the development on the

Stochastic is full as properly; - The

traces drawn by way of the 2 native highs on the chart and Stochastic are

converging to their left.

And on this

a part of the chart, solely the final one of many divergences seems to be 100%

shedding. However if you happen to recall my recommendation to make use of solely these divergences during which the

second excessive breaks by way of the extent of the primary one falsely, you’ll not

use this solely shedding sign on the chart as a result of on this case, the breakaway of

the primary excessive was true.

Take Revenue and Cease Loss

By this

technique, Cease Losses are positioned above the very best excessive

of the divergence in a bearish development and underneath the bottom low of the divergence

in a bullish development. You may drag it after newly rising extremes together with

the value heading for the revenue. In both development, it’s best to drag the SL to

the breakeven utilizing each acceptable excessive, whereas when the place will get

protected against losses, strive utilizing solely these extremes that appear to you secure from

additional testing. As a rule, an excessive is safer when it takes lengthy to kind.

As for the Take Revenue, place it based on your

expertise and the market scenario. When you see the development exhausting or the

market caught at a degree, these is likely to be the moments to find out a spot for

your TP.

Cash administration

Utilizing this

technique for the primary month, by no means danger greater than 1% of your deposit – take

your time to search out good and promising divergences by a bearish/bullish development. As

properly as take your time to really feel how the value behaves after the sign seems.

Once you adapt absolutely, you could enhance your danger to 2% however by no means extra.

To sum up,

I might remind you that this can be very important to decide on a timeframe that’s

good for you and never essentially the one I’m providing you with examples on, or some

Jack down the road recommends you. Additionally, you want a number of persistence if you happen to

commerce in Foreign exchange or on the futures market. Nicely, similar with shares. All people

is aware of that 70% of time the market spends in doubtful flats. And the technique

requires clear uptrend and downtrends that take solely 30% of buying and selling time.

By

Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Adblock take a look at (Why?)