Rates of interest have remained persistently low even because the economic system emerges from the pandemic.

The yield on 10-year U.S. Treasury notes

TMUBMUSD10Y,

hasn’t been above 2% for greater than two years. (It’s yielding 1.32% on Monday.)

In consequence, many income-seeking buyers have migrated from bonds, thought-about the most secure revenue investments, to the inventory market. However the revenue from a diversified inventory portfolio won’t be excessive sufficient.

There’s a method to improve that revenue, even whereas decreasing your danger.

Beneath is an outline of an revenue technique for shares that you just won’t concentrate on — lined name choices — together with examples from Kevin Simpson, the founding father of Capital Wealth Planning in Naples, Fla., which manages the Amplify CWP Enhanced Dividend Revenue ETF

DIVO,

This alternate traded fund is rated 5 stars (the best) by Morningstar. We will even take a look at different ETFs that use lined name choices another way, however with revenue as the primary goal.

Coated name choices

A name possibility is a contract that permits an investor to purchase a safety at a specific worth (referred to as the strike worth) till the choice expires. A put possibility is the alternative, permitting the purchaser to promote a safety at a specified worth till the choice expires.

A lined name possibility is one that you just write if you already personal a safety. The technique is utilized by inventory buyers to extend revenue and supply some draw back safety.

Right here’s a present instance of a lined name possibility within the DIVO portfolio, described by Simpson throughout an interview.

On Aug. 23, the ETF wrote a one-month name for ConocoPhillips

COP,

At the moment, the inventory was buying and selling at about $55 a share. The decision has a strike worth of $57.50.

“We collected between 70 cents and 75 cents a share” on that possibility, Simpson stated. So if we go on the low aspect, 70 cents a share, we’ve a return of 1.27% for just one month. That isn’t an annualized determine — it exhibits how a lot revenue will be created from the covered-call technique whether it is employed over and over.

If shares of ConocoPhillips rise above $57.50, they are going to doubtless be referred to as away — Simpson and DIVO will likely be compelled to promote the shares at that worth. If that occurs, they might remorse parting with a inventory they like. However together with the 70 cents a share for the choice, they will even have loved a 4.6% achieve from the share worth on the time they wrote the choice. And if the choice expires with out being exercised, they’re free to jot down an alternative choice and earn extra revenue.

In the meantime, ConocoPhillips has a dividend yield of greater than 3%, which itself is enticing in contrast with Treasury yields.

Nonetheless, there’s danger. If ConocoPhillips have been to double to $110 earlier than the choice expired, DIVO would nonetheless must promote it for $57.50. All that upside can be left on the desk. That’s the value you pay for the revenue supplied by this technique.

Simpson additionally supplied two earlier examples of shares for which he wrote lined calls:

-

DIVO purchased shares of Nike Inc.

NKE,

-2.49%

for between $87 and $88 a share in Could 2020 after the inventory’s pullback after which then booked $4.50 a share in income by writing repeated lined name choices for the inventory via December. Simpson ultimately bought the inventory in August after reserving one other $5 a share in possibility premiums. -

DIVO earned $6.30 a share in covered-call premiums on shares of Caterpillar Inc.

CAT,

+0.58% ,

which have been referred to as away “in late February round $215-$220,” Simpson stated. After that, the inventory rallied to $245 in June, displaying some misplaced upside. Caterpillar’s inventory has now pulled again to about $206.

Simpson’s technique for DIVO is to carry a portfolio of about 25 to 30 blue chip shares (all of which pay dividends) and solely write a small variety of choices at any time, based mostly on market situations. It’s primarily a long-term progress technique, with the revenue enhancement from the lined name choices.

The fund presently has 5 covered-call positions, together with ConocoPhillips. DIVO’s fundamental goal is progress, but it surely has a month-to-month distribution that features dividends, possibility revenue and at occasions a return of capital. The fund’s quoted 30-day SEC yield is only one.43%, however that solely contains the dividend portion of the distribution. The distribution yield, which is what buyers really obtain, is 5.03%.

You may see the fund’s high holdings right here on the MarketWatch quote web page. Right here is a brand new information to the quote web page, which features a wealth of knowledge.

DIVO’s efficiency

Morningstar’s five-star score for DIVO relies on the ETF’s efficiency throughout the funding analysis agency’s “U.S. Fund By-product Revenue” peer group. A comparability of the ETF’s whole return with that of the S&P 500 Index

SPX,

will be anticipated to indicate decrease efficiency over the long run, in step with the revenue focus and the giving-up of some upside potential for shares which can be referred to as away as a part of the covered-call technique.

DIVO was established on Dec. 14, 2016. Right here’s a comparability of returns on an NAV foundation (with dividends reinvested, although the fund could be greatest for buyers who want revenue) for the fund and its Morningstar class, together with returns for the S&P 500 calculated by FactSet:

| Whole return – 2021 | Whole return – 2020 | Common return – 3 years | |

|

Amplify CWP Enhanced Dividend Revenue ETF DIVO, |

13.8% | 13.2% | 13.9% |

| Morningstar U.S. Fund By-product Revenue Class | 13.0% | 4.3% | 8.3% |

|

S&P 500 SPX, |

19.9% | 18.4% | 17.8% |

| Sources: Morningstar, FactSet | |||

Return of capital

A return of capital could also be included as a part of a distribution by an ETF, closed-end fund, real-estate funding belief, enterprise growth firm or different funding automobile. This distribution isn’t taxed as a result of it’s already the investor’s cash. A fund could return some capital to take care of a dividend briefly, or it might return capital as an alternative of constructing a distinct type of taxable distribution.

In a earlier interview, Amplify ETFs CEO Christian Magoon distinguished between “accretive and harmful” returns of capital. Accretive means the fund’s internet asset worth (the sum of its property divided by the variety of shares) continues to extend, regardless of a return of capital, whereas harmful means the NAV is declining, which makes for a poor funding over time if it continues.

Coated calls on total indexes

There are ETFs that take the covered-call possibility technique to extra of an excessive, by writing choices in opposition to a complete inventory index. An instance is the International X Nasdaq 100 Coated Name ETF

QYLD,

which holds the shares that make up the Nasdaq-100 Index

NDX,

in the identical proportions because the index, whereas regularly writing covered-call choices in opposition to all the index. QYLD has a four-star score from Morningstar.

The ETF pays month-to-month; its trailing 12-month distribution yield has been 12.47% and its distribution yields have constantly been above 11% because it was established in December 2013.

That’s fairly a little bit of revenue. Nevertheless, QYLD additionally underlines of the significance of understanding {that a} “pure” covered-call technique on a complete inventory index is actually an revenue technique.

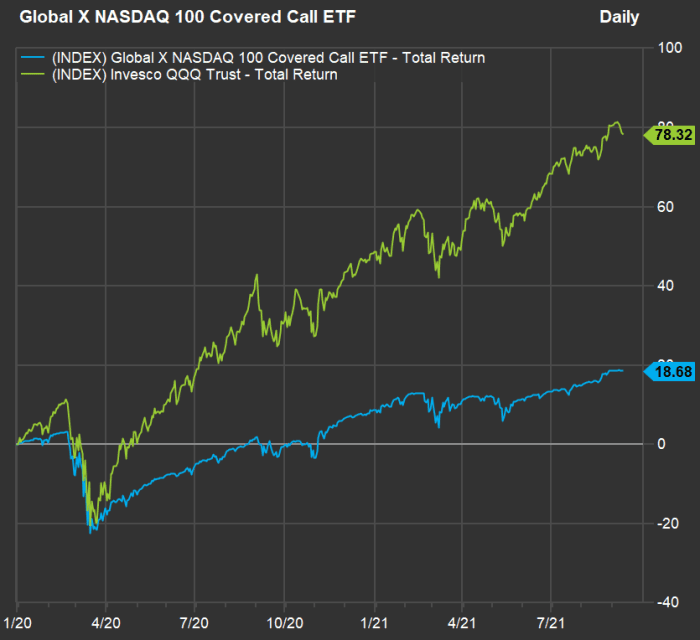

Right here’s a comparability of returns for the fund and the Invesco QQQ Belief

QQQ,

which tracks the Nasdaq-100, from the top of 2019, encompassing all the COVID-19 pandemic and its have an effect on on the inventory market:

FactSet

QYLD took a pointy dive throughout February 2020, as did QQQ. However you may see that QQQ recovered extra shortly after which soared. QYLD continued paying its excessive distributions all via the pandemic disaster, but it surely couldn’t seize most of QQQ’s extra upside. It isn’t designed to do it.

International X has two different funds following covered-call methods for total indexes for revenue:

-

The International X S&P 500 Coated Name ETF

XYLD,

+0.26% -

The International X Russell 2000 Coated Name ETF

RYLD,

+0.16%

Coated-call methods can work significantly nicely for shares which have enticing dividend yields, and a few funding advisers make use of the technique for particular person buyers. The ETFs present a better approach of following the technique. DIVO makes use of lined requires a progress and revenue technique, whereas the three listed International X funds are extra income-oriented.

Don’t miss: Right here’s a safer method to spend money on bitcoin and blockchain expertise