The greenback rose Monday and Asian shares had been blended as merchants weighed the implications of upper U.S. Treasury yields amid President-elect Joe Biden’s push for enormous fiscal assist to battle the impression of the pandemic.

The greenback climbed a 3rd day in opposition to main friends and Treasury futures had been flat. Japan’s fairness market is shut for a vacation and money Treasuries gained’t commerce till the London open. An Asian share gauge fluctuated as South Korea turned decrease after earlier rising as a lot as 3.6%. S&P 500 futures dipped.

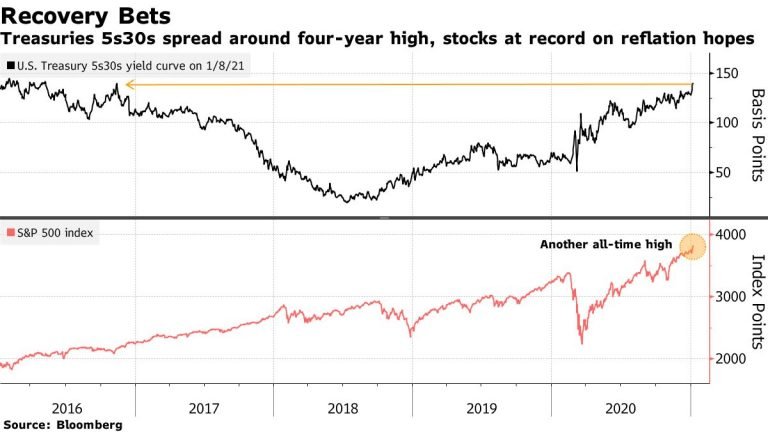

U.S. shares hit a report Friday after Biden mentioned he’ll lay out proposals this week for trillions of {dollars} in fiscal help to battle the financial toll of surging virus circumstances. Oil pared a few of final week’s leap and gold fell additional.

The fairness rally has paused initially of the week as buyers consider stretched valuations and a few indicators that international shares could also be working too sizzling. Shares and Treasury yields have climbed on expectations of a worldwide restoration pushed by stimulus and eventual management of the pandemic with the assistance of vaccines. Increased yields may buoy demand for the greenback.

“After being bullish for a number of months, we’re positively changing into extra cautious on the inventory market up at these ranges,” Matt Maley, the chief market strategist at Miller Tabak + Co., wrote in a observe. He added the “greenback is so extraordinarily oversold, over-hated, and over-shorted that all of it however has to rally for some time at some point.”

Learn: Inventory Market Jackpot Bells Simply Preserve Ringing

The Democratic Social gathering underneath Biden is ready to manage each homes of Congress as soon as he takes cost, however successful assent for bold outlays — similar to $2,000 stimulus checks — could but be a problem in a Senate that can be break up 50-50 with Republicans. In the meantime, President Donald Trump enters the ultimate days of his presidency dealing with a potential impeachment decision after being blamed for inciting final week’s lethal riot on the U.S. Capitol.

Biden’s looming coverage duties after his inauguration subsequent week embrace dealing with escalating stress with Beijing. China’s state-run media known as for retaliation after the Trump administration mentioned the U.S. will take away self-imposed curbs on diplomatic interactions with Taiwan. China claims the island as its territory.

On the virus entrance, Japan mentioned it discovered a brand new pressure of the coronavirus with similarities to the variants within the U.Ok. and South Africa. The Asian nation mentioned it’s troublesome to right away decide how infectious the pressure is or the effectiveness of present vaccines in opposition to it.

Elsewhere, Bitcoin retreated from Friday’s excessive of about $42,000.

Listed here are some key occasions developing:

These are a number of the most important strikes in markets:

Shares

- S&P 500 futures slid 0.7% as of 1:50 p.m. in Tokyo. The S&P 500 index rose 0.6% on Friday.

- Australia’s S&P/ASX 200 index fell 0.8%.

- South Korea’s Kospi index dropped 0.8%.

- Shanghai Composite index fell 0.2%.

- Hong Kong’s Grasp Seng index rose 0.9%.

Currencies

- The Bloomberg Greenback Spot Index superior 0.5%.

- The yen fell 0.2% to 104.19 per greenback.

- The euro slipped 0.4% $1.2170.

- The pound misplaced 0.5% to $1.3499.

- The offshore yuan fell 0.4% to six.4873 per greenback.

Bonds

- The yield on 10-year Treasuries climbed 4 foundation factors to 1.12% on Friday.

Commodities

- West Texas Intermediate crude fell 0.9% to $51.78 a barrel.

- Gold dropped 0.9% to $1,831.86 an oz..

— With help by Joanna Ossinger

Let’s block adverts! (Why?)