In a transfer that can assist traders to make a extra knowledgeable funding resolution, capital markets regulator Securities and Change Board of India (SEBI) has made it necessary for mutual funds to assign a threat stage to schemes, based mostly on sure parameters.

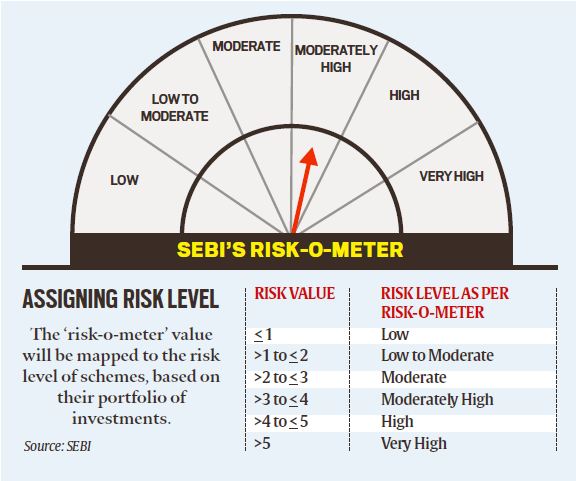

SEBI’s resolution on the “risk-o-meter”, which it introduced on October 5, 2020, got here into impact on January 1. In its round issued on October 5, the regulator made it necessary for mutual fund homes to characterise the chance stage of their schemes on a six-stage scale from “Low” to “Very Excessive”.

How will the risk-o-meter work?

As per the October 5 round, all mutual funds shall, starting January 1, assign a threat stage to their schemes on the time of launch, based mostly on the scheme’s traits.

The chance-o-meter should be evaluated on a month-to-month foundation. Fund homes are required to reveal the risko-o-meter threat stage together with the portfolio disclosure for all their schemes on their very own web sites in addition to the web site of the Affiliation of Mutual Funds in India (AMFI) inside 10 days of the shut of every month.

Any change within the risk-o-meter studying with regard to a scheme shall be communicated to the unit-holders of that scheme, SEBI has mentioned.

Supply: SEBI

Supply: SEBI

How is that this completely different from the older class threat stage?

There was a form of risk-o-meter for mutual funds since 2015; nonetheless, the schemes merely confirmed the chance stage of the class that they belonged to. They didn’t mirror the riskiness of particular person schemes and their respective portfolios.

Subsequently, all massive cap schemes — or some other class of schemes — throughout fund homes, carried the identical threat stage (one in all 5 dangers ranges) that was assigned by SEBI to the class to which they belonged.

This has modified with impact from January 1 this yr. Fund homes should now assign a threat stage out of six obtainable ranges — the “Very Excessive” class is new — after calculating their threat worth from their respective portfolios.

📣 JOIN NOW 📣: The Categorical Defined Telegram Channel

Because the threat worth and threat ranges could be arrived at after considering essential parameters resembling credit score threat, rate of interest threat, and liquidity threat in case of a debt scheme, and parameters resembling market capitalisation, volatility, and affect price in case of an fairness scheme, trade consultants really feel that the risk-o-meter will now present a extra goal evaluation of the riskiness of a specific scheme to potential traders.

Many really feel that the sooner class risk-o-meter was in a manner deceptive — the class risk-o-meter had no reference to the schemes, and two schemes of two completely different fund homes in the identical class would mirror the identical threat stage, although that they had very completely different portfolios and riskiness profiles.

Now, if in the identical class, one scheme is producing a better return than others, traders will be capable of work out whether it is, in truth, taking a better threat than others for producing these superior returns. In impact, this provides one other layer of knowledge to make an funding resolution.

How will the extent of threat be assigned?

Which one of many six threat ranges — low, low to reasonable, reasonable, reasonably excessive, excessive, and really excessive — would apply, would rely on the chance worth (lower than 1 for low threat to greater than 5 for very excessive threat) calculated for the scheme. So if the chance worth of a scheme is lower than 1, its threat stage could be low, and whether it is extra the 5, the chance can be very excessive on the risk-o-meter.

How will the chance worth be calculated?

For an fairness portfolio, the chance worth could be a easy common of market capitalisation worth, volatility worth, and affect price worth.

Whereas market cap worth of a portfolio can be based mostly on the weighted common of the market capitalisation values of every safety (5 for big cap, 7 for mid cap and 9 for small cap), the volatility threat worth of the portfolio would be the weighted common of the volatility worth of every safety (5 for every day volatility of as much as 1, and 6 for higher than 1).

As for affect price worth, which is a measure of liquidity, the worth could be the weighted common of affect price values of every safety (5 in case of common month-to-month affect price of as much as 1; 7 for that between 1 and a couple of; and 9 for that above 2).

The chance worth for the debt portfolio could be a easy common of credit score threat worth, rate of interest threat worth, and liquidity threat worth. Nonetheless, if the liquidity threat worth is increased than the common of credit score threat worth, liquidity threat worth, and rate of interest threat worth, then the worth of liquidity threat shall be thought-about as threat worth of the debt portfolio.

Whereas the credit score threat worth of the portfolio could be assigned 1 for AAA rated and 12 for devices beneath funding grade, the rate of interest threat can be valued utilizing the Macaulay Length of the portfolio (1 for period beneath 0.5 years and 6 for these with period of over 4 years). (Macaulay Length is the weighted common time for which a bond needs to be held so that the full current worth of money flows obtained matches the present market value paid for the bond.)

For measuring the liquidity threat of schemes, itemizing standing, credit standing, and construction of debt devices is taken into account (1 for Gsec and AAA-rated PSUs, and 14 for beneath funding grade and unrated debt securities).