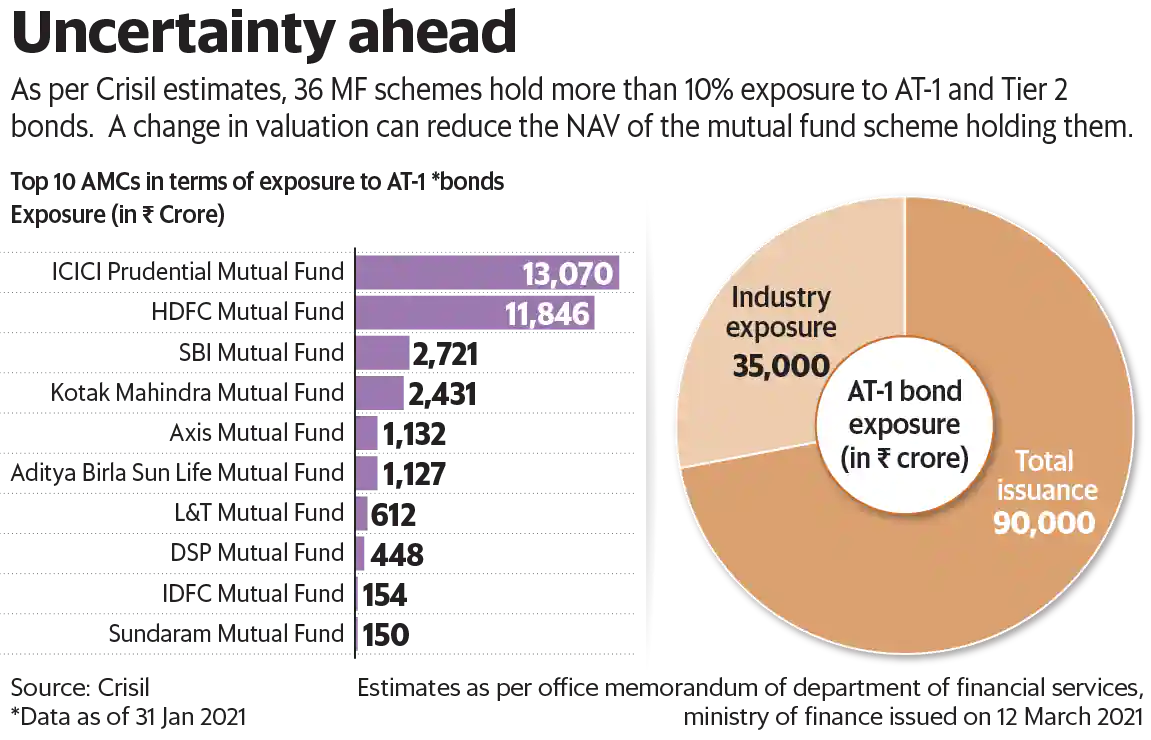

Final week Sebi requested MFs to deal with perpetual bonds as if they’ve a maturity of 100 years. It additionally capped publicity to such bonds at 10% of scheme belongings. The MF business has raised issues that this rule might depress the valuation of such bonds, decrease NAVs. Mint explains:

What are extra Tier 1 or AT-1 bonds?

Extra Tier 1 (AT-1) bonds are issued by banks as a way to take in losses in case of abrasion of their capital. As an example, if non-performing belongings (NPAs) threaten a financial institution’s monetary viability, AT1 bonds will bear losses earlier than strange bond-holders or depositors are hit. These bonds don’t have any maturity date. Nevertheless, banks can repay them at sure “name dates” with out having any obligation to repay on these dates. Although Indian banks have traditionally not skipped on name dates, there are exceptions. One well-known instance of AT1 bonds not being repaid is the Sure Financial institution failure in 2020.

What’s the downside with AT-1 bonds?

AT-1 or perpetual bonds are historically valued at price-to-call. Because of this mutual funds have valued them as if they might be repaid on the decision dates. Such dates are usually set at brief intervals of, say, 5 to 10 years, and therefore their maturity is about accordingly. A change in valuation to 100-year maturity will tremendously enhance their sensitivity to rate of interest adjustments and influence the general period of the mutual fund portfolio. Such a revaluation may additionally decrease their worth and therefore cut back the online asset values (NAVs) of the mutual fund scheme holding them, and set off a flood of redemptions.

View Full Picture

When will the Sebi round be applied?

The round will come into impact on 1 April, 2021. Nevertheless, business executives fear that some funds might not wait until then to decrease the worth of the bonds of their portfolios, to discourage redemptions in anticipation of an NAV shock on 1 April. The division of monetary companies of the finance ministry and MFs themselves have requested Sebi to withdraw the maturity rule.

What precautions can you’re taking for now?

It’s best to test the publicity of your debt MFs to AT-1 bonds. In case you have bought the bonds through a distributor or financial institution, ask them to offer this info. As per Crisil, 36 MF schemes maintain greater than 10% publicity to AT-1 and Tier 2 bonds (one other risk-absorbing debt paper issued by banks). Don’t take any motion in haste. The availability could also be withdrawn or diluted following the response from the finance ministry and the MF business. Even when the round will not be withdrawn, the NAV dip could also be short-term.

Must you purchase if MFs offload AT-1 bonds?

AT1 bonds are a posh product. People who purchased AT-1 bonds of Sure Financial institution earlier than the 2020 disaster noticed their cash worn out. As well as, Sebi has stipulated a minimal buying and selling lot measurement of ₹1 crore for such bonds, and permitted solely certified institutional patrons (QIBs) to buy them from banks. For retail people, shopping for these bonds might not be a good suggestion. Additionally, word that the banks issuing them have the choice however not the duty of repaying holders of such bonds on the decision dates.

Let’s block advertisements! (Why?)