A small mutual-fund supplier has made historical past by turning into the primary to formally change its merchandise into exchange-traded funds.

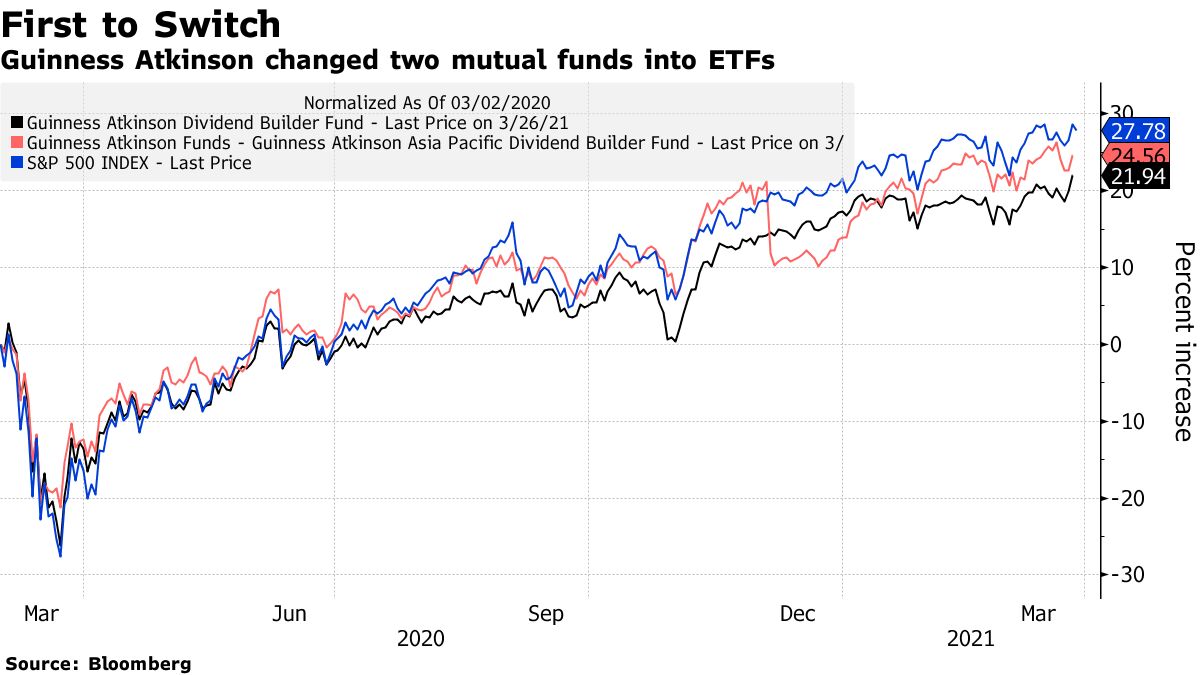

Guinness Atkinson Funds introduced on Monday that it had transformed two of its mutual funds into the SmartETFs Dividend Builder (ticker DIVS) and SmartETFs Asia Pacific Dividend Builder (ADIV). The conversion was a non-taxable occasion for shareholders, and the funds will retain their efficiency historical past.

It’s a giant second for the $5.9 trillion U.S. ETF business, which has lengthy been thought of the scrappy upstart to the extra established, mature marketplace for mutual funds.

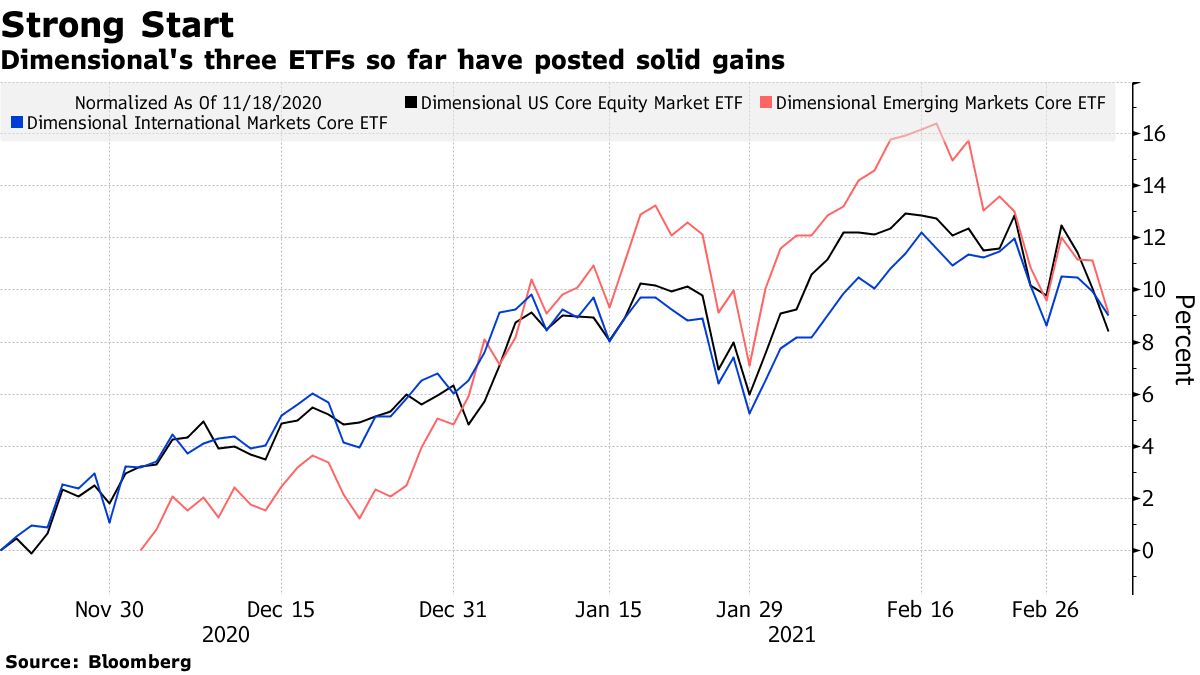

Typically decrease prices, simpler entry and tax benefits imply ETFs have been luring belongings away from mutual funds for years, and this week’s conversions could possibly be the beginning of a wave. Quant big Dimensional Fund Advisors is already subsequent in line, with a much more substantial change set to happen subsequent month.

“It might shake up the panorama a bit of,” mentioned Sal Bruno, chief funding officer of IndexIQ. “The primary one goes to be probably the most tough, however as soon as that highway will get paved a bit of bit, I believe we’ll see some extra are available in.”

New Dimension

The U.S. ETF business took in nearly $500 billion final yr, whereas mutual funds misplaced about $362 billion, in line with information compiled by Bloomberg. That’s helped push whole ETF belongings up from about $4 trillion at the moment in 2020.

Bloomberg Intelligence estimates lively managers might convey $100 billion to the ETF business via the mutual-fund conversions in addition to different inner asset strikes.

Los Angeles-based Guinness Atkinson is already planning to transform its Different Power Fund into the SmartETFs Sustainable Power ETF. However the small measurement of its funds — DIVS has $23 million and ADIV has $4.4 million — imply all Wall Avenue eyes are actually set to show to Dimensional.

The Austin, Texas-based supervisor of $601 billion will begin changing round $26 billion value of mutual funds into ETFs starting in early June. That can catapult the agency to develop into one of many 12 largest ETF issuers within the U.S., in line with Bloomberg Intelligence. It solely entered the market final yr.

Whereas the Guinness Atkinson conversion is formally the primary, the shift of belongings between the fund courses has lengthy been an business characteristic. Most notably, Vanguard Group has been changing some mutual-fund holdings to lower-cost ETFs, though these are structured as a share class inside the mutual-fund enterprise.

In the meantime, not each mutual fund can simply rework into an ETF. Many have broad a number of share courses and are distributed throughout a wide range of platforms, in line with Ben Johnson, director of worldwide ETF analysis at Morningstar Inc.

“For instance, it could be tough and customarily inadvisable to transform a mutual fund that’s predominantly owned in employer-sponsored retirement applications into an ETF,” he mentioned. “Most of those applications don’t have the plumbing to accommodate ETFs and the advantages of the ETF wrapper don’t have the identical attraction in a tax-deferred setting that’s designed for long-term financial savings.”

Pot Luck

The brand new Guinness Atkinson ETFs acquired off to a sluggish begin, with solely $27,000 value of shares traded in DIVS and $25,000 in ADIV throughout their first day.

All the identical, the conversions mark a brand new part within the tug-of-war between the buildings. Even because the agency was finalizing the switches, yet one more supervisor — Adaptive Investments — was submitting to vary a few of its mutual funds into ETFs.

Additionally within the queue is a small hashish fund, which completely encapsulates why issuers want to make the bounce.

Foothill Capital Administration’s Hashish Development Fund (CANNX) has returned greater than 140% up to now 12 months, however regardless of its success has lower than $7 million in belongings.

In distinction, pot ETFs have been having fun with file recognition. The ETFMG Different Harvest ETF (MJ), which has returned 95% up to now yr, has $1.8 billion in belongings.

“Managers are getting more proficient at figuring out the profit that the ETF might current,” mentioned Ryan Sullivan, senior vice chairman of Brown Brothers Harriman’s international ETF providers. “That ought to give them a tailwind to get their boards comfy with it.”

(Updates with first day buying and selling numbers in thirteenth paragraph)